Organochlorine Pesticides Market Size (2024 –2030)

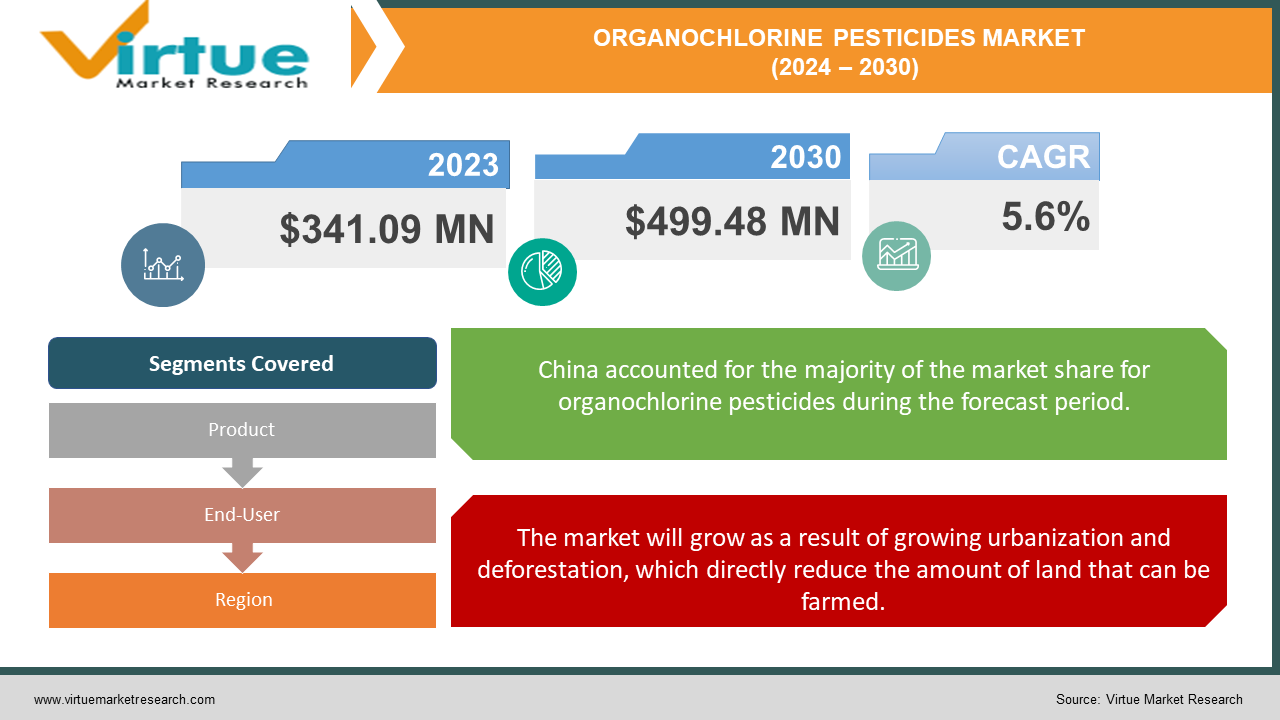

In 2023, the Global Organochlorine Pesticides Market was valued at USD 341.09 Million and is projected to reach a market size of USD 499.48 Million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%.

Synthetic pesticides of the organochlorine (OC) variety are widely used worldwide. These pesticides are employed in agriculture and the chemical industry. They belong to a class of substances known as chlorinated hydrocarbons. They have a reputation for being extremely poisonous, degrading slowly, and accumulating in living things. Despite the fact that many OC pesticides are now illegal in developed nations, their use has increased despite this, frequently leading to misuse. These pesticides frequently harm non-target species even though they are intended to target specific pests. Chemicals called pesticides are used to eradicate undesirable weeds, bacteria, fungi, insects, and other organisms. Depending on what they kill, they are referred to as herbicides, bactericides, fungicides, insecticides, or rodenticides. Most pesticides are effective against a wide range of weeds and pests, but some are made to kill only certain kinds. These substances cause malfunctions and loss of vitality in the targeted pests by interfering with their physiological processes. Pesticide residues have the potential to contaminate soil, water, and other environmental elements, endangering the local flora and fauna.

Key Market Insights:

Pesticides and insecticides account for approximately 45% of the organochlorines market share, despite increasing regulations, due to their effectiveness in pest control and relatively low cost of production.

The agriculture sector constitutes around 60% of the demand for organochlorines, reflecting their continued use in crop protection and pest management in some regions, particularly in developing countries.

In terms of region, Asia-Pacific holds the largest market share of about 40% for organochlorines, attributed to the presence of large agricultural economies and less stringent regulations compared to Western countries.

The adoption of alternative, less persistent organic compounds as substitutes for organochlorines is growing at a rate of approximately 8% annually, driven by increasing environmental concerns, stricter regulations, and the push for more sustainable agricultural practices.

Global Organochlorine Pesticides Market Drivers:

The market will grow as a result of growing urbanization and deforestation, which directly reduce the amount of land that can be farmed.

Since there is less arable land due to increasing urbanization and deforestation, increasing agricultural output is essential. Chemical crop protection is one way to accomplish this. New and creative technology developments also contribute to longer and higher crop yields. For example, genetic modification can increase food production and increase an organism's lifespan. Utilizing novel and creative crop species created in labs is becoming more and more popular as a way to increase agricultural productivity.

Growing agrochemical demand will fuel market expansion.

Agrochemicals such as insecticides are necessary for crops to control pests and sustain maximum yields. Genetically modified crops are driving up the demand for pesticides. As a result, the development of novel and efficient technologies that enhance crop productivity and quality on cultivable land is anticipated to propel the global agrochemicals market's growth prospects in the upcoming years.

Organochlorine Pesticides Market Challenges and Restraints:

In order to reduce pest infestations and boost agricultural productivity, pesticides are applied to crops. However, as pests become resistant to more advanced pesticides, the environment may suffer both short-term and long-term harm. Robust government regulations limit the use of hazardous chemicals in the manufacture of pesticides in order to address this. Concerns about the environment make environmental protection organizations oppose the use of these compounds as well. Strict laws like the Clean Air Act and pollution control measures are predicted to eventually lower the demand for agrochemicals.

Organochlorine Pesticides Market Opportunities:

Opportunities are opening up in the market for organochlorines for the creation of safer and more efficient substitutes. Biopesticides are becoming more and more popular because they come from natural sources and don't harm the environment. Biotechnology and nanotechnology advancements present opportunities for new formulations that are environmentally friendly and effective against pests. Furthermore, there is a growing need for integrated pest management solutions, which lessen reliance on single chemical solutions by combining multiple approaches to pest control. Businesses that invest in the study and development of sustainable pest management solutions stand to benefit from the move toward safer agricultural practices as regulations continue to tighten.

ORGANOCHLORINE PESTICIDES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Product, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer Crop Science AG, Marrone Bio Invention, Adama Agricultural Solutions, Certis USA LLC, Dow Inc., Monsanto, Isagro SPA, Camson Bio-Technology Ltd, Andermatt Biocontol AG, BASF SE, Som Phytopharma India Ltd, Varsha Bio science & Technology, Syngenta AG, Koppert Biological Systems, BioWorks Inc., Valent Bio science corp |

Global Organochlorine Pesticides Market- By Product

-

Conventional Chemicals

-

Herbicides

-

Fungicides

-

Insecticides

-

Bio-pesticides

-

Bio Control Agents

-

Plant-Incorporated Protectants

The bio-pesticides segment is anticipated to generate revenue in 2021 at a robust 10.1% annual growth rate. The demand for conventional chemicals is expected to increase by 4.1% between 2020 and 2021, resulting in a 4.8% growth in the pesticide market as a whole in 2021. The world over, awareness of environmental degradation is growing at an accelerating rate. Strict regulations are being enforced by a number of regional governmental and environmental regulatory organizations in order to counter this. Customers are being encouraged to switch to eco-friendly products by this growing awareness. As a result, it is expected that during the estimated period of 2022–2030, the demand for bio-pesticides will rise quickly.

Global Organochlorine Pesticides Market- By End-User

-

Row Crops

-

Fruits & Vegetables

-

Turfs & Ornamentals

-

Horticulture

-

Other Crop Types

Pesticides are widely used in agriculture to safeguard crops from damaging insects, fungi, weeds, and other organisms. It is anticipated that 32% of insecticides produced globally will be used on row crops. The need for food and agricultural products will probably rise as the population expands, increasing the use of pesticides in the agriculture industry.

Global Organochlorine Pesticides Market- By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

China is anticipated to rank among the top nations in the world for pesticide demand. China is expected to generate roughly 44% of the world's pesticide sales revenue in 2021. China is the country with the largest population in the world, with about 1.4 billion people, which creates a huge demand for food and agricultural products. Farmers in China are employing a variety of strategies to increase yield and meet the country's food needs in order to meet this increasing demand. Pro-industry policies by the government help local manufacturers. On the other hand, people who live in developed nations like North America and Europe have to abide by a lot of stringent laws. China's capacity to produce pesticides is growing as a result of manufacturers expanding there in response to the implementation of such restrictions around the world.

COVID-19 Impact on the global Organochlorine Pesticides Market:

The COVID-19 pandemic, which originated in Wuhan, China, has impacted the lives of millions of people and led to economic issues in numerous regions as a result of a decline in commercial activity. According to World Bank estimates, the pandemic will cause the global GDP to decline by 5%. All market sectors and industries have been severely impacted by this, including the biopesticide market, where supply and demand have been severely disrupted. These market disruptions have resulted in significant changes in consumer behavior across numerous sectors. The increased use of biopesticides in agriculture is one obvious shift. Because biopesticides don't contain the dangerous chemicals present in chemical pesticides, which can have an adverse effect on both people and the environment, consumers and food producers believe they are better for the soil. Because agricultural activities were deemed essential and continued largely unaffected by lockdowns, the agricultural sector was one of the least affected by the COVID-19 outbreak. Farming operations had to continue operating all over the world in order to meet the increasing demand for food. The pandemic had only a minor effect on the demand for pesticides. However, restrictions on international travel and trade had an impact on raw material supply and production, which resulted in supply chain disruptions and a 2.5% market decline.

Latest Trend/Development:

The market for organochlorines is contracting as a result of increased public awareness of their harmful effects on the environment and public health. In response, governments all over the world are enacting stronger laws that severely restrict the use and production of these substances. A move toward safer substitutes, such as biopesticides and integrated pest management (IPM) methods, which come from natural sources and have less of an adverse effect on the environment, is being prompted by regulatory pressure. Since they address worries about pesticide residues in food and their possible long-term effects on ecosystems, these alternatives are becoming more and more well-liked. Furthermore, the promotion of sustainable farming practices is greatly aided by developments in agricultural technology. Technological advancements like biotechnology and precision agriculture are empowering farmers to use more effective and focused pest management techniques. The development of technology has facilitated the shift away from organochlorines by offering efficient substitutes that reduce environmental hazards while preserving crop quality and yield. Because of this, businesses that invest in the study and development of these environmentally friendly pest control methods will be well-positioned to profit from the rising demand for safer farming methods throughout the world.

Key Players:

-

Bayer Crop Science AG

-

Marrone Bio Invention

-

Adama Agricultural Solutions

-

Certis USA LLC

-

Dow Inc.

-

Monsanto

-

Isagro SPA

-

Camson Bio-Technology Ltd

-

Andermatt Biocontol AG

-

BASF SE

-

Som Phytopharma India Ltd

-

Varsha Bio science & Technology

-

Syngenta AG

-

Koppert Biological Systems

-

BioWorks Inc.

-

Valent Bio science corp

Market News:

-

To gain a commanding lead in the wheat market, Syngenta Seeds completed the acquisition of Sensako, a South African seed company that specializes in cereals, in 2020.

-

At a cost of more than US$ 4.2 billion, UPL Ltd acquired Arysta LifeScience (Arysta) from Platform Specialty Products in 2019. The acquisition is expected to enhance the company's reputation as a top supplier of agricultural solutions.

Chapter 1. Organochlorine Pesticides Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organochlorine Pesticides Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organochlorine Pesticides Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organochlorine Pesticides Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organochlorine Pesticides Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organochlorine Pesticides Market – By Product

6.1 Introduction/Key Findings

6.2 Conventional Chemicals

6.3 Herbicides

6.4 Fungicides

6.5 Insecticides

6.6 Bio-pesticides

6.7 Bio Control Agents

6.8 Plant-Incorporated Protectants

6.9 Y-O-Y Growth trend Analysis By Product

6.10 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Organochlorine Pesticides Market – By End-User

7.1 Introduction/Key Findings

7.2 Row Crops

7.3 Fruits & Vegetables

7.4 Turfs & Ornamentals

7.5 Horticulture

7.6 Other Crop Types

7.7 Y-O-Y Growth trend Analysis By End-User

7.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Organochlorine Pesticides Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Organochlorine Pesticides Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bayer Crop Science AG

9.2 Marrone Bio Invention

9.3 Adama Agricultural Solutions

9.4 Certis USA LLC

9.5 Dow Inc.

9.6 Monsanto

9.7 Isagro SPA

9.8 Camson Bio-Technology Ltd

9.9 Andermatt Biocontol AG

9.10 BASF SE

9.11 Som Phytopharma India Ltd

9.12 Varsha Bio science & Technology

9.13 Syngenta AG

9.14 Koppert Biological Systems

9.15 BioWorks Inc.

9.16 Valent Bio science corp

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Organochlorine Pesticides Market was valued at USD 341.09 Million and is projected to reach a market size of USD 499.48 Million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%

The market will grow as a result of growing urbanization and deforestation, which directly reduce the amount of land that can be farmed and The market will grow as a result of growing urbanization and deforestation, which directly reduce the amount of land that can be farmed.

Bayer Crop Science AG, Marrone Bio Invention, Adama Agricultural Solutions, Certis USA LLC, Dow Inc., Monsanto, Isagro SPA, Camson Bio-Technology Ltd, Andermatt Biocontol AG, BASF SE

Conventional Chemicals, Herbicides, Fungicides, Insecticides, Bio-pesticides, Bio Control Agents, Plant-Incorporated Protectants

China is most dominating in the Global Organochlorine Pesticides Market.