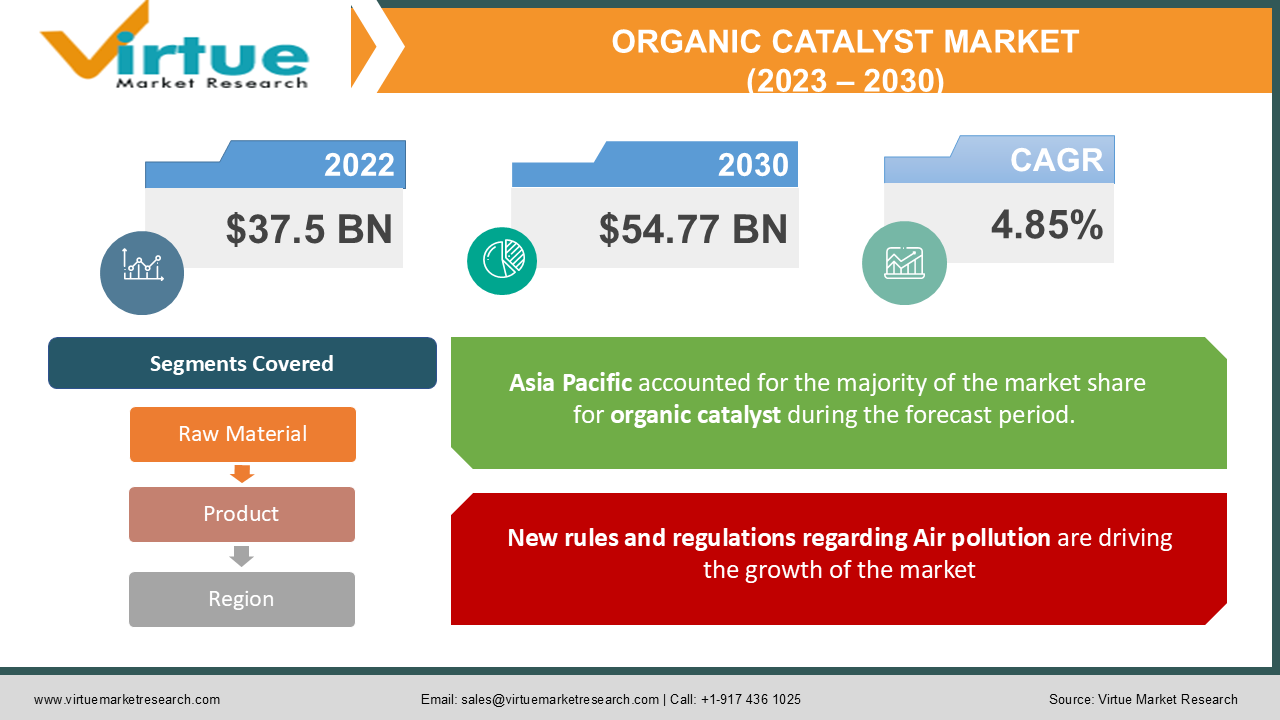

Global Organic Catalyst Market Size (2023 – 2030)

The global Organic Catalyst Market size was USD 37.5 billion in 2022 and is estimated to grow to USD 54.77 billion by 2030. This market is witnessing a healthy CAGR of 4.85% from 2023 - 2030. The use of organocatalysis in green chemistry to innovate technologies that reduce the usage of hazardous substances and the environmental benefits associated with this market are majorly driving the growth of the industry.

Industry Overview:

Catalyst is a substance that will increase the speed of a chemical reaction besides getting eaten up in it. Organic catalysts are compounds that predominately consist of organic molecules of C, H, O, N, S, and P to speed up the fee of a chemical reaction. Organic catalyst is additionally regarded as organocatalyst and the process of growing the charge of a chemical reaction is referred to as organocatalysis. Owing to the benefits such as lack of sensitivity to oxygen and moisture, easy response manipulation, low toxicity, low value, and their ready availability, Organic catalyst are favored in the pharmaceutical and agricultural quarter as the materials of desire over other transition steel catalysts. Furthermore, organocatalyst is compatible with quite a few practical teams and does not require anhydrous conditions, accordingly decreasing the variety of reaction steps and the cost of synthesis. Metal natural catalysts consist of steel linked to the organic catalyst and given that these metals can cause health problems if used for medicinal purposes, thereby manufacturers are the use of the natural chemical catalyst for biological catalysis and shifting in the direction of adopting the principles of green chemistry. Global gas demand is predicted to drop by 15-10% in Q2, 2020 due to a halt in air journeys and countrywide lockdowns. A number of plants have been shut down and some are walking but at decreased charges which may for that reason impact the market demand, mainly in Iran, the U.S., China, India, France, Italy, and the U.K., which are some of the worst-hit economies. Environmental catalysts assist producers to meet all the stringent mandates related to NOx, Sox, and carbon dioxide emissions. Shifting strength tendencies in the direction of choice fuels including biodiesel and shale fuel gas have propelled the demand for catalysts. Additionally, manufacturers searching to add price to their feedstock or refining by using producing value-added petrochemicals and chemical substances such as methanol and polyolefins, have stimulated the demand for the product from petrochemicals and chemical compounds applications.

COVID-19 impact on Organic Catalyst Market

With the unheard-of outbreak of COVID-19, which has led to the closure of factories and manufacturing sites, there has been a sizeable decline in demand for oil, the first such occasion in a decade. Additionally, the rate of fighting between Russia and KSA has led to an awful lot of decline in oil prices. The pandemic has created many opportunities for the market as well as producers to innovate and experiment with the products.

MARKET DRIVERS:

New rules and regulations regarding Air pollution are driving the growth of the market

The most important drivers for the Industrial Catalyst market used to be the tightening of rules globally in regard to Air pollution standards. The catalysts have a primary use in emission manipulation and clean gasoline technologies, in automotive, chemical industries, petrochemical industries, and more than a few other sectors. With the rising international population, there has been an extension in industrialization which has led to extremely high pollution levels. There has also been a huge boom in the demand and production of car motors both light and heavy, all of which use catalysts to control emission levels. Governments in the Asia Pacific Region, US, and Europe have been tightening policies closer to air pollution due to which the use of catalysts for lowering undesirable emissions as a byproduct from industries and vehicles and to amplifying environment-friendly usage of fuels has propelled the increase of the market for industrial catalysts.

Production of Chemical products is also driving the growth of the market

Another growth driver has been the use of catalysts in chemical production, petroleum refining and petrochemical process. The non-stop increase in these markets and their derivatives has additionally persevered to observe a stable increase in demand from the catalyst market

MARKET RESTRAINTS:

Raw material price fluctuation is also restraining the growth of the market

Catalyst carriers are synthesized particularly from one-of-a-kind metallic and non-metal oxides. Over time, the price of the raw substances used to produce catalyst carriers fluctuated. This has extensively affected the catalyst carriers market. In addition, some of them are synthesized from uncommon earth factors which due to their low availability extend the ordinary fee of manufacturing catalyst carriers. The fee for uncooked materials is expected to fluctuate similarly in the instant future, thereby impacting the catalyst carrier market significantly. Also, metallic prices that go into catalyst provider production have fluctuated in current years. This is supposed to have a significant impact on catalyst service producers, as they will be forced to pass the fee on to catalyst provider consumers.

ORGANIC CATALYST MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.85% |

|

Segments Covered |

By Raw Material, Product, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bio-Organic Catalyst (US), Yangzhou Dajiang Chemical Co., Ltd (China), newtopchem (China), BASF SE (Germany), Nouryon (The Netherlands), Pon Pure Chemicals (India), Gulbrandsen (US), Evonik Industries AG (Germany), Mitsubishi Biopharma (India), Mystical Biotech Pvt Ltd (India), Novozymes (Denmark), AB Enzymes (Germany), DSM (The Netherlands), Aum Enzymes (India), and F. Hoffmann-La Roche Ltd (Switzerland). |

This research report on the global Organic Catalyst Market has been segmented and sub-segmented based on Raw Material, Product, and region.

Organic Catalyst Market - By Raw Material:

- Chemicals

- Metal

- Zeolites

- And others

Chemical compounds emerged as the dominant uncooked cloth section of the market representing a value share of 38.3% in 2019. Chemical compounds such as sulfuric acid, hydrofluoric acid, and calcium carbonate are used as catalyst raw materials for numerous functions in chemical, petrochemical, and polymer industries.

Metals used for dehydrogenation and hydrogenation are noble metals (platinum, palladium, ruthenium, rhodium, gold, and copper), non-noble metals (tungsten and molybdenum), and others such as nickel and cobalt are also used as key catalyst uncooked materials. These metals speed up the system of breaking and re-arranging the aromatics and olefins to produce fractions such as alkanes and naphthenes.

Besides metals and chemical compounds, zeolites are another kind of outstanding uncooked material used in catalysts that are majorly used in catalyzing and adsorbent purposes owing to their porosity and large floor area. Zeolites can accommodate a variety of ions supported with the aid of their porous structure. These are acquired naturally and can also be manufactured commercially from crystallization reactions.

Organic Catalyst Market - By Product:

- Homogenous

- Heterogenous

- Others

Based on Product, Heterogeneous catalysts emerged as the outstanding product segment of the market with a price share of 72.1% in 2019. Homogeneous catalysts are transformed into heterogeneous catalysts via solid supports to limit their toxicity. Some frequent examples of heterogeneous catalysts include sulfated zirconia, sulfonated carbon materials, sulfonated silica materials, and sulfonated MOF materials.

The advantages of heterogeneous catalyst software include low-cost usage, easy separation of catalyst from products, and ease of application, which are likely to drive the segment. Further, gaining acceptance of heterogeneous catalysts over their homogenous counterparts for biodiesel production is in all likelihood to accelerate the boom of the catalyst market over the forecast period.

Homogeneous catalysts include products such as boric acid, phosphoric acid, hydrochloric acid, p-toluenesulfonic acid, and sulfuric acid. These catalysts are suggested to show better overall performance in industrial and uncooked material reactions in contrast to their heterogeneous counterparts. However, these tactics create big amounts of toxic waste, causing environmental hazards. This has brought about the need for environment-friendly catalysts, and the availability of biodegradable homogeneous catalysts such as methanesulfonic acid (MSA) has helped to meet such demands.

Organic Catalyst Market - By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East

- Africa

Geographically, Asia Pacific is probably to account for the largest value share corresponding to 33.7% in 2019, supported by the dominance of the automobile, petrochemicals, polymer, and chemical industries in China. China had a sizeable chunk of chemical and polymer manufacturing groups and thus, emerged as a manufacturing destination for chemical and petrochemical products owing to growing domestic demand and low manufacturing expenses in contrast to the U.S. and the European Union countries. The market increase in the Asia Pacific is similarly augmented through the increasing FDI investments and profitable increase possibilities projected via creating nations such as India and Vietnam.

North America is the second-largest market, owing to the evolving low sulfur and automotive mandates that necessitate the utility of environmental catalysts in the region. The mounting consumption of gasoline in the U.S. is predicted to expand the demand for catalysts used for reworking heavy crude oil into light fractions such as kerosene, diesel, and gasoline. Further, the increase of the oil and fuel, and chemical sectors in Mexico is a key aspect contributing to the market increase in North America.

The Middle East and Africa which represented a market value share of 6.5% in 2019 are anticipated to venture profitable possibilities for petroleum refining catalysts on account of oil and gas industry dominance in Saudi Arabia, Oman, Kuwait, and Qatar, international locations of the region. A surge in home demand in the automotive, construction, packaging, and pharmaceutical industries is expected to propel chemical manufacturers to boost their manufacturing output for polymers and petrochemicals in the Middle East.

Organic Catalyst Market Share by company

Companies like

-

Bio-Organic Catalyst (US)

-

Yangzhou Dajiang Chemical Co., Ltd (China)

-

Newtopchem (China)

-

BASF SE (Germany)

-

Nouryon (The Netherlands)

-

Pon Pure Chemicals (India)

-

Gulbrandsen (US)

-

Evonik Industries AG (Germany)

-

Mitsubishi Biopharma (India)

-

Mystical Biotech Pvt Ltd (India)

-

Novozymes (Denmark)

-

AB Enzymes (Germany)

-

DSM (The Netherlands)

-

Aum Enzymes (India)

-

F. Hoffmann-La Roche Ltd (Switzerland)

And others are playing a pivotal role in the market.

A rising trend in the Industrial Catalyst Industry is the application of Industrial Catalyst in the production of methanol with the rising demand for methanol production. With crude oil prices rising and the demand for important derivatives of crude oils, such propylene, butylene, and many more, also rising, companies have started looking at methanol as an alternative source for the production of these derivatives. The increase in the number of plants being set up for methanol production is booting the market for catalyst technologies pertaining to efficient methanol production.

NOTABLE HAPPENINGS IN THE GLOBAL ORGANIC CATALYST MARKET IN THE RECENT PAST:

Product Launch - In April 2021, catalyst carriers for the Accu sphere were introduced by Saint Gobain Norpro (U.S.). This new spherical catalyst carrier is estimated to meet the increasing demand of small diameter supports from the petrochemical, chemical & refining industry to provide high geometric surface area, uniform packaging, and even flow distribution

Product Integration - In early 2020, BASF announced a series of new product innovations in its selective hydrogenation catalysts portfolio palladium alumina catalysts and PTA catalyst CBA-250.

Chapter 1. Organic Catalyst Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Organic Catalyst Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Organic Catalyst Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Organic Catalyst Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Organic Catalyst Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Organic Catalyst Market – By Raw Material

6.1. Chemicals

6.2. Metal

6.3. Zeolites

6.4. Others

Chapter 7. Organic Catalyst Market – By Product

7.1. Homogenous

7.2. Heterogenous

7.3. Others

Chapter 8. Organic Catalyst Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Organic Catalyst Market – Key Companies

9.1. Bio-Organic Catalyst (US)

9.2. Yangzhou Dajiang Chemical Co., Ltd (China)

9.3. Newtopchem (China)

9.4. BASF SE (Germany)

9.5. Nouryon (The Netherlands)

9.6. Pon Pure Chemicals (India)

9.7. Gulbrandsen (US)

9.8. Evonik Industries AG (Germany)

9.9. Mitsubishi Biopharma (India)

9.10. Mystical Biotech Pvt Ltd (India)

9.11. Novozymes (Denmark)

9.12. AB Enzymes (Germany)

9.13. DSM (The Netherlands)

9.14. Aum Enzymes (India)

9.15. F. Hoffmann-La Roche Ltd (Switzerland)

Download Sample

Choose License Type

2500

4250

5250

6900