Packaged Manchow Soup Market Size (2024 – 2030)

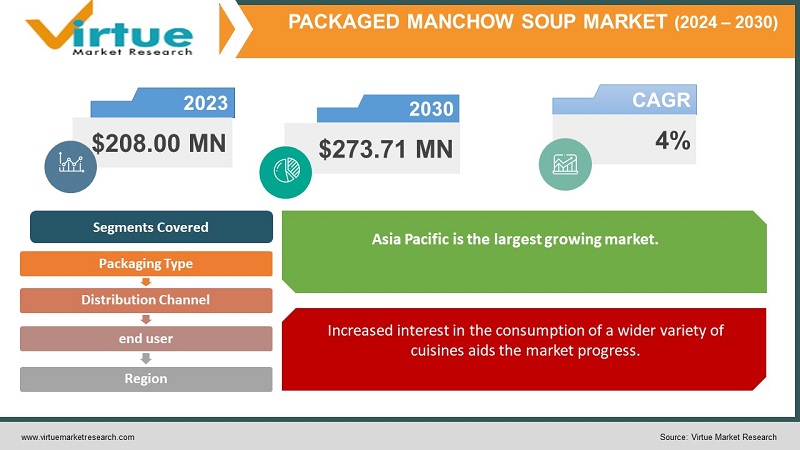

The Global Packaged Manchow Soup Market was valued at USD 208.00 million and is projected to reach a market size of USD 273.71 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4%

Packaged Manchow soup is a food product that has had limited availability in the past in many countries. This was mainly confined to restaurants and hotels. But, in the present scenario due to social media presence and an enthusiastic younger generation this soup has gained immense attention. It is popularly consumed by many as a starter or as an evening delight. It has a lot of vegetables and spices which make it a notable choice. Ongoing trends toward the creation of innovations and changing preferences are further predicted to expand the market during the forecast period.

Key Market Insights:

-

Social conversations about Soup have increased by 21.7% over the past year.

-

38.68% of restaurants offer Soup on their menus which is over 331590 restaurants.

-

In 2020, E-Commerce saw a tremendous increase in the selling of soup products.

-

Consumer preference for having organic and healthy soup grew by 20% in the last few years.

-

Backslash or criticism is given by a lot of customers because of the plastic packaging for packaged noodles. Companies have started to invest in alternatives and have reduced environmental impact by 30% in the last five years.

Packaged Manchow Soup Market Drivers:

Rising demand for ready-to-eat and instant food products is driving the growth of the market.

The past decade has seen a shift in the lifestyles of a majority of the population globally. Many people who are working often find themselves to have a lack of time for daily errands. Additionally, factors like urbanization and busy schedules also add up. Convenient food products are a boon in such cases. They require little or no work saving a lot of time. The ingredients need to be emptied in a kettle and water needs to be added. After boiling for 2-5 minutes, the soup is usually ready. This is tasty, healthy, fulfilling, and extremely easy to make. Furthermore, this is a go-to product for people who are unable to cook for themselves. It gives an authentic restaurant taste. These advantages play a huge role in enhancing development.

Increased interest in the consumption of a wider variety of cuisines aids the market progress.

Food products having a blend of spices are often known for their taste and aroma making it a very popular choice for locals as well as tourists. Packaged manchow soup falls under this category. Various social media platforms and entertainment channels create a broader consumer base with piqued curiosity towards the consumption of unique foods. This soup offers a diverse range of flavors and tastes making it a suitable choice, especially during the winter season. Restaurants have increased production due to rising demand. Moreover, in recent years hot beverages like this are sold in trekking areas like hills and mountains where they see an enormous profit. Furthermore, this is also consumed to relieve the common cold.

Packaged Manchow Soup Market Restraints and Challenges:

Preservatives, nutritional content, and plastic usage are a few issues that are the major barriers in the market.

Packaged soups are usually loaded with preservatives for a longer shelf life. This can be a major health concern. Preservatives are harmful chemicals that are known to cause allergies, damage the neurological system, and disrupt the gut bacteria. Some are even claimed to be carcinogenic that is they can cause cancer. This can demotivate a majority from buying these products. Secondly, the nutritional value is half of what one gets in natural soup. They are processed for too long which makes the nutritional value very less or nil. Moreover, plastic is often used as a packaging material which is not environmentally friendly. Certain soup products give instructions to pour hot water directly into the plastic can/bottle. This results in the accumulation of toxic substances which can weaken the immune system. This can decrease the consumer rate.

Packaged Manchow Soup Market Opportunities:

Various innovations and creativity are being carried out by chefs all over the world to improve the existing soups and to find better options in the future. Different flavors, vegetable usage, and seasonings are experimented with to create a premium beverage that presents the market with an ample number of opportunities. Sustainable packaging is being given utmost prominence. R&D activities are being carried out to find alternatives to plastic. More manufacturers and shops are being encouraged to use eco-friendly products as packaging materials which would retain the freshness, taste, and texture of the soup. Options are being explored to create soups with no preservatives and more nutritional value.

PACKAGED MANCHOW SOUP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Packaging Type, Distribution Channel, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé, Unilever, Kohinoor Foods, Gits Food Ching's Secret, Tasty Bite, iD Fresh Food, ITC Limited, Keya Food, Suhana |

Packaged Manchow Soup Market Segmentation: By Packaging Type

-

Bottles

-

Cans

-

Packets

Based on packaging type, packets are considered to be the largest and fastest growing in this market. Pouches and cups are included in this segment. This is because they help retain the shelf life, are very convenient, reduce the risk of contamination, and help to retain the original flavor. Additionally, with new technologies and graphic design, they are made attractive to please customers with different aesthetics. They are easy to carry as well making them a popular choice. Furthermore, they take up less space.

Packaged Manchow Soup Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Online Retail

-

Specialty Stores

-

Others

Supermarkets/hypermarkets are the largest growing distribution channel in this sector. This is due to the increased variety of options, face-to-face interaction, familiarity, convenience, a larger consumer base, discounts and offers, and fresher products. They control around half of the whole market. Online retail is the fastest expanding, accounting for around 25% of the market. We can access online products from the convenience of our own homes. They provide more possibilities, including access to worldwide supplies, discounts, customer service, and shipping options. Following the pandemic, the new shift was digital transformation, which caused many suppliers to register on numerous websites, creating a possibility for income generation. This category is expected to grow significantly throughout the projected period.

Packaged Manchow Soup Market Segmentation: By End User

-

Household

-

Commercial

Based on end users, the household segment is the largest growing. This is because of the change in preferences and lifestyle. Due to packed schedules and busy lives, this soup has become a go-to option owing to its convenience. It is also advantageous to bachelors who do not know how to cook. The taste, aroma, and fulfilling proportion propel the expansion. This held a total share ranging between 60% to 70%. The commercial segment is the fastest growing holding a share of around 20% to 30%. Increased dining and rising demand are the major factors. Moreover, it helps people having travel sickness and nausea due to lesser oil content in them. Restaurants have increased the options with new and delightful flavors.

Packaged Manchow Soup Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, Asia Pacific is the largest growing market. Manchow soup is of Chinese origin. However, the popularity has spread sufficiently in Asian countries like India, Japan, and South Korea. The share of these regions is due to higher demand, presence of different brands, and popularity. Additionally, they are included in day-to-day meals. Moreover, rapid urbanization, growing economic class, and changes in lifestyle choices are contributing to market success. This holds an approximate share of around 55%. North America is the fastest growing with a share of around 20%. The USA and Canada are the leading regions. Better availability, rising demand, convenience, food trends, and a shift in culinary preference are the main reasons.

COVID-19 Impact Analysis on the Global Packaged Manchow Soup Market:

The pandemic had a positive impact on the market. Lockdown, social isolation, and movement restriction were the new norm. The virus caused a shift in lifestyle. People became more health conscious and leaned towards including homemade as well as healthy supplements in their diets. Social media apps like Instagram and Facebook encourage people to learn cooking. So, many of them were inclined towards cooking and trying out new recipes that covered soups. Packaged manchow soups were a convenient way and easy to store for people who were stuck in places. Online channels played a huge role in delivering packets in bulk amounts as most of them feared to step out. Due to this, there was an increase in demand and more products were sold during this period.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heftily to improve existing formulations alongside maintaining competitive pricing. This has further resulted in increased government engagement and further enlargement.

End-user industries like hospitality, food & beverage, and catering services are constantly working on innovations in formulations to provide a unique experience. The creation of clean-label products is being emphasized to broaden the consumer base. The desire for environmentally friendly choices is projected to expand the market.

Key Players:

-

Nestlé

-

Unilever

-

Kohinoor Foods

-

Gits Food

-

Ching's Secret

-

Tasty Bite

-

iD Fresh Food

-

ITC Limited

-

Keya Foods

-

Suhana

In August 2023, Amcor, a company known for flexible packaging solutions for many food products including soup announced an agreement to acquire Phoenix Flexibles, expanding Amcor’s capacity in the high-growth Indian market. The acquisition adds advanced film technology, enabling local production of a broader range of more sustainable packaging solutions, and brings capabilities allowing Amcor to expand its product offering in attractive high-value segments.

In March 2021, reports indicated that Unilever food brand Knorr launched the Eat for Good campaign which aimed to be a springboard for a global movement of Eativists that will safeguard the planet’s eco and food system.

Chapter 1.Packaged Manchow Soup Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2.Packaged Manchow Soup Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3.Packaged Manchow Soup Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4.Packaged Manchow Soup Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5.Packaged Manchow Soup Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6.Packaged Manchow Soup Market – By Packaging Type

6.1 Introduction/Key Findings

6.2 Bottles

6.3 Cans

6.4 Packets

6.5 Y-O-Y Growth trend Analysis By Packaging Type

6.6 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 7.Packaged Manchow Soup Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Online Retail

7.4 Specialty Stores

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2023-2030

Chapter 8.Packaged Manchow Soup Market – By End User

8.1 Introduction/Key Findings

8.2 Household

8.3 Commercial

8.4 Y-O-Y Growth trend Analysis By End User

8.5 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9.Packaged Manchow Soup Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Packaging Type

9.1.3 By Distribution Channel

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Packaging Type

9.2.3 By Distribution Channel

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Packaging Type

9.3.3 By Distribution Channel

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Packaging Type

9.4.3 By Distribution Channel

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Packaging Type

9.5.3 By Distribution Channel

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10.Packaged Manchow Soup Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestlé

10.2 Unilever

10.3 Kohinoor Foods

10.4 Gits Food

10.5 Ching's Secret

10.6 Tasty Bite

10.7 iD Fresh Food

10.8 ITC Limited

10.9 Keya Foods

10.10 Suhana

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Packaged Manchow Soup Market was valued at USD 208.00 million and is projected to reach a market size of USD 273.71 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4%

Rising demand for ready-to-eat and instant food products and an increased interest in the consumption of a wider variety of cuisines are the drivers boosting the Global Packaged Manchow Soup Market.

Based on End User, the Global Packaged Manchow Soup Market is segmented into Household and Commercial.

Asia Pacific is the most dominant region for the Global Packaged Manchow Soup Market.

Nestlé, Unilever, and Kohinoor Foods are the key players operating in the Global Packaged Manchow Soup Market.