Paperboard Packaging Market Size (2025 – 2030)

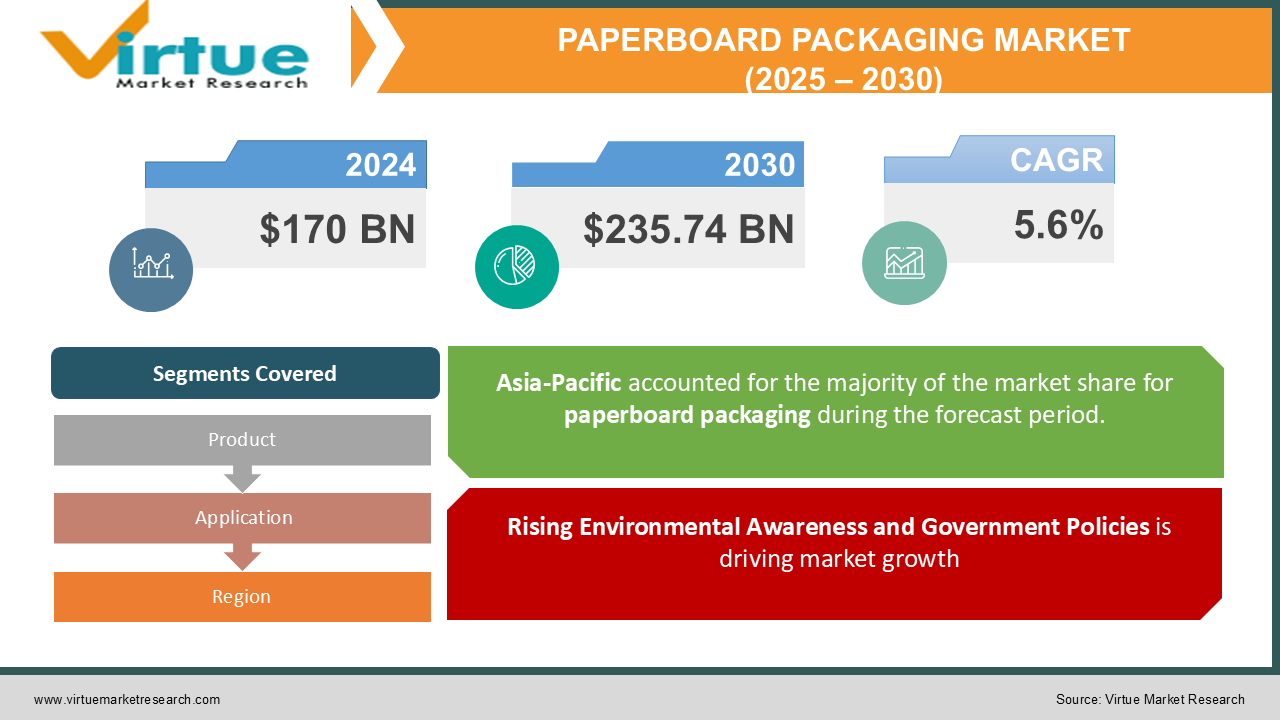

The Global Paperboard Packaging Market was valued at USD 170 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. The market is expected to reach USD 235.74 billion by 2030.

The Paperboard Packaging Market revolves around the use of paper-based materials for packaging purposes. These materials are lightweight, eco-friendly, and recyclable, making them a preferred choice in industries such as food & beverages, cosmetics, pharmaceuticals, and retail. Increasing consumer awareness of sustainable packaging solutions and stringent government regulations promoting eco-friendly alternatives are driving the market's growth.

Key Market Insights

-

The food and beverage industry accounts for the largest share of the Paperboard Packaging Market, making up over 40% of global demand in 2024, driven by the need for sustainable packaging solutions for ready-to-eat meals and beverages.

-

Increasing e-commerce activities have boosted the demand for corrugated paperboard packaging, contributing significantly to market growth, especially in Asia-Pacific, which recorded a 7% CAGR in this segment from 2020-2024.

-

Flexible paperboard packaging options, such as liquid packaging cartons, are expected to grow at a CAGR of 6.5% due to rising demand for milk and non-dairy beverages.

Global Paperboard Packaging Market Drivers

Rising Environmental Awareness and Government Policies is driving market growth:

The shift towards sustainability has been a significant driver for the paperboard packaging market. Increasing awareness of environmental issues, such as plastic pollution and climate change, has encouraged industries to adopt eco-friendly solutions. Governments across the globe have introduced stringent policies, such as bans on single-use plastics, to curb environmental damage. For instance, India's ban on single-use plastics in 2022 led to a surge in demand for alternatives like paperboard packaging. Paperboard is biodegradable, recyclable, and sourced from renewable resources, making it an ideal replacement for plastic. Additionally, several international brands, including Unilever and Nestlé, have committed to achieving 100% sustainable packaging by 2030, further driving market demand.

E-Commerce Boom and Packaging Needs is driving market growth:

The rapid growth of the e-commerce sector has fueled demand for efficient, lightweight, and durable packaging solutions. Paperboard, particularly corrugated packaging, is highly preferred in e-commerce due to its ability to protect products during transit and its eco-friendly nature. With global e-commerce sales expected to surpass USD 7 trillion by 2030, the demand for paperboard packaging is poised to grow significantly. Brands such as Amazon and Alibaba are increasingly adopting sustainable packaging practices, focusing on recyclable materials like paperboard. Furthermore, the integration of smart packaging technologies, such as QR codes on paperboard boxes for tracking, is enhancing their appeal in logistics.

Innovations in Packaging Design and Functionality is driving market growth:

The market is driven by advancements in paperboard packaging technologies, which enhance both functionality and aesthetic appeal. Coating technologies have made paperboard more resistant to moisture and grease, expanding its application in food and beverage packaging. Lightweight paperboard is being increasingly used in retail for branding purposes, as it supports high-quality printing and unique designs. The cosmetics and personal care industries are also adopting paperboard packaging for its ability to convey premium value while aligning with sustainability goals. Innovations like flexible paperboard packaging and customized cartons are addressing diverse consumer needs, contributing to market expansion.

Global Paperboard Packaging Market Challenges and Restraints

Raw Material Availability and Price Volatility is restricting market growth:

One of the primary challenges facing the paperboard packaging market is the fluctuating availability and cost of raw materials. The production of paperboard depends heavily on wood pulp, which is subject to supply chain disruptions and environmental regulations. Rising deforestation concerns and restrictions on logging in certain regions have led to an imbalance between supply and demand, causing price volatility. Additionally, energy-intensive production processes for virgin and recycled paperboard have led to increased production costs, particularly during times of economic uncertainty. Manufacturers are struggling to maintain profit margins while keeping prices competitive, especially in cost-sensitive markets like Asia and Africa.

Competition from Alternative Packaging Solutions is restricting market growth:

While paperboard packaging is gaining popularity, it faces stiff competition from alternative sustainable packaging materials like bioplastics, metal, and glass. Bioplastics, in particular, have emerged as a viable alternative, offering biodegradability and superior durability in certain applications. Additionally, some industries prefer glass or metal packaging for their premium feel and ability to preserve products for extended periods. The durability and versatility of these materials present challenges for paperboard manufacturers to position their products as equally effective solutions. Furthermore, consumer perception of paperboard's limited durability compared to other materials in specific applications, such as heavy or wet products, continues to act as a restraint.

Market Opportunities

The Paperboard Packaging Market is poised to witness significant growth opportunities due to the rising trend of personalized and branded packaging. With consumers increasingly seeking unique and visually appealing products, brands are leveraging paperboard packaging for its superior printability and design flexibility. This has opened avenues for innovative packaging formats, including foldable cartons, sleeves, and laminated paperboard, which cater to specific consumer demands. Additionally, the focus on circular economy principles is encouraging manufacturers to invest in recycled paperboard, aligning with sustainability goals. Another major opportunity lies in the expanding food delivery and takeaway market, where paperboard packaging is becoming the standard for meal boxes, cups, and trays. As global food delivery platforms like Uber Eats and DoorDash expand, they are driving demand for packaging that ensures product safety while being environmentally friendly. Emerging markets such as India, China, and Brazil present untapped potential due to their growing middle-class population and preference for sustainable packaging. The ongoing digitalization of packaging, with features such as QR codes for brand engagement and traceability, is further elevating the role of paperboard packaging in meeting modern consumer needs.

PAPERBOARD PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

International Paper, WestRock, Smurfit Kappa, Mondi Group, Stora Enso, Nippon Paper Industries, DS Smith, Sappi Limited, Georgia-Pacific LLC, Nine Dragons Paper |

Paperboard Packaging Market Segmentation - By Product

-

Solid Bleached Sulfate (SBS) Paperboard

-

Coated Unbleached Kraft (CUK) Paperboard

-

Folding Boxboard (FBB)

-

White Lined Chipboard (WLC)

-

Others

Folding Boxboard (FBB) dominates this segment due to its superior stiffness, printability, and versatility, making it a preferred choice in food, beverage, and cosmetics packaging. FBB's lightweight nature and ability to protect delicate items make it particularly popular in the retail sector.

Paperboard Packaging Market Segmentation - By Application

-

Food & Beverages

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Retail Packaging

-

Others

Food & Beverages lead the application segment, driven by the growing demand for takeaway and packaged food. The segment benefits from the moisture-resistant and sustainable properties of paperboard, making it suitable for ready-to-eat and frozen food packaging.

Paperboard Packaging Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in the Paperboard Packaging Market, accounting for over 35% of global revenue in 2024. Rapid urbanization, population growth, and rising disposable incomes in countries like China and India are driving demand for sustainable packaging solutions. The region's thriving e-commerce industry is further fueling demand for corrugated paperboard for shipping and delivery applications. Additionally, government initiatives promoting environmental sustainability, such as China's "Green Packaging Action Plan," have created a conducive environment for paperboard packaging adoption.

COVID-19 Impact Analysis on the Paperboard Packaging Market

The COVID-19 pandemic had a profound impact on the Paperboard Packaging Market, creating both challenges and opportunities. On the positive side, the rapid growth of e-commerce during lockdowns led to an unprecedented demand for corrugated paperboard packaging, primarily for shipping purposes. This surge was especially significant in essential sectors like food, beverages, and pharmaceuticals, as consumers stockpiled goods, boosting the need for sustainable packaging solutions. However, the pandemic also led to difficulties for certain industries. Luxury goods and cosmetics, which rely on high-end paperboard packaging, saw a decline in demand as consumer spending dropped. Additionally, supply chain disruptions, raw material shortages, and temporary halts in production affected manufacturers’ ability to meet demand. These issues created delays and increased costs, presenting challenges for the market as a whole. In the aftermath of the pandemic, the Paperboard Packaging Market has experienced a shift towards sustainability. Brands have increasingly recognized the long-term benefits of eco-friendly packaging, making paperboard an attractive solution for reducing environmental impact. This trend is further fueled by changing consumer preferences, with many prioritizing hygienic, recyclable, and sustainable packaging. The growing focus on sustainability is expected to continue driving the market’s growth, as more companies adopt paperboard packaging to align with environmental goals and consumer expectations. As the world recovers from the pandemic, the paperboard packaging industry is well-positioned for steady growth, with sustainability at the forefront of its evolution. This shift towards greener, more efficient packaging solutions will likely shape the market’s trajectory in the coming years, ensuring both environmental and economic benefits.

Latest Trends/Developments

The Paperboard Packaging Market is experiencing a wave of innovation driven by sustainability and technological advancements. Recycled paperboard is gaining traction as brands aim to minimize their environmental impact, with many adopting 100% recycled materials for packaging. The integration of smart packaging features, such as QR codes and augmented reality, is transforming paperboard packaging into an interactive medium for brand engagement. Furthermore, flexible paperboard solutions are being developed to cater to the growing demand for convenience in food and beverage packaging.

Customization is another emerging trend, with brands leveraging paperboard's design flexibility to create unique packaging that enhances shelf appeal. The focus on lightweight materials to reduce transportation costs and carbon footprints is driving research into advanced paperboard materials. In the luxury packaging segment, coated and laminated paperboard is gaining popularity for its premium finish and durability. Collaborative efforts between manufacturers and brands are also fostering the development of innovative solutions, such as water-resistant coatings for paperboard used in frozen foods.

Key Players:

-

International Paper

-

WestRock

-

Smurfit Kappa

-

Mondi Group

-

Stora Enso

-

Nippon Paper Industries

-

DS Smith

-

Sappi Limited

-

Georgia-Pacific LLC

-

Nine Dragons Paper

Chapter 1. Paperboard Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Paperboard Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Paperboard Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Paperboard Packaging Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Paperboard Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Paperboard Packaging Market – By Product

6.1 Introduction/Key Findings

6.2 Solid Bleached Sulfate (SBS) Paperboard

6.3 Coated Unbleached Kraft (CUK) Paperboard

6.4 Folding Boxboard (FBB)

6.5 White Lined Chipboard (WLC)

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Paperboard Packaging Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Personal Care & Cosmetics

7.4 Pharmaceuticals

7.5 Retail Packaging

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Paperboard Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Paperboard Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 International Paper

9.2 WestRock

9.3 Smurfit Kappa

9.4 Mondi Group

9.5 Stora Enso

9.6 Nippon Paper Industries

9.7 DS Smith

9.8 Sappi Limited

9.9 Georgia-Pacific LLC

9.10 Nine Dragons Paper

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Paperboard Packaging Market was valued at USD 170 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. The market is expected to reach USD 235.74 billion by 2030.

Key drivers include rising environmental awareness, government policies promoting sustainable packaging, the e-commerce boom, and innovations in packaging design and functionality.

The market is segmented by product (Solid Bleached Sulfate, Coated Unbleached Kraft, Folding Boxboard, etc.) and by application (Food & Beverages, Personal Care, Pharmaceuticals, etc.).

Asia-Pacific is the dominant region, driven by rapid urbanization, e-commerce growth, and government sustainability initiatives.

Leading players include International Paper, WestRock, Smurfit Kappa, Mondi Group, and Stora Enso, among others