Outdoor Power Equipment Market Size (2025 – 2030)

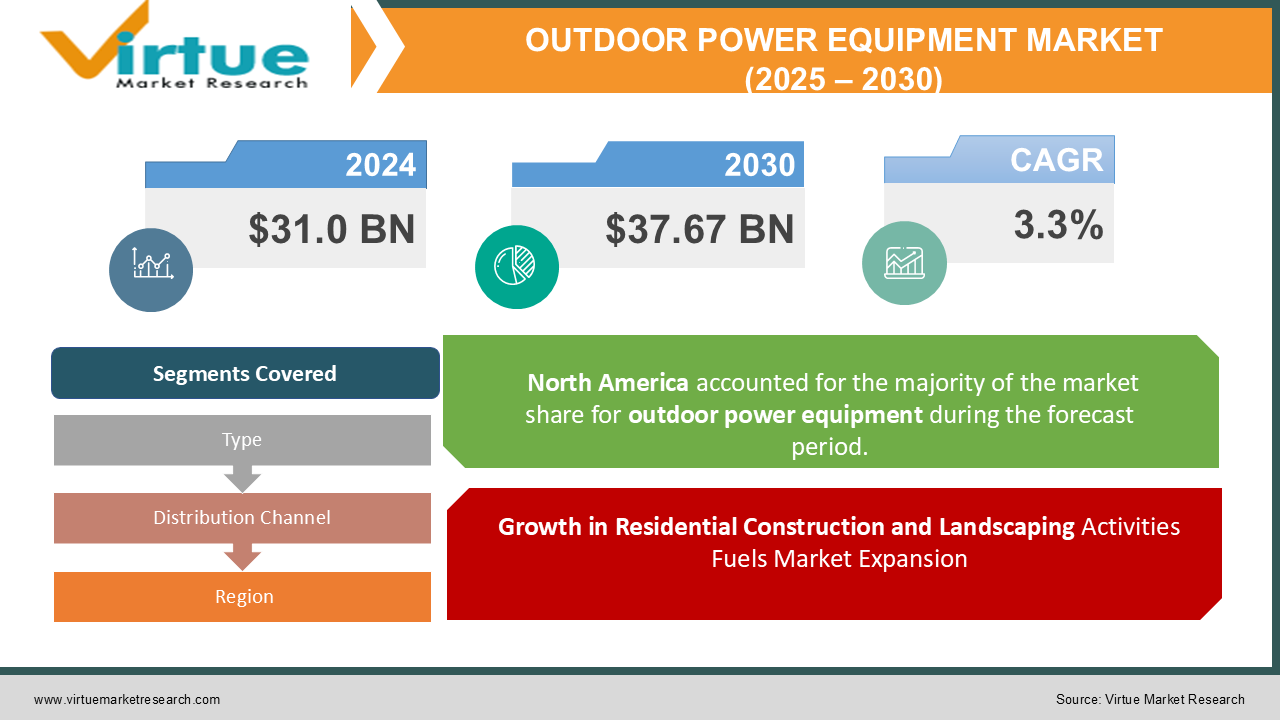

The Outdoor Power Equipment Market was valued at USD 31.0 Billion in 2024 and is projected to reach a market size of USD 37.67 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.3%.

The outdoor power equipment market encompasses a wide array of tools and machinery designed for lawn care, landscaping, forestry, and other outdoor maintenance tasks. This market is driven by several factors, including the increasing number of households with lawns and gardens, the growing popularity of landscaping and outdoor living spaces, and advancements in technology that have led to more efficient and user-friendly equipment. The market includes products such as lawnmowers, trimmers, blowers, chainsaws, tillers, snow throwers, and other specialized equipment. The shift towards battery-powered and electric equipment is a significant trend in the market, driven by environmental concerns and advancements in battery technology. The market is also influenced by seasonal factors, with peak demand typically observed during spring and summer months. The professional landscaping and lawn care industry is a significant consumer of outdoor power equipment, driving demand for heavy-duty and commercial-grade products. The market is characterized by a mix of established global brands and smaller regional players, competing on factors such as product performance, durability, price, and features. The increasing availability of online retail channels has also impacted the market, providing consumers with greater access to a wider selection of products. The market is also influenced by government regulations related to emissions and noise levels, driving innovation in cleaner and quieter equipment.

Key Market Insights:

-

The residential segment accounted for 55% of total equipment sales.

-

Battery-powered equipment made up 38% of total sales, reflecting a growing trend towards sustainability.

-

Over 65% of homeowners reported using outdoor power tools for routine landscaping.

-

The average annual spending on outdoor power tools per household was $350 in 2023.

-

Chainsaws were used by 45% of professional landscapers for tree care services.

-

Commercial landscaping services drove 30% of total equipment purchases in 2023.

-

Robotic lawn mowers saw a sales growth of 42%, reflecting rising adoption of automated solutions.

-

Gas-powered tools accounted for 50% of the market share, despite a shift towards electric models.

-

Electric and battery-powered snow blowers grew by 29%, driven by severe winter conditions.

-

The average life expectancy of outdoor power equipment is estimated at 8 years.

-

70% of new purchases were influenced by product reviews and social media recommendations.

-

45% of buyers considered energy efficiency a top priority when purchasing equipment.

-

Equipment rental services grew by 18%, catering to occasional users.

-

Over 60% of manufacturers offered trade-in programs to promote sustainability.

-

The global demand for robotic outdoor equipment reached 2.5 million units in 2023.

-

Walk-behind mowers made up 40% of total lawn mower sales.

-

Snow blowers accounted for 15% of total outdoor power equipment revenue.

-

Online sales channels represented 25% of total market revenue, showing increasing digital adoption.

-

80% of battery-powered tools sold included lithium-ion batteries for better performance.

-

40% of urban households invested in lawn and garden maintenance tools.

-

Chainsaw demand spiked by 20% due to increasing tree-care awareness.

-

Home improvement retailers contributed to 35% of total sales in 2023.

-

Compact and lightweight tools made up 30% of new product launches.

Market Drivers:

Growth in Residential Construction and Landscaping Activities Fuels Market Expansion

The steady growth in residential construction and the increasing emphasis on landscaping and outdoor living spaces are significant drivers for the outdoor power equipment market. As more homes are built and existing homeowners invest in improving their outdoor areas, the demand for equipment to maintain these spaces increases. The trend towards larger lot sizes and more elaborate landscaping designs further contributes to the market's growth. The increasing popularity of outdoor kitchens, patios, and other outdoor living spaces also drives demand for equipment to maintain these areas. The availability of financing options and home improvement loans also facilitates investment in landscaping and outdoor power equipment. The increasing popularity of DIY home improvement projects also contributes to the market's growth.

Technological Advancements and Shift Towards Battery Power

Technological advancements, particularly in battery technology, are revolutionizing the outdoor power equipment market. The development of more powerful and longer-lasting batteries has made battery-powered equipment a viable alternative to traditional gas-powered equipment. This shift is driven by growing environmental concerns, stricter emissions regulations, and the desire for quieter and more convenient equipment. The advancements in electric motor technology have also improved the performance and efficiency of battery-powered equipment. The increasing availability of charging stations and fast-charging technology further supports the adoption of battery-powered equipment. The development of smart features and connectivity in outdoor power equipment also drives market growth.

Market Restraints and Challenges:

The outdoor power equipment market is highly seasonal, with peak demand typically observed during spring and summer months. This seasonality can create challenges for manufacturers and retailers in terms of inventory management and sales forecasting. Unfavourable weather conditions, such as droughts or excessive rainfall, can also negatively impact market demand. The reliance on weather patterns can make it difficult to predict sales and plan production. The need for specialized storage for equipment during off-season can also be a challenge for consumers. Growing environmental concerns and stricter emissions regulations pose a significant challenge to the market, particularly for gas-powered equipment. Consumers are becoming more environmentally conscious and are seeking cleaner alternatives. Government regulations aimed at reducing emissions and noise levels are also forcing manufacturers to invest in developing cleaner and quieter equipment. The increasing cost of complying with environmental regulations can also be a challenge for manufacturers. The negative perception of gas-powered equipment among environmentally conscious consumers can also impact market demand.

Market Opportunities:

The integration of smart features and connectivity into outdoor power equipment presents significant market opportunities. Features such as GPS tracking, remote control, and data analytics can enhance the user experience and improve equipment efficiency. The development of apps that provide maintenance reminders, usage data, and other helpful information can also drive market growth. The integration of artificial intelligence and machine learning can also lead to more advanced and autonomous equipment. There is a growing focus on ergonomics and user comfort in the design of outdoor power equipment. Manufacturers are investing in developing lighter, more balanced, and easier-to-use equipment to reduce user fatigue and improve safety. The development of adjustable handles, ergonomic grips, and other features that enhance user comfort can also drive market growth. The increasing awareness of workplace safety and ergonomics also contributes to this trend.

OUTDOOR POWER EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.3% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Husqvarna Group, The Toro Company, Deere & Company, Stanley Black & Decker, STIHL,Techtronic Industries, Honda Motor Co., Yamabiko Corporation, Makita Corporation, Robert Bosch GmbH, MTD Products, Ariens Company, Briggs & Stratton, Emak S.p.A., Kubota Corporation |

Outdoor Power Equipment Market Segmentation: by Type

-

Lawnmowers

-

Trimmers and Edgers

-

Blowers

-

Chainsaws

-

Tillers and Cultivators

-

Snow Throwers

-

Other Equipment

Most Dominant Type: Lawnmowers remain the most dominant type due to their widespread use in residential lawn care.

Fastest-Growing Type: Battery-powered equipment across all categories is the fastest-growing segment, driven by environmental concerns and technological advancements.

Outdoor Power Equipment Market Segmentation: by Distribution Channel

-

Retail Stores

-

Online Retailers

-

Dealers and Distributors

Most Dominant Distribution Channel: Retail stores, particularly large home improvement chains, remain a dominant channel due to their wide reach and physical presence.

Fastest-Growing Distribution Channel: Online retailers are the fastest-growing channel due to the convenience and wider selection they offer.

Outdoor Power Equipment Market Segmentation - by Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

North America, particularly the United States, likely holds a significant share due to high rates of homeownership and a strong emphasis on lawn care and landscaping. North America is likely the most dominant region due to its large market size and high adoption rates of outdoor power equipment.

The Asia Pacific region is expected to be the fastest-growing due to rapid economic development and increasing demand for landscaping and lawn care services.

COVID-19 Impact Analysis on the Market:

The COVID-19 pandemic had a mixed impact on the outdoor power equipment market. Initially, lockdowns and supply chain disruptions led to a temporary decline in sales. However, as people spent more time at home, there was a surge in home improvement and gardening activities, which positively impacted the demand for outdoor power equipment. The increased focus on maintaining outdoor spaces and creating comfortable outdoor living areas further contributed to market growth. The shift towards online shopping also accelerated the growth of online retail channels for outdoor power equipment. The pandemic also highlighted the importance of having a functional and well-maintained outdoor space, which further fueled demand. As economies recover and consumer spending patterns normalize, the market is expected to continue its growth trajectory, driven by ongoing trends in home improvement and outdoor living.

Latest Trends and Developments:

The development of robotic lawnmowers and other automated equipment is a significant trend in the market. These products offer convenience and time-saving benefits for consumers. The integration of AI and machine learning in outdoor power equipment is leading to more advanced features such as autonomous navigation, obstacle avoidance, and optimized performance. The increasing connectivity of outdoor power equipment with smartphones and other devices allows for remote control, data monitoring, and other smart features. Manufacturers are investing in developing quieter equipment to reduce noise pollution and improve user comfort. The development of advanced safety features, such as automatic shut-off mechanisms and improved blade designs, is a key trend in the market.

Key Players in the Market:

-

Husqvarna Group

-

The Toro Company

-

Deere & Company

-

Stanley Black & Decker

-

STIHL

-

Techtronic Industries

-

Honda Motor Co.

-

Yamabiko Corporation

-

Makita Corporation

-

Robert Bosch GmbH

-

MTD Products

-

Ariens Company

-

Briggs & Stratton

-

Emak S.p.A.

-

Kubota Corporation

Chapter 1. Outdoor Power Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Outdoor Power Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Outdoor Power Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Outdoor Power Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Outdoor Power Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Outdoor Power Equipment Market – By Type

6.1 Introduction/Key Findings

6.2 Lawnmowers

6.3 Trimmers and Edgers

6.4 Blowers

6.5 Chainsaws

6.6 Tillers and Cultivators

6.7 Snow Throwers

6.8 Other Equipment

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Outdoor Power Equipment Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Retail Stores

7.3 Online Retailers

7.4 Dealers and Distributors

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Outdoor Power Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Outdoor Power Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Husqvarna Group

9.2 The Toro Company

9.3 Deere & Company

9.4 Stanley Black & Decker

9.5 STIHL

9.6 Techtronic Industries

9.7 Honda Motor Co.

9.8 Yamabiko Corporation

9.9 Makita Corporation

9.10 Robert Bosch GmbH

9.11 MTD Products

9.12 Ariens Company

9.13 Briggs & Stratton

9.14 Emak S.p.A.

9.15 Kubota Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Outdoor Power Equipment Market grows due to increasing landscaping trends, rising urbanization, demand for battery-powered tools, advancements in technology, heightened focus on aesthetics, DIY culture adoption, and expanding applications in residential, commercial, and industrial sectors.

The main concerns about the outdoor power equipment market include high upfront costs, rising fuel and maintenance expenses, increasing environmental regulations, limited battery performance for electric models, competition from rental services, and seasonal demand fluctuations.

Husqvarna Group, The Toro Company, Deere & Company, Stanley Black & Decker, STIHL, Techtronic Industries, Honda Motor Co.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.