Organic Steel Cut Oats Market Size (2023 – 2030)

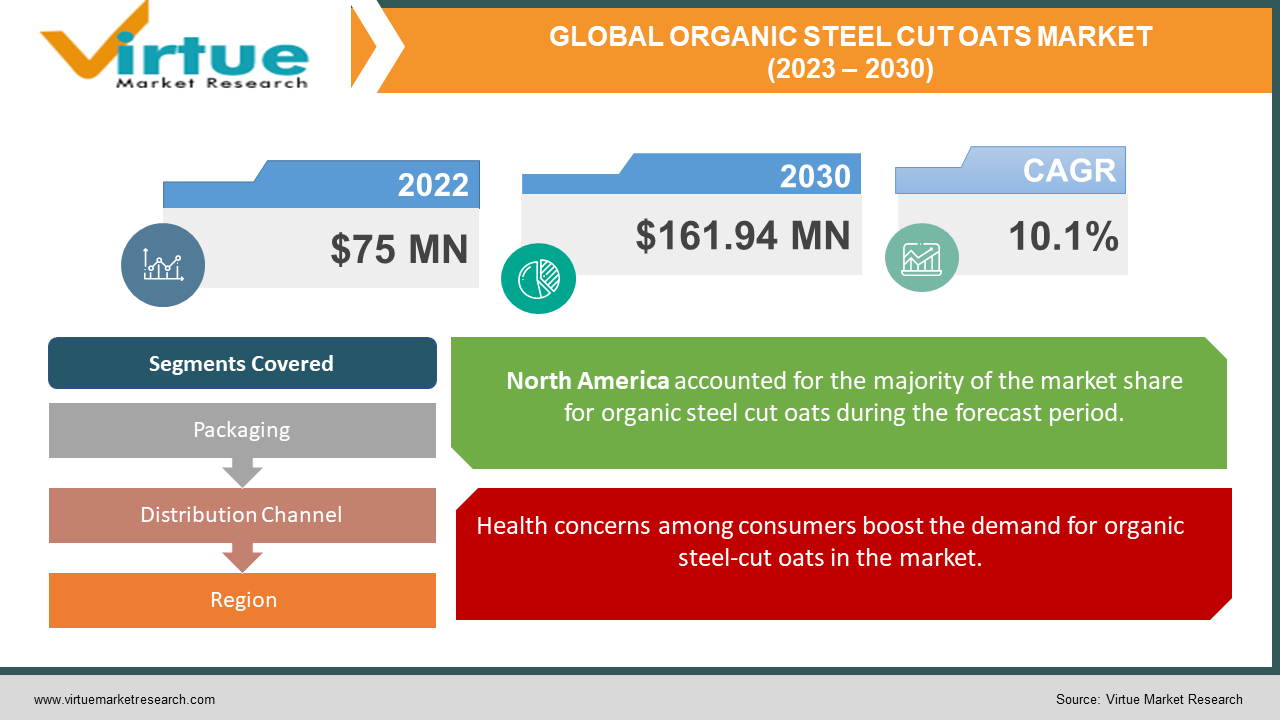

The Global Organic Steel Cut Oats Market was valued at USD 75 Million and is projected to reach a market size of USD 161.94 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.1%.

The organic steel cut market is experiencing increased demand from consumers due to rising health awareness among consumers. Further, environmental concerns such as cultivating vegetables organically and processing food organically are some other factors propelling the market for organic steel-cut oats. In addition, recent developments in packaging and marketing of organic food such as green and clean labeling and using recycled packaging materials have further influenced consumer demand for this market. Future anticipations for this market include domination by technology, which involves the use of high-end machines and equipment to process and manufacture oats. Additionally, AI-augmented machines will be used increasingly, thus increasing the productivity and efficiency of oats. Furthermore, the rising online presence of fitness and wellness companies will increase demand for oats from e-commerce websites.

Key Market Insights:

Oats are the premium source of nutrients and contain all the nutrients such as antioxidants, fiber, proteins, and others that benefit the human body. Further, Oats contain a specific kind of beta-glucan fiber that helps to reduce chronic heart diseases such as coronary heart diseases. As per studies, an oat contains 3g of beta-glucan fiber and can lower the risk of heart disease and blood cholesterol.

Additionally, steel-cut oats have a GI (Glycemic Index) score of about 53, which showcases that it takes less time to digest these oats than other conventional oats.

Furthermore, a single intake of organic steel cut can provide huge nutritional value to the customers. These oats contain less saturated fat of about 3g and hence help reduce cholesterol and weight management.

Furthermore, in coming years the consumption of oats is anticipated to increase by 6.01%.

Moreover, Europe is the global leader in the production of oats and contributes to about 60% of global production. Apart from Europe, the USA is also one of the biggest producers of oats and produced around 65.4 million oats in 2020, depicting the increased demand for organic steel-cut oats in the region.

Furthermore, oat milk is among the dominant products to use organic steel-cut oats and is projected to grow at a CAGR of 9.7%, showcasing its increased usage by the health and fitness-conscious population.

Organic Steel Cut Oats Market Drivers:

Health concerns among consumers boost the demand for organic steel-cut oats in the market.

Consumers are increasingly becoming concerned about healthy lifestyles and balanced diets, which have increased the demand for organic steel-cut oats in the market. These oats possess beneficial nutrients such as fiber, vitamins, minerals, antioxidants, and proteins. Furthermore, chronic diseases such as diabetes and heart disease can be reduced by taking organic steel-cut oats. Moreover, as per WHO, 422 million people worldwide are suffering from diabetes and nearly 1.5 million deaths are attributed to diabetes each year. This can be overcome by increasing the intake of oats, research claims that steel-cut oats can help to reduce type 2 diabetes. Moreover, organic steel-cut oats are widely used in other processed foods such as energy bars and protein bars, making it a suitable on-the-go consumption option for consumers.

Environmental concerns have boosted the market for organic steel-cut oats.

Rising environmental awareness among producers, manufacturers, and consumers has boosted the market for organic steel-cut oats, as these oats are prepared using organic methods such as organic processing, manufacturing, and environment-friendly packaging, which includes using recycled materials for packaging. Moreover, as per studies, 75% of sustainable goods witness an increase in demand from the online platform than the in-store or offline segment, and more than 55% of consumers are willing to pay high for eco-friendly products of brands. Furthermore, rising demand for cruelty-free products has further increased the usage of these oats in food products.

Organic Steel Cut Oats Market Restraints and Challenges:

The expensive price of oats-based products can decrease the demand for organic steel-cut oats in the market. These products are high in price due to their organic production and manufacturing processes. Moreover, steel-cut oats are organically processed and packaged, which further raises the final price of the product.

Another challenge to the organic steel-cut oats market is the perishability of oats. Unlike other types of oats, these oats perish faster and smell and taste rancid, which can reduce their demand in the market.

Organic Steel Cut Oats Market Opportunities:

The organic steel-cut oats market has various opportunities in the market. Due to trends in veganism and organic diets, the market will witness increased demand from consumers, especially athletes and other sports persons for maintaining their bodies and for immune boosting. Further, personalized health products witness increased incorporation of steel-cut oats with other products such as nuts, dry fruits, seeds, vegetable and fruit extracts, and others. Additionally, functional beverages containing organic steel-cut oats are further anticipated to witness an increase in demand from consumers.

ORGANIC STEEL CUT OATS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.1% |

|

Segments Covered |

By Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bagrry, Quaker Oats, Better Oats, Sattvic Foods, Bob’s Red Mill,Prairie Mills, Nourish You, True Elements, Southern Foods, Zerobeli |

Organic Steel Cut Oats Market Segmentation: By Packaging

-

Single-Serve Packaging

-

Bulk Packaging

-

Retail Packaging

In 2022, based on market segmentation by packaging, single-serve packaging occupies the highest share of about 19.7% in the market. The growth is attributed to rising demand for on-the-go consumption of food by individuals due to hectic working schedules and busy lifestyles. Further, single-serve packaged oats energy bar is witnessing an increased demand due to the nutritional benefits it provides.

The retail packaging segment is the fastest-growing segment during the forecast period. It involves packaging in family-size containers, boxes, and others that are available in various forms such as pouches, boxes, and containers. Retail packaged organic steel-cut oats are increasingly in demand due to the convenience they offer to consumers such as nutritional details and product information on the boxes. Moreover, packaged concentrated steel-cut oats provide cooking and mixing instructions for individuals wanting to use them in trail mixes or protein shakes.

Organic Steel Cut Oats Market Segmentation: By Distribution Channel

-

Offline

-

Online

In 2022, the offline segment occupies the highest share of about 29% in the market. These include supermarkets/hypermarkets, health and wellness stores, grocery stores, and others that offer various organic steel-cut oats-based products such as breakfast cereals, baked products, snacks and energy bars, smoothie ingredients, and others. The segment’s growth is attributed to varied product availability and availability of premium and fresh products.

The online segment is the fastest-growing segment during the forecast period and is growing more rapidly at a CAGR of more than 25%. These include online retail stores and e-commerce websites that offer product/price comparisons with other brands, easy and flexible delivery options, and access to premium health and wellness snack brands from various geographic locations.

Organic Steel Cut Oats Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, based on market segmentation by region, North America occupies the highest share of about 29.7% in the market. The growth is attributed to rising consumer demand for healthy and nutrient-rich food products such as oat mixes, oat bars, oat cakes, muffins, and others; and sustainability trends in the production of organic steel-cut oats in the region. Moreover, oat milk is one of the popular steel-cut oat products that is widely used in coffee shops and home fridges and accounts for more than 50% of retail sales in 2022.

Asia-Pacific is the fastest-growing region during the forecast period. Increasing Western influences such as vegan dietary patterns organic food eating habits, and culinary versatility have boosted the consumer demand for organic steel-cut oats in the region.

COVID-19 Impact Analysis on the Global Organic Steel Cut Oats Market:

The pandemic had a positive impact on the organic steel-cut oats market. Due to increased health awareness among consumers during the pandemic, there was a rising demand for organic steel-cut oats in the market. Furthermore, the e-commerce sector witnessed a boom as offline stores were closed, which shifted consumer shopping preferences towards online shopping. Additionally, organic steel-cut oats mixes were increasingly in demand for preparing at-home healthy meals. Moreover, oats-based energy bars also witnessed an increase in demand from consumers during the pandemic.

Latest Trends/ Developments:

The global Organic Steel Cut Oats Market is reasonably split and fragmented with the existence of several global companies. These players are motivated to achieve higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are constantly infusing oats steel-cut oats into their food products, especially in protein and smoothie mixes. Further, trends in flavored organic steel-cut oats products can be seen such as maple, vanilla, cinnamon, and other flavors are widely demanded by consumers. Moreover, health and wellness brands are focusing more on steel-cut oats products as they are high in fiber, and low in calories and sugar, making them suitable for health-conscious consumers. Furthermore, trends in gluten-free steel oats are witnessing an increase as consumers become more health conscious.

Additionally, premium packaged oats products such as oats chocolates, and bars have been gaining momentum in the market due to their peculiar taste and health benefits. Furthermore, new product launches and innovations in the healthy snacking industry are further paving the way for the development of organic steel-cut oats in the market. For instance, in April 2021, Path of Life launched frozen steel-cut oatmeal in two flavors that are gluten-free, Non-GMO, dairy-free, and plant-based.

Key Players:

-

Bagrry

-

Quaker Oats

-

Better Oats

-

Sattvic Foods

-

Bob’s Red Mill

-

Prairie Mills

-

Nourish You

-

True Elements

-

Southern Foods

-

Zerobeli

Chapter 1. Organic Steel Cut Oats Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Organic Steel Cut Oats Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Organic Steel Cut Oats Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Organic Steel Cut Oats Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Organic Steel Cut Oats Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Organic Steel Cut Oats Market – By Packaging

6.1. Introduction/Key Findings

6.2 Single-Serve Packaging

6.3 Bulk Packaging

6.4 Retail Packaging

6.5 Y-O-Y Growth trend Analysis By Packaging

6.6 Absolute $ Opportunity Analysis By Packaging, 2023-2030

Chapter 7. Organic Steel Cut Oats Market - By Distribution Channel

7.1. Introduction/Key Findings

7.2 Offline

7.3 Online

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2023-2030

Chapter 8. Organic Steel Cut Oats Market , By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.3 By Packaging

8.1.4. By Distribution Channel

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1. U.K.

8.2.2. Germany

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.2.2 By Packaging

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. Rest of Asia-Pacific

8.3.2. By Packaging

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.3.5. South America

8.4.1. By Country

8.4.1. Brazil

8.4.2. Argentina

8.4.3. Colombia

8.4.4. Chile

8.4.5. Rest of South America

8.4.2. By Packaging

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.4.5. Middle East & Africa

8.5.1. By Country

8.5.1. United Arab Emirates (UAE)

8.5.2. Saudi Arabia

8.5.3. Qatar

8.5.4. Israel

8.5.5. South Africa

8.5.6. Nigeria

8.5.7. Kenya

8.5.8. Egypt

8.5.9. Rest of MEA

8.5.3. By Packaging

8.5.4. By Distribution Channel

8.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Organic Steel Cut Oats Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bagrry

9.2 Quaker Oats

9.3 Better Oats

9.4 Sattvic Foods

9.5 Bob’s Red Mill

9.6 Prairie Mills

9.7 Nourish You

9.8 True Elements

9.9 Southern Foods

9.10 Zerobeli

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Organic Steel Cut Oats Market was valued at USD 75 Million and is projected to reach a market size of USD 161.94 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.1%.

Health and Environmental Concerns are the market drivers of the Global Organic Steel Cut Oats Market.

Offline and Online are the segments under the Global Organic Steel Cut Oats Market by Distribution Channel.

North America is the most dominant region for the Global Organic Steel Cut Oats Market.

Asia-Pacific is the fastest-growing region in the Global Organic Steel Cut Oats Market.