Organic Flavor Drop Market Size (2024 – 2030)

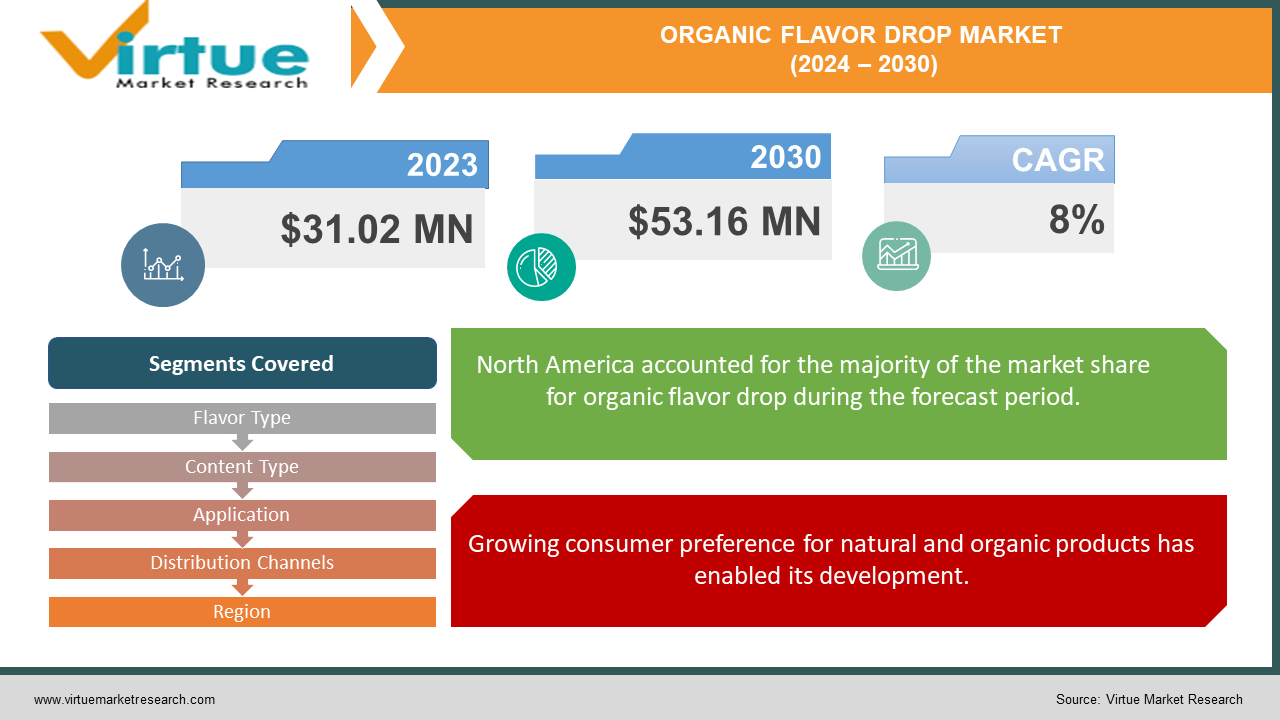

The global organic flavor drop market was valued at USD 31.02 million and is projected to reach a market size of USD 53.16 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8%.

Concentrated liquid extracts from natural sources, such as fruits, herbs, and spices, are what make up organic flavor drops. These flavoring drops offer a quick and flexible solution to improve flavor without the use of artificial additives or sweeteners in a variety of food and beverage items. The market has seen a notable range of organic flavor drops over the past decade. This is because of increasing consumer consciousness. Presently, the market has witnessed a steady expansion owing to demand and product innovation. In the future, with a focus on global expansion and retail availability, an immense boost is anticipated.

Key Market Insights:

The market is growing primarily due to rising customer demand for food and beverage goods with clean labels and sustainable production, as well as more innovation in taste profiles.

Market expansion is hampered by the high cost of organic ingredients, problems with taste stability, and competition from artificial flavor substitutes.

Growing clean labeling trends, more people baking and cooking at home, and the development of distribution networks in developing nations all boost the industry.

While the pandemic caused supply chain hiccups and economic downturns, it also spurred internet sales and the popularity of home cooking by raising consumer demand for organic and health-conscious goods.

Because of its well-established food and beverage industry and innovative culture, North America is the largest market, while Asia-Pacific is the area with the quickest growth due to rising consumer awareness and urbanization.

Organic Flavor Drop Market Drivers:

Growing consumer preference for natural and organic products has enabled its development.

Over the years, there has been a lot of awareness about health and wellness products. Consumers have become more aware of what they consume. Organic products have gained tremendous demand as they are grown without the aid of chemicals, fertilizers, and other hormones. This enhances the nutritional profile of the yield, making the public less susceptible to chronic conditions like diabetes, high blood pressure, cholesterol, and cancer. Consumers are actively seeking products from the food & beverage industry that are labeled as organic. Besides, organic products benefit the environment, as sustainable methods are used in agriculture to avoid water, soil, and air pollution. All these advantages make flavor drops an ideal option for attracting a broader consumer base.

Increasing innovations in the food & beverage industry have contributed to its success.

In the food and beverage industry, chefs are constantly looking for new cuisines. Economic growth has led to an increase in disposable income. A lot of young people are interested in experimenting with food flavors and beverages. Besides, with an increase in funds, a greater number of restaurants, hotels, cafes, and other dineries have formed. These places offer fusions of different cultures. Because flavor drops are generally powerful and only need a tiny amount to give a detectable taste, they are frequently employed in baking, cooking, and mixology. Without requiring extra ingredients or time-consuming preparation, flavor drops provide a straightforward way to add flavor. These drops offer manufacturers a convenient way to add authentic flavors that align with consumer demand for healthy products. There have been a lot of R&D activities to improve the flavor profile of these drops.

Organic Flavor Drop Market Restraints and Challenges:

Associated costs, flavor stability, and intense competition are the main issues that the market is currently facing.

Organic ingredients tend to be expensive when compared to conventional ones. This is because higher production costs lead to higher selling costs. A lot of customers might choose the traditional ones owing to their affordability. This can cause significant losses for the market. Secondly, they are more prone to degradation and have a shorter shelf life. This is because no synthetic chemicals or preservatives are used to maintain the freshness and duration. This is a major barrier, especially in liquid formulations. Thirdly, they face heavy competition from synthetic substitutes. Consumers often choose the conventional category, even though it is loaded with chemicals. This is because of their consistency, cost-effectiveness, and taste. Businesses must implement suitable solutions to tackle these concerns.

Organic Flavor Drop Market Opportunities:

Clean labeling of food products and beverages provides the market with an ample number of possibilities. There is an upsurge in demand for organic yield. Transparency and authenticity need to be maintained by the manufacturers. Demand for organic flavor drops is being driven by consumers' growing preference for products with fewer, more recognizable components and their greater attention to product labels. Secondly, the growing interest in baking activities is beneficial to the market. Among the most popular sweets are cakes, pastries, croissants, muffins, pavlova, brownies, and so on. Flavor drops are usually used in these baking products to provide a unique taste. Businesses can work on creating new sweets and eateries. Experimentation with different flavor drops is also recommended to bring out a different taste. Thirdly, the beverage industry is also advantageous. Cocktails, mocktails, sodas, and refreshing juices are the popular categories that are consumed. These drops can be added to these drinks. Apart from this, distribution channels can be expanded in emerging economies of Latin America, The Middle East, and Asia-Pacific. By having physical stores and online centers, a greater percentage of people have better accessibility, increasing revenue generation.

ORGANIC FLAVOR DROP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Flavor Type, Content Type, Application, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Frontier Co-op, Simply Organic, Nature's Flavors, LorAnn Oils, Watkins Incorporated, Flavorganics, Nielsen-Massey Vanillas, OliveNation, Cook's, Inc., Amoretti |

Organic Flavor Drop Market Segmentation: By Flavor Type

-

Fruit Flavors

-

Sweet Flavors

-

Savory Flavors

-

Herb and Spice Flavors

-

Beverage-Inspired Flavors

-

Others

Fruit flavors are the largest and fastest-growing type. Fruit tastes are frequently connected to elements that are natural and fresh. Fruit-flavored drops appeal to consumers, especially those looking for healthier alternatives, as they seem more natural. Additionally, customers are looking for goods with identifiable and natural components as a result of the growing emphasis on health and well-being. Fruit-flavored drops that are made from actual fruit extracts fit in nicely with the current trend toward products with clear labeling and healthier options.

Organic Flavor Drop Market Segmentation: By Content Type

-

Regular

-

Sugar-free

The regular segment is the largest growing content type. Regular flavors are quite popular and well-liked by customers of all ages. They frequently resemble well-known flavors like vanilla, chocolate, strawberry, and mint. Regular tastes' popularity in the market is partly attributed to their familiarity and comfort. Most notably, normal tastes are adaptable and may be used in a variety of food and drink applications, such as dairy products, confections, drinks, and baked goods. Because of their versatility, producers looking for a product that would appeal to a wide range of consumers often choose them. Sugar-free options are the fastest-growing.

Diabetes is a common disease that is being diagnosed in a vast majority of cases. As such, people are on the lookout for reduced- or sugar-free options. Organizations are utilizing this opportunity to create flavor drops with little or no sugar. As a result, flavor drops can have fewer calories. This drives the health-conscious and diabetic population to try out the products that have this ingredient.

Organic Flavor Drop Market Segmentation: By Application

-

Beverages

-

Health and Nutritional Products

-

Food Products

-

Pharmaceuticals

-

Others

The beverages category is the largest and fastest-growing application. Customers may tailor their beverages to their tastes with the help of flavor drops. The popularity of customizing drinks has grown, particularly in the area of flavored water, tea, coffee, and other non-alcoholic beverages. The growing need for low-calorie and sugar-free beverage alternatives is partly a result of consumers' increased focus on their health and wellness. Flavor drops are in line with health-conscious trends by enabling people to improve the flavor of their drinks without adding unnecessary sugar or calories.

Organic Flavor Drop Market Segmentation: By Distribution Channels

-

Offline

-

Online

Offline channels exhibit the largest growth. This segment includes supermarkets, convenience stores, and hypermarkets. Customers may converse with the shops, pose inquiries, and evaluate the visual appeal of their products. They could even change the price by haggling over the products. Furthermore, those who are not familiar with the Internet can make good purchases in person. Easy accessibility is still another key element driving this category. Since these establishments are often found in every community, demand has increased. The online category is the fastest-growing. The increasing tendency toward digitization has led to an expansion of the sector. Customers choose this option because it is convenient. Online buyers may place orders and have products delivered straight to their residences. Additionally, a wider range of both local and international products will be more easily accessible to them. Moreover, internet retailers may assist their customers by offering discounts and free delivery on frequent orders.

Organic Flavor Drop Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest growing market. The United States and Canada are at the forefront. The food and beverage sector in North America is well-established, and its innovative culture fosters ongoing product development and the creation of new taste profiles to meet changing customer demands. There are a lot of prominent companies like Simply Organic, Nature's Flavors, LorAnn Oils, and Watkins Incorporated. These players are well-established and have higher revenue generation. Apart from this, the economy of the region favors easier investments for launches and collaborations. Asia-Pacific is the fastest-growing market. Countries like China, India, and Japan are the notable ones. This is because of the growing consumer awareness about organic yield. Besides, urbanization has led to a change in the standard of living, giving access to a variety of options. The food & beverage industry is expanding due to greater investments. People are keen on trying different cuisines. Chefs are constantly working on different flavor profiles to be commercialized on the market.

COVID-19 Impact Analysis on the Global Organic Flavor Drop Market:

The outbreak of the virus had a mixed impact on the market. The new normal included social isolation, movement restrictions, and lockdowns. Transportation, logistics, and supply chain management were impacted by this. The main emphasis was on working remotely. Manufacturing and production operations were halted due to rules and regulations. Safety constraints presented obstacles to operations. An economic downturn was seen. Many people lost their jobs. Restaurants, lodging facilities, and other eating places had to close. The food and beverage industry experienced losses as a result. The majority of the funds were supposed to go toward healthcare-related projects. This caused delays in collaborations and launches. Many only purchased necessities. However, on the other hand, people began to prioritize their health. Many of them realized the importance of organic food. This kind of yield had a huge demand. Sustainability became important. The emphasis was on home cooking. Many people became passionate cooks and bakers out of boredom. The sales were augmented by internet purchases. Retailers placed a high priority on keeping their websites active. Post-pandemic, regulations and limits have been eased, which has allowed the market to grow.

Latest Trends/ Developments:

The growing trend of plant-based diets has created a need for organic flavor drops that satisfy the needs of vegan and vegetarian customers. Vegan diets include only plant-based products. To address this need, producers are creating plant-based taste alternatives made from fruits, vegetables, and botanicals.

Key Players:

-

Frontier Co-op

-

Simply Organic

-

Nature's Flavors

-

LorAnn Oils

-

Watkins Incorporated

-

Flavorganics

-

Nielsen-Massey Vanillas

-

OliveNation

-

Cook's, Inc.

-

Amoretti

Chapter 1. Organic Flavor Drop Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organic Flavor Drop Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organic Flavor Drop Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organic Flavor Drop Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organic Flavor Drop Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organic Flavor Drop Market – By Flavour

6.1 Introduction/Key Findings

6.2 Fruit Flavors

6.3 Sweet Flavors

6.4 Savory Flavors

6.5 Herb and Spice Flavors

6.6 Beverage-Inspired Flavors

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Flavour

6.9 Absolute $ Opportunity Analysis By Flavour, 2024-2030

Chapter 7. Organic Flavor Drop Market – By Content Type

7.1 Introduction/Key Findings

7.2 Regular

7.3 Sugar-free

7.4 Y-O-Y Growth trend Analysis By Content Type

7.5 Absolute $ Opportunity Analysis By Content Type, 2024-2030

Chapter 8. Organic Flavor Drop Market – By Application

8.1 Introduction/Key Findings

8.2 Beverages

8.3 Health and Nutritional Products

8.4 Food Products

8.5 Pharmaceuticals

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Organic Flavor Drop Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Offline

9.3 Online

9.4 Y-O-Y Growth trend Analysis By Distribution Channel

9.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. Organic Flavor Drop Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Flavour

10.1.3 By Distribution Channel

10.1.4 By Application

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Flavour

10.2.3 By Flavour

10.2.4 By Application

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Flavour

10.3.3 By Flavour

10.3.4 By Application

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Flavour

10.4.3 By Flavour

10.4.4 By Application

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Flavour

10.5.3 By Flavour

10.5.4 By Application

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Organic Flavor Drop Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Frontier Co-op

11.2 Simply Organic

11.3 Nature's Flavors

11.4 LorAnn Oils

11.5 Watkins Incorporated

11.6 Flavorganics

11.7 Nielsen-Massey Vanillas

11.8 OliveNation

11.9 Cook's, Inc.

11.10 Amoretti

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global organic flavor drops market was valued at USD 31.02 million and is projected to reach a market size of USD 53.16 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8%.

Growing consumer preference for natural and organic products and increasing innovations in the food & beverage industry are the main factors propelling the global organic flavor drop market.

Based on content type, the global organic flavor drops market is segmented into regular and sugar-free.

North America is the most dominant region in the global organic flavor drop market.

Frontier Co-op, Simply Organic, and Nature's Flavors are the key players operating in the global organic flavor drop market.