Organic Beverage Market Size (2024 – 2030)

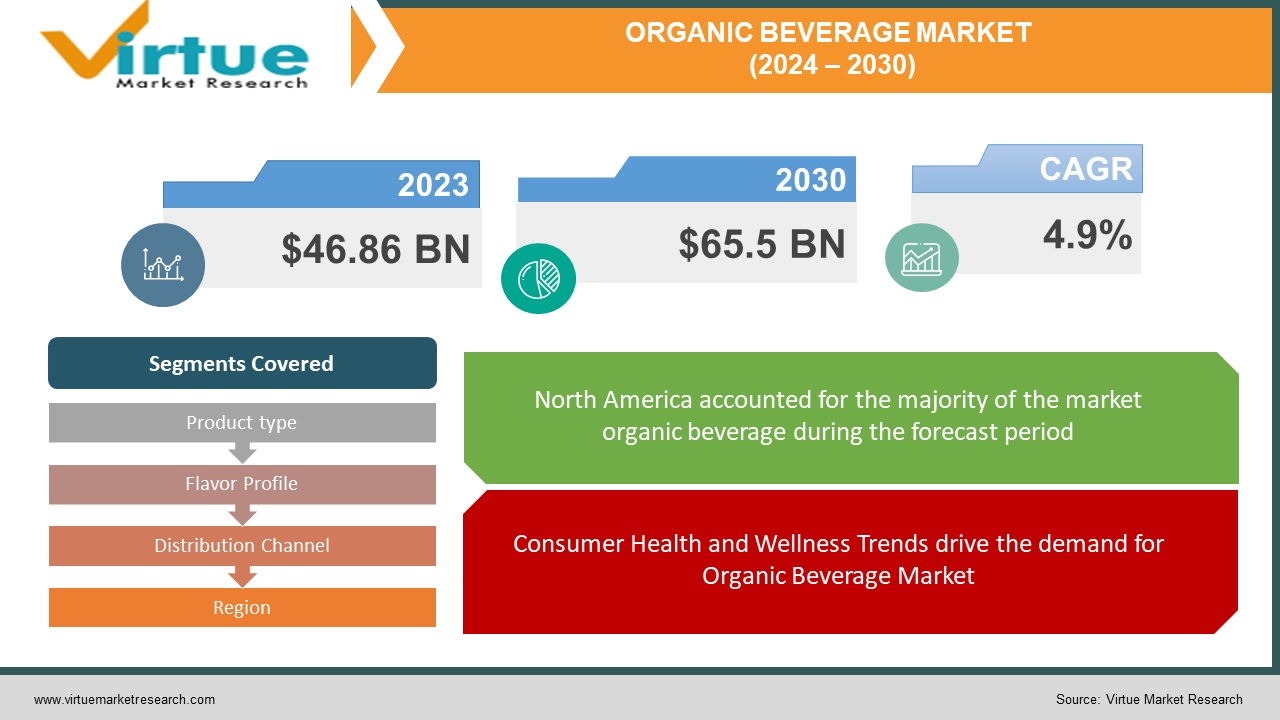

The Global Organic Beverage Market was valued at USD 46.86 billion and is projected to reach a market size of USD 65.5 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.9%.

The organic beverage market includes a wide range of products, such as organic juices, organic tea, organic coffee, organic functional beverages, and organic plant-based milk alternatives. Consumers are becoming more aware of the potential health benefits associated with organic beverages. They are looking for products that are free from synthetic additives, pesticides, and genetically modified organisms (GMOs). The Organic Beverage Market is expected to grow significantly in the coming years due to increasing consumer demand for healthier and more sustainable food and beverage options. The major well-established key players in the Organic Beverage Market are Hain Celestial Group, Nature's Best, Suja Juice, Organic Valley, and Purity Organic.

Key Market Insights:

Organic beverages are commonly available in health food stores, supermarkets, and online platforms. The convenience of e-commerce allows consumers to access a variety of organic beverage options easily. Companies are investing in research and development to introduce innovative organic beverage products, catering to various consumer preferences, including flavors, functional ingredients, and nutritional profiles. Consumers are increasingly interested in supporting brands that adopt sustainable and ethical practices. Growing consumer health consciousness and increasing emphasis on sustainability are propelling the Organic Beverage Market. The restraints on the Organic Beverage Market include higher production costs and supply chain challenges. North America occupies the highest share of the Organic Beverage Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Organic Beverage Market Drivers:

Consumer Health and Wellness Trends drive the demand for Organic Beverage Market

One of the key drivers of the organic beverage market is the increasing emphasis on health and wellness among consumers. People are becoming more health-conscious. They seek products perceived as healthier and more natural. Organic beverages are healthier alternatives to conventional counterparts, as they are often free from synthetic pesticides, herbicides, and genetically modified organisms (GMOs). Consumers are becoming more aware of the potential health risks associated with consuming chemical residues present in non-organic products. This leads to a preference for organic options. This consumer trend drives the demand for organic beverages across various categories, including organic juices, teas, coffees, and plant-based milk alternatives. Companies that effectively communicate the health benefits of their organic products are likely to see increased consumer trust and loyalty. This also contributes to the growth of functional beverages, where organic ingredients are often associated with additional health-promoting properties.

Sustainability and Environmental Concerns are propelling the Organic Beverage Market

The growing awareness of environmental issues and sustainability plays a significant role in driving the organic beverage market. Consumers are increasingly concerned about the environmental impact of food and beverage production. This includes issues such as soil health, water conservation, and the use of synthetic chemicals in agriculture. Organic farming practices avoid synthetic pesticides and prioritize soil health. This appeals to environmentally conscious consumers. Brands that adopt sustainable and eco-friendly practices, such as using biodegradable packaging or supporting fair trade initiatives, are gaining favor among consumers. As a result, companies that demonstrate a commitment to environmentally friendly practices are often better positioned to capitalize on the growing demand for organic beverages.

Organic Beverage Market Restraints and Challenges

The major challenge faced by the Organic Beverage Market is the higher cost of production. This can limit the affordability of organic beverages for some consumers, potentially restricting market penetration. It poses a challenge for organic beverage producers to maintain competitive pricing and profit margins. Another challenge is the instabilities in the organic supply chain. This can affect the consistency of product availability and lead to challenges in maintaining a steady production flow. Companies need to invest in building resilient supply chains and establishing relationships with reliable organic ingredient suppliers to mitigate these challenges.

Organic Beverage Market Opportunities:

The Organic Beverage Market has various opportunities in the market. The increasing consumer demand for functional and innovative organic beverages creates opportunities for product diversification. Rising interest in exotic and unique organic ingredients offers opportunities for differentiation and premium positioning. Expanding e-commerce platforms provide a broader reach for organic beverage brands. Collaborations with local farmers and the adoption of regenerative agriculture practices enhance sustainability and supply chain resilience. Addressing the demand for low-sugar and natural sweeteners in organic beverages aligns with health-conscious consumer preferences. Strategic marketing emphasizing health benefits, ethical sourcing, and eco-friendly packaging attracts environmentally conscious consumers.

ORGANIC BEVERAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Product type, Flavor Profile, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hain Celestial Group, Nature's Best, Organic Gemini, Suja Juice, Organic Valley, Odwalla (Coca-Cola), Purity Organic, Organic Gemini, R.W. Knudsen Family, Alnatura |

Organic Beverage Market Segmentation: By Product Type

-

Organic Juices

-

Organic Tea

-

Organic Coffee

-

Organic Soft Drinks

-

Organic Functional Beverages

-

Organic Plant-Based Milk Alternatives

In 2023, based on market segmentation by Product Type, Organic Plant-Based Milk Alternatives occupy the highest share of the Organic Beverage Market. This is mainly due to the increasing shift towards plant-based diets, driven by health and environmental considerations. Plant-based milk alternatives, such as organic almonds, soy, oats, and coconut milk, have gained significant popularity.

However, organic functional beverages are also the fastest-growing segment during the forecast period and are projected to grow at a CAGR of 12%. This is due to increasing demand for beverages that offer not just refreshments but also health benefits. Organic functional beverages include organic energy drinks, sports drinks, and probiotic beverages.

Organic Beverage Market Segmentation: By Flavor Profile

-

Fruit Flavors (e.g., apple, berry, citrus)

-

Herbal and Botanical Infusions

-

Coffee Blends

-

Spiced Varieties

In 2023, based on market segmentation by Flavor Profile, the Fruit flavors segment occupies the highest share of the Organic Beverage Market. This is mainly due to its versatility, catering to a wide range of preferences, and often appealing to those seeking refreshing and familiar tastes. Fruit flavors, such as apple, berry, and citrus, are traditionally popular and accessible to a broad consumer base.

However, Herbal and botanical infusions are the fastest-growing segment during the forecast period. This is mainly due to the increasing demand for unique and health-oriented beverage options. Consumers are drawn to the perceived wellness benefits associated with herbs, making this a potential fast-growing niche.

Organic Beverage Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online Retail (E-commerce)

-

Convenience Stores

-

Foodservice (Restaurants, Cafes)

In 2023, based on market segmentation by the Distribution Channel, the Supermarkets and hypermarkets occupy the highest share of the Organic Beverage Market. This is mainly due to their widespread reach. Supermarkets and hypermarkets can offer a diverse range of products to a broad consumer base.

However, Online Retail (E-commerce) is the fastest-growing segment during the forecast period. This growth is driven by the convenience of online shopping, especially for health-conscious and niche products like organic beverages.

Organic Beverage Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Organic Beverage Market. This growth is due to the well-established consumer base with a high awareness of health and sustainability. The United States and Canada, have traditionally been a significant market for organic beverages. North America is a technologically advanced region with a well-established consumer base with a strong preference for organic and natural products, contributing to its prominence in the organic beverage market.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the increasing consumer awareness of health and wellness, coupled with a rising middle class and changing lifestyles. Countries like China, Japan, and India have significant market shares due to increasing urbanization, rising disposable incomes, and a growing awareness of health and wellness.

COVID-19 Impact Analysis on the Global Organic Beverage Market:

The COVID-19 pandemic had a significant impact on the Organic Beverage Market. The pandemic led to travel restrictions, lockdowns, disruptions in global supply chains and safety measures. This affected the sourcing of organic ingredients and impacted the transportation and availability of raw materials, potentially affecting production. The closure or restrictions on restaurants, cafes, and other food service establishments impacted the consumption of organic beverages in these venues. During the pandemic, there was increased interest in health and wellness, economic uncertainties might have led some consumers to opt for more budget-friendly choices, impacting premium organic products. The pandemic accelerated the adoption of online shopping. E-commerce platforms became important for the organic beverage market, providing consumers with a convenient and safe way to purchase products.

Latest Trends/ Developments:

Brands are exploring unique and exotic flavor profiles, as well as creative blends of fruits, herbs, and spices to differentiate their products and cater to diverse consumer preferences. Consumers are increasingly interested in organic beverages with functional ingredients, including adaptogens, superfoods, and botanical extracts. This is believed to offer health benefits beyond basic nutrition. There is a growing trend for organic beverages with lower sugar content and the use of natural sweeteners. Consumers demand healthier alternatives without sacrificing taste. There is a surge in plant-based innovations, including organic plant-based protein drinks and beverages made from alternative ingredients like hemp, flaxseed, and pea protein.

Key Players:

-

Hain Celestial Group

-

Nature's Best

-

Organic Gemini

-

Suja Juice

-

Organic Valley

-

Odwalla (Coca-Cola)

-

Purity Organic

-

Organic Gemini

-

R.W. Knudsen Family

-

Alnatura

Market News:

In January 2023, Califia Farms launched USDA-certified Organic Oatmilk and Almondmilk, featuring minimal ingredients—purified water, sea salt, oats/almonds. Priced at $5.99 and $6.49 (48-ounce bottles) respectively, these dairy-free options offer simplicity and accessibility.

Chapter 1. Organic Beverage Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organic Beverage Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organic Beverage Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organic Beverage Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organic Beverage Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organic Beverage Market – By Product Type

6.1 Introduction/Key Findings

6.2 Organic Juices

6.3 Organic Tea

6.4 Organic Coffee

6.5 Organic Soft Drinks

6.6 Organic Functional Beverages

6.7 Organic Plant-Based Milk Alternatives

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Organic Beverage Market – By Flavor Profile

7.1 Introduction/Key Findings

7.2 Fruit Flavors (e.g., apple, berry, citrus)

7.3 Herbal and Botanical Infusions

7.4 Coffee Blends

7.5 Spiced Varieties

7.6 Y-O-Y Growth trend Analysis By Flavor Profile

7.7 Absolute $ Opportunity Analysis By Flavor Profile, 2024-2030

Chapter 8. Organic Beverage Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3 Specialty Stores

8.4 Online Retail (E-commerce)

8.5 Convenience Stores

8.6 Foodservice (Restaurants, Cafes)

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Organic Beverage Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Flavor Profile

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Flavor Profile

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Flavor Profile

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Flavor Profile

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Flavor Profile

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Organic Beverage Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Hain Celestial Group

10.2 Nature's Best

10.3 Organic Gemini

10.4 Suja Juice

10.5 Organic Valley

10.6 Odwalla (Coca-Cola)

10.7 Purity Organic

10.8 Organic Gemini

10.9 R.W. Knudsen Family

10.10 Alnatura

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

AnsThe Global Organic Beverage Market was valued at USD 46.86 billion and is projected to reach a market size of USD 65.5 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.9%.

Growing consumer health consciousness and increasing emphasis on sustainability are the market drivers of the Global Organic Beverage Market.

Organic Juices, Organic Tea, Organic Coffee, Organic Soft Drinks, Organic Functional Beverages, and Organic Plant-Based Milk Alternatives are the segments under the Global Organic Beverage Market by Product Type.

North America is the most dominant region for the Global Organic Beverage Market.

Hain Celestial Group, Nature's Best, Suja Juice, Organic Valley, and Purity Organic are the key players in the Global Organic Beverage Market.