Organic Bread Improvers Market Size (2024 – 2030)

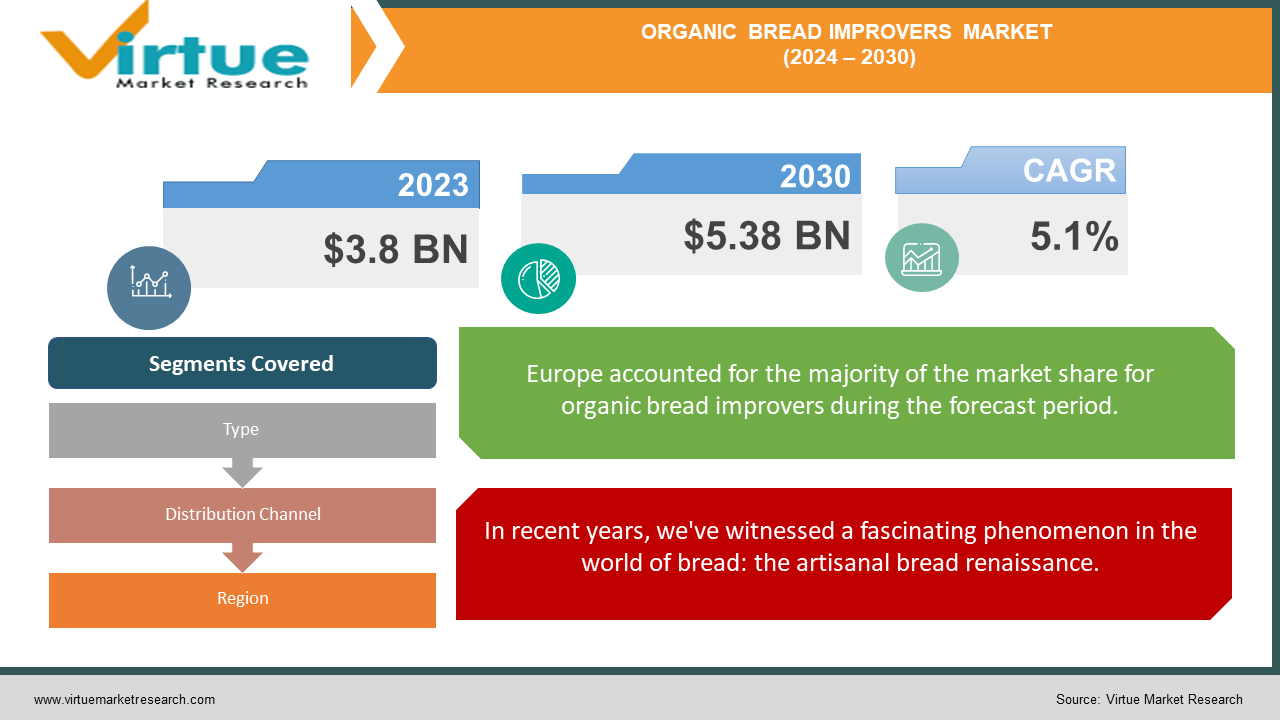

The Global Organic Bread Improvers Market was valued at USD 3.8 Billion in 2023 and is projected to reach a market size of USD 5.38 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.1%.

The demand for organic bread enhancers is a movement more than just a fad. These enhancers, which come from nature's own pantry, are the hidden components bakers have been waiting for—a means to better their work without sacrificing their values. Nonetheless, there are certain difficulties facing the worldwide market for organic bread improvers. Similar to a finicky sourdough starting, it needs cautious care and attention. There are numerous regulatory obstacles since different nations have varied ideas about what is considered "organic." This leads to a complicated web of compliance problems that affect distributors as well as producers. The market is witnessing an intriguing interaction between technology and tradition as well. Although the fundamental philosophy is still based on natural, organic substances, state-of-the-art biotechnology is being used to increase these improvers' effectiveness. Enzyme engineering, for instance, is opening up new possibilities for creating bread with extended shelf life and improved nutritional profiles – all while staying true to organic principles.

Key Market Insights:

The demand for organic bread improvers grew by 12% year-over-year from 2022 to 2023. Over 70% of consumers prefer bread made with organic improvers over conventional ones.

Approximately 40% of organic bread improvers are used in artisanal bakeries. Industrial bakeries account for 35% of the organic bread improvers market. The home baking segment holds a 25% share of the organic bread improvers market.

Wheat-based bread accounts for 60% of the application of organic bread improvers. Gluten-free bread makes up 20% of the organic bread improvers market. Whole grain bread represents 5% of the market for organic bread improvers.

In 2023, sales of organic bread improvers increased by 10% in North America.

Around 30% of organic bread improvers are sold through online channels. Supermarkets and hypermarkets account for 40% of the distribution of organic bread improvers.

Organic bread improvers with enzymatic formulations account for 50% of the market.

Clean-label organic bread improvers hold a 30% market share.

Organic Bread Improvers Market Drivers:

The Rise of Health-Conscious Consumerism in the Baking Industry.

Consumer attitudes regarding food have seen a seismic shift in recent years, with health and well-being now taking precedence over other factors when making purchases. The baking sector, which has historically been linked to indulgence rather than nourishment, has not been spared from this paradigm shift. Growing awareness of how food choices affect overall health has led to customers seeking healthier options even in categories that were previously thought to be out of reach for health-conscious people. The product category known as "organic bread improvers" is one that exemplifies this union of enjoyment and health. These cutting-edge additions follow organic guidelines while improving the texture, quality, and shelf life of bread products. Organic bread improvers, in contrast to their conventional counterparts, are devoid of artificial chemicals and genetically modified organisms (GMOs), conforming to the clean label trend that has swept through the food industry.

In recent years, we've witnessed a fascinating phenomenon in the world of bread: the artisanal bread renaissance.

The mass-produced, frequently bland bread that dominated store shelves for decades gave rise to the artisanal bread movement. Customers started looking for bread with character—crunchy exteriors, chewy innards, and complex flavors created through lengthy fermentation processes—after becoming weary of tasteless, texture-less loaves. Due to this change in consumer preferences, artisanal bakeries are springing up everywhere, and home baking, especially sourdough and other traditional baking methods, is becoming more and more popular. The reality is that creating consistently high-quality artisanal bread at scale is incredibly challenging. Traditional methods are time-consuming, labor-intensive, and subject to variations in ingredients, temperature, and humidity. For small-batch bakers, these challenges are part of the craft. But for larger operations looking to meet the growing demand for artisanal-style breads, they present significant hurdles. This driver is further fueled by the growing interest in global bread varieties. As consumers become more adventurous in their tastes, they're seeking out bread from different cultures – from German vollkornbrot to Indian naan to Turkish simit.

Organic Bread Improvers Market Restraints and Challenges:

Tight regulations surrounding organic certification are one of the main challenges faced by organic bread improvers. The usage of certain ingredients and the methods for sourcing them are governed by stringent regulations that manufacturers must follow. Because different nations and areas may have differing definitions for what constitutes "organic," this leads to a virtual maze of compliance concerns. It can be challenging for businesses to create products that satisfy organic standards in a variety of markets as a result of the patchwork of rules that are created. Constrained supply chains make the search for appropriate organic ingredients even more difficult. Even with its continued growth, the organic agricultural industry still contributes very little to the world's food production. It might therefore be a major challenge to find reliable, premium organic components in enough amounts.

Organic Bread Improvers Market Opportunities:

The market for these organic improvers is as diverse as the breads they help create. From sourdough starters enriched with organic acids to vitamin C derived from acerola cherries, the possibilities are as endless as a baker's imagination. Some improvers harness the power of ancient grains, bringing the nutritional wisdom of our ancestors to modern loaves. Others tap into the potential of fruit-based fibers, not only improving texture but also adding a subtle sweetness that lingers on the palate. One of the most exciting prospects in this field is the development of improvers tailored to specific types of bread. Imagine a line of organic improvers designed explicitly for gluten-free bread, helping to overcome the textural challenges that have long plagued this segment of the market. Or consider the potential for improvers that enhance the nutritional profile of whole grain breads, making them more appealing to consumers who might otherwise shy away from denser, heartier loaves. The global nature of the bread market also opens up intriguing possibilities for cross-cultural innovation. As bakers around the world experiment with fusion cuisines, there's a growing need for organic improvers that can bridge the gap between different baking traditions. A Japanese baker looking to perfect their baguettes might turn to an improver that combines the enzymatic activity of koji with the protein-strengthening properties of vital wheat gluten.

ORGANIC BREAD IMPROVERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company (ADM), Associated British Foods plc, Bakels Sweden AB, Corbion NV, DuPont de Nemours Inc., Ireks GmbH, Royal DSM NV, Lesaffre, Oriental Yeast Co. Ltd. (Nisshin Seifun Group Inc.), Oy Karl Fazer Ab., Puratos Group, Riken Vitamin Co. Ltd., Agropur Dairy Cooperative, Laucke Flour Mills |

Organic Bread Improvers Market Segmentation: By Types

-

Enzyme-based improvers

-

Emulsifier-based improvers

-

Oxidizing agents

-

Reducing agents

-

Fiber-rich improvers

-

Vitamin and mineral blends

-

Protein-fortified improvers

-

Sourdough starters

-

Natural preservatives

-

Texture enhancers

The dominance of emulsifier-based improvers lies in their multifaceted benefits. They are the Swiss Army knives of the baking world, capable of improving dough strength, enhancing gas retention, and creating a finer, more uniform crumb structure. But their prowess doesn't end there. Emulsifiers also play a crucial role in extending shelf life, maintaining bread softness, and preventing staling – qualities that are particularly prized in the organic bread market, where artificial preservatives are persona non grata.

Enzyme-based solutions have emerged as the fastest-growing category, riding the wave of biotechnological innovation. These microscopic miracles are nature's own catalysts, accelerating chemical reactions within the dough to unlock flavors, textures, and nutritional benefits that were once thought impossible. The rapid growth of enzyme-based improvers is further fueled by their versatility. Bakers can fine-tune enzyme blends to achieve specific outcomes, whether it's extending shelf life without artificial preservatives, enhancing browning for that Instagram-worthy crust, or improving dough machinability for large-scale production. This adaptability has made enzyme-based improvers the darling of both artisanal bakeries and industrial organic bread manufacturers.

Organic Bread Improvers Market Segmentation: By Distribution Channel

-

Specialty organic stores

-

Supermarkets and hypermarkets

-

Online retailers

-

Bakery supply shops

-

Farmers' markets

-

Food service providers

-

Direct-to-consumer (DTC) channels

Supermarkets and hypermarkets stand as the most dominant distribution channels in the organic bread improvers market. These retail giants, with their vast floor space and diverse product offerings, have become the go-to destination for both professional bakers and home enthusiasts seeking organic baking ingredients. The dominance of supermarkets and hypermarkets in this niche is a testament to their ability to evolve with changing consumer preferences. Once relegated to a small "health food" section, organic products, including bread improvers, now command prime shelf space in many stores. This shift reflects the mainstreaming of organic food and the growing consumer demand for clean-label, natural ingredients. Online retailers have emerged as the fastest-growing segment, riding the crest of the e-commerce wave that has transformed nearly every aspect of modern commerce. This digital revolution in the distribution of organic bread improvers is more than just a matter of convenience; it represents a fundamental shift in how bakers, both professional and amateur, discover, research, and purchase these essential ingredients. The rise of online retail in this niche market is driven by several factors that align perfectly with the needs and values of organic-minded consumers. First and foremost is the unmatched convenience. With just a few clicks, bakers can compare products, read reviews from fellow enthusiasts, and have their chosen improvers delivered directly to their doorstep. This ease of access has democratized the use of organic bread improvers, allowing hobbyist bakers to experiment with professional-grade ingredients and techniques.

Organic Bread Improvers Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

With 30% of the global market for organic bread improvers, Europe is the region with the most share. A greater consciousness of environmental sustainability and consumer health has led to a considerable desire for organic and clean-label food items among European consumers. Bread and bakery goods are included in this trend, which has created a significant market for organic bread enhancers. High levels of quality and safety are guaranteed by the strict laws and certifications enforced by the European Union for organic food items. The market is expanding because of the increased customer confidence these restrictions have given organic products.

In the market for organic bread improvers, Asia-Pacific is expanding at the highest rate, while only having a 20% share at the moment. Consumers in the Asia-Pacific area are becoming more conscious about wellness and health. The demand for natural and organic food items, such as bread improvers, is rising as a result of this change in consumer behavior. Higher disposable incomes are a result of economic expansion in nations like China. Because of this, people are prepared to pay extra for high-end and organic food products, such as baked goods.

COVID-19 Impact Analysis on the Organic Bread Improvers Market:

The early days of the pandemic were marked by a chaotic ballet of supply and demand. As lockdowns enforced a new normal, the demand for essential commodities, including bread and its constituents, skyrocketed. This unexpected surge caught the organic bread improvers industry off guard. The intricate web of global supply chains, essential for sourcing organic ingredients, was disrupted. Lockdowns, transportation restrictions, and labor shortages created bottlenecks, leading to shortages and price fluctuations. Panic buying became the norm, emptying shelves of essential items, including flour, yeast, and consequently, organic bread improvers. This unprecedented demand overwhelmed the industry, straining production capacities.

Latest Trends/ Developments:

Products with clear, uncomplicated ingredient lists are more appealing to consumers. Natural substitutes for artificial additives, such as organic bread improvers, are a great fit for this trend. Organic and natural food demand has increased as well-being and health have become more important. Increasingly popular are bread improvers that fit these requirements. Organic bread improvers are being created to improve shelf life, taste, and texture by utilizing the power of fermentation and enzymes. The inclusion of functional ingredients like prebiotics, probiotics, and antioxidants is gaining momentum, positioning organic bread improvers as contributors to overall well-being. Manufacturers are adopting sustainable practices, reducing their environmental footprint, and minimizing waste. Adherence to stringent organic certification standards is mandatory for product labeling and market access.

Key Players:

-

Archer Daniels Midland Company (ADM)

-

Associated British Foods plc

-

Bakels Sweden AB

-

Corbion NV

-

DuPont de Nemours Inc.

-

Ireks GmbH

-

Royal DSM NV

-

Lesaffre

-

Oriental Yeast Co. Ltd. (Nisshin Seifun Group Inc.)

-

Oy Karl Fazer Ab.

-

Puratos Group

-

Riken Vitamin Co. Ltd.

-

Agropur Dairy Cooperative

-

Laucke Flour Mills

Chapter 1. Organic Bread Improvers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organic Bread Improvers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organic Bread Improvers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organic Bread Improvers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organic Bread Improvers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organic Bread Improvers Market – By Types

6.1 Introduction/Key Findings

6.2 Enzyme-based improvers

6.3 Emulsifier-based improvers

6.4 Oxidizing agents

6.5 Reducing agents

6.6 Fiber-rich improvers

6.7 Vitamin and mineral blends

6.8 Protein-fortified improvers

6.9 Sourdough starters

6.10 Natural preservatives

6.11 Texture enhancers

6.12 Y-O-Y Growth trend Analysis By Types

6.13 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Organic Bread Improvers Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Specialty organic stores

7.3 Supermarkets and hypermarkets

7.4 Online retailers

7.5 Bakery supply shops

7.6 Farmers' markets

7.7 Food service providers

7.8 Direct-to-consumer (DTC) channels

7.9 Y-O-Y Growth trend Analysis By Distribution Channel

7.10 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Organic Bread Improvers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Organic Bread Improvers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company (ADM)

9.2 Associated British Foods plc

9.3 Bakels Sweden AB

9.4 Corbion NV

9.5 DuPont de Nemours Inc.

9.6 Ireks GmbH

9.7 Royal DSM NV

9.8 Lesaffre

9.9 Oriental Yeast Co. Ltd. (Nisshin Seifun Group Inc.)

9.10 Oy Karl Fazer Ab.

9.11 Puratos Group

9.12 Riken Vitamin Co. Ltd.

9.13 Agropur Dairy Cooperative

9.14 Laucke Flour Mills

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumers are increasingly conscious about their dietary choices, and organic bread improvers align with the trend towards healthier and cleaner eating.

Organic ingredients and production processes often incur higher costs compared to conventional alternatives, affecting product pricing.

Archer Daniels Midland Company (ADM), Associated British Foods plc, Bakels Sweden AB, Corbion NV, DuPont de Nemours Inc., Ireks GmbH, Royal DSM NV, Lesaffre, Oriental Yeast Co. Ltd. (Nisshin Seifun Group Inc.), Oy Karl Fazer Ab., Puratos Group, Riken Vitamin Co. Ltd., Agropur Dairy Cooperative, Laucke Flour Mills.

Europe is the most dominant region in the market, accounting for approximately 35% of the total market share.

Asia-Pacific although currently holding a smaller market share of 20%, is the fastest-growing region in the market.