Organic Photonics Materials Market Size (2023 – 2030)

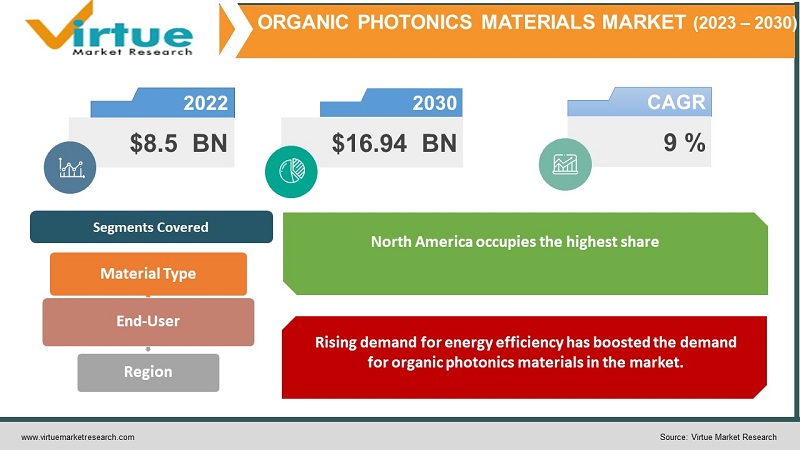

In 2022, the Global Organic Photonics Materials Market was valued at $8.5 billion, and is projected to reach a market size of $16.94 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 9%.

Organic photonic materials have been in the industry for a very long time and have found applications in various industries due to their good flexibility, lightweight, low power consumption, and biocompatibility. In recent years, owing to rapid advancements in technology and industry demand for energy efficiency, organic photonics are increasingly used in OLEDs (Organic Light light-emitting diodes), photovoltaics, lasers, and others. Moreover, their low energy consumption feature makes them a popular choice for smart TVs, smartphones, and wearable devices. Additionally, as consumers shifted their focus towards renewable energy sources, manufacturers incorporated organic photonics in solar panels and windows for enhanced energy efficiency. Furthermore, the future holds positive for the organic photonic materials market, as demand for smart and energy-efficient electronics increases in the market. Moreover, the rising demand for biophotonics in the medical and healthcare industry for diagnosing and imaging systems is further shaping the market landscape for organic photonic materials.

Key Market Insights:

-

As per the International Energy Agency, power generation from solar PV will increase by 26% in 2022, reaching 1300 TWh.

-

AS per OLED Works, OLEDWorks panels are 30 times longer and provide 80% better efficiency than incandescent light bulbs.

-

Energy Star-certified televisions are 25% more energy efficient than conventional television models.

Organic Photonics Materials Market Drivers:

Rising demand for energy efficiency has boosted the demand for organic photonics materials in the market.

Organic photonics witness an increased demand in the market, as consumers and manufacturers shift their demand towards energy-efficient products. Organic photonic materials are increasingly used in consumer electronics such as smartphones and TVs due to their low power consumption and enhanced colour gamut. That is, organic photonic materials are incorporated in OLEDs that emit light directly without the need for a separate backlight. Moreover, OLED displays offer a vibrant colour experience to the viewer, as each pixel in it emits its light and provides energy-efficient colour to the consumer. Furthermore, OLED displays are thinner than conventional displays and hence reduce material costs during the manufacturing process. Apart from this, organic photonic materials find increased application in the solar energy industry, as they are lightweight, environment friendly, and consume less energy than other materials. They are increasingly used in solar panels, windows, organic photovoltaics, and others.

Government support for energy-efficient technologies and renewable energy drives the market demand for organic photonic materials.

Governments worldwide are continuously contributing to the development of organic photonic materials through policies, schemes, investment expenditures, and others. For instance, as per the International Energy Agency (IEA), since 2020, governments worldwide have invested around USD 1 trillion in energy-efficiency actions, which include public and infrastructure projects, electric vehicle support, building retrofits, and others. Many governments are offering financial incentives to manufacturers of energy companies for the adoption of sustainable and energy-efficient technology. Moreover, the allocation of research funds for the development of renewable sources of energy such as PVs and solar panels, have further contributed to the growth of organic photonic materials in the market. Additionally, environmental and energy goals set by various countries such as greenhouse gas emission reductions, phasing out of pollution generating machines and equipment, and adoption of green er technologies. For instance, The European Union (EU) committed to reducing energy consumption to 20% by the year 2020.

Organic Photonics Materials Market Restraints and Challenges:

Changing government regulations can affect the market growth of organic photonic materials. Government regulations are constantly changing, which can create a time gap in the execution of it by manufacturers and hence can affect the demand for organic photonic materials in the market.

Furthermore, the high initial overhead costs of deploying advanced sensors, lasers, and other materials can reduce the demand for organic photonic materials by consumers.

Organic Photonics Materials Market Opportunities:

The Global Organic Photonics Materials Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing trends in greener technologies and an increase in government support for renewable energy sources, are predicted to develop the market for organic photonics materials and enhance its future growth opportunities.

ORGANIC PHOTONICS MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By Material Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SPIE, SAFTRA Photonics, Rainbow Photonics, NLM Photonics, Hamamatsu Photonics, BOE Technology, Emagin Corporation, AU Optronics, LG Display, Panasonic, NanoFlex Power, Moresco, Novaled |

Organic Photonics Materials Market Segmentation: By Material Type

-

OLEDs (Organic Light-Emitting Materials)

-

OPVs (Organic Photovoltaic Materials)

-

Organic Laser Materials

-

Organic Semiconductor Materials

In 2022, based on market segmentation by material type, OLEDs occupy the highest share of about 27% in the market. OLED materials are lightweight offer greater flexibility and consume less energy, which makes it a popular choice in the consumer electronics industry to be used in TVs and smartphones. Moreover, they offer high contrast ratios and a vibrant colour gamut that provides an enhanced viewing experience to the consumers. Additionally, they are used in lighting systems such as lighting panels, interior and exterior lighting, smart home lighting solutions, and others.

The OPVs segment is the fastest-growing segment during the forecast period. OPVs are used in the energy sector for electricity generation purposes, such as in solar panels, PV cells, and windows. These materials are flexible, semi-transparent, and consume low energy, which makes them an energy-efficient material to be used in various industries. Moreover, various absorbers can be used to create coloured and transparent OPV devices and therefore are widely used in building-integrated photovoltaics. Additionally, they are also used in solar-powered wearable devices and chargers.

Organic Photonics Materials Market Segmentation: By End-User

-

Automotive

-

Healthcare

-

Consumer Electronics

-

Aerospace

-

Construction & Building

-

Renewable Energy

-

Others

In 2022, based on market segmentation by end-users, consumer electronics occupies the highest share of about 25% in the market. Organic photonic materials are increasingly used in smartphones, tablets, wearable devices, TVs, and other devices due to their low energy consumption, enhanced visual display, affordable cost, and energy efficiency.

The healthcare segment occupies the second position in the market. Organic photonic materials are widely used in medical devices due to their excellent optical properties, biocompatibility, flexible integration, and easy application. Moreover, organic materials such as organic lasers and LEDs are used in biosensors, drug delivery systems, diagnosing and imaging systems, and others. For example, organic optical devices are widely used in the healthcare industry as they can be directly attached to the skin and monitor the bio-signals from the body to the device.

The renewable energy segment is the fastest-growing segment during the forecast period. Organic photonic materials are widely used to generate electrical energy from the sunlight in solar panels and PV cells. Their increased demand is attributed to lightweight structure, reduced environmental impact as opposed to silicon solar panels, biodegradability, and semitransparency.

Organic Photonics Materials Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, based on market segmentation by region, North America occupies the highest share of about 26.8% in the market. Continuous technological innovations and rapid adoption and developments in the energy sector have contributed to the growth of organic photonic materials in the region. Technological advancements such as the development of nanophotonic materials for solar cells, medical imaging & and devices, and microelectronics have boosted the market growth for organic photonic materials. Further, the increased use of solar panels, windows, and PV cells in building materials has developed the demand for organic photovoltaic materials in the region. As per Roundup Org’s Statistics, 3.2 million homes in the USA have installed solar panels

Asia-Pacific is the fastest-growing region during the forecast period. The rapidly booming consumer electronics industry in countries such as China, India, and Japan and increased government support for adopting greener technologies have boosted the demand for organic photonic materials in the region. For instance, in November 2022, the Chinese government announced its plans for a green technology innovation system by leveraging innovations in big data, AI, and biotech. They aimed to tackle problems related to air, soil, groundwater pollution, and waste reduction. Moreover, it also committed to carbon capture, utilization, and storage (CCUS) technology that can prevent greenhouse gases from entering the atmosphere.

COVID-19 Impact Analysis on the Global Organic Photonics Materials Market:

The pandemic had a significant impact on the organic photonic materials market. On one hand, supply chain disruptions caused production and distribution delays of the components required to produce photonic products, which declined the demand for organic photonic materials in the market. However, increasing demand for diagnosis and imaging purposes from the healthcare sector raised the market demand for organic photonic lasers, bio-medical imaging systems, and others.

Key Players:

-

SPIE

-

SAFTRA Photonics

-

Rainbow Photonics

-

NLM Photonics

-

Hamamatsu Photonics

-

BOE Technology

-

Emagin Corporation

-

AU Optronics

-

LG Display

-

Panasonic

-

NanoFlex Power

-

Moresco

-

Novaled

Chapter 1. Organic Photonics Materials Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organic Photonics Materials Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organic Photonics Materials Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organic Photonics Materials Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organic Photonics Materials Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organic Photonics Materials Market– By Material Type

6.1 Introduction/Key Findings

6.2 OLEDs (Organic Light-Emitting Materials)

6.3 OPVs (Organic Photovoltaic Materials)

6.4 Organic Laser Materials

6.5 Organic Semiconductor Materials

6.6 Y-O-Y Growth trend Analysis By Material Type

6.7 Absolute $ Opportunity Analysis by By Material Type, 2023-2030

Chapter 7. Organic Photonics Materials Market– By End-User

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Healthcare

7.4 Consumer Electronics

7.5 Aerospace

7.6 Construction & Building

7.7 Renewable Energy

7.8 Others

7.9 Y-O-Y Growth trend Analysis By End-User

7.10 Absolute $ Opportunity Analysis By End-User, 2023-2030

Chapter 8. Organic Photonics Materials Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By INDUSTRY VERTICAL

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Material Type

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Material Type

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Material Type

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Material Type

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Organic Photonics Materials Market– Company Profiles – (Overview, Organic Photonics Materials Market Portfolio, Financials, Strategies & Developments)

9.1 SPIE

9.2 SAFTRA Photonics

9.3 Rainbow Photonics

9.4 NLM Photonics

9.5 Hamamatsu Photonics

9.6 BOE Technology

9.7 Emagin Corporation

9.8 AU Optronics

9.9 LG Display

9.10 Panasonic

9.11 NanoFlex Power

9.12 Moresco

9.13 Novaled

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2022, the Global Organic Photonics Materials Market was valued at $8.5 billion, and is projected to reach a market size of $16.94 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 9%.

Rising demand for energy efficiency and Government support for energy-efficient technologies and renewable energy are the market drivers of the Global Organic Photonics Materials Market.

OLEDs (Organic Light-Emitting Materials), OPVs (Organic Photovoltaic Materials), Organic Laser Materials, and Organic Semiconductor Materials are the segments under the Global Organic Photonics Materials Market by material type.

North America is the most dominant region for the Global Organic Photonics Materials Market.

Asia-Pacific is the fastest-growing region in the Global Organic Photonics Materials Market.