Organic Ice-cream Market Size (2024 – 2030)

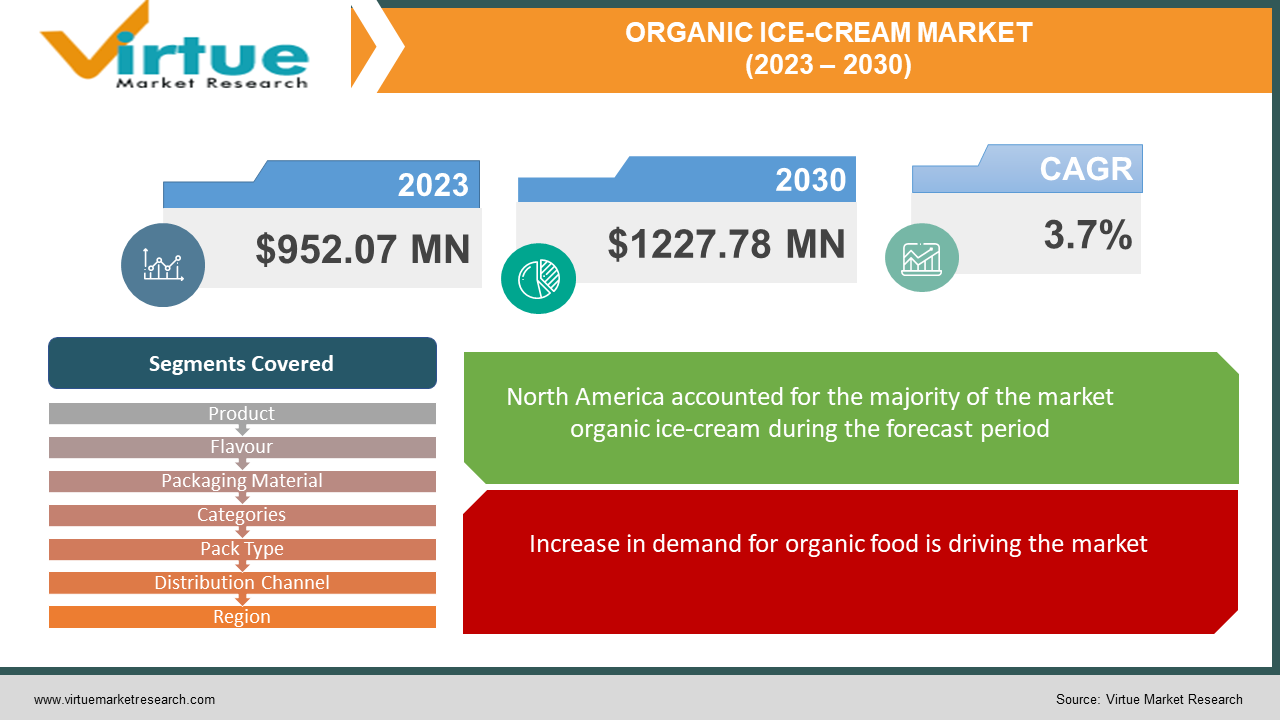

The Organic Ice-cream Market was valued at USD 952.07 Million in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 1227.78 Million by 2030, growing at a CAGR of 3.7%.

The production of organic ice cream involves the utilization of organic elements, including organic milk, cream, sweeteners, and flavoring agents, while abstaining from the incorporation of artificial taste enhancers or preservatives. The market for organic ice cream is propelled by an increasing awareness of health considerations and shifts in consumer taste preferences towards nutrient-rich products that offer health advantages upon consumption.

Key Market Insights:

Crafted from non-GMO, naturally cultivated milk, cream, and other components untouched by pesticides or fertilizers, organic ice cream reflects a commitment to wholesome ingredients. Over the recent years, consumers have embraced a comprehensive perspective, carefully evaluating product attributes and claims. The commercialization of organic ice cream is still in its nascent stages. Anticipated drivers of future demand include escalating concerns regarding animal welfare within the dairy sector and a heightened consumer interest in the origins of food products.

Organic Ice-cream Market Drivers:

Increase in demand for organic food is driving the market.

The surge in health-conscious consumers dedicating more resources to products with heightened nutritional value, as opposed to conventional alternatives primarily focused on taste, has resulted in an increased demand for organic ice creams. These ice creams, enriched with nutritious elements, cater to the preferences of individuals seeking both health benefits and indulgence.

Organic ice cream is available in various types, including take-home, artisanal, and impulse categories. The take-home segment is poised to secure the predominant market share, driven by its alignment with consumer convenience. The impulse category of organic ice cream is experiencing a rising demand, attributed to its versatile applications such as ice cream sandwiches, ice cream tubes, and chocolate-coated variations. Artisanal ice cream, crafted by skilled artisans, has garnered substantial interest from consumers who prioritize the expertise of craftsmen over mass-produced alternatives. The market has witnessed flourishing dynamics through the introduction of these diverse product offerings.

The increasing demand for homemade desserts and products are presenting lucrative growth opportunities in the market.

The burgeoning desire for homemade products, facilitated by extensive marketing channels and straightforward preparation methods, is poised to present substantial growth opportunities in the market. A case in point is the Straus Family Creamery, which is capitalizing on this trend by providing a diverse array of organic super premium ice cream options, including but not limited to Organic Chocolate Fudge Brownie and Organic Snickerdoodle ice cream. This strategic offering aligns with the prevailing consumer preference for organic, high-quality ice cream products.

Organic Ice-cream Market Restraints and Challenges:

High cost of the raw material in organic ice cream hinders the market.

The transportation and storage of organic ice-cream products entail logistical challenges, particularly in maintaining the necessary temperature for product integrity, coupled with elevated storage costs. Specialized automotive machineries equipped with advanced refrigeration capabilities are imperative for transporting these products, contributing to substantial transportation expenses. These factors are anticipated to impede market growth throughout the forecast period.

A notable drawback associated with organic ice-cream is its lower calcium content compared to regular ice-cream. This deficiency has led to a decline in demand among health-conscious consumers, thereby posing a potential hindrance to market growth.

Organic Ice-cream Market Opportunities:

Consuming Organic ice creams as a healthy snack creating opportunity.

The market has witnessed a significant shift towards healthier ice cream options, creating opportunities for marketers to customize offerings based on consumer preferences. This transition has led to the prominence of organic ice creams, bringing diversity to the market with an increased emphasis on health considerations. The distinguishing feature of organic ice creams lies in their inclusion of fat-soluble vitamins, augmenting their appeal as a healthier alternative for consumption.

These ice creams are characterized by elevated nutritional value and rich, natural flavors, sparking substantial consumer interest and fostering robust demand. With evolving lifestyles, there is a noticeable rise in consumer reliance on outdoor recreational activities. This evolving trend has resulted in a heightened demand for snacks that align with customer needs and the requirements of such activities. Products providing nutrition and free from artificial ingredients are highly sought after by health-conscious consumers, contributing to the heightened demand for organic ice cream.

Increasing usage of functional ingredients in ice-cream by market players

Market players are increasingly incorporating functional ingredients, including organic elements, into ice-cream formulations to meet evolving consumer demands. In April 2021, an article published in Food Ingredients First highlighted manufacturers' efforts to enhance the health benefits of frozen desserts by utilizing functional ingredients. Organic ingredients have been extensively adopted as a substitute for synthetic counterparts in the expansion of ice cream product lines. Consequently, the growing utilization of functional ingredients in ice-cream by market players is anticipated to create lucrative opportunities for market growth.

ORGANIC ICE-CREAM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.7% |

|

Segments Covered |

By Product, Flavour, Packaging Material, Categories, Pack Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Oregon Ice Cream, Clover Stornetta Farms Inc, Natural Ice Cream, Straus Family Creamery, Three Twins Ice Cream, Boulder Organic Ice Cream, LUV Ice Cream, Havmor, Blue Marble Ice Cream, Mackie's of Scotland |

Organic Ice-cream Market Segmentation: By Product

-

Artisanal

-

Impulse

-

Take Home

The artisanal segment is experiencing rapid growth in the market. The heightened demand for artisan ice cream is attributed to its requirement for superior quality, crafted with fresh ingredients and without the inclusion of flavorings, colorings, or preservatives. This emphasis on quality is driving the increasing demand for artisanal ice cream on a daily basis.

The Take-Home Ice Cream category encompasses all dairy and water-based ice cream products designed for consumption at home or in bulk. This includes multiple-serving ice cream tubs, ice-cream cakes, low-fat dairy- and oil-based products (excluding frozen yogurt), and sorbets.

Impulse ice-creams refer to water-based or all-dairy products crafted for immediate consumption, such as chocolate-coated ice-creams, ice cream tubes, ice-cream sandwiches, and other instantly gratifying options.

Organic Ice-cream Market Segmentation: By Flavour

-

Vanilla

-

Chocolate

-

Butter Pecan

-

Strawberry

-

Coffee

-

Black Raspberry

-

Mint Chocolate Chip

-

Other

The vanilla segment continues to dominate the market, particularly in North America, Asia, and Europe. Vanilla is a widely used flavor for ice cream, and its popularity extends beyond ice cream, finding applications in various drinks such as cold coffee and shakes. The classic vanilla ice cream, created by chilling a mixture of cream, sugar, and vanilla over a container of ice and salt, remains a favored choice.

Chocolate emerges as the fastest-growing segment in the market, boasting the status of one of the oldest and most globally popular ice cream flavors. Beyond being enjoyed on its own, chocolate serves as a versatile base for numerous other flavors.

The Mint Chocolate Chip segment is also on the rise in the market. This flavor combination offers a unique experience, with chocolate providing a rich, rounded, and sometimes earthy flavor, complemented by the sharp and refreshing taste of mint. The contrasting textures and tastes of chocolate and mint contribute to the appeal of this flavor, exemplifying the idea that opposites attract.

Organic Ice-cream Market Segmentation: By Packaging Material

-

Paper and Board

-

Rigid Plastics

-

Flexible Packaging

Paper & Board packaging holds the largest market share in the ice cream industry, as a significant portion of ice cream products is distributed in this form. While family pack ice cream commonly utilizes Rigid Plastics, there is a growing concern about its environmental impact due to its non-eco-friendly nature. As a result, there is a notable preference among consumers for paper and board packaging materials for ice cream, reflecting a heightened awareness and inclination towards more sustainable packaging options in the market.

Organic Ice-cream Market Segmentation: By Categories

-

Reduced Fat

-

Low Fat

-

Light

-

Fat Free

Low-fat options currently dominate this market segment in 2023, driven by a growing population concerned about their health. The organic ice cream market is witnessing an upswing as more people prioritize healthier choices. Traditional ice cream products are often high in calories and added sugar while lacking essential nutrients. Despite the common marketing of low-fat and no-sugar-added alternatives as healthier options, it is essential to note that they can still be calorie-dense and may incorporate various sweeteners, highlighting the importance of informed choices for health-conscious consumers.

Organic Ice-cream Market Segmentation: By Pack Type

-

Tub

-

Bag/Sachet

-

Wrapper

The tub segment currently holds the dominant position in the market, while cones emerge as the fastest-growing segment. Tubs provide a neat and tidy container, eliminating the risk of sticky drips and serving as a convenient vessel for enjoying the main attraction: ice cream. On the contrary, cones contribute to zero waste and introduce an additional dimension to the eating experience. Handling a cone requires technique and focus to prevent any mishaps and ensure a delightful ice cream consumption experience.

Organic Ice-cream Market Segmentation: By Distribution Channel

-

Hypermarket and Supermarket

-

Food and Drink Specialist

-

Convenience Stores

-

Online

-

Others

The hypermarket and supermarket segment collectively contribute to almost half of the global organic ice cream market share. This is primarily due to factors such as substantial discounts and convenient accessibility provided by supermarkets, which attract customers and propel the growth of this segment. Hypermarkets and supermarkets are further boosting their market presence by introducing private labels featuring organic ingredients at lower costs, aiming to attract customers and drive sales of their own products.

In addition to the dominance of hypermarkets and supermarkets, the specialist food and drink grocery market is experiencing modest yet steady growth. To expand the reach of organic ice cream products, they are also made available in convenience stores, contributing to the overall growth of the organic ice cream market.

Organic Ice-cream Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America currently holds a dominant position in the organic ice cream market, both in terms of revenue and market share. This can be attributed to a significant consumer shift towards organic food products and the presence of well-established distribution networks in Canada and the United States. Additionally, the increasing demand for packaged and canned goods in the United States is contributing to the overall growth of the market in the region.

On the other hand, Asia-Pacific is anticipated to be the fastest-growing region from 2024 to 2030, fueled by a robust demand for organic ice cream, particularly among young consumers. Major manufacturers in the region are responding to this trend by introducing a variety of products to cater to the growing preference for premium offerings. This dynamic is expected to propel the organic ice cream market's growth in the Asia-Pacific region during the forecast period.

COVID-19 Pandemic: Impact Analysis

The food and beverage industry, particularly the ice cream segment that typically thrives during the summer season, has experienced a decline in growth due to the impact of the COVID-19 pandemic. This downturn is linked to consumer preferences shifting towards homemade food and a reduction in dining out activities. The closure of production industries and disruptions in supply chains have impeded the supply of organic ice creams. As a result, a significant imbalance between demand and supply has emerged, ultimately affecting the revenue of the industry. The repercussions of the pandemic continue to pose challenges for the organic ice cream market.

Latest Trends/ Developments:

In January 2022, Cold Stone Creamery initiated the nationwide distribution of its inaugural vegan ice cream, crafted using almond milk and an assortment of other ingredients.

Key Players:

These are top 10 players in the Organic Ice-cream Market:-

-

Oregon Ice Cream

-

Clover Stornetta Farms Inc

-

Natural Ice Cream

-

Straus Family Creamery

-

Three Twins Ice Cream

-

Boulder Organic Ice Cream

-

LUV Ice Cream

-

Havmor

-

Blue Marble Ice Cream

-

Mackie's of Scotland

Chapter 1. Organic Ice-cream Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organic Ice-cream Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organic Ice-cream Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organic Ice-cream Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organic Ice-cream Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organic Ice-cream Market – By Product Type

6.1 Introduction/Key Findings

6.2 Artisanal

6.3 Impulse

6.4 Take Home

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2023-2030

Chapter 7. Organic Ice-cream Market – By Flavour

7.1 Introduction/Key Findings

7.2 Vanilla

7.3 Chocolate

7.4 Butter Pecan

7.5 Strawberry

7.6 Coffee

7.7 Black Raspberry

7.8 Mint Chocolate Chip

7.9 Other

7.10 Y-O-Y Growth trend Analysis By Flavour

7.11 Absolute $ Opportunity Analysis By Flavour, 2023-2030

Chapter 8. Organic Ice-cream Market – By Packaging Material

8.1 Introduction/Key Findings

8.2 Paper and Board

8.3 Rigid Plastics

8.4 Flexible Packaging

8.5 Y-O-Y Growth trend Analysis Packaging Material

8.6 Absolute $ Opportunity Analysis Packaging Material, 2023-2030

Chapter 9. Organic Ice-cream Market – By Categories

9.1 Introduction/Key Findings

9.2 Reduced Fat

9.3 Low Fat

9.4 Light

9.5 Fat Free

9.6 Y-O-Y Growth trend Analysis Categories

9.7 Absolute $ Opportunity Analysis Categories, 2023-2030

Chapter 10. Organic Ice-cream Market – By Pack Type

10.1 Introduction/Key Findings

10.2 Tub

10.3 Bag/Sachet

10.4 Wrapper

10.5 Y-O-Y Growth trend Analysis Pack Type

10.6 Absolute $ Opportunity Analysis Pack Type, 2023-2030

Chapter 11. Organic Ice-cream Market – By Distribution Channel

11.1 Introduction/Key Findings

11.2 Hypermarket and Supermarket

11.3 Food and Drink Specialist

11.4 Convenience Stores

11.5 Online

11.6 Others

11.7 Y-O-Y Growth trend Analysis Distribution Channel

11.8 Absolute $ Opportunity Analysis Distribution Channel, 2023-2030

Chapter 12. Organic Ice-cream Market, By Geography – Market Size, Forecast, Trends & Insights

12.1 North America

12.1.1 By Country

12.1.1.1 U.S.A.

12.1.1.2 Canada

12.1.1.3 Mexico

12.1.2 By Product Type

12.1.2.1 By Flavour

12.1.3 By Packaging Material

12.1.4 By Pack Type

12.1.5 By Distribution Channel

12.1.6 Countries & Segments - Market Attractiveness Analysis

12.2 Europe

12.2.1 By Country

12.2.1.1 U.K

12.2.1.2 Germany

12.2.1.3 France

12.2.1.4 Italy

12.2.1.5 Spain

12.2.1.6 Rest of Europe

12.2.2 By Product Type

12.2.3 By Flavour

12.2.4 By Packaging Material

12.2.5 By Categories

12.2.6 By Pack Type

12.2.7 By Distribution Channel

12.2.8 Countries & Segments - Market Attractiveness Analysis

12.3 Asia Pacific

12.3.1 By Country

12.3.1.1 China

12.3.1.2 Japan

12.3.1.3 South Korea

12.3.1.4 India

12.3.1.5 Australia & New Zealand

12.3.1.6 Rest of Asia-Pacific

12.3.2 By Product Type

12.3.3 By Flavour

12.3.4 By Packaging Material

12.3.5 By Categories

12.3.6 By Pack Type

12.3.7 By Distribution Channel

12.3.8 Countries & Segments - Market Attractiveness Analysis

12.4 South America

12.4.1 By Country

12.4.1.1 Brazil

12.4.1.2 Argentina

12.4.1.3 Colombia

12.4.1.4 Chile

12.4.1.5 Rest of South America

12.4.2 By Product Type

12.4.3 By Flavour

12.4.4 By Packaging Material

12.4.5 By Categories

12.4.6 By Pack Type

12.4.7 By Distribution Channel

12.4.8 Countries & Segments - Market Attractiveness Analysis

12.5 Middle East & Africa

12.5.1 By Country

12.5.1.1 United Arab Emirates (UAE)

12.5.1.2 Saudi Arabia

12.5.1.3 Qatar

12.5.1.4 Israel

12.5.1.5 South Africa

12.5.1.6 Nigeria

12.5.1.7 Kenya

12.5.1.8 Egypt

12.5.1.9 Rest of MEA

12.5.2 By Product Type

12.5.3 By Flavour

12.5.4 By Packaging Material

12.5.5 By Categories

12.5.6 By Pack Type

12.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 13. Organic Ice-cream Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

13.1 Oregon Ice Cream

13.2 Clover Stornetta Farms Inc

13.3 Natural Ice Cream

13.4 Straus Family Creamery

13.5 Three Twins Ice Cream

13.6 Boulder Organic Ice Cream

13.7 LUV Ice Cream

13.8 Havmor

13.9 Blue Marble Ice Cream

13.10 Mackie's of Scotland

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The surge in health-conscious consumers dedicating more resources to products with heightened nutritional value, as opposed to conventional alternatives primarily focused on taste.

Top Players operating in the Organic Ice-cream Market are - Oregon Ice Cream,Clover Stornetta Farms Inc, Natural Ice Cream, Straus Family Creamery , Three Twins Ice Cream.

The food and beverage industry, particularly the ice cream segment that typically thrives during the summer season, has experienced a decline in growth due to the impact of the COVID-19 pandemic

Cold Stone Creamery initiated the nationwide distribution of its inaugural vegan ice cream, crafted using almond milk and an assortment of other ingredients.

Asia-Pacific is anticipated to be the fastest-growing region from 2024 to 2030, fueled by a robust demand for organic ice cream, particularly among young consumers.