Packaging Robots Market Size (2024 – 2030)

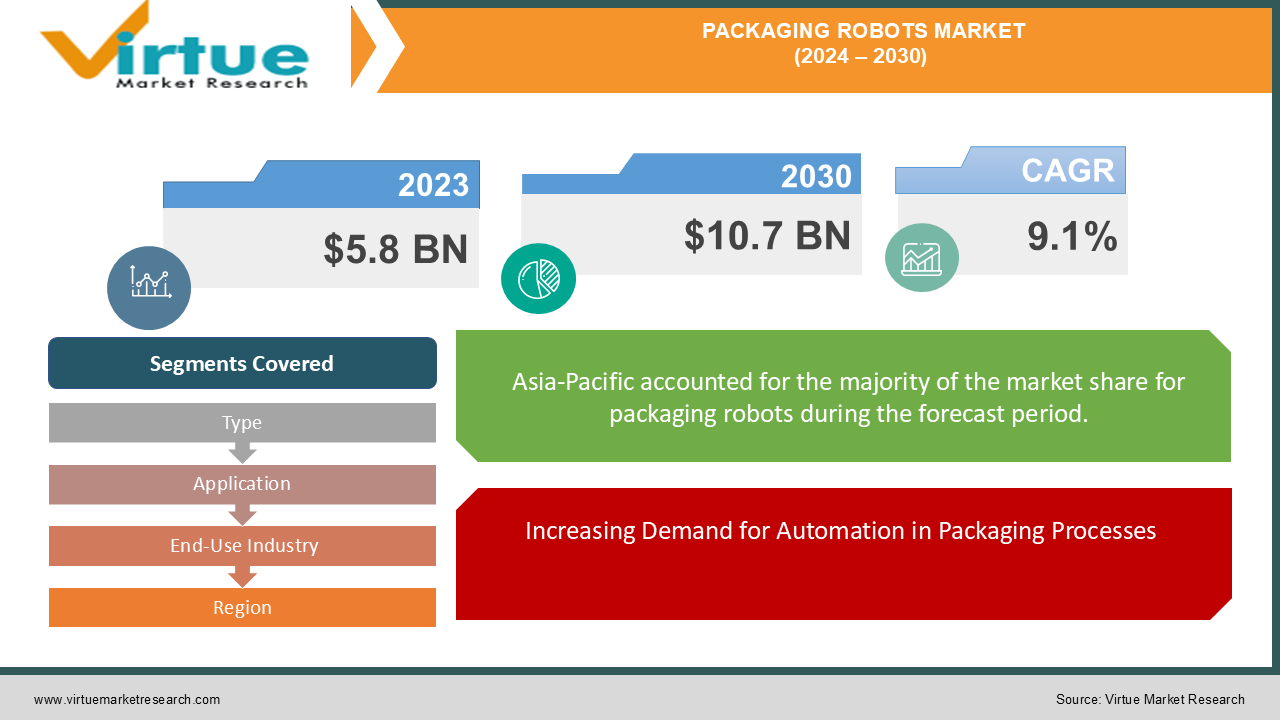

As of 2023, the Packaging Robots Market is valued at approximately USD 5.8 billion, with projections indicating a robust growth trajectory, reaching USD 10.7 billion by 2030, at a compound annual growth rate (CAGR) of 9.1% during the forecast period.

The Global Packaging Robots Market has experienced substantial growth, driven by the increasing demand for automation in packaging processes across various industries. The market's growth is fueled by the expansion of industries such as food & beverages, pharmaceuticals, and consumer goods, where packaging efficiency is critical. Key players in the market are focusing on the development of advanced robotic solutions, including collaborative robots (cobots), to cater to the diverse packaging needs of these industries. Additionally, the increasing adoption of Industry 4.0 and the integration of artificial intelligence (AI) and machine learning (ML) in robotics are expected to further drive the market growth.

Key Market Insights

Articulated robots dominate the market, accounting for over 40% of the global market revenue, driven by their versatility and widespread application in complex packaging tasks across various industries.

Pick & place applications hold a significant share, representing over 35% of the market revenue, as these robots are increasingly used to enhance speed and precision in packaging operations.

Asia-Pacific leads the market, contributing to 38% of global revenue, due to the rapid industrialization and the presence of major manufacturing hubs in the region.

The adoption of collaborative robots (cobots) is expected to increase significantly, with projected adoption rates growing by 25% by 2028, driven by their ability to work alongside human operators safely and efficiently.

Global Packaging Robots Market Drivers

Increasing Demand for Automation in Packaging Processes: The growing demand for automation in packaging processes is a primary driver of the Packaging Robots Market. Industries such as food & beverages, pharmaceuticals, and consumer goods are increasingly adopting packaging robots to enhance efficiency, reduce labor costs, and minimize human error. Packaging robots offer several advantages, including high-speed operations, precision, and the ability to handle a wide range of packaging tasks. These benefits are driving the adoption of packaging robots across various sectors, particularly in high-volume production environments where efficiency and accuracy are paramount. The shift towards automation is also fueled by the need to meet stringent quality standards and regulatory requirements, further boosting the demand for packaging robots.

Technological Advancements in Robotics are Driving the Market Growth: Technological advancements in robotics are significantly driving the growth of the Packaging Robots Market. Innovations such as AI, ML, and advanced sensors are enhancing the capabilities of packaging robots, enabling them to perform complex tasks with greater accuracy and efficiency. The integration of AI and ML allows robots to learn from their environments and improve their performance over time, making them more adaptable to changing packaging needs. Additionally, the development of cobots, which can work safely alongside human operators, is expanding the scope of robotics in packaging. These technological advancements are not only improving the functionality of packaging robots but also making them more accessible to a wider range of industries, driving market growth.

Growth of the Food & Beverage Industry is Driving the Market Growth: The rapid growth of the food & beverage industry is a significant driver of the Packaging Robots Market. As consumer demand for packaged food and beverages continues to rise, manufacturers are increasingly turning to automation to keep up with production demands. Packaging robots are widely used in the food & beverage industry for tasks such as pick & place, packing, and palletizing, helping manufacturers to improve efficiency and reduce operational costs. The need for high-speed, accurate, and hygienic packaging solutions is particularly critical in this industry, where product safety and quality are of utmost importance. As the food & beverage industry continues to expand, the demand for packaging robots is expected to grow in tandem.

Global Packaging Robots Market Challenges and Restraints

High Initial Investment Costs Restricting the Market Growth: Despite the numerous benefits of packaging robots, the high initial investment costs associated with their adoption are a significant restraint on the market. The cost of purchasing, installing, and maintaining packaging robots can be prohibitive for small and medium-sized enterprises (SMEs), limiting their ability to invest in automation. Additionally, the need for skilled personnel to operate and maintain these robots can further increase operational costs. While the long-term benefits of automation often outweigh the initial costs, the upfront investment remains a barrier for many companies, particularly in regions with limited access to capital. This challenge is particularly pronounced in developing markets, where the adoption of packaging robots may be slower due to financial constraints.

Complex Integration and Compatibility Issues Restricting the Market Growth: The integration of packaging robots into existing production lines can be complex and time-consuming, posing a challenge to the market's growth. Compatibility issues with existing equipment, software, and infrastructure can lead to delays and increased costs during the implementation process. Additionally, the customization of robotic systems to meet specific packaging needs requires careful planning and expertise, further complicating the integration process. These challenges are particularly relevant for companies with legacy systems that may not be easily compatible with modern robotics solutions. Ensuring seamless integration and minimizing downtime during the transition to automated packaging systems are critical concerns for manufacturers, and addressing these issues is essential for the widespread adoption of packaging robots.

Market Opportunities

The Packaging Robots Market presents several opportunities for growth and innovation. The increasing focus on sustainable packaging solutions is driving interest in eco-friendly packaging robots that can reduce waste and improve energy efficiency. Manufacturers and service providers that invest in sustainable robotics technologies are well-positioned to capitalize on the growing demand for environmentally friendly packaging solutions. Additionally, the expansion of packaging robots into new industries, such as healthcare and pharmaceuticals, presents significant growth opportunities. The rise of e-commerce and the increasing demand for customized packaging solutions are also creating opportunities for innovation in the packaging robots market. Companies that embrace these trends and invest in technology-driven solutions are likely to experience substantial growth in the packaging robots market.

PACKAGING ROBOTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.1% |

|

Segments Covered |

By Type, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Schneider Electric SE,Universal Robots A/S, Kawasaki Heavy Industries, Ltd., Robert Bosch GmbH, Denso Corporation |

Packaging Robots Market Segmentation - By Type

-

Articulated

-

SCARA

-

Delta

-

Cartesian

Articulated robots have emerged as the most dominant type in the packaging robots market, capturing over 40% of the global revenue. This dominance is primarily due to their versatility and ability to perform a wide range of packaging tasks, from pick & place to palletizing, across various industries. Articulated robots are particularly valued for their flexibility, which allows them to handle complex packaging operations with ease. Their widespread adoption in industries such as food & beverages, pharmaceuticals, and consumer goods has solidified their position as the leading type of packaging robots. As technological advancements continue to enhance the capabilities of articulated robots, their dominance in the packaging robots market is expected to persist.

Packaging Robots Market Segmentation - By Application

-

Pick & Place

-

Packing

-

Palletizing

Pick & place applications play a crucial role in the packaging robots market, accounting for over 35% of the total revenue. These robots are widely used to enhance the speed and precision of packaging operations, particularly in high-volume production environments. The ability of pick & place robots to quickly and accurately handle a wide range of products makes them indispensable in industries such as food & beverages, pharmaceuticals, and consumer goods. The growing demand for efficiency and accuracy in packaging processes is driving the adoption of pick-and-place robots, making this application segment a key contributor to the overall growth of the packaging robot market.

Packaging Robots Market Segmentation - By End-Use Industry

-

Food & Beverages

-

Pharmaceuticals

-

Consumer Goods

-

Others

The food & beverages industry is the most dominant end-use industry in the packaging robots market, contributing significantly to the overall revenue. The industry's reliance on high-speed, accurate, and hygienic packaging solutions makes it a key driver of demand for packaging robots. As consumer demand for packaged food and beverages continues to rise, manufacturers in this industry are increasingly adopting packaging robots to enhance efficiency and reduce operational costs. The food & beverages industry's ongoing expansion and the need for reliable packaging solutions are expected to drive further growth in the packaging robots market.

Packaging Robots Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Asia-Pacific leads the Packaging Robots Market, contributing to 38% of global revenue. The region's leadership is driven by rapid industrialization, the presence of major manufacturing hubs, and the increasing adoption of automation across various industries. Countries such as China, Japan, and South Korea are at the forefront of the robotics revolution, with significant investments in robotics technology and infrastructure. The growing demand for packaging robots in industries such as food & beverages, pharmaceuticals, and consumer goods is driving the market's growth in Asia-Pacific. Additionally, the region's strong manufacturing base and favorable government policies supporting automation are expected to further bolster the market's expansion.

COVID-19 Impact Analysis on Packaging Robots Market

The COVID-19 pandemic has had a profound impact on the Packaging Robots Market. The pandemic accelerated the adoption of automation and robotics in the packaging industry as companies sought to minimize human contact and ensure the safety of their workforce. The surge in demand for packaged goods, particularly in the food & beverage and pharmaceutical industries, highlighted the need for efficient and reliable packaging solutions. As a result, investments in packaging robots increased, with companies focusing on enhancing their automation capabilities to meet the growing demand. The COVID-19 pandemic also underscored the importance of resilience and flexibility in supply chains, further driving the adoption of packaging robots. While the pandemic posed challenges, such as supply chain disruptions and economic uncertainties, it ultimately reinforced the critical role of automation in the packaging industry.

Latest Trends/Developments

Several trends and developments are shaping the Packaging Robots Market. One notable trend is the increasing adoption of collaborative robots (cobots) in packaging operations. Cobots are designed to work alongside human operators, enhancing productivity and safety in the workplace. Their ability to perform complex tasks while interacting safely with humans is driving their popularity in the packaging industry. Another significant trend is the integration of AI and ML in packaging robots, enabling them to adapt to changing packaging requirements and optimize their performance. Additionally, there is a growing focus on sustainable packaging solutions, with manufacturers investing in eco-friendly packaging robots that reduce waste and improve energy efficiency. The rise of e-commerce is also influencing packaging robots, as companies seek to meet the demand for customized and efficient packaging solutions. These trends are expected to drive innovation and growth in the Packaging Robots Market.

Key Players

-

ABB Ltd.

-

Fanuc Corporation

-

KUKA AG

-

Yaskawa Electric Corporation

-

Mitsubishi Electric Corporation

-

Schneider Electric SE

-

Universal Robots A/S

-

Kawasaki Heavy Industries, Ltd.

-

Robert Bosch GmbH

-

Denso Corporation

Chapter 1. Packaging Robots Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Packaging Robots Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Packaging Robots Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Packaging Robots Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Packaging Robots Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Packaging Robots Market – By Application

6.1 Introduction/Key Findings

6.2 Pick & Place

6.3 Packing

6.4 Palletizing

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Packaging Robots Market – By Type

7.1 Introduction/Key Findings

7.2 Articulated

7.3 SCARA

7.4 Delta

7.5 Cartesian

7.6 Y-O-Y Growth trend Analysis By Type

7.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Packaging Robots Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Food & Beverages

8.3 Pharmaceuticals

8.4 Consumer Goods

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End-Use Industry

8.7 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Packaging Robots Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Type

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Type

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Type

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Type

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Type

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Packaging Robots Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ABB Ltd.

10.2 Fanuc Corporation

10.3 KUKA AG

10.4 Yaskawa Electric Corporation

10.5 Mitsubishi Electric Corporation

10.6 Schneider Electric SE

10.7 Universal Robots A/S

10.8 Kawasaki Heavy Industries, Ltd.

10.9 Robert Bosch GmbH

10.10 Denso Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As of 2023, the Global Packaging Robots Market is valued at approximately USD 5.8 billion and is projected to reach USD 10.7 billion by 2030, growing at a CAGR of 9.1% during the forecast period.

The key drivers include the increasing demand for automation in packaging processes, technological advancements in robotics, and the growth of the food & beverage industry.

The Packaging Robots Market is segmented by type (Articulated, SCARA, Delta, Cartesian), application (Pick & Place, Packing, Palletizing), and end-use industry (Food & Beverages, Pharmaceuticals, Consumer Goods, Others).

Asia-Pacific is the most dominant region, contributing 38% of the global revenue, driven by rapid industrialization and the presence of major manufacturing hubs.

The leading players in the market include ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Schneider Electric SE, Universal Robots A/S, Kawasaki Heavy Industries, Ltd., Robert Bosch GmbH, and Denso Corporation.