Packaging Equipment Market Size (2024 – 2030)

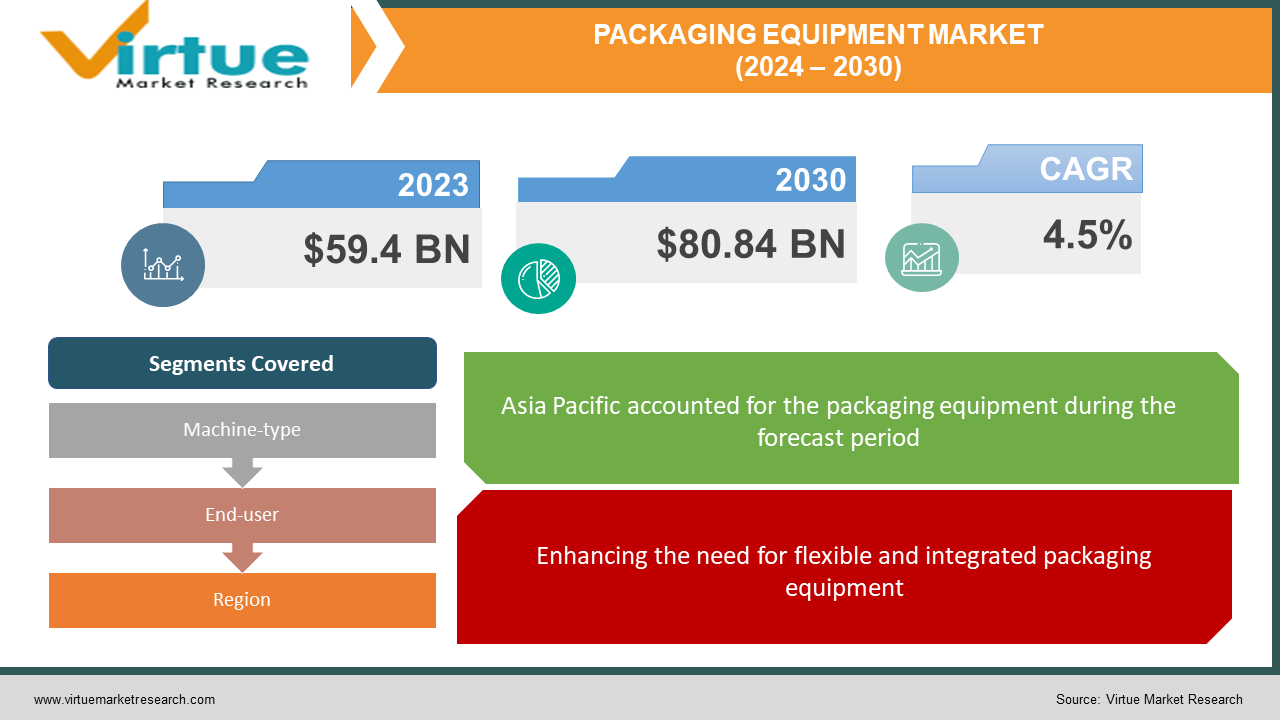

The Global Packaging Equipment Market was estimated at USD 59.4 billion in 2023 and is expected to reach a market size of USD 80.84 billion by the end of 2030. Over the predicted period of 2024-2030, the market is estimated to grow at a CAGR of 4.5%.

Packaging Equipment is utilized to conduct operations such as filling, case handling, packing, bottling, labelling, inspection and check weighing, covering, palletizing, and other associated applications. It is mainly employed for the first step in the transportation process and the last step in the manufacturing process. Lean packaging operation with the overall equipment effectiveness (OEE) technique is an enhancing trend in the market. With lean packaging operation, standardization of equipment becomes an easy activity. It provides multiple advantages such as nations that can need a lower purchasing price and activities with ease of troubleshooting and maintenance. Practically, the Packaging industry is fragmented into three key categories including, packaging manufacturing, packaging services, and packaging equipment. Wherein, the market is estimated to grow moderately due to the purchasing rationalization and minimal timelines of the product.

Key Market Insights:

-

The Packaging Equipment market is consumer-oriented and is directed by increased demand for different types of products in different shapes and sizes. Various manufacturers in the end-user industries deploy packaging machines that ensure flexibility and rapidly adapt to changing packaging formats.

-

Sustainability and increasing environmental concerns have grown the demand for thin and lightweight packaging to lower the amount of material used for packaging. Hence, to adapt to these necessities, producers’ eyes are on developing machines with improved functionality to maximize production pace while facilitating weak and thinner packaging materials.

-

The enhancing aseptic packaging industry also influences the market due to the potential of packaging to address the need for high and uniform product quality, the requirement for larger nutrient retention, and to prevent the bisphenol A (BPA) controversy.

Global Packaging Equipment Market Drivers:

Enhancing the need for flexible and integrated packaging equipment

Packaging plays a significant role in the commercialization of any pharmaceutical drug. Earlier, pharmaceutical packaging was applied to protect and preserve items and communicate promotion and regulatory information to customers. However, the focus has transformed towards developing a reliable packing line that delivers rapid packaging of a batch of products without compromising safety, quality, patient comfort, and security needs. This can be dedicated to the development of new therapies and novel drug delivery technologies, which have enhanced the need for new and innovative forms of packaging. Presently, pre-fillable syringes and parenteral formulations are novel drug delivery systems. These latest formulations need flexible packaging equipment. The primary therapy areas under focus include oncology, respiratory, anti-viral, autoimmune diseases and immuno-suppressants, with many creative projects underway in the biopharmaceutical space.

With these advancements, the necessity for packaging that can maintain the stability of novel drugs and improve their shelf-life is growing. Amid escalating cost pressures, the initial cost of purchasing packaging equipment is one of the major issues for pharmaceutical manufacturers. Nowadays, makers of Pharma products are opting for flexible packaging equipment that can achieve the requirement of packaging a drug in multiple formats, thus saving on capital expenditures. Recent advances show that biopharmaceutical companies, laboratories, and research facilities now make smaller amounts of targeted drugs. This has created a need to manufacture equipment platforms that can take up small batches at larger time intervals. While such packaging lines for smaller batches may lessen pressure on the pharmaceutical industry, their execution will need timely changeovers and maintenance. Resultantly, there is a high demand for packaging equipment that can create multiple small-batch drugs without sacrificing manufacturing speed.

Global Packaging Equipment Market Restraints and Challenges:

Escalating preference for refurbished equipment

Refurbished machines are feasible alternatives to the latest instruments for manufacturers in cases where time (taken to deliver and set up new equipment) and cost (new instruments being comparatively high-priced) are problems. This is specifically evident in low-cost manufacturing locations across the Asia Pacific region, where regulatory standards are comparatively lenient. Spending on refurbished equipment can save approximately 40–45% of the costs incurred on purchasing new equipment, thus reducing the capital expenditure required to set up a new production line. Moreover, manufacturers can obtain a renewed or updated form of their existing products, thus eliminating the requirement to purchase a new product. However, analysing the compatibility of refurbished equipment with existing manufacturing operations is a must to optimize the operational efficiency of a manufacturing facility. When modifications are made to the function, design, or safety of a machine, there has to be an assessment to check the level of alterations made to the equipment. If the changes are too crucial, it may be considered a new product and be subject to conformity assessment and regulatory approvals. This will stand true even if a product was originally compliant and approved by regulatory bodies.

Maintaining sterility in fill-finish manufacturing functions

Aseptic fill-finish operations pose more risk than non-sterile processes. They need careful planning, trained personnel, and expert facilities & equipment to execute the process properly. Ensuring sterility is of utmost significance, as any failure can result in massive financial losses and life-threatening effects on patients. All the components utilised in aseptic fill-finishing processes need to be sterilized before use. Sterilization with pressurized steam, irradiation, or hydrogen peroxide needs to be performed in a manner that does not disturb the stability of the drug. This represents the need for carefully designing cleanroom facilities to ensure sterility, thereby incurring high expenses. Sterile lyophilizing requires deployments in specialized equipment and facilities. For products that require lyophilizing, strict steps must be taken to ensure that the risk of contamination is minimized during the loading and unloading processes.

Global Packaging Equipment Market Opportunities:

Accelerating demand for automation in the food & beverage industry

Growing urbanization and globalization have enhanced the demand for automation in the food industry. Food packaging is necessary to safeguard food products from contamination, tampering, and damage, due to which food manufacturers need to pack more products with a higher level of precision and speed. Over the years, consumption patterns have also altered considerably, mainly due to the quickly growing global population. Consumers are becoming increasingly conscious of food-related issues and their impact on health, the environment, and communities. Food labelling is a significant means of communicating information to customers, due to which the use of automated labelling machines has developed in the food industry. Regulatory authorities like the Food Safety and Standard Authority of India (FSSAI), the US Food and Drug Administration (FDA), the United States Department of Agriculture (USDA), the Department of Agriculture and Agri-Food (Canada), and the European Food Safety Authority (EFSA) laid down guidelines on the labelling of food products to facilitate that these products are not wrongly labelled.

PACKAGING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Machine-type, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Langley Holding plc, Maillis Group, Rovema GmbH, Douglas Machine Inc., KHS Group, SIG, Tetra Laval International S.A., Krones AG, I.M.A. Industria Macchine Automatiche S.p.A., Syntegon Technology GmbH, ProMach, GEA Group Aktiengesellschaf |

Global Packaging Equipment Market Segmentation: By Machine-type

-

Filling

-

Labelling

-

Form-Fill-Seal

-

Cartoning

-

Wrapping

-

Palletizing

-

Bottling Line

-

Others

The Form-Fill-Seal segment is estimated to register the fastest growth rate of 5.7% over the future period. Horizontal Form Fill Seal (HFFS) machines are packaging techniques for high-production manufacturing structures that serve, pack, and ship edible products. HFFS saves time and money owing to their speed and efficiency, effectively sealing and vacuum sealing products in a shorter time. Rising demand for sealed foods, such as wrapped vegetables, sandwiches, loaves of bread, etc., in urban areas, is expected to considerably contribute to the development of the wrapping machine segment. Wrapping machines are also utilised for industrial and commercial goods. The growing e-commerce industry and enhanced total production output, especially in emerging industrial nations including China, are expected to drive this segment.

The Filling segment also held a major market share in 2023. Filling machines have multiple types of applications. They are utilised to fill bottled water and other liquids. In addition, they are used in numerous end-use industries including food, beverages, pharmaceuticals, chemicals, and cosmetics. The development in these end-use industries is highly adding to the segment’s industry share.

Global Packaging Equipment Market Segmentation: End-user

-

Beverages

-

Food

-

Chemicals

-

Personal Care

-

Pharmaceuticals

-

Others

The Food end-use segment led the global industry in 2023 and accounted for the biggest share of more than 36.00% of the overall revenue. The enhanced need for packed food owing to convenience and ease is estimated to drive the growth of this segment. Additionally, there has been a rising consumption of healthy and organic food products, which need a special type of packaging. This is certain to further augment the demand for packaging equipment. The demand for packaging equipment in the beverage industry is most certainly to be propelled by factors, such as the escalated consumption of beverages and a rise in the variety of beverage products. Many beverage product companies have extended their product offerings, thus growing the demand for highly refined and flexible packaging machines.

Global Packaging Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific dominated the global industry in 2023 and accounted for the highest share of more than 36.5% of the overall revenue. Rapid population growth and rising consumer purchasing power are likely to push the demand for packaged goods, which is predicted to facilitate regional market growth. Introducing production facilities by major regional players is expected to increase the e-commerce industry, which is anticipated to encourage the regional market. North America is primarily influenced by the highly established food & beverage industry in the U.S. and Canada. The existence of various multinational food processing and manufacturing companies results in an enhanced demand for packaging equipment. Technological progress in packaging equipment is also one of the leading elements driving the region’s growth.

With the quick growth of China’s e-commerce industry in the upcoming years, the product demand in the country is projected to grow. Moreover, improved norms and conditions of food processing & protection and packaging technologies, along with favourable government policies on power saving and equipment advancements, are estimated to boost the growth. Central & South America is predicted to grow significantly over the future period. The region’s growth can be dedicated to the increasing industrial investments, particularly in manufacturing due to the inexpensive labour availability. Furthermore, the demand for well-packaged food and rising consciousness about the ingredients are expected to propel the packaging equipment industry.

COVID-19 Impact Analysis on the Global Packaging Equipment Market:

The COVID-19 pandemic boosted market development, particularly for the food and beverage and pharmaceutical packaging equipment suppliers. This is due to a rise in online and offline demand for multiple food goods and pharmaceuticals. People buy in bulk to curb numerous visits and store up supplies in case of an extended quarantine. Therefore, packaging companies work around the clock to meet the enhanced demand.

Latest Trends:

Food segment to have an exponential growth

The Food Packaging process includes packaging facilities, where the packaging process is executed using machines. Initially, factories or manufacturing plants utilised manual methods to process food items. However, presently, most of the food packaging facilities use complicated equipment throughout the assembly line of food packaging. There are several benefits to using equipment. Food packaging automation can be a necessary tool for businesses, as technology can better productivity and provide protection and security without human intervention. Various manufacturers turn to Industry 4.0 solutions to re-configure food manufacturing. The latest trends ruling food packaging demand packaging companies to ensure that the machines in their lines align with the requirement for energy efficiency, machine safety, and cleanliness standards. Manufacturers' recent trends using technology and automation involve the internet of packaging, biodegradable packaging, digital printing, recyclable packaging, 3D printing, and nanotechnology. Several companies stress developing automation solutions for highly delicate packaging to meet customer preferences.

Key Players:

-

Langley Holding plc

-

Maillis Group

-

Rovema GmbH

-

Douglas Machine Inc.

-

KHS Group

-

SIG

-

Tetra Laval International S.A.

-

Krones AG

-

I.M.A. Industria Macchine Automatiche S.p.A.

-

Syntegon Technology GmbH

-

ProMach

-

GEA Group Aktiengesellschaf

Recent Developments

-

In January 2022, Syntegon Technology officially confirmed the expansion of its portfolio for coffee packaging machines with the addition of a PMX packaging machine for ground coffee and whole beans. The PMX consists of individual modules, which make machine design and dosing and closing stations individually configurable.

-

In January 2022, Multivac announced the purchase of the complete holdings of TVI in Bruckmühl. TVI is a service provider of portioning machines and has been a fragment of the Multivac Group since January 2017. This purchase is an essential component for the further alignment of MUltivac as a whole supplier of packaging and processing solutions.

-

In March 2022, Multivac made it public about the launch of a new tray sealer with its compact and fully automatic T 305. The recently introduced product is characterized by its high performance, flexibility, and pack quality. Moreover, the product is designed for packing small and medium-sized batches in the food sector and for rapid product changes.

Chapter 1. Packaging Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Packaging Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Packaging Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Packaging Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Packaging Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Packaging Equipment Market – By Machine-type

6.1 Introduction/Key Findings

6.2 Filling

6.3 Labelling

6.4 Form-Fill-Seal

6.5 Cartoning

6.6 Wrapping

6.7 Palletizing

6.8 Bottling Line

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Machine-type

6.11 Absolute $ Opportunity Analysis By Machine-type , 2024-2030

Chapter 7. Packaging Equipment Market – By End-user

7.1 Introduction/Key Findings

7.2 Beverages

7.3 Food

7.4 Chemicals

7.5 Personal Care

7.6 Pharmaceuticals

7.7 Others

7.8 Y-O-Y Growth trend Analysis By End-user

7.9 Absolute $ Opportunity Analysis By End-user, 2024-2030

Chapter 8. Packaging Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Machine-type

8.1.3 By End-user

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Machine-type

8.2.3 By End-user

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Machine-type

8.3.3 By End-user

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Machine-type

8.4.3 By End-user

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Machine-type

8.5.3 By End-user

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Packaging Equipment Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Langley Holding plc

9.2 Maillis Group

9.3 Rovema GmbH

9.4 Douglas Machine Inc.

9.5 KHS Group

9.6 SIG

9.7 Tetra Laval International S.A.

9.8 Krones AG

9.9 I.M.A. Industria Macchine Automatiche S.p.A.

9.10 Syntegon Technology GmbH

9.11 ProMach

9.12 GEA Group Aktiengesellschaf

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Packaging Equipment Market was estimated at USD 59.4 billion in 2023 and is expected to reach a market size of USD 80.84 billion by the end of 2030. Over the predicted period of 2024-2030, the market is estimated to grow at a CAGR of 4.5%.

The rising need for flexible packaging is propelling the Global Packaging Equipment Market.

Global Packaging Equipment Market is segmented based on Machine type, End-User and Region.

Asia-Pacific is the most dominant region for the Global Packaging Equipment Market.

Langley Holding plc, Maillis Group, Rovema GmbH, Douglas Machine Inc, KHS Group and Krones AG are a few of the key players operating in the Global Packaging Equipment Market.