Pandora Bream Aquaculture Market Size (2024-2030)

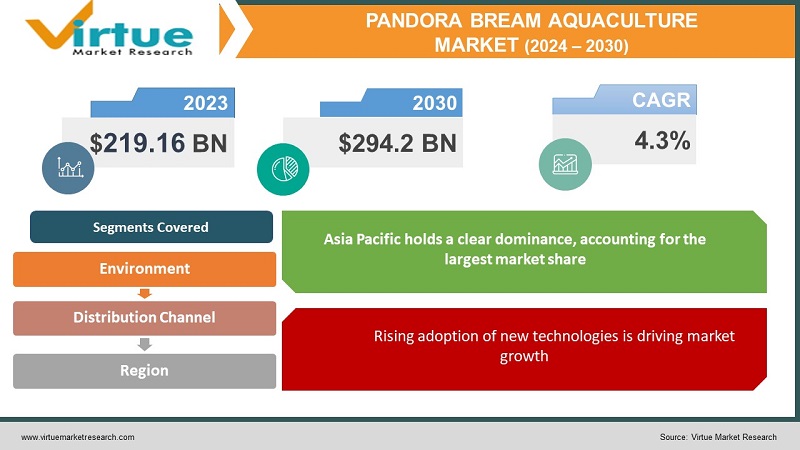

The Global Aquaculture Market was valued at USD 219.16 billion in 2023 and is projected to reach a market size of USD 294.2 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 4.3%.

Sea bream is a group of medium-sized, compact fish, which is also called as Sparidae. The growing emphasis on sustainable fishing practices and responsible aquaculture benefits across the world and the exponential development in the number of consumers becoming more aware of the environmental impact of their food alternatives and preferring seafood sourced from well-managed fisheries or responsible aquaculture operations are the chief factors boosting the market growth. Additionally, the rising seafood consumption, including sea bream, due to several reasons like changing dietary preferences, increasing disposable incomes and a growing middle-class population in many countries, are likely to contribute majorly towards the market growth.

Key Market Insights:

- The demand for seafood is estimated to exceed 260 million tons by 2030, while the supply is anticipated to be 210 million tons at the current production rate. As a result, it is considered a reliable source to fulfill the rising demand for seafood.

- The farm-gate price and retail price for fresh and whole gilthead sea bream ranges approximately from US$ 6.5 to 9.5 per kg and US$ 8 to 17 per kg, respectively.

- Regional Fish collaborated with the Kyoto University and Kinki University, & Ministry of Healthcare, developed a gene-edited sea bream named “Madai” which is developed using the CRISPR gene editing technology & better feed utilization by around 14%.

- In the current scenario, yellow sea bream has the major share of the sea bream market. However, it is expected that in the coming years the whitesea bream market will have a higher growth rate than other types of sea bream due to increased demand because of its various benefits.

Pandora Bream Aquaculture Market Drivers:

- Rising adoption of new technologies is driving market growth.

The increasing adoption of new technologies is offering several opportunities for the market. Technology is revolutionizing aquaculture operations by recommending innovative solutions that enhance productivity, efficiency and sustainability. Automated feeding systems, for example, ensure precise and timely feeding, reducing waste and bettering fish health. Water quality controlling tools enable real-time assessment and control, optimizing growing conditions. Genetic advancements in optional breeding and biotechnology lead to faster-growing and disease-resistant aquatic species. Furthermore, the implementation of data analytics and Artificial Intelligence permits for predictive modelling and proactive decision-making, resulting in better resource management. Recirculating aquaculture systems (RAS) reduce water usage and waste, making land-based aquaculture more cost effective and environmentally viable. As aquaculture embraces these technologies, it becomes more competitive and adaptive, attracting deployment and fostering innovation. Consequently, the sector not only meets the escalating global demand for seafood but also aligns with sustainability goals, reinforcing its position as a critical contributor to the future of food production.

- Growing demand for seafood products is fueling global market growth.

The improving demand for seafood products is favourably influencing the market. With the world's population constantly expanding and evolving dietary preferences, the appetite for seafood has reached unprecedented levels. Aquaculture, as a sustainable and efficient means of seafood production, plays a significant role in meeting this soaring demand. Wild fisheries lead to overexploitation and depletion, making aquaculture indispensable in bridging the seafood supply gap. Consumers increasingly identify the nutritional benefits of seafood, encouraging greater consumption. Moreover, as health-consciousness grows, seafood is chosen for its lean protein and omega-3 fatty acids. The stretching of global middle-class populations, particularly in emerging economies, further propels seafood consumption as it becomes cost effective and accessible. As a result, aquaculture's capacity to produce diverse aquatic species in controlled environments aligns perfectly with the need for a consistent and trustworthy seafood supply. This factor makes sure that the market continues to expand, contributing significantly to global food security and economic growth.

- Growing consumption of organic seafood items boosting growth in the market.

The rising consumption of organic seafood items is fuelling the market development. As consumers worldwide increasingly prioritize health and sustainability, organic seafood provides a compelling choice. Organic aquaculture practices stick to stringent environmental and ethical standards, minimising the use of antibiotics and chemicals. This resonates with consumers demanding safer and more environmentally friendly food options. Organic seafood is particularly opted by health-conscious consumers due to its reduced exposure to contaminants and antibiotics. The request for organic certification in aquaculture represents a broader shift toward organic and healthier dietary choices. Furthermore, the global trend pointing at sustainable and ethical consumption aligns with organic aquaculture's principles, promoting responsible fishing practices and conservation. This trend has prompted aquaculture producers to embrace organic farming methods, contributing to market growth.

Pandora Bream Aquaculture Market Restraints and Challenges:

Environmental issues stand as the major restraint to the growth of the aquaculture market. The aquaculture industry’s expansion gives birth to various other worries about potential negative impacts on marine ecosystems, including water pollution from excess nutrients and chemicals, habitat destruction due to coastal development and the risk of introducing non-native creatures. These issues have gained more traction from regulatory authorities and environmental organizations, resulting to the implementation of stricter regulations and sustainability standards. To ensure long-term development and mitigate these problems, aquaculture operators must adopt eco-friendly practices, invest in responsible waste management and promote sustainable farming types that reduce environmental footprints while meeting the global demand for seafood.

Majority of consumers are gradually becoming more considerate towards animals. These consumers are thus embracing vegetarianism-based food practices. Therefore, many of them are ignoring or reducing seafood, impacting seafood sales. Thus, the increasing fondness towards vegetarian food affects the market growth of aquaculture.

Pandora Bream Aquaculture Market Opportunities:

- Escalating Investment regarding Research and Development activities

Rising investments in research and development activities can give space to numerous opportunities in the aquaculture market by driving innovation and improving efficiencies. Investments in research and development can aid to develop new aquaculture technologies that will enhance production efficiency and make it economically feasible. This constitutes new techniques for fish breeding, disease control and feed production. Research into sustainable aquaculture methods can help to minimise environmental impacts and improve the overall sustainability of the industry. This includes developing new ways to recycle waste and decrease water usage. Growing investments in such activities lead to higher productivity, profitability, and sustainability. This creates opportunities for businesses and entrepreneurs to launch new products and services.

- Rising Innovation in the aquaculture industry creating new opportunities.

The growing demand for seafood has put pressure on resources and sustainable fishing methods, necessitating the creative application of current and new technologies. Aquaculture could be on the verge of a transformation, with underwater drones giving fish farmers with eyes beneath the waves, allowing them to monitor and control water conditions and the correct equipment. Fortunately, with the modernisation of technology, there is a lot of promise for sustainably producing this protein source. Aquaculture technologies, like those being launched in other agricultural industries, are catching the attention of farmers and investors. Many drones have sensors that move underwater and collect data like pH, oxygen levels, salinity, and contaminants. These technologies are helping to better the industry efficiency by analysing oxygen levels, water temperature and heart rate.

PANDORA BREAM AQUACUTLURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Environment, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Global Maris Groupe, Avramar , Selonda Aquaculture , The Nissui Group , HESY Aquaculture, Ardag Seafood Company , Greig Seafood |

Pandora Bream Aquaculture Market Segmentation:

Pandora Bream Aquaculture Market By Environment

- Fresh Water

- Marine Water

- Brackish Water

In 2023, the fresh water segment holds the largest share. Freshwater environments are significant in driving growth within the aquaculture market. These environments include rivers, lakes, and ponds and give crucial habitats for various aquatic species that are commercially farmed. Freshwater aquaculture provides several benefits, including lower operating costs, ease of access and minimised environmental impact compared to marine aquaculture. The accessibility to freshwater resources supports the cultivation of popular species like tilapia, catfish, and carp, contributing to market expansion.

The growth of freshwater aquaculture is in line with environmental sustainability goals, as it minimizes the need for overexploitation of natural fish stocks. By optimizing freshwater resources and adopting responsible methods, this segment plays a pivotal role in ensuring the industry's long-term viability and reducing pressure on fragile aquatic ecosystems.

Pandora Bream Aquaculture Market By Distribution Channel

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

Traditional Retail represents the dominating segment in 2023. Traditional retail distribution channels play a crucial role in driving market growth within the aquaculture industry. These channels constitute brick-and-mortar stores, fish markets and local seafood retailers that have long been the chief source for consumers to purchase seafood products. Multiple factors contribute to the importance of traditional retail in the aquaculture market. These outlets give accessibility and convenience to consumers, providing a wide range of seafood choices, including fresh, frozen and processed products. Shoppers can physically examine and choose their preferred seafood items, fostering consumer confidence in product quality.

Additionally, traditional retailers often have direct relationships with local aquaculture producers, ensuring a fresh and consistent seafood supply. This sanctions consumers to access locally sourced and sustainably harvested seafood, aligning with their freshness and environmental responsibility preferences. Moreover, traditional retail channels are significant in promoting aquaculture products, raising awareness about different seafood varieties and educating consumers about responsible and healthy seafood options.

Pandora Bream Aquaculture Market By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

It is observed that Asia Pacific holds a clear dominance, accounting for the largest market share. The Asia Pacific's extensive coastlines, extensive freshwater resources and favourable climate conditions provide a suitable environment for aquaculture operations. Countries like China, India, Vietnam, and Indonesia are major aquaculture producers, benefiting from these geographical edges. The Asia Pacific nations have an old history of aquaculture practices, allowing for cultivating a wide range of species, including shrimp, tilapia, and carp. This diversity serves to both local and global demand for seafood products.

Furthermore, the region's growing population and rising disposable income levels drive the demand for seafood, enabling aquaculture a critical contributor to food security and economic growth. Availability of labour in some countries also supports the expansion of aquaculture operations. Additionally, the region actively embraces technological modernisations in aquaculture, implementing innovations such as recirculating aquaculture systems (RAS) and sustainable practices to escalate productivity and environmental sustainability.

COVID-19 Impact Analysis on the Pandora Bream Aquaculture Market:

As an impact of the COVID-19 outbreak, lot of companies were forced to either completely cease operations or significantly slow output as a direct result of the lockdown and subsequent quarantine. This had a major influence on the company's ability to earn profits. However, despite the COVID-19 epidemic, the aquaculture business continued to advance quickly because of the major focus on innovations and research and development operations. Right from the beginning of the SARS-CoV-2 pandemic, there has been significant growth in the number of business partnerships and collaborations, all of which share the common goal of decreasing the amount of financial damage caused by the pandemic. In spite of the fact that the lockdown has heavily hampered supply chains, it is expected that market demand will continue to be high in the future time frame.

Latest Trends:

- Heightening seafood demand is expected to propel the market

Seafood is any aquatic species that can be consumed from the ocean and freshwater, including lobsters, crabs, and shrimps and occasionally other sea life. The risen demand for seafood contributes to aquaculture’s increasing importance in the fish supply. For example, the Organization for Economic Cooperation and Development, an intergovernmental economic organization with headquarters in France, approximates that 90% of the fish produced will be eaten by humans, which is expected to increase by 16.3% by 2029. The market CAGR will escalate due to the growing demand for seafood.

Additionally, many diverse cultural traditions heavily embrace on eating fish. Given the quantity of protein, vitamins, fatty acids, vital micronutrients and minerals in fish, it has amazing nutritional profile due to its positive effects on health. Fish is an excellent source of Omega-3 fatty acids, which have multiple health benefits, including mitigating the risk of heart attacks, preventing depression, preventing childhood asthma and enhancing brain health.

Key Players:

- Global Maris Groupe

- Avramar

- Selonda Aquaculture

- The Nissui Group

- HESY Aquaculture

- Ardag Seafood Company

- Greig Seafood

Recent Developments

- In April 2023, the Japanese company, Nippon Suisan Kaisha, launched a new line of sea bream products that are enriched with omega-3 fatty acids. The products are focused at consumers who are looking for healthy and sustainable seafood alternatives.

- In March 2023, the Chinese company, Beijing Tongzhou Fish Industry Group, introduced the construction of a new sea bream aquaculture farm with a capacity of 10,000 metric tons. The farm will utilise the latest technologies in aquaculture, including RAS (recirculating aquaculture system) and AI-powered feeding systems.

- In February 2023, a group of researchers from the University of Santiago de Compostela in Spain made it public about the implementation of a new method for breeding sea bream in closed-loop systems. The method uses a combination of artificial intelligence and machine learning to optimize the feeding and environmental conditions of the fish, impacting a significant increase in growth rates.

- In November 2022, Cooke Aquaculture Inc. took ownership of Tassal Group Limited as a plan of expansion.

- In September 2023, Leroy Seafood Group announced to deploy 158 MNOK in the factory located in Kjøllefjord.

- In March 2022, WorldFish made it public, a comprehensive legal agreement with Premium Aquaculture Limited for the transfer of Genetically Improved Farmed Tilapia(GIFT) to Nigeria. By 2023, WorldFish/PAL GIFT should be available in Nigerian Fish markets because of the collaboration between WorldFish and PAL.

Chapter 1. GLOBAL PANDORA BREAM AQUACULTURE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL PANDORA BREAM AQUACULTURE MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL PANDORA BREAM AQUACULTURE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL PANDORA BREAM AQUACULTURE MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL PANDORA BREAM AQUACULTURE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL PANDORA BREAM AQUACULTURE MARKET – By Environment

6.1. Introduction/Key Findings

6.2. Fresh Water

6.3. Marine Water

6.4. Brackish Water

6.5. Y-O-Y Growth trend Analysis By Environment

6.6. Absolute $ Opportunity Analysis By Environment , 2024-2030

Chapter 7. GLOBAL PANDORA BREAM AQUACULTURE MARKET – By Distribution Channel

7.1. Introduction/Key Findings

7.2. Traditional Retail

7.3. Supermarkets and Hypermarkets

7.4. Specialized Retailers

7.5. Online Stores

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. GLOBAL PANDORA BREAM AQUACULTURE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Environment

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution Channel

8.2.3. By Environment

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution Channel

8.3.3. By Environment

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution Channel

8.4.3. By Environment

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution Channel

8.5.3. By Environment

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL PANDORA BREAM AQUACULTURE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Global Maris Groupe

9.2. Avramar

9.3. Selonda Aquaculture

9.4. The Nissui Group

9.5. HESY Aquaculture

9.6. Ardag Seafood Company

9.7. Greig Seafood

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

the Global Aquaculture Market was valued at USD 219.16 billion in 2023 and is projected to reach a market size of USD 294.2 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 4.3%.

The heightened health awareness and growing technological advancements is propelling the Pandora Bream Aquaculture Market

Pandora Bream Aquaculture Market is segmented based on Environment, Distribution Channel and Region.