Organic Face Cream & Moisturizer Market Size (2024 – 2030)

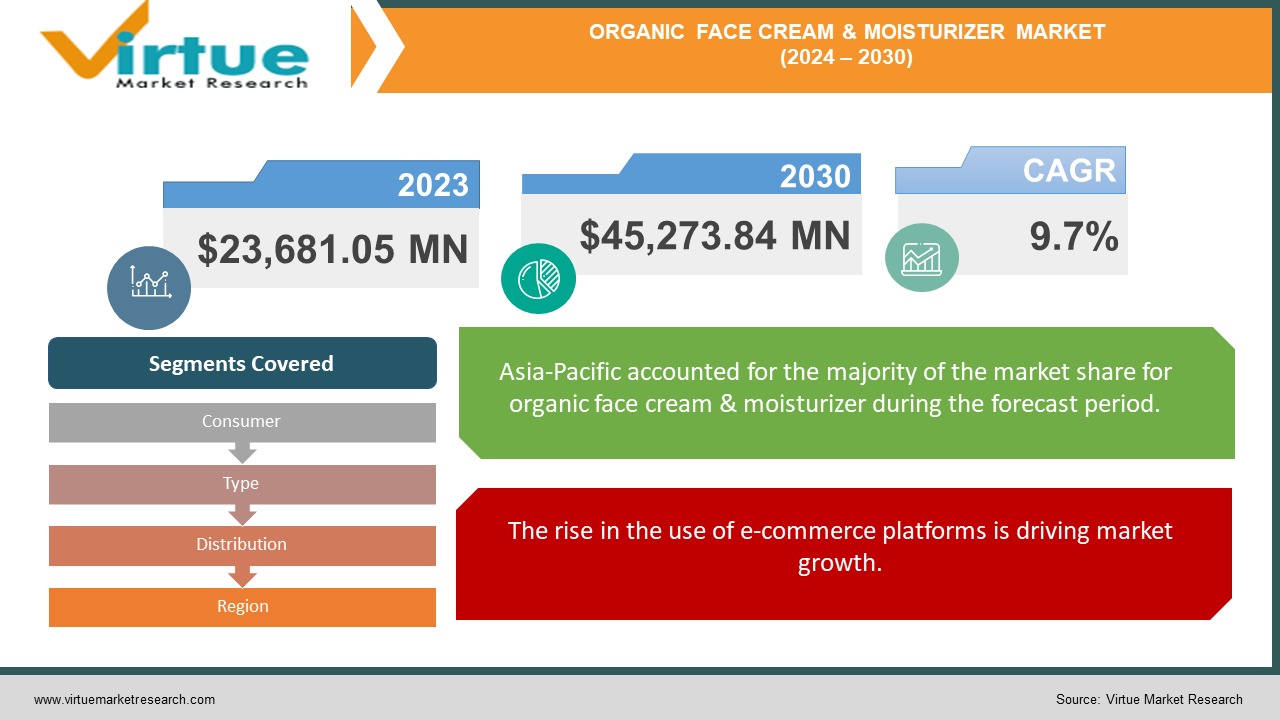

The Organic Face Cream & Moisturizer Market was valued at USD 23,681.05 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 45,273.84 million by 2030, growing at a CAGR of 9.7%.

Skincare constitutes a crucial component of personal hygiene, encompassing both corrective and preventive measures in grooming routines. Ongoing advancements in the beauty sector continuously enhance product offerings, emphasizing health-conscious formulations. The market has seen a sustained presence of makeup products integrating skincare advantages. Rising awareness regarding skin sensitivity and the detrimental impacts of synthetic chemicals fuels the expanding market for organic and natural skincare solutions. A significant portion of consumers prefer products labeled as natural or organic, often prioritizing these designations over detailed scrutiny of ingredient compositions during purchase decisions.

Key Market Insights:

An organic product is defined as originating from natural sources, produced by living organisms, and free from chemical treatments, pesticides, or synthetic fertilizers. Skincare formulations incorporating organic ingredients commonly feature essential oils, organic vegetable oils, fatty acids, and vitamins. The products are crafted to be environmentally sustainable. Organic skincare items are known for their gentle yet potent properties, effectively moisturizing, nourishing, and promoting skin health.

Organic Face Cream & Moisturizer Market Drivers:

The rise in the use of e-commerce platforms is driving market growth.

The widespread influence of beauty blogs and social media platforms has transformed consumer perceptions of health and wellness, particularly regarding the benefits of transitioning to organic skincare products. This shift is a significant driver behind the growth of the organic skincare sector. The online marketplace plays a pivotal role as consumers increasingly rely on it to discover and purchase products that may not be readily available in traditional retail outlets such as malls and stores. Consequently, the rapid expansion of e-commerce is considered one of the primary catalysts propelling the global skincare industry forward. Furthermore, advancements in technology aimed at extending the shelf life of skincare products are expected to have a positive impact on the industry as a whole.

Increasing awareness about paraben-free products etc., drives the market growth

The demand for organic skincare is surging as consumers seek products free from parabens, preservatives, and other harmful ingredients, driving significant growth in the industry. Globalization has played a crucial role in increasing awareness about natural and organic skincare worldwide, with countries like Japan and South Korea having long histories of producing organic skincare products. Recently, this awareness has expanded globally.

Consumers are increasingly opting for clean skincare products due to their knowledge of the potential adverse effects of additives like parabens in traditional skincare items. Organic skincare products are also noted for their effectiveness, albeit often at a higher price point compared to conventional alternatives currently available in the market. The projected increase in disposable income among individuals is expected to further fuel market growth. These factors are anticipated to serve as primary drivers in expanding the organic skincare market.

Organic Face Cream & Moisturizer Market Restraints and Challenges:

Adverse effects of long-term usage of skin care products hinder market growth.

Extended use of cosmetic products can lead to skin injuries such as rashes, swelling, burning sensations, discoloration, and premature aging of skin cells. Certain skin-nourishing creams, specifically formulated for dry or oily skin types, may not be suitable for other skin types. Consumers often prioritize brand names over product suitability, which can be detrimental to their skin's health. Additionally, some products may contain ingredients that are inappropriate for certain users, triggering allergic reactions and acne breakouts. These factors collectively hinder market expansion in the skincare industry.

The limited Shelf Life of organic products restrains market growth.

Organic skincare products, lacking synthetic preservatives, typically have a shorter shelf life compared to synthetic products. This characteristic not only affects product longevity but also increases distribution costs and restricts availability to specific regions.

Availability of Raw Materials constrains market growth.

The availability of raw materials for organic skincare products can be constrained due to the seasonality of certain substances and limited manufacturing capacities among suppliers. Because some ingredients are only available during specific seasons, the production and distribution capabilities of organic skincare products may face constraints accordingly.

Organic Face Cream & Moisturizer Market Opportunities:

Increasing demand for organic skin care in Asia is creating growth opportunities.

Manufacturers in the organic skincare market are actively expanding their customer bases by leveraging opportunities in the growing Asia-Pacific markets. New entrants into the market are focused on promoting sustainability and educating consumers about natural alternatives to synthetic skincare products. This trend has prompted many companies to diversify their product offerings, particularly targeting men with a wide range of organic products including face washes, serums, and facial cleansers. These products are entirely natural and free from artificial ingredients, catering to the increasing demand for clean and effective skincare solutions.

DIY Skin Care creates opportunities.

Consumer interest in reducing waste and personalizing skincare routines has fueled a rise in DIY skincare trends within the organic skincare market. Brands have responded by introducing kits and individual components that enable consumers to craft their organic skincare products at home. This shift reflects a growing preference for sustainable and customizable beauty solutions, aligning with broader environmental and personal health consciousness among consumers.

ORGANIC FACE CREAM & MOISTURIZER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.7% |

|

Segments Covered |

By Consumer, Type, Distribution, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Natura & Co., Arbonne International , Purity Cosmetics (100% Pure), Tata Harper, Shiseido Company Limited, The Estee Lauder Companies, Yves Rocher, True Botanicals, The Hain Celestial Group, Weleda AG |

Organic Face Cream & Moisturizer Market Segmentation: By Consumer

-

Female

-

Male

The women's segment currently holds a dominant position in the organic skincare market, which is expanding due to increasing demand for natural skincare products. This growth is largely attributed to the potential irritations and outbreaks caused by synthetic cosmetics. Women tend to be more conscientious about their appearance, placing significant emphasis on the ingredients and quality of products they use.

Meanwhile, the men's segment is anticipated to grow at the fastest rate globally. This growth is driven by a rising awareness among males about skincare and grooming practices. As societal perceptions evolve and men become more proactive in their personal care routines, the demand for organic skincare products tailored for men is expected to see substantial growth.

Organic Face Cream & Moisturizer Market Segmentation: By Type

-

Face Cream

-

Face Moisturizer

The category of face creams and moisturizers currently holds a significant share of the market, with expectations of maintaining this dominance in the forecast period. Moisturizers play a crucial role in skincare by forming a protective barrier that prevents moisture loss and potential irritation or dryness from harmful substances. Organic moisturizers cater to various skin types such as dry, oily, and textured skin.

For example, ROSEN, a beauty care company, offers a tropical moisturizer designed to be lightweight yet effective, leveraging active ingredients like pineapple enzymes. This formulation aims to reduce excessive oil production and enhance skin texture, illustrating the trend towards specialized organic products tailored to specific skincare needs.

Organic Face Cream & Moisturizer Market Segmentation: By Distribution

-

Online

-

Supermarket/Hypermarket

-

Pharmacy & Drugstore

-

Others

The hypermarket/supermarket distribution channel currently commands a substantial revenue share of approximately 43.9%. Many brands opt to launch their products through grocery chains such as Walmart and Target to maximize consumer reach.

Looking ahead, the internet channel is projected to experience a rapid Compound Annual Growth Rate (CAGR) during the forecast period. E-commerce platforms play a crucial role in expanding the reach of local and regional businesses by connecting them with a broader consumer base. For instance, prominent organic skincare companies in India, like iHerb, exclusively distribute their products online, highlighting the increasing significance of digital platforms in the skincare market's distribution landscape.

Organic Face Cream & Moisturizer Market Segmentation- by region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is recognized for its diverse and dynamic markets across several popular categories including skincare, sun care, hair care, color cosmetics, deodorants, and fragrances. Among these categories, skincare, sun care, color cosmetics, and fragrances are particularly prevalent in the region. This diversity positions Asia-Pacific as a promising market for organic skincare products on a global scale.

During the projected period, the Asia-Pacific region is expected to exhibit the highest growth rate. The increasing demand for organic skincare products in this region is driven by multiple factors, including an aging population, heightened awareness of organic products, a growing millennial demographic, and rising numbers of working women. Investments in branding and advertising of organic skincare products are also contributing to market expansion.

China leads the market share in the Asia-Pacific region, followed by Japan, South Korea, and other countries. These insights underscore the region's significance in the global organic skincare market, fueled by evolving consumer preferences and strategic industry developments.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has heightened public awareness of well-being and self-care, leading to increased demand for chemical-free products, particularly in the organic skincare sector. However, lockdowns and movement restrictions have disrupted supply chains and hindered production capabilities, resulting in resource shortages and a decline in manufacturing output for these products. Despite these challenges, the surge in consumer demand for organic skincare has presented growth opportunities for major players in the industry. This shift underscores the evolving consumer preferences toward natural and health-conscious skincare solutions amid global health crises.

Latest Trends/ Developments:

-

In February 2022, Haeckels, known for its microbiome-friendly skincare products, secured a modest investment from The Estée Lauder Companies. This funding will facilitate the expansion of Haeckels' newly introduced skincare range, bolster manufacturing capabilities to accommodate growing demand, and support its entry into new global markets.

-

In January 2022, e.l.f. Cosmetics announced its commitment to achieving 100% clean beauty standards. This initiative ensures that all products under the e.l.f. Cosmetics brands, including cosmetics and skincare items, will adhere to the stringent criteria set by the European Union Cosmetics Regulation (EUCR) and FDA guidelines.

-

In May 2022, Weleda is set to expand its operations in the UK with the opening of a larger warehouse. This strategic move aims to enhance logistical capabilities and support the brand's growing presence and distribution in the UK market.

Key Players:

These are the top 10 players in the Organic Face Cream & Moisturizer Market: -

-

Natura & Co.

-

Arbonne International

-

Purity Cosmetics (100% Pure)

-

Tata Harper

-

Shiseido Company Limited

-

The Estee Lauder Companies

-

Yves Rocher

-

True Botanicals

-

The Hain Celestial Group

-

Weleda AG

Chapter 1. Organic Face Cream & Moisturizer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organic Face Cream & Moisturizer Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organic Face Cream & Moisturizer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organic Face Cream & Moisturizer Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organic Face Cream & Moisturizer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organic Face Cream & Moisturizer Market – By Consumer

6.1 Introduction/Key Findings

6.2 Female

6.3 Male

6.4 Y-O-Y Growth trend Analysis By Consumer

6.5 Absolute $ Opportunity Analysis By Consumer, 2024-2030

Chapter 7. Organic Face Cream & Moisturizer Market – By Type

7.1 Introduction/Key Findings

7.2 Face Cream

7.3 Face Moisturizer

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Organic Face Cream & Moisturizer Market – By Distribution

8.1 Introduction/Key Findings

8.2 Online

8.3 Supermarket/Hypermarket

8.4 Pharmacy & Drugstore

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Distribution

8.7 Absolute $ Opportunity Analysis By Distribution, 2024-2030

Chapter 9. Organic Face Cream & Moisturizer Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Consumer

9.1.3 By Type

9.1.4 By Distribution

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Consumer

9.2.3 By Type

9.2.4 By Distribution

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Consumer

9.3.3 By Type

9.3.4 By Distribution

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Consumer

9.4.3 By Type

9.4.4 By Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Consumer

9.5.3 By Type

9.5.4 By Distribution

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Organic Face Cream & Moisturizer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Natura & Co.

10.2 Arbonne International

10.3 Purity Cosmetics (100% Pure)

10.4 Tata Harper

10.5 Shiseido Company Limited

10.6 The Estee Lauder Companies

10.7 Yves Rocher

10.8 True Botanicals

10.9 The Hain Celestial Group

10.10 Weleda AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

An organic product is defined as originating from natural sources, produced by living organisms, and free from chemical treatments, pesticides, or synthetic fertilizers. Skincare formulations incorporating organic ingredients commonly feature essential oils, organic vegetable oils, fatty acids, and vitamins.

The top players operating in the Organic Face Cream & Moisturizer Market are - Natura & Co., Arbonne International, Purity Cosmetics (100% Pure), Tata Harper, Shiseido Company Limited, The Estee Lauder Companies, Yves Rocher, True Botanicals, The Hain Celestial Group, Weleda AG.

The COVID-19 pandemic has heightened public awareness of well-being and self-care, leading to increased demand for chemical-free products, particularly in the organic skincare sector.

New entrants into the market are focused on promoting sustainability and educating consumers about natural alternatives to synthetic skincare products. This trend has prompted many companies to diversify their product offerings.

The Asia-Pacific region is expected to exhibit the highest growth rate.