PAO/Ester Blend-Based Industrial Gear Oils Market Size (2023 – 2030)

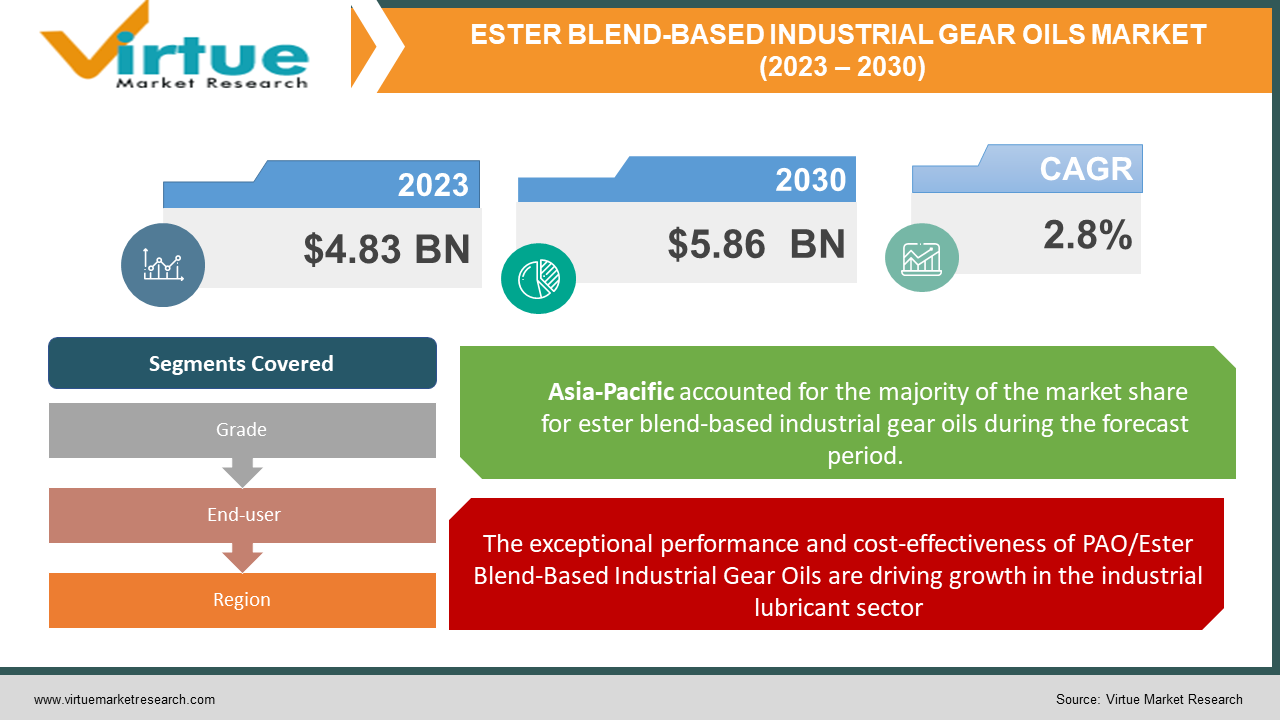

The Global PAO or Ester Blend-Based Industrial Gear Oils Market was valued at USD 4.83 billion and is projected to reach a market size of USD 5.86 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2.8%.

The PAO/Ester Blend-Based Industrial Gear Oils market emerges as a significant global phenomenon. With the industry's ongoing ascent, it has garnered the interest of both academic and professional spheres. As the market continues to expand, the demand for these advanced lubricants for industrial gear applications experiences an upward trajectory. Foreseen as a source of burgeoning career opportunities within the industrial and lubricant sectors in the next decade, industry leaders are compelled to cultivate fresh skill sets and gain an in-depth understanding of the intricate macro and micro factors influencing the PAO/Ester Blend-Based Industrial Gear Oils market. This holistic perspective is pivotal for steering the industry forward, harmonizing nuanced insights with the broader industrial landscape.

Key Market Insights:

The PAO/Ester Blend-Based Industrial Gear Oils market is characterized by several key market insights. Firstly, the growing awareness of environmental concerns and the need for sustainable solutions has elevated the demand for these lubricants, given their favorable eco-friendly attributes. Additionally, the market benefits from the expanding industrial landscape, as various sectors increasingly rely on efficient and durable gear systems. Technological advancements in lubricant formulations and manufacturing processes further enhance the performance of PAO/Ester Blend-Based Industrial Gear Oils, driving their adoption across diverse industries. Furthermore, stringent regulations and quality standards governing industrial operations emphasize the significance of using high-quality lubricants to ensure operational efficiency and equipment longevity. As a result, the market is poised to witness consistent growth driven by a confluence of environmental awareness, industrial expansion, technological progress, and regulatory compliance.

PAO/Ester Blend-Based Industrial Gear Oils Market Drivers:

The exceptional performance and cost-effectiveness of PAO/Ester Blend-Based Industrial Gear Oils are driving growth in the industrial lubricant sector.

The PAO/Ester Blend-Based Industrial Gear Oils market is fueled by several significant drivers. Foremost among these is the remarkable demand for advanced lubrication solutions that can withstand the rigorous conditions of industrial gear applications. The superior thermal stability, oxidation resistance, and load-carrying capabilities of PAO/Ester Blend-Based Industrial Gear Oils make them ideal choices for enhancing equipment performance and lifespan. Moreover, the increasing emphasis on energy efficiency and reduced operational costs compels industries to opt for lubricants that minimize friction and enhance overall gear system efficiency. The market also thrives due to ongoing technological advancements in lubricant formulation, enabling the creation of blends with tailored properties for specific industrial requirements. Additionally, stringent environmental regulations drive the adoption of environmentally friendly lubrication solutions, further boosting the market's growth trajectory. Overall, these drivers collectively reinforce the market's prominence and underscore the vital role PAO/Ester Blend-Based Industrial Gear Oils play in optimizing industrial operations.

Extended equipment downtimes due to inadequate lubrication are a significant concern, driving demand for PAO/Ester Blend-Based Industrial Gear Oils in the industrial sector.

The PAO/Ester Blend-Based Industrial Gear Oils market addresses critical issues within the industrial landscape. Delays in gear system maintenance and inadequate lubrication can lead to compromised industrial operations. Postponing necessary maintenance routines could result in reduced equipment efficiency, heightened friction, and even gear system failures. For instance, neglecting to provide timely lubrication maintenance for industrial gear systems can lead to increased wear and tear, limiting their performance and potentially causing machinery breakdowns. This analogy underscores the vital role that PAO/Ester Blend-Based Industrial Gear Oils play in maintaining the optimal health of industrial equipment, preventing undue wear, and ensuring smooth operations across sectors.

The growing demand for efficient gear lubrication solutions is propelled by the escalating industrial needs in the PAO/Ester Blend-Based Industrial Gear Oils market.

The escalating prevalence of industrial machinery wear and tear, particularly in aging infrastructure, along with the integration of cutting-edge lubrication technologies to address various operational challenges, is spurring the demand for PAO/Ester Blend-Based Industrial Gear Oils within the market. The proactive support provided by governmental regulations and industry associations further contributes to fostering a conducive environment for the growth of these lubricants. Industries opt for PAO/Ester Blend-Based Industrial Gear Oils to mitigate the challenges posed by mechanical inefficiencies and prolonged downtime. This highlights the parallel nature of addressing demand gaps and optimizing operational efficiency across diverse sectors. Additionally, the rising awareness of the significance of proper lubrication and the affordability of advanced lubricant solutions serve as key drivers propelling the escalating demand for PAO/Ester Blend-Based Industrial Gear Oils.

The surging focus on modernizing industrial facilities and enhancing operational efficiency is propelling the growth of the global PAO/Ester Blend-Based Industrial Gear Oils market.

The surging level of governmental investments to build robust, strong, and advanced healthcare facilities is propelling the medical tourism market. The favorable government policies, growing investments for the improvement of air connectivity and other transport mediums, and several initiatives to promote medical tourism are the main factors that contribute hugely to the development of the global market. Moreover, the easily available information regarding facilities and treatments of various diseases, cost, and best destinations for the treatment plays a chief role in spreading awareness regarding medical tourism among the population. Furthermore, the obvious lack of an adequate number of specialized health professionals results in increased medical tourism. Various health professionals undertake tourism activities to perform certain surgeries that require specialization or special knowledge to be conducted.

PAO/Ester Blend-Based Industrial Gear Oils Market Restraints and Challenges:

The complexities in navigating industry standards and regulatory requirements, coupled with challenges related to compatibility and optimal application.

The PAO/Ester Blend-Based Industrial Gear Oils market encounters various challenges that shape its landscape. Firstly, the market faces competition from alternative lubricant formulations and technologies that offer similar functionalities. This necessitates continuous innovation to differentiate and highlight the unique benefits of PAO/Ester Blend-Based Industrial Gear Oils. Additionally, stringent environmental regulations and sustainability expectations push the market towards developing eco-friendly formulations while maintaining high-performance standards. Moreover, ensuring effective compatibility with a wide range of gear systems and operating conditions is a persistent challenge. Addressing these challenges requires a combination of technological advancements, compliance with industry standards, and a commitment to delivering reliable and sustainable lubrication solutions.

PAO/Ester Blend-Based Industrial Gear Oils Market Opportunities:

The PAO/Ester Blend-Based Industrial Gear Oils market is brimming with opportunities poised to shape its trajectory. Firstly, the growing emphasis on sustainable practices and environmentally friendly solutions opens avenues for the market to develop eco-conscious lubricants that meet stringent regulations. As industries increasingly prioritize energy efficiency, PAO/Ester Blend-Based Industrial Gear Oils can step in to optimize gear system performance and minimize energy consumption. Moreover, advancements in technology offer the prospect of formulating specialized blends tailored to specific industrial requirements, expanding their applications across diverse sectors. The trend towards predictive maintenance and condition monitoring further creates opportunities, with these lubricants playing a pivotal role in ensuring the longevity and reliability of industrial equipment. By seizing these opportunities, the PAO/Ester Blend-Based Industrial Gear Oils market is poised to flourish while contributing to sustainable and efficient industrial operations.

PAO/ESTER BLEND-BASED INDUSTRIAL GEAR OILS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

2.8% |

|

Segments Covered |

By Grade, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Exxon Mobil Corporation, Royal Dutch Shell plc, Chevron Corporation, TotalEnergies, FUCHS Group, BP plc, Idemitsu Kosan Co., Ltd., The Lubrizol Corporation |

PAO/Ester Blend-Based Industrial Gear Oils Market Segmentation: By Grade

-

ISO VG 32

-

ISO VG 46

-

ISO VG 68

-

Others

Market segmentation based on grade, The ISO VG 68 segment often holds the largest market share in the PAO/Ester Blend-Based Industrial Gear Oils market. This grade finds extensive use across various industrial applications due to its versatile viscosity, making it a popular choice for different gear systems and operating conditions. Its balanced properties often appeal to a broad spectrum of industries seeking optimal gear lubrication. The ISO VG 32 is poised to experience the fastest-growing segment in the category within the PAO/Ester Blend-Based Industrial Gear Oils market. This grade's rising popularity can be attributed to its increasing adoption in modern, high-efficiency equipment and machinery, where lighter viscosity oils are sought after for improved energy efficiency and reduced friction losses. As industries increasingly embrace these advancements, the demand for ISO VG 32 oils is projected to experience notable growth, driving its segment's accelerated expansion within the market

PAO/Ester Blend-Based Industrial Gear Oils Market Segmentation: By End-user

-

Manufacturing

-

Power Generation

-

Automotive

-

Others

The manufacturing sector commonly boasts the largest market share within the PAO/Ester Blend-Based Industrial Gear Oils market. This is attributed to the extensive utilization of these lubricants across various industrial processes, including machinery, conveyors, and gearboxes, crucial for sustaining efficient manufacturing operations. While the Power Generation category is poised to experience the fastest growth within the PAO/Ester Blend-Based Industrial Gear Oils market. With increased emphasis on sustainable energy solutions and the expansion of power generation infrastructure, the demand for high-performance lubricants that ensure optimal gear system functioning is on the rise. As power generation technologies evolve, the need for reliable and efficient gear lubrication propels the Power Generation segment to experience rapid growth, positioning it as the fastest-growing market share.

PAO/Ester Blend-Based Industrial Gear Oils Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region consistently emerges as a dominant force, occupying a substantial market share of almost 18% within the PAO/Ester Blend-Based Industrial Gear Oils industry. This prominence can be attributed to the region's robust industrialization, vibrant manufacturing activities, and significant strides in infrastructure development. These factors collectively generate a heightened demand for efficient gear lubrication solutions, essential to bolster the performance of industries that are rapidly expanding across Asia-Pacific countries. The Middle East and Africa stand out as the fastest-growing regions in the PAO/Ester Blend-Based Industrial Gear Oils market. The regions’ accelerated pace of industrial expansion, coupled with substantial construction initiatives and a concerted push for infrastructural modernization, fuels the necessity for dependable lubrication solutions. As industrial operations intensify in the Middle East and Africa, the surge in demand for PAO/Ester Blend-Based Industrial Gear Oils is projected, underpinning this region's rapid ascent as the one with the fastest-growing market share.

COVID-19 Impact Analysis on the Global PAO/Ester Blend-Based Industrial Gear Oils Market:

The PAO/Ester Blend-Based Industrial Gear Oils market, much like many industries, was not immune to the transformative impact of the COVID-19 pandemic. Initially, the outbreak disrupted supply chains, manufacturing processes, and distribution networks, leading to operational challenges and delays. The global economic slowdown resulting from lockdowns and restrictions also affected industrial activities, contributing to a reduced demand for lubricants, including PAO/Ester Blend-Based Industrial Gear Oils. However, as economies adapted to the new normal and industries began to recover, there emerged an increased focus on the reliability and efficiency of industrial machinery. This, in turn, propelled the demand for high-quality lubrication to optimize equipment performance. The pandemic highlighted the essential role of maintenance and efficient operations, prompting industries to prioritize lubrication solutions that safeguarded their machinery investment. Consequently, while the COVID-19 pandemic introduced initial setbacks, it ultimately underscored the crucial significance of PAO/Ester Blend-Based Industrial Gear Oils in maintaining resilient industrial operations in the face of unprecedented challenges.

Latest Trends/ Developments:

The PAO/Ester Blend-Based Industrial Gear Oils market plays a pivotal role in enhancing the operational efficiency and longevity of industrial machinery across various sectors. By ensuring optimal lubrication and reduced friction within gear systems, these lubricants contribute to smoother operations and minimize downtime in industries such as manufacturing, power generation, automotive, and more. The increased efficiency resulting from the use of PAO/Ester Blend-Based Industrial Gear Oils leads to improved productivity, reduced maintenance costs, and extended equipment lifespans. This, in turn, positively impacts the overall performance of industries, allowing them to meet production targets, enhance energy efficiency, and maintain high-quality output. Therefore, the benefits of the PAO/Ester Blend-Based Industrial Gear Oils market transcend its domain, influencing and bolstering the broader industrial landscape by facilitating seamless machinery operations and optimizing resource utilization.

Key Players:

-

Exxon Mobil Corporation

-

Royal Dutch Shell plc

-

Chevron Corporation

-

TotalEnergies

-

FUCHS Group

-

BP plc

-

Idemitsu Kosan Co., Ltd.

-

The Lubrizol Corporation

Chapter 1. PAO/Ester Blend-Based Industrial Gear Oils Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. PAO/Ester Blend-Based Industrial Gear Oils Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. PAO/Ester Blend-Based Industrial Gear Oils Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. PAO/Ester Blend-Based Industrial Gear Oils Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. PAO/Ester Blend-Based Industrial Gear Oils Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. PAO/Ester Blend-Based Industrial Gear Oils Market – By Grade

6.1. Introduction/Key Findings

6.2 ISO VG 32

6.3 ISO VG 46

6.4 ISO VG 68

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Grade

6.7 Absolute $ Opportunity Analysis By Grade, 2023-2030

Chapter 7. PAO/Ester Blend-Based Industrial Gear Oils Market - By End-user

7.1. Introduction/Key Findings

7.2 Manufacturing

7.3 Power Generation

7.4 Automotive

7.5 Others

7.6 Y-O-Y Growth trend Analysis By End-user

7.7 Absolute $ Opportunity Analysis By End-user, 2023-2030

Chapter 8. PAO/Ester Blend-Based Industrial Gear Oils Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.3 By Grade

8.1.4. By End-user

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1. U.K.

8.2.2. Germany

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.2.2 By Grade

8.2.3. By End-user

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. Rest of Asia-Pacific

8.3.2. By Grade

8.3.3. By End-user

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.3.5. South America

8.4.1. By Country

8.4.1. Brazil

8.4.2. Argentina

8.4.3. Colombia

8.4.4. Chile

8.4.5. Rest of South America

8.4.2. By Grade

8.4.3. By End-user

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.4.5. Middle East & Africa

8.5.1. By Country

8.5.1. United Arab Emirates (UAE)

8.5.2. Saudi Arabia

8.5.3. Qatar

8.5.4. Israel

8.5.5. South Africa

8.5.6. Nigeria

8.5.7. Kenya

8.5.8. Egypt

8.5.9. Rest of MEA

8.5.3. By Grade

8.5.4. By End-user

8.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 9. PAO/Ester Blend-Based Industrial Gear Oils Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Exxon Mobil Corporation

9.2 Royal Dutch Shell plc

9.3 Chevron Corporation

9.4 TotalEnergies

9.5 FUCHS Group

9.6 BP plc

9.7 Idemitsu Kosan Co., Ltd.

9.8 The Lubrizol Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

These lubricants enhance machinery efficiency, reduce downtime, and improve productivity across industries, positively impacting their overall performance.

Challenges include competition from alternative lubricants, regulatory compliance, compatibility with various gear systems, and sustainability considerations.

The pandemic initially led to supply chain disruptions and reduced demand, but the subsequent focus on machinery reliability and efficiency boosted demand for these lubricants.

Industries such as manufacturing, power generation, automotive, construction, and more utilize these lubricants for their gear systems.

These lubricants offer excellent thermal stability, oxidation resistance, and load-carrying capacity, ensuring smoother gear operations, reduced friction, and prolonged machinery lifespan.