Organic Feed for Aquaculture Market Size (2024 – 2030)

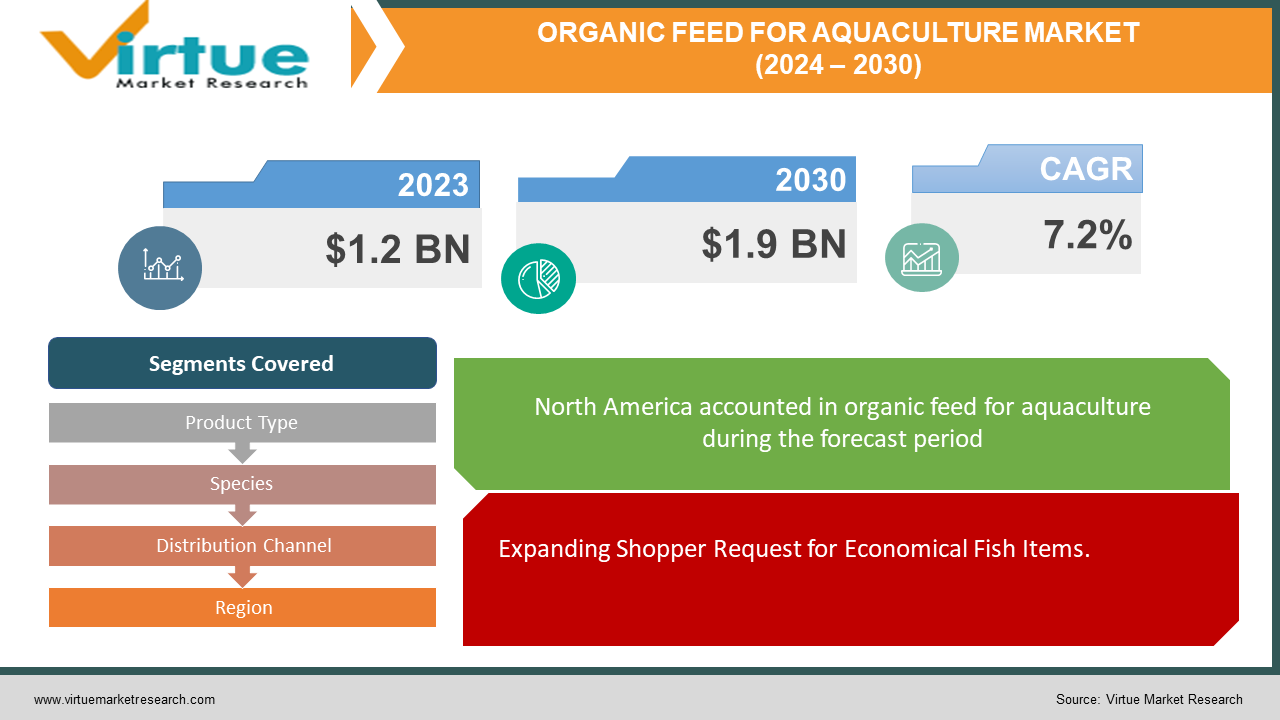

The market for Organic Feed for Aquaculture market at the global level is expanding quickly; it was estimated to be worth 1.2 USD billion in 2023 and is expected to increase to 1.9 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 7.2% from 2024 to 2030.

The showcase for a natural bolster in aquaculture speaks to an energetic segment inside the broader aquafeed industry, driven by expanding customer requests for economically sourced and ecologically inviting fish items. Natural bolster for aquaculture is defined with characteristic fixings, free from engineered added substances, pesticides, and hereditarily adjusted life forms, adjusting with standards of natural cultivating and capable aquaculture hones. With developing mindfulness of the natural effect of customary aquafeed generation strategies and the craving for more advantageous, more morally created fish, the request for natural nourishing choices proceeds to rise all-inclusive. The showcase includes a differing extend of items custom-made to different oceanic species, counting finfish, shellfish, and mollusks, and is backed by an arrangement of dissemination channels counting coordinate deals to aquaculture ranches, retail stores, and online stages.

Key Market Insights:

The global market for organic feed in aquaculture is projected to grow at a CAGR of 8.5% from 2021 to 2026, reaching a value of $1.5 billion by the end of the forecast period.North America and Europe are the leading regions in the organic aquafeed market, accounting for 45% and 30% of global revenue respectively, owing to strong consumer demand for sustainable seafood products.The finfish segment dominates the organic aquafeed market with a revenue share of 60%, driven by increased consumption of organic salmon and trout.Online retail channels are experiencing rapid growth in the organic aquafeed market, with sales expected to triple by 2024, reaching $300 million, as consumers increasingly prefer the convenience of purchasing feed online.Despite the growing demand for organic aquafeed, high production costs remain a challenge for manufacturers, leading to higher retail prices. To address this issue, manufacturers can explore partnerships with local organic farmers to secure a stable supply of raw materials at competitive prices.

Global Organic Feed for Aquaculture Market Drivers:

Expanding Shopper Request for Economical Fish Items.

The worldwide natural nourishment for aquaculture advertisements is driven by a surge in buyer mindfulness and requests for economically sourced fish items. Buyers are progressively looking for natural options due to concerns approximately natural maintainability, creature welfare, and individual well-being. This slant is compelling aquaculture makers to receive natural nourishing hones to meet buyer inclinations and separate their items within the commercial center.

Exacting Controls Advancing Natural Aquaculture Hones.

Exacting directions and certifications advancing natural aquaculture hones are serving as critical drivers for the showcase. Administrative bodies around the world are actualizing guidelines that require aquaculture makers to follow natural cultivating hones, including the utilization of natural nourishment. Compliance with these directions not as it were guarantees the judgment and quality of natural fish items but moreover cultivates consumer trust and certainty within the industry.

Developing Mindfulness of Natural Affect and Maintainability.

Expanding mindfulness of the natural effect of routine aquafeed generation strategies is driving the appropriation of natural nourishment in aquaculture. Ordinary bolster generation frequently includes the utilization of manufactured added substances, pesticides, and hereditarily adjusted life forms, which can have antagonistic impacts on biological systems and marine biodiversity. Natural bolster, made from common fixings and free from hurtful chemicals, is seen as a more economical and naturally neighborly choice, driving its selection among aquaculture makers around the world.

Global Organic Feed for Aquaculture Market Restraints and Challenges:

Tall Generation Costs and Restricted Accessibility of Natural Fixings.

One of the essential challenges confronting the worldwide natural bolster for aquaculture advertising is the high generation costs related to sourcing natural fixings. Natural fixings frequently come at a premium cost, driving to higher generation costs for natural nourish producers. Moreover, the constrained accessibility of natural fixings, particularly in locales with immature natural farming frameworks, compounds the challenge of securing a steady supply chain for natural bolster generation.

Need for Standardization and Certification.

The need for standardized directions and certifications for natural aquafeed postures is a critical limitation to showcase development. Not at all like other natural nourishment segments, such as natural create or dairy items, there's no generally recognized certification standard for natural aquafeed. This need for standardization makes it troublesome for buyers to distinguish and believe natural aquafeed items, preventing advertise extension and shopper appropriation.

Competition from Customary Aquafeed Items.

Competition from routine aquafeed items presents another challenge to the development of natural nourishment for aquaculture advertising. Whereas natural aquafeed offers various natural and well-being benefits, it regularly comes at the next cost point compared to routine bolster. This estimating difference can prevent cost-conscious aquaculture makers from transitioning to natural bolster, particularly in price-sensitive markets. To address this challenge, endeavors to diminish generation costs and increment productivity in organic feed generation are basic, besides focusing on promoting methodologies to highlight the esteem recommendation of natural nourishment in terms of supportability and item quality.

Global Organic Feed for Aquaculture Market Opportunities:

Rising Buyer Inclination for Natural and Feasible Fish.

The worldwide natural bolster for aquaculture showcase presents critical openings driven by the rising customer inclination for natural and feasible fish items. Expanding mindfulness of natural preservation, creature welfare, and individual well-being is driving buyers to look for natural aquaculture items. This drift opens up openings for aquaculture makers to capitalize on the developing request for natural nourishment and separate their items within the advertisement by advertising reasonably sourced and ecologically neighborly fish alternatives.

Extension of Natural Aquaculture Generation.

The development of natural aquaculture generation presents a promising opportunity for the natural bolster showcase. As more aquaculture makers move towards natural cultivating hones to meet buyer requests and administrative benchmarks, the request for organic feed is anticipated to extend. This extension offers openings for nourish producers to scale up generation, improve item definitions, and set up vital organizations with aquaculture ranches to meet the developing request for natural bolster.

Mechanical Headways in Natural Bolster Definition.

Innovative progressions in natural bolster definition show openings for advertising development and development. Progressions in fixing sourcing, handling methods, and definition strategies permit bolster producers to create high-quality natural bolster items that meet the wholesome prerequisites of distinctive oceanic species. Furthermore, advancements in nourishing added substances, such as probiotics and proteins, can upgrade and bolster proficiency, assimilation, and generally angle well-being, encouraging driving selection of natural nourishing in aquaculture generation.

ORGANIC FEED FOR AQUACULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Product Type, Species, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Archer Daniels Midland (ADM), Aller Aqua, Skretting, BioMar, Nutreco, Ridley Corporation, Biomar Group, Charoen Pokphand Foods (CPF), Purina Animal Nutrition (Land O'Lakes), Biomin, EWOS Group |

Organic Feed for Aquaculture Market Segmentation: By Product Type

-

Pellets

-

Powder

-

Liquid

Within the setting of advertise segmentation by item sort within the organic feed for aquaculture showcase, pellets rise as the foremost successful choice due to a few key points of interest. Pellets offer comfort, consistency, and ease of taking care of, making them the favored choice for numerous aquaculture makers. Their uniform estimate and shape encourage exact bolstering, minimizing squandering, and guaranteeing ideal supplement admissions for sea-going species. Moreover, pellets are profoundly flexible and can be customized to meet the particular wholesome necessities of distinctive species and life stages, improving their appropriateness over a wide run of aquaculture operations. Moreover, pellets have predominant capacity solidness compared to powder or fluid shapes, lessening the chance of decay and guaranteeing longer rack life. By and large, the viability of pellets in conveying adjusted nourishment, advancing productive nourishing practices, and optimizing generation results positions them as the favored item sort within the natural nourishment for aquaculture advertisements.

Organic Feed for Aquaculture Market Segmentation: By Species

-

Finfish

-

Crustaceans

-

Mollusks

Within the domain of market segmentation by species within the natural nourishment for the aquaculture sector, targeting the finfish fragment demonstrates to be the foremost successful technique due to a few compelling components. Finfish, counting species such as salmon, trout, tilapia, and carp, speak to a critical parcel of the aquaculture industry and display tall showcase requests universally. These species are regularly raised in large-scale aquaculture operations, making them alluring targets for bolstering producers looking for economies of scale and far-reaching showcase entrances. In addition, finfish tend to have well-established wholesome necessities and nourishing propensities, permitting for the improvement of specialized natural bolster definitions custom-made to meet their particular needs. Also, finfish are favored by buyers around the world, driving requests for economically sourced and organic-certified fish items, in this manner assisting in reinforcing the advertising for natural nourishment focusing on this portion. Given these variables, centering on the finfish section presents profitable openings for nourish producers to capitalize on the developing customer request for natural aquaculture items while catering to the requirements of the flourishing finfish aquaculture industry.

Organic Feed for Aquaculture Market Segmentation: By Distribution Channel

-

Direct Sales

-

Retail Stores

-

Online Platforms

Within the advertising division by dispersion channel for natural bolster in aquaculture, direct sales develop as the foremost successful choice, advertising a few focal points for both makers and consumers. Direct deals empower natural nourish producers to set up coordinate connections with aquaculture ranches, cultivating more noteworthy control overestimating, item quality, and client benefit. By bypassing middle people, makers can minimize dispersion costs, optimize stock administration, and react expeditiously to client input and showcase patterns. Also, coordinating deals encourages personalized intelligence with clients, permitting producers to tailor their offerings to meet particular prerequisites and inclinations. For aquaculture ranches, coordinated acquiring from producers offers straightforwardness, unwavering quality, and get to new, high-quality nourishing items. In any case, whereas coordinated deals display various benefits, a multi-channel approach joining retail stores and online stages may complement coordinated deals endeavors, guaranteeing broader advertise reach and availability for shoppers over diverse geographic locales and acquiring inclinations.

Organic Feed for Aquaculture Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The conveyance of the worldwide natural nourishment for aquaculture advertising over distinctive districts reflects an assorted scene formed by changing shopper inclinations, administrative systems, and aquaculture hones. North America rises as the biggest advertising, commanding 34% of the worldwide share, driven by solid shopper requests for natural and economically sourced fish items, coupled with well-established aquaculture businesses in nations just like the United together States and Canada. Europe takes after closely behind, capturing 26% of the showcase, impelled by rigid directions advancing natural cultivating hones and expanding buyer mindfulness of natural sustainability and nourishment quality benchmarks. Within the Asia-Pacific locale, bookkeeping for 25% of the advertising, quick financial development, changing dietary propensities, and extending aquaculture segments in nations such as China, India, and Indonesia contribute to showcase development openings. South America and the Center East and African locales speak to smaller however noteworthy offers of 9% and 6% individually, with rising aquaculture businesses and rising buyer requests for natural aquafeed items. By and large, the territorial dissemination underscores the worldwide centrality of natural aquaculture hones and shopper inclinations for feasible fish items, driving showcase development and advancement over assorted geographic locales.

COVID-19 Impact Analysis on the Global Organic Feed for Aquaculture Market:

COVID-19 has had a noteworthy effect on the worldwide natural bolster for aquaculture advertising, disturbing supply chains, changing customer behavior, and reshaping advertising flow. Amid the starting stages of the widespread, broad lockdowns and limitations on development driven to disturbances in generation, transportation, and exchange, influencing the accessibility and dispersion of natural nourishing items. Besides, disturbances in fish supply chains and instabilities in advertising requests come about in challenges for aquaculture makers, counting changes in nourish requests and estimating weights. Be that as it may, as the world slowly adjusts to the unused ordinary, the natural bolster for aquaculture showcase is balanced for recuperation, driven by expanding customer requests for maintainable and morally sourced fish items. Aquaculture makers are progressively prioritizing natural nourishing alternatives to meet buyer inclinations for more advantageous, ecologically inviting fish choices, subsequently driving showcase development and advancement. Moreover, innovative progressions and digitalization in supply chain administration are making a difference in making strides in flexibility and proficiency, empowering smoother operations, and encouraging advertise recuperation.

Latest Trends/ Developments:

The worldwide natural bolster for aquaculture showcase is seeing a few eminent patterns and improvements that are reshaping industry flow and driving showcase development. One noticeable slant is the expanding appropriation of innovation and development in bolster detailing and generation forms. Headways in fixing sourcing, preparing procedures, and detailed strategies are empowering nourish producers to create high-quality natural bolster items that meet the wholesome necessities of diverse sea-going species more viably. Also, there's a developing accentuation on economical sourcing hones and traceability all through the supply chain, as shoppers request more noteworthy straightforwardness and responsibility in nourishment generation.

Another critical slant is the extension of natural aquaculture generation, driven by administrative activities advancing natural cultivating hones and shopper inclinations for maintainable fish choices. Aquaculture makers are progressively transitioning towards natural cultivating strategies and sourcing natural bolsters to meet advertising requests and differentiate their items within the commercial center. Moreover, there's a rising mindfulness of the natural effect of routine aquafeed generation strategies, impelling requests for natural bolster choices that minimize biological impressions and advance biodiversity preservation. By and large, these patterns reflect a move towards more maintainable and ecologically neighborly hones within the aquaculture industry, displaying openings for showcase players to improve, separate, and capitalize on the developing request for natural bolster items.

Key Players:

-

Cargill

-

Archer Daniels Midland (ADM)

-

Aller Aqua

-

Skretting

-

BioMar

-

Nutreco

-

Ridley Corporation

-

Biomar Group

-

Charoen Pokphand Foods (CPF)

-

Purina Animal Nutrition (Land O'Lakes)

-

Biomin

-

EWOS Group

Chapter 1. Organic Feed for Aquaculture Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organic Feed for Aquaculture Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organic Feed for Aquaculture Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organic Feed for Aquaculture Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organic Feed for Aquaculture Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organic Feed for Aquaculture Market – By Product Type

6.1 Introduction/Key Findings

6.2 Pellets

6.3 Powder

6.4 Liquid

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Organic Feed for Aquaculture Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Retail Stores

7.4 Online Platforms

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Organic Feed for Aquaculture Market – By Species

8.1 Introduction/Key Findings

8.2 Finfish

8.3 Crustaceans

8.4 Mollusks

8.5 Y-O-Y Growth trend Analysis By Species

8.6 Absolute $ Opportunity Analysis By Species, 2024-2030

Chapter 9. Organic Feed for Aquaculture Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Distribution Channel

9.1.4 By Species

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Distribution Channel

9.2.4 By Species

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Distribution Channel

9.3.4 By Species

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Distribution Channel

9.4.4 By Species

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Distribution Channel

9.5.4 By Species

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Organic Feed for Aquaculture Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill

10.2 Archer Daniels Midland (ADM)

10.3 Aller Aqua

10.4 Skretting

10.5 BioMar

10.6 Nutreco

10.7 Ridley Corporation

10.8 Biomar Group

10.9 Charoen Pokphand Foods (CPF)

10.10 Purina Animal Nutrition (Land O'Lakes)

10.11 Biomin

10.12 EWOS Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Organic Feed for Aquaculture Market was valued at USD 63.89 Million in 2023.

Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

The driving factors are the use of chemical-free ingredients, the increase in seafood trade, and research and investment.

The market restraints are lower organic yields and price volatility of raw materials.

Soybean, Fish oil, Fishmeal, and Corn are the segments.