Pallet Market Size (2025-2030)

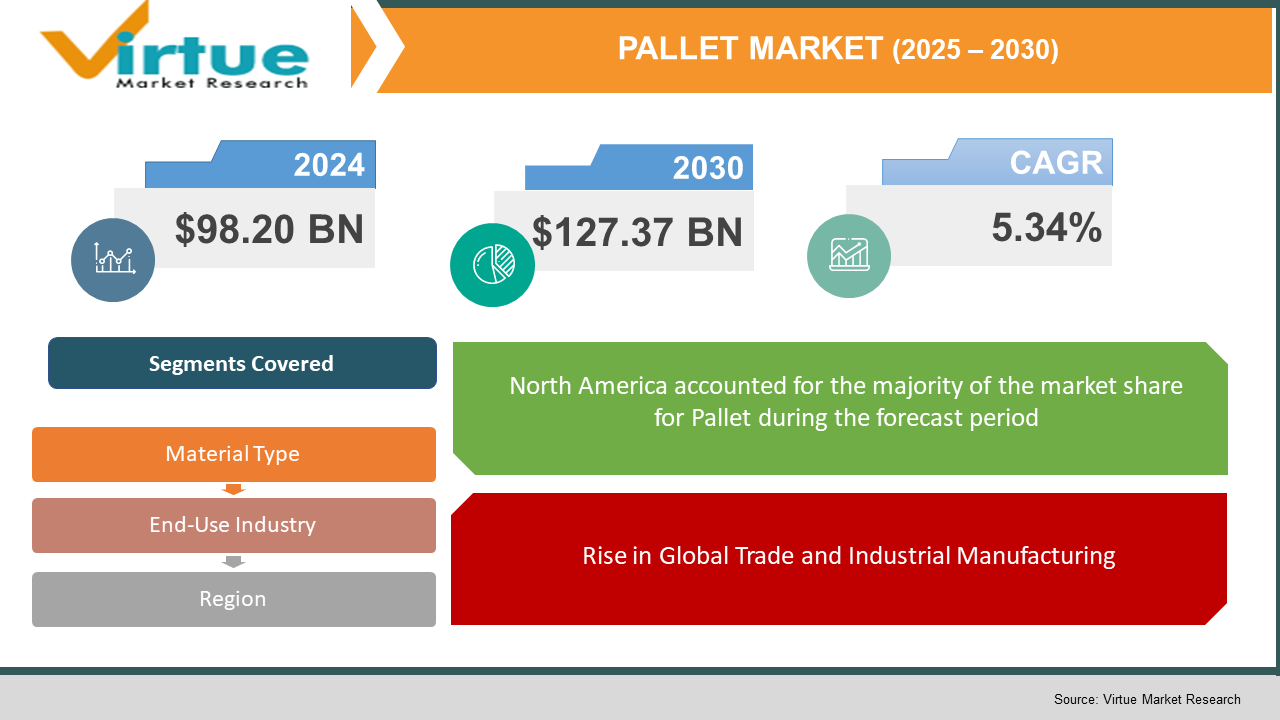

The Pallet Market was valued at USD 98.20 billion in 2024 and is projected to reach a market size of USD 127.37 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.34%.

The pallet market plays a critical role in global supply chains, serving as a backbone for material handling, storage, and transportation across industries. Pallets are flat transport structures that support goods in a stable manner while being lifted by forklifts, pallet jacks, or conveyors. They are widely used in sectors such as food and beverage, pharmaceuticals, retail, manufacturing, and logistics. The most commonly used material is wood, but there is growing adoption of plastic, metal, and paper-based pallets due to sustainability and hygiene considerations. Wooden pallets dominate in volume due to their affordability and ease of repair.

Plastic pallets, while more expensive, are favored for their durability, reusability, and resistance to moisture and contamination. Metal pallets are used in heavy-duty applications, especially in automotive and industrial settings. Corrugated paper pallets, being lightweight and recyclable, are increasingly chosen for air freight and export purposes. Regional demand varies, with North America and Asia-Pacific being the largest markets due to extensive manufacturing and export activities. The market is also influenced by automation trends in warehouses and increasing regulatory focus on environmental compliance.

Key Market Insights:

As of 2023, North America accounted for roughly 35% of the global pallet market, with Europe close behind at 30%, and Asia-Pacific representing about 25%. Although North America leads in market share, Asia-Pacific is emerging as the fastest-growing region. This shift is largely driven by expanding e-commerce networks and rising manufacturing output in countries like China and India.

Wood continues to be the dominant material in pallet production, making up around 60% of global usage. Plastic pallets hold a significant 25% share, appreciated for their durability and hygienic properties, especially in sectors like food and pharmaceuticals. Metal and composite types together constitute the remaining 15%, primarily used in heavy-duty and specialized logistics.

The market size for plastic pallets stood at approximately USD 6.84 billion in 2024. Projections suggest it will reach around USD 8.31 billion by 2030, reflecting a compound annual growth rate (CAGR) of 3.96% from 2025 onward. Asia-Pacific currently commands 32.6% of this market, led by demand in industrial hubs such as Japan, China, and South Korea.

Pallet pooling—a shared logistics model—was valued at USD 7.59 billion in 2023. From 2019 to 2023, it maintained a growth pace of 3.6% annually, with India forecasted to lead future gains at a 7.4% CAGR through 2030. Wood remains the preferred material in pooled pallet systems, accounting for 57.5% of total usage as of 2024.

Pallet Market Drivers:

Expansion of E-commerce and Retail Supply Chains

The rapid growth of e-commerce has led to increased demand for efficient warehousing, storage, and last-mile delivery, which in turn boosts pallet usage. Online retailers and logistics companies require durable and standardized pallets for high-speed, automated fulfillment operations. Pallets are essential for inventory organization and seamless transportation in omni-channel supply chains. As same-day and next-day delivery expectations rise, the need for scalable pallet solutions becomes even more critical.

Rise in Global Trade and Industrial Manufacturing

As global manufacturing activity expands, especially in emerging economies, the demand for pallets used in exports and industrial distribution has surged. Industries such as automotive, chemicals, and electronics rely on pallets for the safe and efficient handling of large volumes of goods. Additionally, globalization has increased cross-border trade, necessitating durable and standardized pallet systems that comply with international regulations. This trend is especially strong in regions like Asia-Pacific, where industrial output continues to climb.

Increased Focus on Sustainability and Recyclability

Environmental regulations and corporate sustainability goals are driving the adoption of recyclable and reusable pallet materials. Companies are shifting from traditional wood pallets to plastic or paper-based alternatives that reduce carbon footprint and promote circular economy practices. Recyclable pallets not only meet green compliance standards but also lower long-term operational costs through reuse. This shift is supported by innovations in pallet pooling and materials science, making sustainability a key value proposition in the market.

Pallet Market Restraints and Challenges:

Volatility in Raw Material Prices

Fluctuating prices of raw materials—especially timber, plastic resin, and steel—pose a significant challenge for pallet manufacturers. For example, timber prices have experienced sharp increases in recent years due to supply chain disruptions and regulatory restrictions on logging. These cost variations directly impact production budgets and profit margins, especially for small and mid-sized manufacturers. Unpredictable material costs also make long-term pricing strategies and inventory planning difficult.

Environmental Regulations on Wood Usage

Stringent environmental and phytosanitary regulations (such as ISPM 15 for wood packaging) limit the use of untreated wooden pallets in international shipping. Compliance with these rules requires heat treatment or fumigation, which adds to production costs and delays. Non-compliance can lead to shipment rejections, fines, or import/export barriers. This creates operational complexity for companies relying heavily on wood pallets for global logistics.

High Initial Costs of Alternative Materials

Although plastic, metal, and paper-based pallets offer durability and sustainability, their high upfront costs hinder widespread adoption. For instance, a plastic pallet can cost 3–5 times more than a standard wooden pallet. This cost barrier is especially significant for small businesses or regions with tight logistics budgets. As a result, many companies hesitate to switch from traditional materials despite long-term benefits.

Pallet Market Opportunities:

The pallet market presents several emerging opportunities driven by evolving industry demands and technological advancements. One major opportunity lies in the adoption of smart pallets equipped with RFID tags and IoT sensors, which allow real-time tracking and better supply chain visibility. As warehouse automation grows, especially in e-commerce and 3PL operations, the demand for standardized, automation-friendly pallet designs is increasing. Another key opportunity is the shift toward sustainable and recyclable pallet materials, such as paper-based or biodegradable plastics, aligning with global ESG goals. Pallet pooling and rental models are also gaining traction, offering cost-effective and environmentally responsible solutions for high-turnover industries. Moreover, emerging markets in Asia, Latin America, and Africa offer significant growth potential due to rising industrialization and logistics infrastructure development. Companies can also capitalize on custom pallet solutions tailored to niche sectors like pharmaceuticals or cold chain logistics. These opportunities are reshaping the pallet landscape, encouraging innovation and investment across the value chain.

PALLET MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.34% |

|

Segments Covered |

By material Type, end user industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Brambles Limited (CHEP), PalletOne Inc., ORBIS Corporation, CABKA Group, Millwood, Inc., Loscam (a division of Brambles Asia), Schoeller Allibert, Craemer Group, Rehrig Pacific Company, United Pallet Services Inc. etc. |

Pallet Market Segmentation:

Pallet Market Segmentation: by Material Type

- Wooden Pallets

- Plastic Pallets

- Metal Pallets

- Corrugated Paper Pallets

Wooden pallets are the most widely used due to their low cost, ease of repair, and broad availability. They are particularly popular in industries like agriculture, construction, and retail where single-use or short-term transport is common. However, wooden pallets require treatment to meet international shipping standards (e.g., ISPM 15) and can be susceptible to moisture and pest infestation. Wooden pallets account for approximately 60% of the global pallet market.

Plastic pallets are gaining popularity due to their durability, reusability, and resistance to moisture, chemicals, and contamination—making them ideal for pharmaceuticals, food, and beverage sectors. They support consistent dimensions and are compatible with automated material handling systems. Despite higher upfront costs, they offer long-term value through multiple use cycles and lower maintenance. Plastic pallets represent around 25% of the global market share.

Pallet Market Segmentation: by End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Retail

- Manufacturing

- Logistics & Transportation

The food and beverage sector is a major user of pallets, requiring hygienic and standardized handling solutions for perishable and packaged goods. Plastic pallets are particularly favored in this segment due to their compliance with food safety standards, resistance to moisture, and ease of cleaning. Pallets in this industry support efficient cold chain logistics and bulk transportation. Food & beverage accounts for approximately 30% of the global pallet market.

Manufacturing industries—including automotive, electronics, chemicals, and heavy machinery—require robust pallet solutions for transporting raw materials and finished products. Wooden and metal pallets are commonly used due to their load-bearing strength and customizability. The segment also benefits from reusable pallet systems and custom-sized options tailored to complex supply chains. Manufacturing accounts for roughly 25% of the market.

Pallet Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is one of the largest and most mature pallet markets, driven by advanced logistics infrastructure, automation in warehousing, and high-volume retail distribution. Wooden pallets dominate, though plastic pallets are gaining traction, particularly in the food, pharmaceutical, and export industries due to hygiene and durability. Pallet pooling is also well established in the U.S. and Canada, supported by major providers like CHEP and PECO. North America accounts for approximately 35% of the global pallet market.

Asia-Pacific is the fastest-growing region in the pallet market, fueled by rapid industrialization, booming e-commerce, and massive export activity in countries like China, India, and Japan. Demand is high for all pallet types, with growing interest in plastic and sustainable alternatives to meet international standards. Government investments in manufacturing and logistics infrastructure are further accelerating market expansion. Asia-Pacific holds about 25% of the global pallet market, with strong future growth potential.

Europe has a highly regulated pallet market, with strong emphasis on sustainability, standardization (e.g., EUR/EPAL pallet systems), and cross-border logistics efficiency. Plastic and corrugated pallets are increasingly used in industries that prioritize hygiene and recyclability, such as pharmaceuticals and food. The region has a well-developed pallet pooling ecosystem and strict compliance with phytosanitary regulations for wood. Europe represents roughly 30% of the global pallet market.

COVID-19 Impact Analysis on the Global Pallet Market:

The COVID-19 pandemic had a mixed impact on the global pallet market, disrupting supply chains while also driving demand in key sectors. Initially, pallet manufacturing faced challenges due to labor shortages, raw material constraints (especially timber), and transportation delays. This led to rising pallet prices and longer lead times, particularly in North America and Europe. However, the surge in e-commerce and essential goods logistics significantly increased demand for pallets in sectors like food, healthcare, and online retail.

Pallet pooling systems and reusable plastic pallets gained attention as companies looked for more hygienic and cost-efficient solutions. Many manufacturers also accelerated the adoption of automation and smart tracking technologies to improve pallet circulation. On the downside, small and regional pallet providers struggled with supply inconsistencies and declining capital availability. Overall, while the market faced short-term disruptions, the pandemic reinforced the need for resilient and scalable pallet solutions across industries.

Latest Trends/ Developments:

The pallet market is experiencing a wave of innovation driven by the rise of smart pallets equipped with RFID, GPS, and sensors for real-time tracking and condition monitoring. There is growing demand for reusable plastic pallets, particularly in food, pharma, and export logistics, due to their hygiene and durability advantages. Corrugated and paper-based pallets are also gaining traction in lightweight, short-cycle applications such as e-commerce and air freight. Companies are increasingly focused on sustainability, adopting recycled materials and promoting circular economy models to meet ESG goals.

At the same time, industry consolidation is intensifying, with larger players acquiring smaller firms to expand capabilities and market reach. The spread of warehouse automation and 3PL services has accelerated the need for uniform, automation-compatible pallet designs. Lastly, pallet pooling is emerging as a strategic solution, offering cost-efficiency, operational agility, and environmental benefits across large-scale supply chains.

Key Players:

- Brambles Limited (CHEP)

- PalletOne Inc.

- ORBIS Corporation

- CABKA Group

- Millwood, Inc.

- Loscam (a division of Brambles Asia)

- Schoeller Allibert

- Craemer Group

- Rehrig Pacific Company

- United Pallet Services Inc.

Chapter 1. Pallet Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. PALLET MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. PALLET MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. PALLET MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. PALLET MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. PALLET MARKET – By Material Type

6.1 Introduction/Key Findings

6.2 Wooden Pallets

6.3 Plastic Pallets

6.4 Metal Pallets

6.5 Corrugated Paper Pallets

6.6 Y-O-Y Growth trend Analysis By Material Type

6.7 Absolute $ Opportunity Analysis By Material Type , 2025-2030

Chapter 7. PALLET MARKET – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Food & Beverage

7.3 Pharmaceuticals

7.4 Retail

7.5 Manufacturing

7.6 Logistics & Transportation

7.7 Y-O-Y Growth trend Analysis By End-Use Industry

7.8 Absolute $ Opportunity Analysis By End-Use Industry , 2025-2030

Chapter 8. PALLET MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-Use Industry

8.1.3. By Material Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Material Type

8.2.3. By End-Use Industry

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Material Type

8.3.3. By End-Use Industry

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Material Type

8.4.3. By End-Use Industry

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Material Type

8.5.3. By End-Use Industry

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. PALLET MARKET – Company Profiles – (Overview, Material Type , Portfolio, Financials, Strategies & Developments)

9.1 Brambles Limited (CHEP)

9.2 PalletOne Inc.

9.3 ORBIS Corporation

9.4 CABKA Group

9.5 Millwood, Inc.

9.6 Loscam (a division of Brambles Asia)

9.7 Schoeller Allibert

9.8 Craemer Group

9.9 Rehrig Pacific Company

9.10 United Pallet Services Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Pallet Market was valued at USD 98.20 billion in 2024 and is projected to reach a market size of USD 127.37 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.34%.

Expansion of E-commerce and Retail Supply Chains, Expansion of E-commerce and Retail Supply Chains, Increased Focus on Sustainability and Recyclability are some of the key market drivers in the Pallet Market.

Wooden Pallets, Plastic Pallets, Metal Pallets, Corrugated Paper Pallets are the segments by Material Type in the Pallet Market.

North America is the most dominant region for the Global Pallet Market.

Brambles Limited (CHEP), PalletOne Inc., ORBIS Corporation, CABKA Group, Millwood, Inc., Loscam (a division of Brambles Asia), Schoeller Allibert, Craemer Group, Rehrig Pacific Company, United Pallet Services Inc. etc.