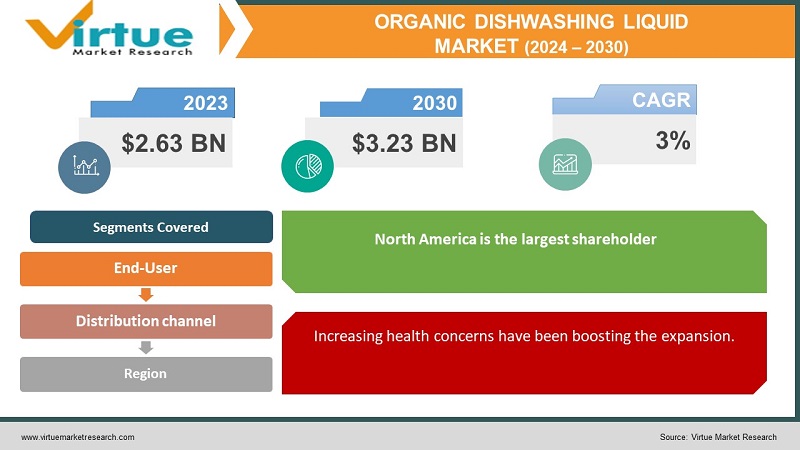

Organic Dishwashing Liquid Market Size (2024-2030)

The global organic dishwashing liquid market was valued at USD 2.63 billion and is projected to reach a market size of USD 3.23 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3%.

Plant-based components are used to make organic dishwashing solutions. The safe, non-toxic, and environmentally friendly dishwashing solutions are devoid of chemicals and do not include foam builders, scents, coloring agents, or stabilizers. In the past, this market has had considerable scope. However, not every household was able to afford these products because of their limited awareness and availability. Presently, with an increasing number of key players, global operations, and economic growth, this market has seen good growth. In the future, with a growing awareness of sustainability and technological advancements, this market is anticipated to have an upsurge.

Key Market Insights:

There are more than 500 brands of organic dishwashing liquid available worldwide.

Thirty percent or more of brands of organic dishwashing detergent emphasize environmentally friendly packaging.

Organic dishwashing solutions may cost 20–30% more than those that are conventional. This can demotivate consumers, making them go for other options. To tackle this, organizations have been working on commercializing cost-effective solutions to attract a wider range of customers.

Organic Dishwashing Liquid Market Drivers:

Rising environmental awareness has been fueling the progress.

Over the years, numerous changes in the standard of living and consumer preferences have impacted the environment significantly. Conventional dishwashing liquids contain hazardous substances commonly found in traditional dishwashing solutions. Synthetic perfumes, sulfates, and phosphates are at the top of this list. These substances destroy aquatic life when they seep into waterways. Secondly, chemical dishwashing detergents have the potential to introduce a severe kind of algae into streams of water. The water's surface may become coated with this alga, obstructing sunlight and destroying marine life. Thirdly, to prevent bacterial contamination, dishwashing detergents may include formaldehyde, a recognized carcinogen. This can disturb the growth of plants, decreasing the number of leaves and surface area. Additionally, when mixed with air as foam, this can shorten the lifespan of animals by causing sickness. However, organic dishwashing liquids contain eco-friendly chemicals and compounds that have no adverse effect on the environment. The biodegradable ingredients are appealing to many consumers, helping with a broader consumer base.

Increasing health concerns have been boosting the expansion.

There have been a lot of disruptions in health owing to lifestyle changes and the use of various products that have harmful chemicals in them. Dishwashing liquids have ingredients like sodium laureth sulfate (SLES), DEA/MEA, and sodium benzoate. Due to these chemicals, dryness, irritation, and rough skin are among the skin problems that can arise. Sometimes, these toxic ingredients can potentially result in skin disorders like dermatitis, eczema, and rashes. Secondly, if dishwashing detergents are swallowed, penetrate the eyes, or remain on the skin, they can cause chemical burns. Due to their high alkalinity, they can dissolve a wide range of materials, including human tissue. Thirdly, few research studies about dishwashing liquids have been connected to many illnesses and metabolic conditions, such as obesity, irritable bowel syndrome, inflammatory bowel disease, and behavioral and metabolic abnormalities. Moreover, brands of dishwashing soap frequently include the antibacterial and antifungal active ingredient triclosan. It has been proven that this substance negatively affects the mitochondria. This has led to health-conscious choices among the public. These health-conscious consumers' desires are supported by the organic dishwashing solutions' emphasis on employing natural, non-toxic chemicals.

Organic Dishwashing Liquid Market Restraints and Challenges:

Price volatility, perceived effectiveness, and lack of availability are the main concerns that the market is currently experiencing.

The biggest barrier in the market is the associated costs. The manufacturing and production process of organic liquid dishwashers requires special technology and equipment. Additionally, labor costs are applied as well. As such, when bought into the market, they have high prices when compared to the conventional ones. This can demotivate the customers. Secondly, a few consumers might have a prejudice against these products. Many of the surveys indicate that some individuals hold conservationist views about the efficiency of natural ingredients versus chemical ones since additional substances are added to the latter to improve cleanliness and performance. Thirdly, limited accessibility can cause huge losses for the industry. Since they are expensive, many vendors might not sell them, restricting access for consumers. This lack of distribution channels can cause hindrances.

Organic Dishwashing Liquid Market Opportunities:

Educating the public about the benefits of organic products provides immense possibilities for the market. This can increase revenue tremendously. To accomplish this, various organizations and NGOs have been spreading awareness about the impact organic dishwashing liquids can have on human health and the environment. Secondly, product innovations have been facilitating the augmentation. By using innovative ingredients and making the formulations visually attractive, more sales are possible. Many startups have been coming up with creative options like using leftover citric fruits, peels of vegetables, and other ingredients for better performance, smell, and efficiency. Companies in this market have been prioritizing strengthening their distribution channels to reach worldwide customers. Online retail has been a boon for this initiative.

ORGANIC DISHWASHING LIQUID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3% |

|

Segments Covered |

By End User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Seventh Generation (Unilever), Ecover (SC Johnson), Attitude, Method Products (S. C. Johnson & Son), Mrs. Meyer's Clean Day, Puracy, Better Life, Green Works (The Clorex Company), Biokleen (McKesson Corporation), Babyganics |

Organic Dishwashing Liquid Market Segmentation:

Organic Dishwashing Liquid Market Segmentation: By End-User:

- Residential

- Commercial

- Industrial

Based on end-users, the residential sector is the largest category in the market in 2023. This is due to the increasing demand, which is boosting the expansion. This is mainly used in the kitchen for washing utensils. It helps with the removal of stains and the cleansing of the items. This is necessary to keep away germs and other bacteria. As such, the success of this segment is higher. The commercial category is the fastest-growing. As part of their corporate social responsibility, many companies, particularly in the hotel and food service sectors, are adopting sustainability. To meet their sustainability objectives, they are actively looking for environmentally friendly cleaning products, such as organic dishwashing detergents. Businesses frequently purchase cleaning supplies in bulk, which results in more extensive purchases of organic dishwashing solutions. Because of the economies of scale made possible by this higher volume, firms may now invest in environmentally friendly solutions at a lower cost. Furthermore, various certifications and recognitions from governmental agencies can be obtained by using organic and suitable procedures, helping the company to benefit.

Organic Dishwashing Liquid Market Segmentation: By Distribution Channels:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Others

The largest in terms of distribution channels are supermarkets and hypermarkets, holding a share exceeding 45% in 2023. Their products are easily obtainable and readily available. They are usually present in each neighborhood, making it simpler for customers to get the products they need. This allows for direct communication between the customer and the business owner for a visual inspection of the merchandise to verify contents, expiration dates, and other important details that are necessary. Additionally, few individuals tend to go for this channel as they might now have access to the internet or might be unaware of the technology. Online retail is the distribution channel in this market that is growing at the fastest rate. The main reason for this is convenience. The required products are delivered to the clients' homes. People also have the choice to choose from a variety of options that can be both domestic and international. Online ordering is a great, economical option because it provides discounts and free deliveries at times. This makes this an affordable choice, helping a larger audience.

Organic Dishwashing Liquid Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Based on region, North America is the largest shareholder. This area holds a rough share of 34% in 2023. The success of this region is mainly because of consumer awareness. Customers have been seeking sustainable choices that have a positive impact on human health and the environment. As such, more products are available because of bulk manufacturing and production. Innovations concerning product variety have been creating more alternatives, allowing the population to choose as per their choice. Secondly, the economic growth of this area helps with a high amount of disposable income, allowing the public to go for organic options. This willingness to pay for premium choices has supported more sales. Furthermore, prominent key players like Seventh Generation, Ecover, Puracy, and Better Life are present in this region and operate globally. Their products are known for their efficiency and performance, aiding in growth. Asia-Pacific is the fastest-growing region. A total share of around 22% is held by this area. E-commerce is the primary reason for this. Due to the convenience of this channel, more customers can access the products that they require. Urbanization has played a huge role as well. This has improved the living conditions of the middle class, allowing them to purchase luxurious products. Apart from this, endorsements by various celebrities, media, influencers, and other environmentalists have been helping to reach more people. Therefore, a good percentage of the population has been changing their choices. This shift in consumer preference has been a major factor in the enlargement. Besides, innovative solutions from companies to prepare products by using homemade ingredients have been creating cost-effective options.

COVID-19 Impact Analysis on the Global Organic Dishwashing Liquid Market:

The outbreak of the virus had a mixed impact on the market. Lockdowns, restricted mobility, and social isolation were all part of the new normal. Consequently, businesses and production facilities had to temporarily close, delaying production and manufacturing activities. Furthermore, there were many disruptions to the supply chain, logistics, and transportation. This affected the market for imports and exports. An economic downturn was seen. Many people lost their jobs as a result of financial difficulties and uncertainty. As a result, sales decreased. Moreover, because the majority of the funding was allocated to healthcare applications like vaccine development, ventilators, hospital beds, oxygen tanks, PPE kits, etc., all launches, investments, and collaborations were halted or postponed. However, the pandemic also played a crucial role in highlighting the importance of physical and mental well-being. Additionally, the importance of living a sustainable life was promoted. This increased the demand for cleaning organic products. Besides, to prevent virus contamination, all products that were ordered were washed to avoid any risk. With many reported cases of illness and sickness due to various elements, a greater percentage of the population started to lean toward organic products. 60% of consumers worldwide claim that the epidemic has increased their awareness of the need to live a healthy lifestyle to avert health issues, according to a report by DSM. Post-pandemic, the market has continued to grow owing to online retail. The upliftment of guidelines and the relaxation of rules have facilitated the normal functioning of industries.

Latest Trends/ Developments:

Businesses in this sector are driven to grow their market share using a variety of tactics, including investments, joint ventures, and acquisitions. To maintain competitive pricing, businesses are also investing a significant amount of money in enhancing their current formulations. This has led to even greater growth.

Sustainable solutions are being given prominence. This includes the use of recycled and eco-friendly materials for packaging. These products have minimal impact on the environment as they are reused, thereby reducing waste generation and landfills. Besides, disposal into the environment can be prevented, thereby leading to a balanced ecosystem. This move can attract a lot of environmental enthusiasts.

Key Players:

- Seventh Generation (Unilever)

- Ecover (SC Johnson)

- Attitude

- Method Products (S. C. Johnson & Son)

- Mrs. Meyer's Clean Day

- Puracy

- Better Life

- Green Works (The Clorex Company)

- Biokleen (McKesson Corporation)

- Babyganics

In November 2023, The Organic World (TOW), the biggest network of organic and natural retail stores in India and one of the country's top ethical merchants, announced the introduction of three new items under its plant-powered home care brand, Osh. Osh Fabric Conditioner, Osh Toilet Cleaner, and Osh Multipurpose Kitchen Cleaner are among TOW's most recent product launches, bringing the company's line of plant-based home care products to six.

In March 2022, Walmart and Palmolive announced the launch of Palmolive Shake & Clean Dish Soap. It comes in a reusable container with a concentrated gel. Compared to purchasing a brand-new 20-ounce container of dish soap, the packaging is intended to cut plastic waste by 75%. Because the soap is refillable, consumers may avoid buying new bottles by using their old ones. It's an easy method to refill; just fill, pour, and shake.

Chapter 1. GLOBAL ORGANIC DISHWASHING LIQUID MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL ORGANIC DISHWASHING LIQUID MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL ORGANIC DISHWASHING LIQUID MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL ORGANIC DISHWASHING LIQUID MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL ORGANIC DISHWASHING LIQUID MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL ORGANIC DISHWASHING LIQUID MARKET – By End-User

6.1. Introduction/Key Findings

6.2 Residential

6.3. Commercial

6.4. Industrial

6.5. Y-O-Y Growth trend Analysis By End-User

6.6. Absolute $ Opportunity Analysis By End-User , 2024-2030

Chapter 7. GLOBAL ORGANIC DISHWASHING LIQUID MARKET – By Distribution Channels

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Specialty Stores

7.4. Online Retail

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channels

7.7. Absolute $ Opportunity Analysis By Distribution Channels , 2024-2030

Chapter 8. GLOBAL ORGANIC DISHWASHING LIQUID MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channels

8.1.3. By End-User

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution Channels

8.2.3. By End-User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution Channels

8.3.3. By End-User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution Channels

8.4.3. By End-User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution Channels

8.5.3. By End-User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL ORGANIC DISHWASHING LIQUID MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Seventh Generation (Unilever)

9.2. Ecover (SC Johnson)

9.3. Attitude

9.4. Method Products (S. C. Johnson & Son)

9.5. Mrs. Meyer's Clean Day

9.6. Puracy

9.7. Better Life

9.8. Green Works (The Clorex Company)

9.9. Biokleen (McKesson Corporation)

9.10. Babyganics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global organic dishwashing liquid market was valued at USD 2.63 billion and is projected to reach a market size of USD 3.23 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3%.

Rising environmental awareness and increasing health concerns are the main factors propelling the Global Organic Dishwashing Liquid Market.

Based on Distribution Channels, the Global Organic Dishwashing Liquid Market is segmented into Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others.

North America is the most dominant region for the Global Organic Dishwashing Liquid Market.

Seventh Generation (Unilever), Ecover (SC Johnson), and Attitude are the key players operating in the Global Organic Dishwashing Liquid Market.