Organometallics for Solar Energy Market Size (2024 – 2030)

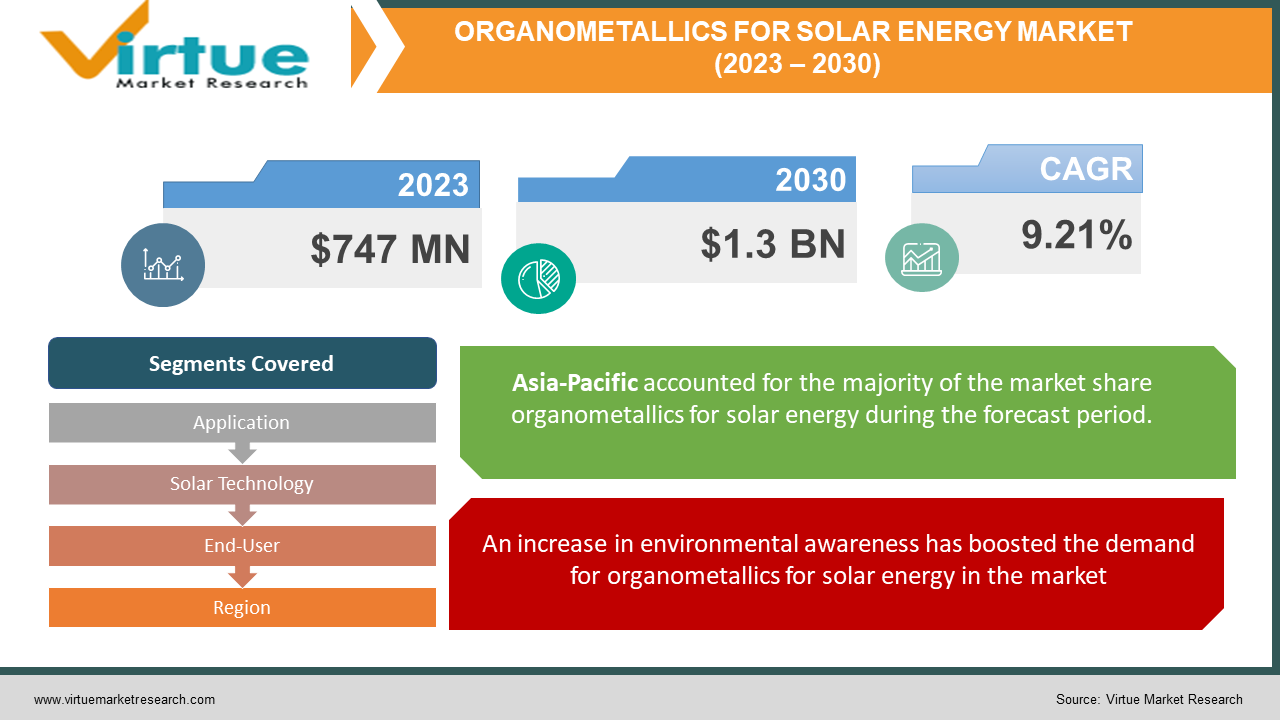

The Organometallics for Solar Energy Market is valued at USD 747 Million in 2023 and is projected to reach a market size of USD 1.3 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.21%.

In the past, solar cells were made using synthetic materials, and organometallic compounds were only used for a few purposes in the electrical and electronics industry. However, with advancements in research and innovation in technology, organometallic compounds are increasingly in demand in solar cells, panels, and systems due to their easy availability and high scalability. One such example in present times that is gaining increased popularity is perovskite solar cells that offer enhanced efficiency, decreased production and manufacturing costs, and a high-power conversion rate. Furthermore, the market for organometallics for solar energy is anticipated to witness an upward trend due to increasing trends in sustainable technologies and demand for environment-friendly materials in solar technologies.

Key Market Insights:

As per the International Energy Agency, power generation from solar photovoltaic cells increased by 270 TWh in the year 2022.

Furthermore, China leads the solar PV industry, by new PV additions to the total solar PV capacity of about 100 GW added in 2022.

The residential segment accounted for 23% of the global solar PV capacity.

In September 2022, Chinese perovskite solar PV Company, Wuxi UtmoLight Technology achieved 18.2% power conversion efficiency for an in-house large-scale perovskite solar module. Moreover, the measurement was confirmed by testing done by The Japan Electrical Safety & Environment Technology Laboratories.

Organometallics for Solar Energy Market Drivers:

An increase in environmental awareness has boosted the demand for organometallics for solar energy in the market.

The increase in environmental problems such as greenhouse gas emissions, increased content of carbon dioxide in the air, and climate change are raising awareness among people across nations. Moreover, this has shifted consumer preferences towards renewable energy systems that generate an appropriate amount of power and also help to reduce carbon footprint globally. Organometallics help in mitigating such risks, as they contain organic compounds that are increasingly used in solar cells and panels, instead of synthetic materials that cause harm to the environment during the production process. One such example is the use of organometallics in perovskite solar cells which are increasingly in demand due to their higher power conversion efficiencies and cost-effectiveness. An organometallic compound called ferrocene helps to extract electrons from perovskites, thereby increasing the efficiency and reliability of the cell. Additionally, it offers stability to the interface of the cell.

The increase in demand for lightweight solar cells and panels has boosted the demand for organometallics for solar energy in the market.

With increased applications of solar cells and panels in nearly every industry, there is further an increase in demand for lightweight solar panels and cells. This has further raised the demand for organometallic compounds in the solar energy market. Moreover, organometallic-based solar panels and cells are not only light in weight but also flexible in usage, as they can be used on roofs of buildings, in large-scale solar-energy plants, and others. In addition, this reduces manufacturing costs and replacement costs. Furthermore, trends in green building are boosting the demand for renewable energy systems in residential settings for electricity generation.

Organometallics for Solar Energy Market Restraints and Challenges:

The expensive cost of rare metals to be included in organometallic technologies such as platinum, iridium, and others can decline the market demand for organometallic solar energy in the market.

In addition, sourcing and processing of metals to be used in organometallic compounds can pose serious harm to the environment, as it can lead to an increase in pollution and also harm the health of nearby residents. This can lead to a decline in demand for organometallics for solar energy.

Furthermore, environmental effects can degrade the quality of these organometallic compounds, as these compounds are sensitive to air, moisture, temperature, and others, leading to a decline in demand for organometallic solar energy in the market.

Organometallics for Solar Energy Market Opportunities:

The Organometallics for Solar Energy Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing demand for environment-friendly, cost-effective, and highly efficient materials in solar technologies is predicted to develop the market for organometallics for solar energy and enhance its future growth opportunities.

ORGANOMETALLICS FOR SOLAR ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.21% |

|

Segments Covered |

By Application, Solar Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sigma Aldrich, Wuxi UtmoLight Technology, Oxford PV, Saule Technologies, Meyer Burger, Swift Solar, First Solar |

Organometallics for Solar Energy Market Segmentation: By Application

-

Solar Cell Materials

-

PV Components

-

Solar Fuel Generation

-

Others

In 2022, based on market segmentation by application, solar cell materials occupied the highest share of about 31% in the market. Organometallic compounds are increasingly used in solar cell materials, as they increase the efficiency and stability of the material and serve as an eco-friendly option compared to traditional solar cell materials such as silicon. One such example of organometallic compound in solar cells is perovskite solar cells. These are increasingly demanded in the market due to their high-power conversion rate and light-weight structure. In addition, increasing sustainability trends in the renewable energy sector have boosted the use of organometallic compounds in OPVs (organic photovoltaics) that are widely used in residential and commercial settings due to their lightweight, flexible, and semi-transparent structure. Additionally, they are also used in windows, cars, and building surfaces for generating solar power.

The solar fuel generation segment is the fastest-growing segment during the forecast period. Organometallic compounds are used as catalysts in generating solar fuel such as in water splitting that converts water into hydrogen and oxygen molecules for generating solar energy, or it is used in reducing the impact of carbon dioxide in fuels, leading to increased production of renewable fuels and reduction in CO2 emissions.

Organometallics for Solar Energy Market Segmentation: By Solar Technology

-

PV (Photovoltaic) Cells

-

CSP (Concentrated Solar Power)

In 2022, PV (photovoltaic) cells occupied the highest share of about 37% in the market. Organometallics are increasingly used in solar cells, due to their thermal and chemical stability. Moreover, they can be used as an alternative to the organic active layers found in solar cells. In addition, organic photovoltaic cells witness an increased demand for organic materials such as organometallics that can used as a sensitizer in organic photovoltaics.

Concentrated solar power is witnessing increased popularity in this market. CSPs are used to generate electricity from sunlight to produce high-temperature heat, which can further be used to drive turbines and engines to generate electricity. Organometallic compounds can be used as a heat transfer fluid in CSPs or can be used in the preparation of thermal energy storage, and others. Additionally, concentrated solar power systems utilize mirrors or lenses to reflect sunlight for power generation, in such a case organometallic coatings or materials can be used for enhancing the reflexivity in CSPs.

Organometallics for Solar Energy Market Segmentation: By End-User

-

Residential

-

Commercial

-

Industrial

-

Utilities

In 2022, based on market segmentation by end-users, the residential segment occupied the highest share of about 26% in the market. The residential segment increasingly uses solar panels, solar systems, and others that contain organometallic compounds and are used for power generation purposes. Moreover, a rising trend toward incorporating sustainable energy solutions in residential settings has boosted the market demand for organometallics in the residential solar market.

The commercial segment is the segment that growing the fastest during the forecast period. Commercial settings such as offices, hotels, resorts, large shopping and food service centers, and others use large-scale solar systems containing organometallics. Moreover, commercial setting utilizes these materials, as they provide increased durability, and reliability, and can withstand the higher energy needs of large infrastructure.

Organometallics for Solar Energy Market Segmentation: Regional Analysis:

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle-East & Africa

In 2022, based on market segmentation by region, Asia-Pacific occupied the highest share of about 27% in the market. Rising demand for solar energy in countries such as China, India, and Japan, and rapid technological advancements in solar energy have contributed to the demand for organometallics for solar energy in the region. For instance, as per the China Electricity Council (CEC) 2023, China’s non-fossil fuel energy sources have increased by 50% of the total electricity generation capacity. Furthermore, solar energy occupies a 32.3% share in this context, which depicts the increasing demand for organometallics for solar energy in the Asian-Pacific market.

North America is the region that is anticipated to be the fastest-growing region during the forecast period. Increased demand for organometallic-based solar cells such as perovskite solar cells and increase in environmental awareness for reducing GHG emissions in the region (as per United Nations Environmental Protection Agency, GHG emissions in the USA was 6340.2 million metric tons of CO2 equivalents in the year 2021), has contributed to the demand for organometallics for solar energy in the region.

COVID-19 Impact Analysis on the Organometallics for Solar Energy Market:

The pandemic hurt the organometallics for solar energy in the market. Lockdown imposed travel restrictions across nations, which impacted the procurement of components required to make solar energy systems and cells. Moreover, this further created supply chain disruptions and led to a slowdown in the production process of solar cells and panels. Furthermore, shifted government support towards the healthcare sector amidst the virus outbreak, resulted in deteriorated market growth for organometallics for solar energy in the market.

Key Players:

-

Sigma Aldrich

-

Wuxi UtmoLight Technology

-

Oxford PV

-

Saule Technologies

-

Meyer Burger

-

Swift Solar

-

First Solar

Chapter 1. Organometallics for Solar Energy Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organometallics for Solar Energy Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organometallics for Solar Energy Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organometallics for Solar Energy Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organometallics for Solar Energy Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organometallics for Solar Energy Market – By Application

6.1 Introduction/Key Findings

6.2 Solar Cell Materials

6.3 PV Components

6.4 Solar Fuel Generation

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Application

6.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Organometallics for Solar Energy Market – By Solar Technology

7.1 Introduction/Key Findings

7.2 PV (Photovoltaic) Cells

7.3 CSP (Concentrated Solar Power)

7.4 Y-O-Y Growth trend Analysis By Solar Technology

7.5 Absolute $ Opportunity Analysis By Solar Technology, 2024-2030

Chapter 8. Organometallics for Solar Energy Market – By End-User

8.1 Introduction/Key Findings

8.2 Residential

8.3 Commercial

8.4 Industrial

8.5 Utilities

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Organometallics for Solar Energy Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Solar Technology

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Solar Technology

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Solar Technology

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Solar Technology

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Solar Technology

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Organometallics for Solar Energy Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sigma Aldrich

10.2 Wuxi UtmoLight Technology

10.3 Oxford PV

10.4 Saule Technologies

10.5 Meyer Burger

10.6 Swift Solar

10.7 First Solar

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Organometallics for Solar Energy Market is valued at USD 747 Million in 2023 and is projected to reach a market size of USD 1.3 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.21%.

Increase in environmental awareness and Increase in demand for lightweight solar cells and panels are the market drivers of the Organometallics for Solar Energy market.

Residential, Commercial, Industrial, and Utilities, are the segments under the Organometallics for Solar Energy Market by end-user.

Asia-Pacific is the most dominant country for the Organometallics for Solar Energy Market.

North America is the fastest growing country in the Organometallics for Solar Energy Market.