Packaging Material Market Size (2025 – 2030)

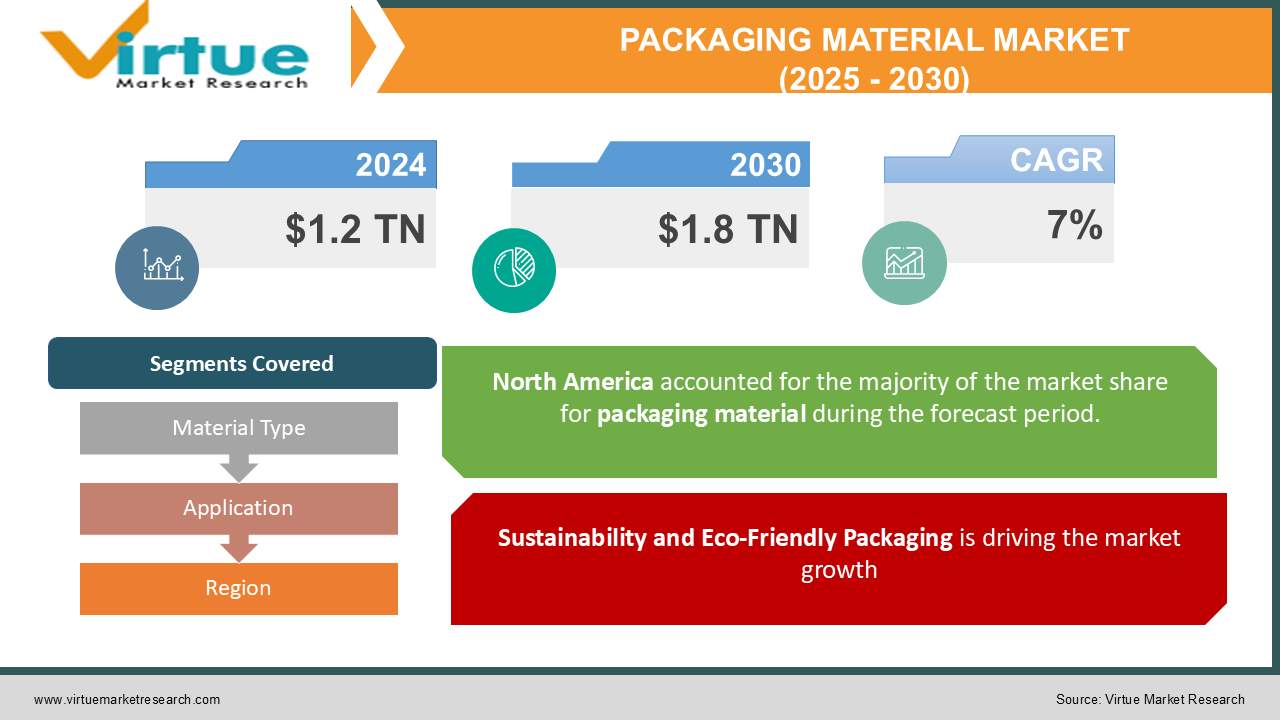

The Global Packaging Material Market was valued at USD 1.2 trillion in 2024 and is projected to reach USD 1.8 trillion by 2030, growing at a CAGR of 7% from 2025 to 2030.

The market encompasses a wide variety of materials used in packaging products for transportation, retail, and industrial use. Packaging materials are essential for protecting, containing, and marketing products across different industries, including food and beverages, healthcare, consumer goods, and e-commerce.

In recent years, consumer demand for more sustainable and eco-friendly packaging solutions has accelerated, influencing the industry significantly. This trend is compounded by stricter environmental regulations and an increased focus on reducing plastic waste, driving innovations such as biodegradable, recyclable, and reusable packaging materials. Moreover, the global growth in e-commerce and rising consumption of packaged goods are contributing factors to the market's expansion. As technology advances, smart packaging that provides enhanced safety, functionality, and consumer interaction is gaining popularity. The packaging materials market is thus poised for continued growth, with key regions like North America, Europe, and Asia-Pacific leading the adoption of innovative packaging solutions.

Key Market Insights:

-

Plastic packaging continues to dominate the market; however, demand for sustainable materials such as paper, glass, and biodegradable options is increasing.

-

North America holds a significant market share of approximately 30%, driven by strong demand from industries like food and beverage, pharmaceuticals, and e-commerce.

-

The Asia-Pacific region, particularly China and India, is witnessing rapid growth due to increasing industrialization, urbanization, and growing middle-class populations.

-

The e-commerce sector is increasingly driving demand for packaging materials, with corrugated cardboard being a key packaging material for shipping products. Sustainability is a primary driver, with a surge in demand for recyclable and compostable materials, creating new opportunities for packaging manufacturers. Technological advancements such as smart packaging and active packaging are gaining traction, particularly in the food and healthcare industries.

-

Consumer preference for eco-friendly packaging is influencing companies to invest in sustainable alternatives to plastic packaging.

Global Packaging Material Market Drivers:

Sustainability and Eco-Friendly Packaging is driving the market growth

As concerns about environmental impact grow, there is an increasing emphasis on reducing the carbon footprint of packaging materials. Sustainable packaging, including recyclable, biodegradable, and reusable options, is gaining momentum. Materials like paper, glass, and bioplastics are becoming alternatives to traditional plastics. Additionally, regulations around plastic waste management, particularly in Europe and parts of North America, are compelling manufacturers to explore eco-friendly packaging solutions. The circular economy model, which encourages reusing and recycling materials, is further pushing the adoption of sustainable packaging practices in industries worldwide. These developments have a direct impact on the growth of eco-friendly packaging material market segments.

Growth of E-commerce and Packaging Demand is driving the market growth

The e-commerce sector is one of the largest consumers of packaging materials globally. As online shopping continues to rise, particularly in the post-pandemic era, the need for durable and secure packaging materials, especially for shipping, has seen a substantial increase. Packaging, such as corrugated boxes, flexible films, and protective materials, is essential to ensure the safe delivery of goods to consumers. With the rapid rise in e-commerce in regions like North America, Europe, and Asia-Pacific, the demand for packaging materials continues to climb. Additionally, innovations in packaging that provide an enhanced consumer experience, such as personalized or branded packaging, are being incorporated into e-commerce strategies.

Technological Innovations in Packaging is driving the market growth

Technological advancements, particularly in smart packaging, are becoming key drivers for the market. Smart packaging offers features such as real-time tracking, temperature control, and product authentication, especially useful in the food and pharmaceutical industries. These innovations improve both consumer experience and product safety by ensuring that items arrive in optimal condition. Active packaging, which uses substances that interact with the product to extend shelf life or improve quality, is also gaining traction. With advancements in materials science and engineering, the ability to develop packaging that is more efficient, functional, and sustainable is reshaping the market.

Global Packaging Material Market Challenges and Restraints:

High Raw Material Costs is restricting the market growth

The rising costs of raw materials such as plastics, paper, and aluminum are a significant challenge for packaging manufacturers. Fluctuations in prices due to global supply chain disruptions or raw material shortages can increase production costs. These increased costs are often passed on to consumers, impacting demand, particularly in price-sensitive markets. Manufacturers are continuously seeking ways to optimize production processes and find alternative materials to mitigate the impact of high raw material costs. Additionally, reliance on petroleum-based raw materials for plastic production adds to concerns about sustainability, prompting companies to explore alternatives, which often come at a higher price.

Regulatory Challenges and Compliance is restricting the market growth

The packaging industry is subject to stringent environmental regulations and waste management laws in various regions. Governments around the world are introducing laws aimed at reducing packaging waste and increasing recycling rates. For instance, the European Union’s Single-Use Plastics Directive aims to eliminate certain plastic products and increase recycling rates. Compliance with these regulations can be costly for manufacturers, especially in developing regions. In addition, varying regulations across different countries can create complexities for companies operating in multiple markets. Meeting regulatory standards while maintaining cost-effectiveness remains a significant challenge for packaging material suppliers.

Market Opportunities:

One of the most promising opportunities for the packaging material market is the shift toward sustainable and eco-friendly packaging solutions. As consumer preference for environmentally responsible products continues to grow, companies are increasingly investing in green packaging alternatives, such as biodegradable plastics, recycled materials, and plant-based packaging. This growing trend is being driven by both regulatory pressures and shifts in consumer behavior, particularly among younger, eco-conscious consumers. Additionally, smart packaging technologies that offer features like enhanced product safety, tracking, and freshness are expected to play a pivotal role in driving future demand. As industries like food and beverages, pharmaceuticals, and electronics continue to innovate, the adoption of advanced packaging materials that offer added functionality will create a competitive edge in the marketplace. Another opportunity lies in the expansion of e-commerce and global trade. As online shopping continues to rise, there is an increasing need for packaging materials that are durable, lightweight, and cost-effective. Innovations in packaging, such as flat-pack designs and minimalist packaging, are gaining traction in e-commerce to reduce shipping costs and waste. Moreover, the increasing consumption of packaged food and beverages, particularly in emerging economies, offers significant market growth potential in regions like Asia-Pacific and Latin America.

PACKAGING MATERIAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Material Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor, International Paper, WestRock Company, Sealed Air Corporation, Smurfit Kappa Group, Ball Corporation, Tetra Pak, Bemis Company, Inc., Mondi Group, Sonoco Products Company |

Packaging Material Market Segmentation: By Material Type

-

Plastic

-

Paper

-

Metal

-

Glass

-

Other Materials (Biodegradable, Composite, etc.)

Plastic packaging is the dominant material type in the packaging market, accounting for the largest market share due to its versatility, low cost, and wide availability. However, paper packaging is gaining momentum as a sustainable alternative, particularly in food and beverage packaging, driven by consumer demand for eco-friendly products. Glass and metal packaging are primarily used in premium products like beverages and cosmetics due to their ability to preserve product integrity.

Packaging Material Market Segmentation: By Application

-

Food & Beverage

-

Healthcare & Pharmaceuticals

-

Consumer Goods

-

E-commerce

-

Other Applications (Cosmetics, Industrial Goods)

The food and beverage sector remains the largest consumer of packaging materials due to the constant demand for food safety, preservation, and convenience. However, e-commerce has become an increasingly significant application, as online shopping continues to grow. The healthcare and pharmaceuticals segment also represents a vital application, with stringent packaging requirements for product safety, such as tamper-proof and sterile packaging.

Packaging Material Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America is the largest market for packaging materials, driven by a strong presence of established packaging manufacturers and a high demand for packaged food, beverages, and consumer goods. Europe follows closely, with its significant focus on sustainable packaging solutions and strict environmental regulations. The Asia-Pacific region, particularly China and India, is witnessing rapid growth in packaging demand due to the expanding middle class, urbanization, and increasing consumption of packaged goods.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the packaging material market. While demand for food packaging and e-commerce packaging surged due to increased consumer reliance on home delivery services, many other industries, such as automotive packaging, saw a decline. Supply chain disruptions, raw material shortages, and logistical challenges led to temporary setbacks. However, as the pandemic shifted consumer habits toward more online shopping and increased food delivery, the demand for packaging materials, particularly for e-commerce and food sectors, saw significant growth. The pandemic also accelerated the demand for hygienic and sustainable packaging solutions, influencing packaging design and materials moving forward.

Latest Trends/Developments:

Sustainable packaging solutions continue to dominate, with paper-based packaging seeing significant growth due to consumer demand for recyclable options. The development of smart packaging that offers enhanced functionality such as temperature control and real-time tracking is gaining traction, particularly in food and pharmaceutical applications. Biodegradable plastics and plant-based materials are becoming more popular, driven by both sustainability concerns and regulatory pressures. The rise of minimalist packaging designs in e-commerce is not only reducing costs but also catering to consumer preferences for less waste. Active packaging that interacts with products to extend shelf life or improve product quality is seeing increased adoption, particularly in the food industry.

Key Players:

-

Amcor

-

International Paper

-

WestRock Company

-

Sealed Air Corporation

-

Smurfit Kappa Group

-

Ball Corporation

-

Tetra Pak

-

Bemis Company, Inc.

-

Mondi Group

-

Sonoco Products Company

Chapter 1. Packaging Material Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Packaging Material Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Packaging Material Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Packaging Material Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Packaging Material Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Packaging Material Market – By Material Type

6.1 Introduction/Key Findings

6.2 Plastic

6.3 Paper

6.4 Metal

6.5 Glass

6.6 Other Materials (Biodegradable, Composite, etc.)

6.7 Y-O-Y Growth trend Analysis By Material Type

6.8 Absolute $ Opportunity Analysis By Material Type, 2025-2030

Chapter 7. Packaging Material Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverage

7.3 Healthcare & Pharmaceuticals

7.4 Consumer Goods

7.5 E-commerce

7.6 Other Applications (Cosmetics, Industrial Goods)

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Packaging Material Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Material Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Material Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Material Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Material Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Material Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Packaging Material Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amcor

9.2 International Paper

9.3 WestRock Company

9.4 Sealed Air Corporation

9.5 Smurfit Kappa Group

9.6 Ball Corporation

9.7 Tetra Pak

9.8 Bemis Company, Inc.

9.9 Mondi Group

9.10 Sonoco Products Company

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global packaging material market was valued at USD 1.2 trillion in 2024 and is expected to reach USD 1.8 trillion by 2030, with a CAGR of 7%.

The key drivers include sustainability and eco-friendly packaging, the growth of e-commerce, and technological innovations such as smart and active packaging.

The market is segmented by material type (plastic, paper, metal, glass, and other materials) and by application (food & beverage, healthcare & pharmaceuticals, consumer goods, e-commerce, and others).

North America dominates the global packaging material market with a market share of approximately 30%, driven by demand from food & beverage, pharmaceuticals, and e-commerce sectors.

Leading players include Amcor, International Paper, WestRock Company, Sealed Air Corporation, Smurfit Kappa Group, Ball Corporation, Tetra Pak, Bemis Company, Inc., Mondi Group, and Sonoco Products Company.