Global Package Boilers Market Size (2024-2030)

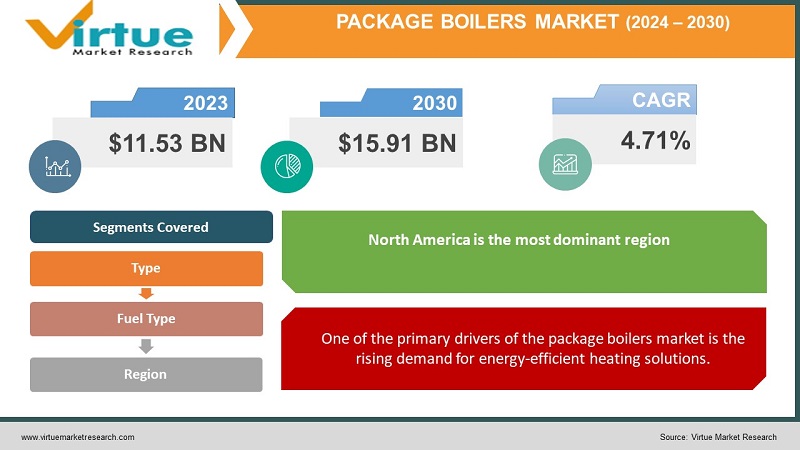

The Global Package Boilers Market was valued at USD 11.53 Billion in 2023 and is projected to reach a market size of USD 15.91 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.71%.

The market for package boilers is essential to many different sectors because it offers a dependable and effective supply of steam for a wide range of uses. These standalone units are well-liked in many industries because they provide a practical and adaptable steam-generating option. Package boilers are used in cogeneration plants, where they produce both steam and electricity and in auxiliary applications within larger power plants. Various manufacturing processes require steam for sterilization, drying, curing, and other industrial applications. Food & beverages, chemicals, and textile industries are major users of package boilers. Refineries and petrochemical plants utilize package boilers for steam-based processes such as distillation and cracking.

Key Market Insights:

The demand for package boilers in the food & beverage industry is expected to grow at a CAGR of around 5% by 2026, driven by the need for steam sterilization and processing.

Natural gas is the most widely used fuel source for package boilers, accounting for roughly 70% of the market share due to its clean burning properties and cost-effectiveness.

Oil-fired package boilers are projected to witness a decline in market share due to fluctuating oil prices and stricter environmental regulations. Their share is expected to fall below 20% by 2030.

Biomass-fired package boilers are gaining traction, particularly in regions with abundant agricultural or forestry waste. This segment is anticipated to grow at a CAGR exceeding 6% by 2027.

The increasing focus on energy efficiency is leading to a surge in demand for high-efficiency condensing package boilers, which can reduce fuel consumption by up to 15% compared to conventional models.

The average lifespan of a package boiler is around 15-20 years. However, proper maintenance and upgrades can extend this lifespan by several years.

The replacement of aging boiler infrastructure in North America and Europe presents a significant growth opportunity for the package boilers market in these regions.

The upfront cost of a package boiler system can range from USD 50,000 to USD 500,000 or more, depending on the size, capacity, and fuel source.

Installation and commissioning costs for a package boiler system can add an additional 10-20% to the overall project cost.

The operation and maintenance (O&M) costs of a package boiler system can vary depending on fuel prices, operating hours, and maintenance practices, but typically account for 20-30% of the total lifecycle cost.

The package boilers market is estimated to generate over 1 million new jobs globally by 2030, including positions in manufacturing, engineering, installation, and maintenance.

Stringent environmental regulations are expected to add around 5-10% to the upfront cost of new package boiler systems due to the implementation of cleaner burning technologies and emission control equipment.

Package Boilers Market Drivers:

One of the primary drivers of the package boilers market is the rising demand for energy-efficient heating solutions.

In industries where cutting expenses and environmental impact are top priorities, energy efficiency plays a crucial role. Cutting-edge technology is used in package boiler designs to maximize fuel combustion and reduce heat loss. Comparing this to conventional boilers, the thermal efficiency is better. For example, contemporary package boilers can achieve thermal efficiencies exceeding 90%, which results in a notable decrease in fuel consumption and operational expenses. In order to drastically save fuel consumption and operating expenses, contemporary package boilers, for example, can attain thermal efficiencies of over 90%. Further increasing their efficiency is the ability to better manage and distribute heat thanks to the modular design of package boilers. Package boilers offer significant energy-saving benefits to industries including food and beverages, chemicals, and pharmaceuticals that need constant heating at a precise temperature.

Industries are increasingly seeking ways to reduce their energy consumption and enhance operational efficiency. Package boilers offer a highly efficient solution, making them an attractive option for various applications.

Technological advancements in boiler design and manufacturing have played a crucial role in improving the energy efficiency of package boilers. Innovations such as condensing technology, which captures and utilizes the latent heat from flue gases, have significantly enhanced the overall efficiency of these systems. Moreover, the integration of smart controls and automation allows for real-time monitoring and optimization of boiler performance, ensuring that energy is used efficiently, and wastage is minimized. Energy-efficient heating systems are in high demand not just in developed but also in emerging nations, where demand is growing significantly. The demand for dependable and efficient heating solutions is being driven by the fast industrialization and urbanization of nations like Brazil, and India, and urbanization of nations like Brazil, India, and China. Because of their small size and great efficiency, package boilers are perfect for supplying these regions' enterprises with the heating they need. The market for package boilers is also being helped by government programs that encourage the use of green technologies and energy efficiency.

Package Boilers Market Restraints and Challenges:

The advanced technologies embedded in modern package boilers, such as condensing mechanisms and low NOx burners, contribute to their high initial cost. While these technologies enhance efficiency and reduce emissions, they also increase the overall price of the equipment. For many businesses, especially those with limited financial resources, the high upfront investment can be a deterrent, prompting them to continue using older, less efficient boilers. Economic instability can further worsen the issue of expensive initial investments. In times of economic downturn or uncertainty, businesses might hesitate to commit to substantial capital spending. The unpredictability of economic circumstances can result in delays or cancellations of projects, consequently impacting the need for package boilers. Operating and maintaining advanced package boilers requires a certain level of technical expertise. Many companies, particularly those in regions with a shortage of skilled labor, may struggle to find qualified personnel to manage these sophisticated systems. This skills gap can lead to operational inefficiencies and higher maintenance costs, deterring companies from investing in package boilers.

Package Boilers Market Opportunities:

The development of advanced combustion technologies can significantly enhance the performance of package boilers. Innovations such as ultra-low NOx burners, flue gas recirculation, and enhanced heat transfer mechanisms can improve fuel efficiency and reduce emissions. These technologies not only make package boilers more environmentally friendly but also appeal to industries looking to comply with stringent emission regulations. The transition worldwide to renewable energy sources offers a significant opportunity for the package boilers market. As businesses aim to lower their carbon footprint and move towards sustainable energy, package boilers can be tailored to work harmoniously with renewable energy systems. Biomass and biofuels are becoming increasingly popular as sustainable energy sources for industrial use. Package boilers optimized for biomass and biofuels can take advantage of this expanding market. These boilers are capable of using agricultural residue, wood pellets, and other natural materials, offering an environmentally friendly and economical heating option. By encouraging the adoption of renewable fuels, package boilers can support industries in reaching their sustainability objectives.

PACKAGE BOILERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.71% |

|

Segments Covered |

By Type, Fuel type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Babcock & Wilcox Enterprises (USA), Mitsubishi Heavy Industries (Japan), Spirax-Sarco Engineering plc (UK), Viessmann Group (Germany), Alfa Laval AB (Sweden), Thermax Limited (India), Forbes Marshall (India), Kawasaki Thermal Engineering Co. (Japan), Nationwide Boiler Inc. (UNITED STATES), Indeck Power Equipment Company (USA), Manley’s Boiler LLC (USA)., Chaotianmen Boiler Group Co., Ltd. (China), Harbin Boiler Co., Ltd. (China), Zhejiang Boiler Co., Ltd. (China), Establishments Godin (France), Hurst Boiler and Welding Co., Inc.(UNITED STATES), Clayton Industries (USA), Fulton Boiler Works, Inc.(UNITED STATES), Cleaver Brooks, Inc. (USA)

|

Package Boilers Market Segmentation:

Package Boilers Market Segmentation: By Type:

- Fire-tube Package Boilers

- Water-tube Package Boilers

- Electric Package Boilers

Fire-tube package boilers are the prominent choice in the market because of their uncomplicated design, easy installation process, and flexibility. Within a fire-tube boiler, the hot gases produced during combustion travel through tubes that are encompassed by water. This enables the transfer of heat from the gases to the water, producing steam. The design and production of fire-tube boilers are relatively straightforward, making them cost-effective solutions for various industries. Their simple construction also facilitates easy installation and maintenance.

Water-tube package boilers are increasingly popular due to their exceptional performance in high-pressure and high-capacity settings. In a water-tube boiler, water passes through tubes that are heated externally by combustion gases. This design enables higher pressure and temperature capabilities, making them well-suited for more demanding industrial applications. Water-tube boilers are capable of operating at significantly higher pressures and temperatures than fire-tube boilers, making them perfect for power generation and other heavy industrial processes. They can achieve higher efficiencies and offer quicker response times compared to fire-tube boilers, which is crucial for industries with varying steam demands.

Package Boilers Market Segmentation: By Fuel Type:

- Natural Gas

- Oil

- Biomass

- Coal

- Dual Fuel

With a dominating 45% share, natural gas now dominates the market for package boilers. Natural Gas is often more affordable than coal and oil and is widely available in many parts of the world. Many Different businesses choose it because of its stable pricing and low operating costs. Sulphur dioxide (SO2) and nitrogen oxides (NOx) are produced in smaller quantities in natural gas than opposed to coal and oil since it produces fewer greenhouse gases and pollutants. Natural gas boilers are the preferable option for businesses seeking to comply with environmental regulations because of this feature, which is in line with legislative trends focused on reducing industrial emissions.

Biomass currently accounts for 15% of the package boilers market but is considered the fastest-growing segment. Biomass is classified as a renewable energy source because it is obtained from organic resources such as wood chips, agricultural waste, and specific energy crops. Many countries around the world are offering incentives, subsidies, and favorable laws to encourage the usage of renewable energy. The utilization of biomass reduces dependence on fossil fuels and contributes to reduced greenhouse gas emissions. countries throughout the world are offering incentives, subsidies, and favorable laws to encourage the usage of renewable energy. Biomass boilers frequently qualify for these incentives, making them financially appealing for enterprises looking to transition to greener alternatives. Stricter environmental Laws aimed at lowering carbon emissions are driving industries to use biomass boilers.

Package Boilers Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- The Middle East & Africa

North America has the largest market share of 35% in the worldwide package boilers industry. North America, especially the United States and Canada, has a well-developed industrial sector. Package boilers are widely used in several industries, including food and beverage, chemicals, pharmaceuticals, and power generation. The region is a hotbed of technological innovation, with substantial advances in boiler efficiency, automation, and emissions control technology. advancements improve the performance and appeal of package boilers. These advances improve the performance and aesthetics of packaged boilers.

Asia-Pacific currently represents 25 % of the global package boiler market, but it is considered the fastest-growing region. Asia-Pacific countries are rapidly industrializing, including China, India, and Southeast Asian governments. The growing industrial base in these countries increases the demand for efficient steam and heating solutions from package boilers. The growing rate of urbanization and infrastructure development in Asia-Pacific necessitates efficient heating solutions for residential, commercial, and industrial applications. The growing urbanization and infrastructure in the Asia-Pacific region necessitate the adoption of energy-efficient heating systems in residential, commercial, and industrial applications. Package boilers are becoming more popular in fast-growing metropolitan areas.

COVID-19 Impact Analysis on the Package Boilers Market:

Lockdowns and restrictions on economic activity led to a sharp decline in demand for steam across various industries. Manufacturing facilities scaled back production or shut down, significantly reducing their steam requirements. This resulted in a drop in new boiler orders and project delays. Global lockdowns and travel restrictions disrupted the movement of goods and materials. Manufacturers of package boilers faced difficulties in procuring essential components like valves, tubes, and control systems. This led to delays in production schedules and project completion times. The economic uncertainty caused by the pandemic led many companies to postpone or cancel capital expenditure projects, including those involving new boiler installations. This further dampened demand for package boilers in the short term. Social distancing measures and travel restrictions made it challenging to conduct routine maintenance and service activities on existing boilers. This posed operational challenges for some industries that rely heavily on steam for their processes.

Latest Trends/ Developments:

The Exhaust gases from conventional package boilers lose a considerable amount of heat. This Waste heat is captured by high-efficiency condensing boilers, which can increase overall efficiency by up to 15%. This results in less gasoline being used and cheaper operational expenses for companies. Implementing new combustion technologies including low NOx burners and flue gas recirculation systems. improve the burning process by reducing hazardous nitrogen oxide emissions and contribute to cleaner air. Cutting-edge combustion technology including flue gas recirculation systems and low NOx burners are being included by manufacturers. By streamlining the combustion process, these solutions reduce air pollution-causing nitrogen oxide emissions. Package boilers are increasingly integrating automation systems and digital controls. Precise control over boiler operations, combustion parameters, and fuel-air ratios is made possible by these systems. This allows for predictive maintenance and remote monitoring in addition to performance and efficiency optimization.

Key Players:

- Babcock & Wilcox Enterprises (USA)

- Mitsubishi Heavy Industries (Japan)

- Spirax-Sarco Engineering plc (UK)

- Viessmann Group (Germany)

- Alfa Laval AB (Sweden)

- Thermax Limited (India)

- Forbes Marshall (India)

- Kawasaki Thermal Engineering Co.(Japan)

- Nationwide Boiler Inc.(UNITED STATES)

- Indeck Power Equipment Company (USA)

- Manley’s Boiler LLC (USA)

- Chaotianmen Boiler Group Co., Ltd. (China)

- Harbin Boiler Co., Ltd. (China)

- Zhejiang Boiler Co., Ltd. (China)

- Establishments Godin (France)

- Hurst Boiler and Welding Co., Inc.(UNITED STATES)

- Clayton Industries (USA)

- Fulton Boiler Works, Inc.(UNITED STATES)

- Cleaver Brooks, Inc. (USA)

Chapter 1. GLOBAL PACKAGE BOILERS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL PACKAGE BOILERS MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL PACKAGE BOILERS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL PACKAGE BOILERS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL PACKAGE BOILERS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL PACKAGE BOILERS MARKET – By Type

6.1. Introduction/Key Findings

6.2. Fire-tube Package Boilers

6.3. Water-tube Package Boilers

6.4. Electric Package Boilers

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL PACKAGE BOILERS MARKET – By Fuel Type

7.1. Introduction/Key Findings

7.2 Natural Gas

7.3. Oil

7.4. Biomass

7.5. Coal

7.6. Dual Fuel

7.7. Y-O-Y Growth trend Analysis By Fuel Type

7.8. Absolute $ Opportunity Analysis By Fuel Type , 2024-2030

Chapter 8. GLOBAL PACKAGE BOILERS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Fuel Type

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Fuel Type

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Fuel Type

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Fuel Type

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Fuel Type

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL PACKAGE BOILERS MARKET – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1.Babcock & Wilcox Enterprises (USA)

9.2. Mitsubishi Heavy Industries (Japan)

9.3. Spirax-Sarco Engineering plc (UK)

9.4. Viessmann Group (Germany)

9.5. Alfa Laval AB (Sweden)

9.6. Thermax Limited (India)

9.7. Forbes Marshall (India)

9.8. Kawasaki Thermal Engineering Co.(Japan)

9.9. Nationwide Boiler Inc.(UNITED STATES)

9.10. Indeck Power Equipment Company (USA)

9.11. Manley’s Boiler LLC (USA)

9.12. Chaotianmen Boiler Group Co., Ltd. (China)

9.13. Harbin Boiler Co., Ltd. (China)

9.14. Zhejiang Boiler Co., Ltd. (China)

9.15. Establishments Godin (France)

9.16. Hurst Boiler and Welding Co., Inc.(UNITED STATES)

9.17. Clayton Industries (USA)

9.18. Fulton Boiler Works, Inc.(UNITED STATES)

9.19. Cleaver Brooks, Inc. (USA)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Across various industries, the need for reliable and efficient steam generation for processes such as sterilization, drying, heating, and chemical reactions is a major driver.

The installation of package boilers may require upgrades to existing infrastructure such as pipelines and ventilation systems. Additionally, the initial investment for purchasing and installing a new boiler system can be significant

Babcock & Wilcox Enterprises (USA), Mitsubishi Heavy Industries (Japan), Spirax-Sarco Engineering plc (UK), Viessmann Group (Germany), Alfa Laval AB (Sweden), Thermax Limited (India), Forbes Marshall (India), Kawasaki Thermal Engineering Co. (Japan), Nationwide Boiler Inc. (UNITED STATES), Indeck Power Equipment Company (USA), Manley’s Boiler LLC (USA).

North America has emerged as the most dominant player in the MEA smart irrigation market, commanding an impressive 35% share.

Asia-Pacific emerges as the fastest-growing region in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.