Packaged Water Treatment System Market Size (2024-2030)

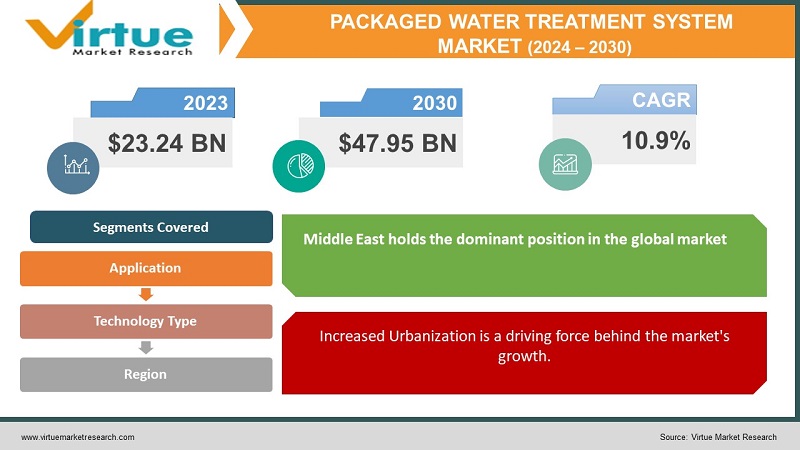

The Global Packaged Water Treatment System Market was valued at USD 23.24 billion in 2023 and is expected to reach USD 47.95 billion by 2030, registering a CAGR of 10.9% during the forecast period of 2024 to 2030.

In the anticipated period, substantial growth is foreseen in the Packaged Water Treatment System market. These systems present an alternative to conventional in-ground treatment methods and have the capacity to store large volumes of water, allowing for easy transportation to different locations. The application of this water treatment apparatus is not limited to specific sectors, making it suitable for both commercial and residential complexes without any reservations.

The driving forces behind the growth of the Packaged Water Treatment System Market include the escalating global population, rapid urbanization trends, and the emergence of economies in various countries, such as China, India, and other Asian nations. In pharmaceutical manufacturing facilities, the system is employed to curtail overall costs by eliminating suspended particles from the water, thereby enhancing its overall appearance. Diverse technologies like moving bed biofilm reactors, membrane bioreactors, and others are utilized in the process, providing a cost-effective approach to water treatment. Additionally, increasing government regulations pertaining to environmental sustainability contribute to the market's expansion.

Key Market Insights:

Forecasts indicate a positive trajectory for the packaged water treatment system market in the forthcoming years. These systems are instrumental in rendering water potable at varying levels. Some plants focus on the removal of suspended particles, while others address factors like flavor, odor, and transparency improvement. Each system comes with its own set of advantages and drawbacks, making it challenging for a single system to cater comprehensively to market needs. Sediment filtration water treatment devices, for instance, exclusively target suspended particles to enhance water appearance. Carbon filtration technology is integrated into certain systems to absorb hazardous substances from water, although it does not eliminate dissolved mineral salts. Reverse osmosis water treatment equipment is employed when the removal of dissolved mineral salts is necessary, enhancing water quality and taste. Water distillation, involving the evaporation and condensation of water in a separate location, is another method employed for water treatment. For wastewater or sewage water treatment, membrane bioreactor (MBR) and moving bed biofilm reactor (MBBR) technologies are commonly used. UV sterilization and ozonation serve as additional techniques, either applied independently or in conjunction with other methods. The packaged water treatment system proves to be a cost-effective solution for water utilities.

Global Packaged Water Treatment System Market Drivers:

The market is being propelled by a heightened awareness of water quality and health concerns.

The anticipated growth in market value is attributed to the increasing recognition of the advantages associated with clean water. The global demand for safe and clean water is expanding, driven by a heightened understanding of the health hazards linked to consuming contaminated water. Consequently, there is a rising inclination towards packaged water treatment systems among individuals seeking a reliable source of clean and safe water. This surge in demand is a key factor contributing to the expansion of the global packaged water treatment system market.

Moreover, advancements in education, literacy, and income levels worldwide have fostered a heightened consciousness regarding the significance of clean water in disease prevention and overall health maintenance. Developing nations such as China, India, Brazil, and South Africa have experienced a rise in awareness. The advantageous features of packaged water treatment systems, including ease of operation, compact size, cost-effectiveness, and trouble-free functionality, are expected to further accelerate the growth rate of the packaged water treatment system market. The combination of rapid urbanization and the expansion of industrial and commercial sectors has underscored the inadequacy of centralized treatment facilities in handling the increasing supply of treated wastewater and addressing larger volumes of wastewater production, thereby contributing to the market's growth.

Increased Urbanization is a driving force behind the market's growth.

The global packaged water treatment system market is witnessing widespread development due to a substantial increase in the global population. As the global population continues to surge, a significant transition from rural areas to urban centers is evident. The escalating urbanization trend is a pivotal factor driving the global growth of the packaged water treatment system market. The intensified urbanization has generated a heightened demand for clean and safe water. To cater to this escalating demand, numerous cities and municipalities are investing in packaged water treatment systems to ensure the safety and compliance of their water supplies. The pronounced degree of urbanization is poised to significantly boost the global industry, particularly during the forecast period.

Global Packaged Water Treatment System Market Restraints and Challenges:

Elevated Costs of Systems and Installation May Restrict Market Growth.

The substantial expense associated with packaged water treatment systems is poised to pose challenges for market expansion. The acquisition, installation, and ongoing maintenance costs of these systems are notably high. This encompasses the initial purchase price, installation expenses, and the costs related to regular maintenance and services that might be necessary. Consequently, the steep initial outlay may act as a deterrent for potential users considering this technology. Water treatment processes are not only costly but also require consistent maintenance and appropriate management or further treatment of the sludge generated during the process. Factors such as the demand for environmentally friendly solutions, the need for fresh water, and adherence to zero liquid discharge (ZLD) standards are expected to further complicate the situation for the packaged water treatment system market, potentially impeding its growth rate.

Inadequate Maintenance and Service Infrastructure May Slow Market Expansion.

Another challenge arises even if potential users are prepared to invest in this technology, stemming from the insufficient service and maintenance infrastructure. This includes the availability of adequately trained personnel for routine maintenance and the necessary spare parts and consumables for system upkeep. In the absence of such infrastructure, the systems may not function at their optimal capacity, which could hinder market growth.

Low Production Efficiency Could Impede Market Progress.

The Global Packaged Water Treatment System Market faces significant obstacles due to its low production efficiency. This shortcoming limits the technology's ability to meet the growing demand for clean water, thus restraining its broader adoption. Factors like high energy consumption and limited scalability play a role in this limitation, hampering the market's growth prospects. Addressing these efficiency issues is crucial for maximizing the potential of packaged water treatment systems. Overcoming these challenges is essential to ensure sustainable access to clean water, a necessity for global populations and industries that depend on effective water purification solutions.

Global Packaged Water Treatment System Market Opportunities:

Anticipated significant growth is foreseen in the global packaged water treatment system market in the coming years, propelled by the escalating demand for clean and safe drinking water, heightened consumer awareness regarding health, and growing environmental apprehensions. Additionally, the surge in population and industrial activities contributes to increased water pollution, amplifying the need for water treatment systems. Packaged water treatment systems boast various advantages, including a compact design, effortless installation, low maintenance costs, and economical investment requirements. These systems are characterized by energy efficiency and can be readily tailored to meet individual specifications.

Furthermore, the presence of advanced technologies like membrane filtration, ultraviolet disinfection, and reverse osmosis has intensified the demand for packaged water treatment systems. The market is categorized based on technology, end-use application, and geographic regions. Technology options encompass membrane filtration, ultraviolet disinfection, reverse osmosis, and other variants. End-use applications span residential, commercial, and industrial sectors. Geographically, the market is segmented into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. The market landscape is highly competitive, featuring numerous large and small players offering technologically advanced products at competitive prices. Forecasts predict significant growth in the market during the forecast period, driven by increased awareness of its benefits, rapid industrialization, and ongoing technological advancements.

PACKAGED WATER TREATMENT SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.9% |

|

Segments Covered |

By Application. technology type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Electric (U.S.), WPL (U.K.), Veolia (France), Fluence Corporation Limited (U.S.), WesTech Engineering, LLC (U.S.), Smith & Loveless (U.S.), Napier Reid (Canada), Enviroquip (U.S.), Corix (Canada) |

Global Packaged Water Treatment System Market Segmentation

Global Packaged Water Treatment System Market Segmentation: By Application:

- Municipal Wastewater Treatment

- Industrial Wastewater Treatment

- Drinking Water Treatment

Under the application segment, Drinking Water Treatment accounted for approximately 40% of the market share in 2023. This can be attributed to the global increase in population and the growing scarcity of drinking water. According to National Geographic, only a small fraction of the planet's total water is freshwater, comprising 2.5%, while the rest is ocean-based and saline. With a mere 0.007% of the planet's water available to sustain a population of over 7.8 billion people, the demand for packaged water treatment systems is expected to rise significantly in the long term. Other application segments include drinking, industrial wastewater treatment, and municipal wastewater treatment.

Global Packaged Water Treatment System Market Segmentation: By Technology Type:

- Extended Aeration

- Moving Bed Biofilm Reactor (MBBR)

- Reverse Osmosis (RO)

- Membrane Bioreactor (MBR)

- Sequential Batch Reactor (SBR)

- Others

The extended aeration segment is projected to grow at a CAGR of over 9% from 2024 to 2030, driven by lower costs and investments. Following this, reverse osmosis and MBBR are expected to witness growth. Stringent environmental regulations and sustainability directives are paving the way for alternative technologies to chemical-based water and wastewater treatment systems, such as MBBR, extended aeration, MBR, SBR, and RO, thereby supplementing the market for these technologies.

Global Packaged Water Treatment System Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Regionally, the Packaged Water Treatment System Market is divided into North America, South America, Asia Pacific, the Middle East and Africa, and Europe. The Middle East holds the dominant position in the global market, capturing the largest market share. This trend is followed by Africa, driven by increasing urbanization in the region. Saudi Arabia and the UAE emerge as rising industrial niche markets in the global packaged water treatment system market. Additionally, the Asia Pacific packaged water treatment system market is expected to experience notable growth in the forecast period, attributed to population growth, increased government investments in water purification improvements, and the rising demand for pure water resources across the region.

COVID-19 Impact Analysis on the Global Packaged Water Treatment System Market:

The global COVID-19 pandemic adversely affected the packaged water treatment system market. Various lockdown measures implemented by governments around the world led to significant operational disruptions, resulting in substantial financial challenges for the market. These measures led to shortages in resources and skilled workers, impeding the market's ability to meet increasing customer demands. These factors are expected to influence the market's revenue growth during the forecast period.

However, there are signs of market recovery as restrictions begin to ease and regulatory bodies lift lockdown measures. Additionally, global markets and governments are ramping up investments in research and development to curb water misuse and promote efficient water usage.

Recent Trends and Developments:

The Michigan Department of Environment, Great Lakes, and Energy (EGLE) mandated ZF Active Safety US Inc. to install a treatment system to address high levels of vinyl chloride contamination originating from the former Kelsey-Hayes property on Oak Street, close to downtown.

GE Water & Process Technologies (US) is investing significantly in research and development to gain a competitive edge in the market. This investment is anticipated to boost the company's sales revenue.

Key Players:

- General Electric (U.S.)

- WPL (U.K.)

- Veolia (France)

- Fluence Corporation Limited (U.S.)

- WesTech Engineering, LLC (U.S.)

- Smith & Loveless (U.S.)

- Napier Reid (Canada)

- Enviroquip (U.S.)

- Corix (Canada)

The Illinois Environmental Protection Agency (Illinois EPA) announced the issuance of $182,222,203 in water infrastructure loans to local governments and sanitary districts for the third quarter of Fiscal Year 2022 (January – March 2022).

Chapter 1. GLOBAL PACKAGED WATER TREATMENT SYSTEM MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL PACKAGED WATER TREATMENT SYSTEM MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL PACKAGED WATER TREATMENT SYSTEM MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL PACKAGED WATER TREATMENT SYSTEM MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL PACKAGED WATER TREATMENT SYSTEM MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL PACKAGED WATER TREATMENT SYSTEM MARKET – By Technology Type

6.1. Introduction/Key Findings

6.2 Extended Aeration

6.3. Moving Bed Biofilm Reactor (MBBR)

6.4. Reverse Osmosis (RO)

6.5. Membrane Bioreactor (MBR)

6.6. Sequential Batch Reactor (SBR)

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Technology Type

6.9. Absolute $ Opportunity Analysis By Technology Type , 2024-2030

Chapter 7. GLOBAL PACKAGED WATER TREATMENT SYSTEM MARKET – By Application

7.1. Introduction/Key Findings

7.2 Municipal Wastewater Treatment

7.3. Industrial Wastewater Treatment

7.4. Drinking Water Treatment 7.6. Y-O-Y Growth trend Analysis By Application

7.5. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. GLOBAL PACKAGED WATER TREATMENT SYSTEM MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Technology Type

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Technology Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Technology Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Technology Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Technology Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL PACKAGED WATER TREATMENT SYSTEM MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 General Electric (U.S.)

9.2. WPL (U.K.)

9.3. Veolia (France)

9.4. Fluence Corporation Limited (U.S.)

9.5. WesTech Engineering, LLC (U.S.)

9.6. Smith & Loveless (U.S.)

9.7. Napier Reid (Canada)

9.8. Enviroquip (U.S.)

9.9. Corix (Canada)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Packaged Water Treatment System Market was valued at USD 23.24 billion in 2023 and is expected to reach USD 47.95 billion by 2030, registering a CAGR of 10.9% during the forecast period of 2024 to 2030.

The worldwide Global Packaged Water Treatment System Market growth is estimated to be 10.9% from 2024 to 2030.

The Global Packaged Water Treatment System Market is segmented by Technology Type (Extended Aeration, Moving Bed Biofilm Reactor (MBBR), Reverse Osmosis (RO), Membrane Bioreactor (MBR), Sequential Batch Reactor (SBR), and Others), by Application (Municipal Wastewater Treatment, Industrial Wastewater Treatment and Drinking Water Treatment).

Rising clean water demand and strict environmental laws are expected to fuel substantial expansion in the global packaged water treatment system market. Upcoming developments in modular, energy-efficient systems will likely lead to chances for growth in developing nations and the industrial wastewater treatment sector.

The global market for packaged water treatment systems has been positively impacted by the COVID-19 epidemic, which has highlighted the significance of water treatment. Demand has been fueled by growing awareness of sanitation and water quality, but supply chain disruptions have created difficulties and altered market dynamics.