Organochlorines Market Size (2024-2030)

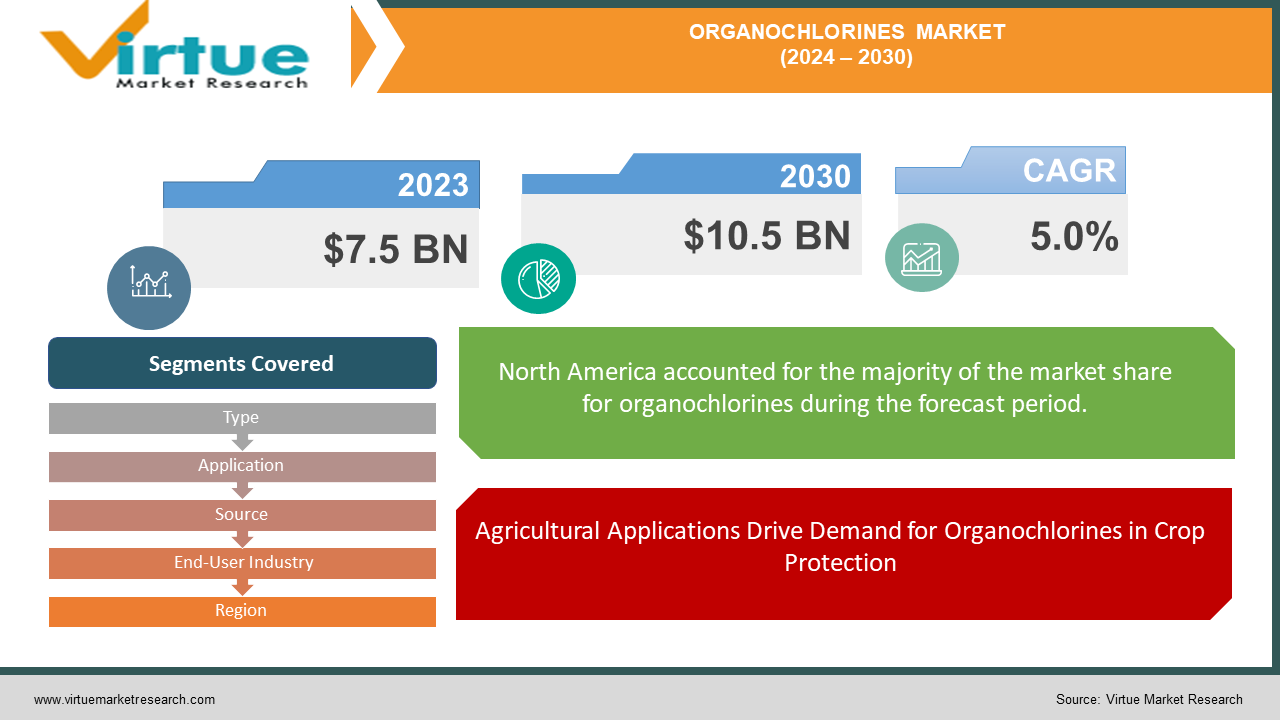

The Global Organochlorines Market was valued at USD 7.5 billion in 2023 and is projected to reach a market size of USD 10.5 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.0%.

The organochlorine market, characterized by compounds containing carbon, chlorine, and hydrogen, is widely used across sectors such as agriculture, pharmaceuticals, and manufacturing. These chemicals are prized for their stability and effectiveness, making them valuable as pesticides, solvents, and intermediates in chemical synthesis. However, the market faces significant challenges due to stringent environmental regulations and health concerns associated with their persistence and bioaccumulation. In response, there is a growing focus on developing safer and more sustainable alternatives. This shift is prompting industries to balance efficacy with environmental and health considerations, thereby reshaping market dynamics.

Key Market Insights:

The annual global demand for organochlorines is estimated at approximately 2.5 million metric tons in 2023, with expectations to increase as agricultural and pharmaceutical applications expand.

The pesticide segment dominates the market, accounting for about 60% of the total revenue in 2023, driven by the high demand for pest control solutions in agricultural sectors.

Innovative uses for organochlorines are expanding beyond traditional agriculture, including applications in water treatment and soil remediation, with new projects increasing by 10% annually.

Climate change influences the demand for organochlorines, with unpredictable weather patterns causing a 5% increase in the need for effective pest management solutions.

Increasing consumer awareness about the environmental impact of organochlorines is leading to a growing demand for products with lower environmental footprints, impacting market dynamics with a 6% shift towards eco-friendly options.

Collaborations between organochlorine manufacturers and research institutions are on the rise, with a 9% annual increase in joint projects focused on developing safer and more effective chemical solutions.

Organochlorines Market Drivers:

Agricultural Applications Drive Demand for Organochlorines in Crop Protection

Agricultural applications significantly drive the organochlorines market, ensuring higher crop yields and food security despite regulatory scrutiny.. Their high efficacy in eliminating a broad spectrum of pests ensures higher crop yields and food security. Farmers rely on their long-lasting action to minimize crop losses, sustaining robust demand in this sector despite regulatory scrutiny.

The Pharmaceutical Industry Depends on Organochlorine Compounds for Drug Synthesis

The pharmaceutical industry is a crucial driver for the organochlorines market, utilizing these compounds as vital intermediates in drug synthesis. They facilitate efficient and cost-effective production of medications. As the pharmaceutical sector grows and innovates, the demand for organochlorines in drug manufacturing remains strong, supporting market expansion.

Industrial Uses of Organochlorines in Manufacturing and Material Production

Organochlorines are extensively used in various industrial processes, acting as solvents and intermediates in the manufacturing of plastics, synthetic rubbers, and other materials. Their chemical stability and effectiveness ensure high-quality production outputs. The industrial sector’s reliance on these compounds underscores their importance, driving market growth.

Versatility in Chemical Reactions Expands Market Applications for Organochlorines

The versatility of organochlorines in numerous chemical reactions broadens their market applications. Their unique properties make them suitable for a wide array of uses, from organic synthesis to advanced materials science. This versatility fosters innovative applications and sustains market demand across diverse industries.

Organochlorines Market Restraints and Challenges:

A major restraint in the organochlorines market is the stringent environmental regulations imposed by governments globally. These regulations are due to the long-term environmental persistence and bioaccumulation potential of organochlorines, which pose significant risks to both ecosystems and human health. Compliance with these regulations involves increased costs for manufacturers and can restrict the use of these compounds. Additionally, growing public awareness and concern about the environmental impacts of organochlorines contribute to the challenge of maintaining market acceptance.

Another significant challenge for the organochlorines market is the development and adoption of safer, more sustainable alternatives. Advances in green chemistry and biotechnology are fostering the creation of new compounds that provide effective pest control and industrial applications without the environmental and health risks associated with organochlorines. This shift requires substantial investment in R&D and forces traditional producers to innovate and adapt. As these alternatives gain traction, they pose a growing competitive threat to the organochlorines market.

Organochlorines Market Opportunities:

One key opportunity in the organochlorines market is the potential for developing environmentally friendly chemical alternatives. As regulatory frameworks become stricter, there is an increasing demand for new organochlorine products that offer reduced environmental and health risks. This trend opens up opportunities for companies to invest in research and development for greener alternatives that comply with current standards while maintaining effectiveness in their applications. Embracing these innovations can help companies not only meet regulatory requirements but also gain a competitive edge in the market.

The organochlorines market also stands to benefit from new technological innovations that expand their applications. Advancements in fields like materials science and electronics are creating opportunities for organochlorines to be used in new and emerging technologies. For instance, their chemical properties are being explored for advanced coatings, specialty materials, and electronic components. Companies that explore these new applications can tap into growth opportunities and diversify their product portfolios, positioning themselves as leaders in high-tech industries.

ORGANOCHLORINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.0% |

|

Segments Covered |

By Type, Application, Source, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Dow Inc., Syngenta International AG, Monsanto Company (Bayer AG), UPL Limited, Nufarm Limited, FMC Corporation, Adama Agricultural Solutions Ltd., Sumitomo Chemical Co., Ltd.,SABIC |

Organochlorines Market Segmentation: By Type

-

Pesticides

-

Solvents

-

Plastics

-

Pharmaceuticals

In the organochlorines market, the largest segment is pesticides, which includes well-established chemicals like DDT and Lindane, used extensively for crop protection and pest control throughout the 20th century. Despite growing environmental concerns, pesticides remain a major segment due to their historical and ongoing applications in agriculture. However, the plastics segment is currently the fastest-growing area in the market, driven by the increasing demand for versatile and durable materials such as PVC for construction, packaging, and infrastructure. Innovations in production techniques and expanded applications contribute to the rapid growth of this sector, reflecting a shift towards more sustainable and diverse uses of organochlorine compounds.

Organochlorines Market Segmentation: By Application

-

Agriculture

-

Industrial Cleaning

-

Construction

-

Healthcare

The agriculture sector is the largest application segment, historically driven by the use of organochlorine pesticides for pest control and crop protection. Despite environmental concerns, agriculture remains a major application area due to the continued need for effective pest management solutions. In contrast, the industrial cleaning sector is the fastest-growing application, fueled by increasing demand for efficient and powerful cleaning agents. This growth is driven by innovations in cleaning formulations and a stronger focus on maintaining hygiene standards across various industries.

Organochlorines Market Segmentation: By Source

-

Synthetic Organochlorines

-

Natural Organochlorines

In the organochlorines market, synthetic organochlorines dominate as the largest source category due to their extensive historical use in applications such as pesticides, solvents, and plastics. Their effectiveness and long-standing presence in various industries solidify their position as the market leader. However, the fastest-growing segment is natural organochlorines, driven by increasing demand for environmentally sustainable alternatives and advancements in green chemistry. This growth reflects a broader trend towards eco-friendly solutions and the exploration of natural sources for chemical applications.

Organochlorines Market Segmentation: By End-User Industry

-

Agricultural Industry

-

Manufacturing Industry

-

Pharmaceutical Industry

-

Construction Industry

In the organochlorines market, the agricultural industry is the largest end-user due to its historic and widespread application of organochlorine pesticides for pest control and crop protection. This sector remains dominant despite the evolving regulatory environment and increased focus on sustainability. Conversely, the pharmaceutical industry is the fastest-growing sector, spurred by ongoing advancements in drug research and development aimed at discovering new therapeutic applications for organochlorine compounds. This growth reflects a significant shift towards exploring innovative medical uses and expanding R&D efforts in the pharmaceutical field.

Organochlorines Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The North American region is the largest segment, largely due to its extensive use of organochlorine pesticides in agricultural practices and a well-established chemical manufacturing infrastructure. This region’s leading position is bolstered by significant historical use and high production capacities. On the other hand, the Asia-Pacific region is recognized as the fastest-growing market, driven by a combination of rapid industrialization, expanding agricultural sectors, and advancements in chemical production technologies. The rapid growth in Asia-Pacific reflects a surge in demand for organochlorine products and increasing investments in regional chemical industries.

COVID-19 Impact Analysis on the Organochlorines Market:

The COVID-19 pandemic caused significant disruptions in the organochlorines market, leading to temporary declines in production and logistical challenges due to global lockdowns and supply chain interruptions. These disruptions increased the costs of raw materials and affected the availability of organochlorine-based products, including those used in agricultural and pharmaceutical applications. However, the pandemic also brought to light the critical role of organochlorine pesticides in maintaining agricultural productivity amidst global challenges.

In response to these disruptions, the pandemic spurred a shift towards digital innovation and advancements in chemical research. The focus of R&D efforts increased on developing sustainable alternatives and improving production processes. This period saw a rise in investment towards innovative technologies and eco-friendly solutions in the organochlorines market, highlighting a trend towards more environmentally responsible chemical practices in the post-pandemic era.

Latest Trends/ Developments:

The organochlorines market is increasingly focusing on the development of sustainable and environmentally friendly products. Recent innovations include the creation of new organochlorine formulations that aim to minimize toxicity while maintaining effectiveness for various applications. This trend is driven by heightened regulatory scrutiny and a growing consumer demand for greener chemical solutions. For example, the development of biopesticides that combine organochlorine compounds with natural biological agents exemplifies the industry's commitment to balancing efficacy with ecological safety.

In parallel, significant advancements are being made in analytical technologies used for the detection and monitoring of organochlorine residues. Emerging methods such as ultra-high-performance liquid chromatography and advanced spectroscopy are improving the accuracy of environmental analyses. Additionally, the incorporation of big data analytics and machine learning into these techniques is enhancing data interpretation and predictive capabilities. These technological innovations are crucial for ensuring regulatory compliance and advancing environmental monitoring efforts in the organochlorines market.

Key Players:

-

BASF SE

-

Dow Inc.

-

Syngenta International AG

-

Monsanto Company (Bayer AG)

-

UPL Limited

-

Nufarm Limited

-

FMC Corporation

-

Adama Agricultural Solutions Ltd.

-

Sumitomo Chemical Co., Ltd.

-

SABIC

Chapter 1. Organochlorines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organochlorines Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organochlorines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organochlorines Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organochlorines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organochlorines Market – By Type

6.1 Introduction/Key Findings

6.2 Pesticides

6.3 Solvents

6.4 Plastics

6.5 Pharmaceuticals

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Organochlorines Market – By Application

7.1 Introduction/Key Findings

7.2 Agriculture

7.3 Industrial Cleaning

7.4 Construction

7.5 Healthcare

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Organochlorines Market – By Source

8.1 Introduction/Key Findings

8.2 Synthetic Organochlorines

8.3 Natural Organochlorines

8.4 Y-O-Y Growth trend Analysis By Source

8.5 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 9. Organochlorines Market – By End-User

9.1 Introduction/Key Findings

9.2 Agricultural Industry

9.3 Manufacturing Industry

9.4 Pharmaceutical Industry

9.5 Construction Industry

9.6 Y-O-Y Growth trend Analysis By End-User

9.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10. Organochlorines Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.2.1 By ApplicationApplication

10.1.3 By Source

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By ApplicationApplication

10.2.4 By Source

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By ApplicationApplication

10.3.4 By Source

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By ApplicationApplication

10.4.4 By Source

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By ApplicationApplication

10.5.4 By Source

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Organochlorines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 BASF SE

11.2 Dow Inc.

11.3 Syngenta International AG

11.4 Monsanto Company (Bayer AG)

11.5 UPL Limited

11.6 Nufarm Limited

11.7 FMC Corporation

11.8 Adama Agricultural Solutions Ltd.

11.9 Sumitomo Chemical Co., Ltd.

11.10 SABIC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the global organochlorines market was valued at approximately USD 7.5 billion. By 2030, it is projected to reach USD 10.5 billion, growing at a CAGR of 5.0% during the forecast period from 2023 to 2030.

Growing Demand for Effective Pest Control Solutions, Rising Investment in Agricultural R&D, Expanding Pharmaceutical Applications, and Regulatory Support for Agricultural Productivity.

Agricultural Industry, Manufacturing Industry, Pharmaceutical Industry, Construction Industry.

North America is the most dominant region in the organochlorines market due to its advanced agricultural practices and significant need for pest management solutions.

BASF SE, Dow Inc., Syngenta International AG, Monsanto Company (Bayer AG), UPL Limited, Nufarm Limited, FMC Corporation, Adama Agricultural Solutions Ltd., Sumitomo Chemical Co., Ltd., SABIC.