Packaging Market Size (2024 – 2030)

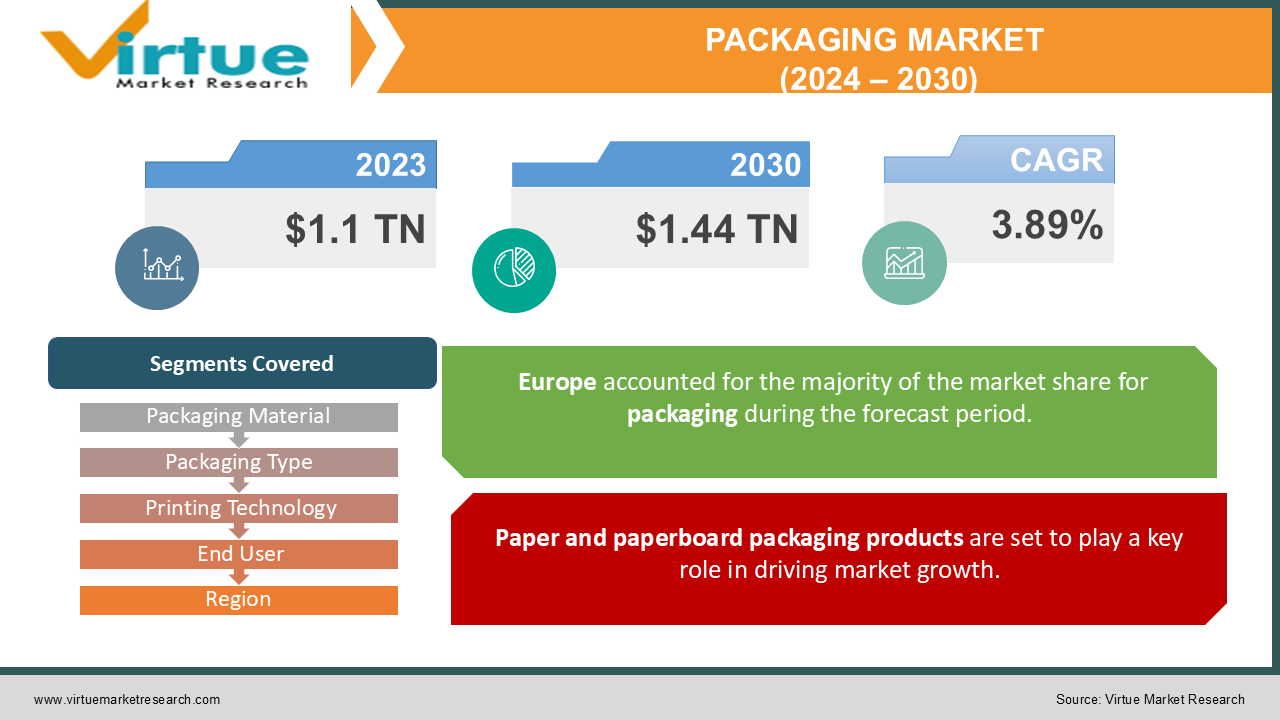

The Packaging Market was valued at USD 1.1 trillion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.44 trillion by 2030, growing at a CAGR of 3.89%.

The packaging industry is experiencing significant growth, primarily driven by the expansion of the organized retail sector, alongside the growing demand for sustainable and recyclable packaging solutions. Furthermore, the integration of blockchain technology for enhanced traceability and ongoing innovations in packaging technology are creating new opportunities for market advancement.

Key Market Insights:

-

Over the past decade, the global packaging market has witnessed consistent expansion, influenced by shifts in material preferences, the emergence of new markets, and changes in ownership structures. Flexible packaging formats, high-barrier films, and stand-up retort pouches are increasingly displacing traditional packaging formats such as metal tins and glass jars, particularly within the food industry.

-

Digital printing technology is poised for substantial growth within the packaging sector, driven by its ability to offer high-quality, customizable, and cost-effective solutions. Additionally, the rise of smart packaging technologies is expected to transform the industry, introducing new possibilities for innovation and functionality.

Packaging Market Drivers:

Paper and paperboard packaging products are set to play a key role in driving market growth.

The growing demand for environmentally friendly materials is significantly driving the packaging market. Eco-friendly packaging, which includes characteristics such as recyclability, biodegradability, reusability, and low toxicity, is gaining traction due to its reduced environmental impact. Among these, paper-based packaging solutions—such as bags, pouches, and cartons—have been at the forefront of the shift toward more sustainable packaging options. The rise of e-commerce, coupled with stringent environmental regulations on non-biodegradable and non-recyclable packaging, is fueling the demand for eco-friendly paper-based packaging solutions. As a result, companies are increasingly adopting sustainable packaging to align with consumer preferences and regulatory standards. Consumers generally perceive paper and paperboard packaging as more environmentally responsible compared to plastic alternatives.

Packaging Market Restraints and Challenges:

The high cost of sustainable packaging materials presents a significant challenge to market growth.

The rising cost of raw materials derived from crude oil and petrochemicals, which are essential for plastic production, is a key factor restraining growth in the global plastic packaging market. Additionally, the volatility in crude oil prices at the global level contributes to increased costs for transportation and exploration, further elevating the overall cost of plastic packaging. These rising expenses are expected to pose challenges to the market, potentially slowing down growth and shifting focus toward alternative packaging solutions.

Packaging Market Opportunities:

The paper and paperboard packaging industry is anticipated to generate considerable opportunities.

Eco-friendly packaging, defined by its recyclability, biodegradability, reusability, and low toxicity, is gaining traction due to its minimal environmental impact. In particular, paper-based solutions such as bags, pouches, and cartons have played a leading role in the growing adoption of sustainable packaging. The surge in online retail, coupled with stricter environmental regulations targeting non-biodegradable and non-recyclable packaging, is creating a strong demand for eco-friendly paper packaging alternatives. In response, companies are increasingly transitioning to sustainable packaging to meet both consumer expectations and regulatory standards. Consumers are also increasingly viewing paper and paperboard packaging as more environmentally responsible compared to plastic options.

PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.89% |

|

Segments Covered |

By Packaging Material, Packaging Type, Printing Technology, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor Plc, Sealed Air Corporation, Mondi Plc, Sonoco Products Company , Berry Global, International Paper, Huhtamaki, Westrock Company , Constantia Flexibles , Coveris Holdings |

Packaging Market Segmentation: By Packaging Material

-

Plastics

-

Paper and paperboard

-

Metal

-

Glass

The paper and paperboard segment commands a dominant share of the packaging market and is projected to experience significant growth in the coming years. These materials are highly valued in the packaging industry due to their sustainability, affordability, and versatility. Derived from renewable wood fibers, paper and paperboard are biodegradable, making them a key component in the shift toward more eco-friendly packaging solutions. Their ability to be both cost-effective and adaptable to various packaging needs further strengthens their market position. Paper and paperboard are primarily sourced from wood pulp, which is processed through either chemical or mechanical pulping methods, ensuring a sustainable supply of raw materials for the packaging sector.

Packaging Market Segmentation: By Packaging Type

-

Flexible packaging

-

Rigid packaging

The rigid packaging segment led the packaging market and is expected to maintain its dominance throughout the forecast period. Rigid packaging refers to packaging materials and containers that have a solid, inflexible structure, offering enhanced protection for the products inside. This type of packaging is widely utilized across various industries due to its durability, strength, and capacity to safeguard goods during transit and storage. Common materials used in rigid packaging include plastics, metals, glass, and occasionally wood, all of which provide the necessary robustness and protection for a wide array of products.

Packaging Market Segmentation: By Printing Technology

-

Offset

-

Flexography

-

Screen

-

Gravure

-

Digital

The flexography segment dominated the packaging market and is expected to experience substantial growth during the forecast period. Flexography, or flexo printing, is a highly adaptable and advanced printing technology used across a wide range of packaging applications. It is a relief printing method that employs flexible photopolymer plates to transfer ink onto various substrates, such as paper, cardboard, plastic, or film. Key components of the flexographic process include the flexo press, printing plates, ink, and the substrate. The printing plates, typically made of flexible polymer materials, are mounted on cylinders and engraved with the design or image to be printed, enabling high-quality, efficient, and versatile printing for packaging materials.

Packaging Market Segmentation: By End User

-

Food

-

Beverage

-

Pharmaceutical

-

beauty and personal care

-

industrial

-

Others

The food and beverage industry is increasingly transitioning from plastic to paper packaging in response to growing environmental concerns and regulatory pressures aimed at reducing plastic waste. As a result, manufacturers are increasingly adopting paper and paperboard packaging solutions. This shift also reflects a broader consumer demand for convenience, with packaging solutions designed to fit into busy lifestyles. In particular, the food and beverage sector is seeing a surge in demand for packaging that offers convenience, such as single-serve portions, resealable packs, and easy-to-open containers.

This trend highlights the need for on-the-go packaging options that cater to the fast-paced nature of modern life. Beyond convenience, packaging in the food industry plays a critical role in preservation, protection, marketing, and regulatory compliance. Preservation, in particular, is a key function of food packaging, as it helps extend the shelf life of perishable goods. Packaging solutions such as vacuum-sealed bags, modified atmosphere packaging (MAP), and barrier coatings help create protective environments that minimize exposure to oxygen, moisture, and other factors that can degrade the quality of food.

Packaging Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The European packaging market held the largest market share and is expected to sustain robust growth throughout the forecast period. It plays a critical role in safeguarding goods during transit while also significantly influencing consumer purchasing decisions and contributing to the broader sustainability efforts within the economy. Germany, in particular, stands out as a leader in the sector, known for its innovation in packaging machinery, advanced materials, and a strong presence in key packaging segments such as paperboard, flexible packaging, and plastics.

The packaging market in the Asia Pacific region is projected to experience substantial growth throughout the forecast period. Plastic packaging has become widely adopted across the region, with countries like India and China playing pivotal roles, particularly within their food and beverage industries. The packaging sector in China is strongly influenced by factors such as rising per capita income, demographic changes, and the implementation of plastic bans aimed at reducing environmental impact. These regulations are having a significant effect on the packaging landscape in the region.

As the fifth-largest sector in India's economy, packaging has seen consistent growth, with considerable potential for future development, particularly in the export sector. Notably, packaging costs in India are up to 40% lower than in many European countries, making the nation an attractive destination for businesses seeking cost-effective packaging solutions. India’s large, skilled labor force further strengthens its appeal as a competitive hub for packaging production.

Japan is another major player in the region, particularly known for its high consumption of paper-based products across various industries, including packaging, printing, and sanitary applications. Driven by growing environmental awareness, concerns over deforestation, and resource availability, Japan’s packaging industry is increasingly shifting toward sustainable, paper-based alternatives.

In China, the production of plastic packaging materials has witnessed remarkable growth, with a monthly average output of 6.59 million metric tons, peaking at 6.98 million metric tons. This high production volume ensures a stable supply of plastic raw materials, helping packaging manufacturers maintain consistent production schedules, reduce lead times, and improve delivery reliability.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a notable impact on the packaging market, leading many companies to shift toward increased use of single-use plastics. As the demand for single-use plastic packaging and medical supplies surged, supply chains faced significant strain in trying to meet this heightened need. This rapid increase in plastic consumption is expected to cause a temporary delay in the industry's transition toward a circular economy, as short-term priorities

focused on addressing immediate public health and safety concerns took precedence. Moreover, this spike in demand is likely to put additional pressure on the plastic packaging manufacturing supply chain, potentially impacting production capacity and sustainability efforts in the near term.

Latest Trends/ Developments:

In June 2024, Berry Global Group Inc. unveiled a new rectangular Domino bottle, specifically designed for the beauty, home, and personal care sectors. This innovative bottle is made from up to 100% post-consumer recycled (PCR) plastic, aligning with sustainability goals. The 250ml Domino bottle features a 75-millimeter wide front panel, which can be customized on its side panels, offering brands the flexibility to personalize their packaging.

Artemis specializes in packaging for the food and beverage industry and also manufactures films and caps for wine bags used in Bag-in-Box packaging. This acquisition further strengthens Smurfit Kappa's position in the sustainable packaging market.

This one-liter bottle is made entirely from 100% post-consumer recycled materials, marking it as the first of its kind in the PET stock-keeping unit (SKU) category. This launch underscores Amcor's commitment to sustainability, as the company seeks to support its clients in achieving their own environmental goals through innovative, eco-friendly packaging solutions.

Key Players:

These are top 10 players in the Packaging Market :-

-

Amcor Plc

-

Sealed Air Corporation

-

Mondi Plc

-

Sonoco Products Company

-

Berry Global

-

International Paper

-

Huhtamaki

-

Westrock Company

-

Constantia Flexibles

-

Coveris Holdings

Chapter 1. Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Packaging Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Packaging Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Packaging Market – By Packaging Material

6.1 Introduction/Key Findings

6.2 Plastics

6.3 Paper and paperboard

6.4 Metal

6.5 Glass

6.6 Y-O-Y Growth trend Analysis By Packaging Material

6.7 Absolute $ Opportunity Analysis By Packaging Material, 2024-2030

Chapter 7. Packaging Market – By Packaging Type

7.1 Introduction/Key Findings

7.2 Flexible packaging

7.3 Rigid packaging

7.4 Y-O-Y Growth trend Analysis By Packaging Type

7.5 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 8. Packaging Market – By By Printing Technology

8.1 Introduction/Key Findings

8.2 Offset

8.3 Flexography

8.4 Screen

8.5 Gravure

8.6 Digital

8.7 Y-O-Y Growth trend Analysis By Printing Technology

8.8 Absolute $ Opportunity Analysis By Printing Technology, 2024-2030

Chapter 9. Packaging Market – By End-User

9.1 Introduction/Key Findings

9.2 Food

9.3 Beverage

9.4 Pharmaceutical

9.5 beauty and personal care

9.6 industrial

9.7 Others

9.8 Y-O-Y Growth trend Analysis End-User

9.9 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Packaging Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Packaging Material

10.1.2.1 By Packaging Type

10.1.3 By By Printing Technology

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Packaging Material

10.2.3 By Packaging Type

10.2.4 By By Printing Technology

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Packaging Material

10.3.3 By Packaging Type

10.3.4 By By Printing Technology

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Packaging Material

10.4.3 By Packaging Type

10.4.4 By By Printing Technology

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Packaging Material

10.5.3 By Packaging Type

10.5.4 By By Printing Technology

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Amcor Plc

11.2 Sealed Air Corporation

11.3 Mondi Plc

11.4 Sonoco Products Company

11.5 Berry Global

11.6 International Paper

11.7 Huhtamaki

11.8 Westrock Company

11.9 Constantia Flexibles

11.10 Coveris Holdings

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The packaging industry is experiencing significant growth, primarily driven by the expansion of the organized retail sector, alongside the growing demand for sustainable and recyclable packaging solutions.

The top players operating in the Packaging Market are - Amcor Plc, Sealed Air Corporation, Mondi Plc, Sonoco Products Company, Berry Global.

The COVID-19 pandemic had a notable impact on the packaging market, leading many companies to shift toward increased use of single-use plastics.

In June 2024, Berry Global Group Inc. unveiled a new rectangular Domino bottle, specifically designed for the beauty, home, and personal care sectors. This innovative bottle is made from up to 100% post-consumer recycled (PCR) plastic, aligning with sustainability goals.

The Asia Pacific packaging market is forecasted to undergo significant growth over the duration of the projected period.