Optoelectronic Components Market Size (2024 – 2030)

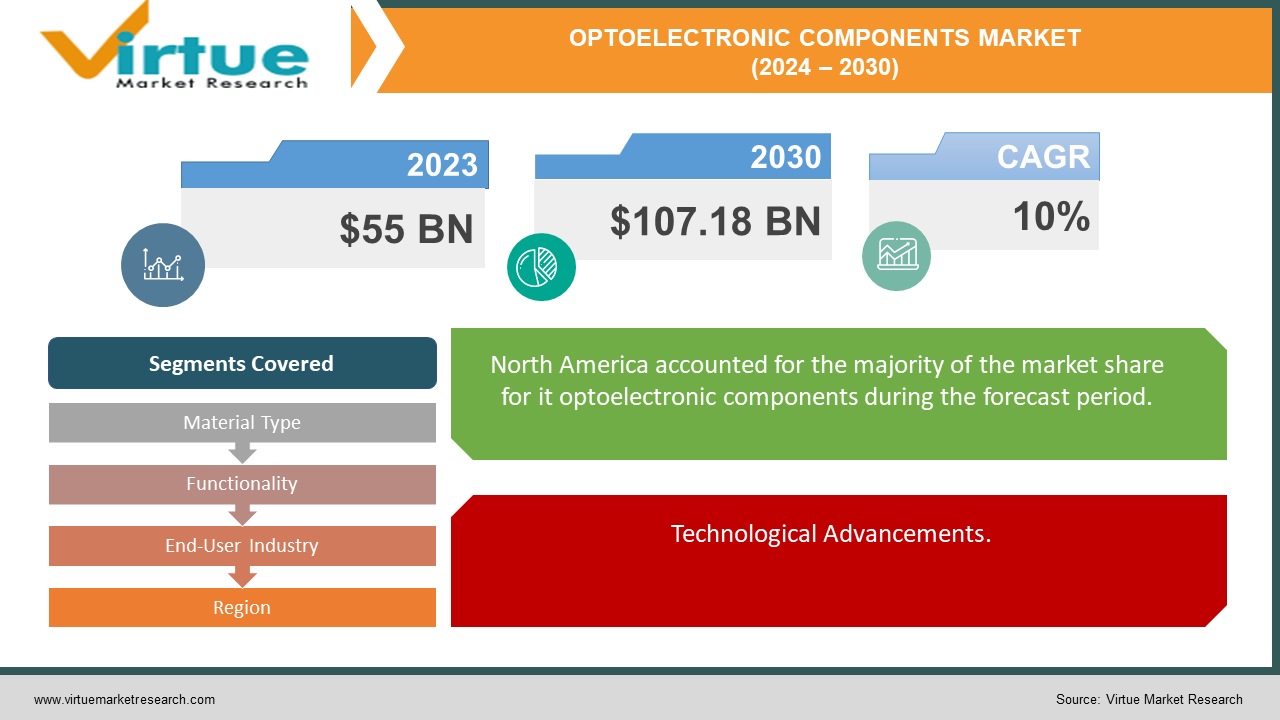

The market for optoelectronic components was estimated to be worth USD 55 billion in 2023 and is expected to increase to USD 107.18 billion by 2030, with a projected compound annual growth rate (CAGR) of 10% from 2024 to 2030.

Key drivers of this growth include the proliferation of consumer electronics, advancements in automotive technologies such as electric vehicles and advanced driver-assistance systems (ADAS), and the expanding applications in industrial automation and healthcare. Additionally, the telecommunications sector's shift towards fiber optic communications and the energy sector's increasing adoption of photovoltaic cells for solar energy are significant contributors to market expansion. Geographically, the Asia-Pacific region is expected to dominate the market, with significant contributions from North America and Europe due to their technological advancements and strong industrial bases.

Key Insights:

In 2023, the consumer electronics segment accounted for 35% of the total market share, driven by high demand for smartphones, tablets, and wearables.

The automotive sector is projected to see a CAGR of 11% from 2023 to 2030, fueled by the increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs).

Optoelectronic components in the healthcare sector are anticipated to grow at a CAGR of 10% during the forecast period, driven by advancements in medical imaging and diagnostic tools.

In 2023, supply chain disruptions led to a 15% increase in lead times for optoelectronic components.

Global Optoelectronic Components Market Drivers:

Technological Advancements.

Technological advancements in optoelectronics are significantly driving market growth. Innovations such as the development of more efficient LEDs, high-performance image sensors, and advanced laser diodes are enhancing the functionality and application range of optoelectronic components. These advancements are enabling their integration into various high-tech applications, including augmented reality (AR), virtual reality (VR), and advanced medical devices, thereby expanding the market potential.

Increasing Demand in Consumer Electronics.

The surge in demand for consumer electronics is a major driver for the optoelectronic components market. With the proliferation of smartphones, tablets, laptops, and wearable devices, the need for components such as LEDs, image sensors, and photodetectors is rising. These components are crucial for enhancing display quality, improving camera performance, and enabling biometric security features, making them indispensable in the rapidly evolving consumer electronics sector.

Growth in Automotive Applications.

The automotive industry's shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is boosting the demand for optoelectronic components. Components like laser diodes and image sensors are integral to ADAS, providing functionalities such as collision detection, lane departure warnings, and adaptive cruise control. As the automotive sector continues to innovate and integrate more sophisticated electronic systems, the demand for high-quality optoelectronic components is expected to increase significantly.

Global Optoelectronic Components Market Restraints and Challenges:

High Initial Costs.

One of the significant restraints in the global optoelectronic components market is the high initial costs associated with these technologies. The development and manufacturing of optoelectronic components, such as high-performance LEDs and advanced image sensors, require substantial investment in research and development, specialized equipment, and materials. These high initial costs can be a barrier for small and medium-sized enterprises (SMEs) and new market entrants, limiting the market's growth potential.

Supply Chain Disruptions.

Supply chain disruptions pose a considerable challenge to the optoelectronic components market. Events such as geopolitical tensions, natural disasters, and global pandemics can lead to interruptions in the supply of raw materials and components. These disruptions can result in increased lead times, higher costs, and difficulties in meeting production schedules. To mitigate these risks, companies need to implement robust supply chain management strategies and diversify their supplier base.

Rapid Technological Changes.

The fast pace of technological change in the optoelectronics industry can be a double-edged sword. While it drives innovation and market growth, it also poses challenges for manufacturers to keep up with the latest advancements and standards. Companies need to continuously invest in research and development to stay competitive, which can strain financial and human resources. Additionally, the rapid obsolescence of existing technologies can lead to inventory management issues and increased costs for upgrading manufacturing processes. To address this, firms must adopt agile development practices and maintain close collaboration with research institutions and industry partners.

Global Optoelectronic Components Market Opportunities:

Expansion in Renewable Energy Applications.

The growing emphasis on renewable energy sources presents significant opportunities for the optoelectronic components market. Photovoltaic cells, a key optoelectronic component, are crucial for converting solar energy into electricity. With increasing global investments in solar power infrastructure and a push towards sustainable energy solutions, the demand for high-efficiency photovoltaic cells is expected to surge. This opens up substantial growth avenues for manufacturers specializing in optoelectronic components designed for renewable energy applications.

Rising Adoption of Smart Home Devices.

The increasing adoption of smart home devices presents a lucrative opportunity for the optoelectronic components market. Smart home technology, encompassing smart lighting, security systems, and home automation devices, relies extensively on optoelectronic components like LEDs, sensors, and photodetectors. As consumer interest in smart home technology grows, driven by the desire for convenience, energy efficiency, and enhanced security, the market for these components is poised for substantial expansion. This trend is further supported by advancements in Internet of Things (IoT) technology, which integrates optoelectronics into a broader ecosystem of connected devices.

OPTOELECTRONIC COMPONENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Material Type, Functionality, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Broadcom Inc., Sony Corporation, Samsung Electronics Co., Ltd., Nichia Corporation, OSRAM Licht AG, Cree, Inc., Hamamatsu Photonics K.K., Philips Photonics,Finisar Corporation, II-VI Incorporated, Texas Instruments Incorporated, Panasonic Corporation |

Optoelectronic Components Market Segmentation: By Material Type

-

Silicon

-

Gallium Arsenide (GaAs)

-

Indium Phosphide (InP)

-

Gallium Nitride (GaN)

-

Silicon Carbide (SiC)

Gallium Nitride (GaN) is emerging as one of the most effective materials in the global optoelectronic components market, primarily due to its superior properties and wide-ranging applications. GaN offers exceptional efficiency, high thermal conductivity, and robustness, making it an ideal material for high-power and high-frequency applications. Its ability to operate at higher temperatures and voltages compared to traditional materials like silicon makes GaN highly suitable for use in advanced LEDs, power electronics, and RF (radio frequency) components. The growing adoption of GaN in electric vehicles (EVs), renewable energy systems, and high-performance telecommunications infrastructure underscores its critical role in driving innovation and efficiency in optoelectronics. With continuous advancements and declining production costs, GaN is set to dominate the optoelectronic components market, providing significant performance benefits and enabling next-generation technologies.

Optoelectronic Components Market Segmentation: By Functionality

-

Illumination

-

Sensing

-

Data Communication

-

Energy Generation

Illumination stands out as one of the most effective segments in the global optoelectronic components market, driven by the widespread adoption and continuous innovation in LED technology. LEDs are revolutionizing the lighting industry due to their superior energy efficiency, long lifespan, and environmental benefits compared to traditional incandescent and fluorescent lighting. The demand for high-quality illumination solutions spans various applications, including residential, commercial, industrial, and public infrastructure. Additionally, advancements in LED technology, such as smart lighting systems and human-centric lighting, are further enhancing the market potential. The increasing focus on sustainability and energy conservation globally is propelling the growth of the illumination segment, making it a critical area of development and investment in the optoelectronic components market.

Optoelectronic Components Market Segmentation: By End-User Industry

-

Consumer Electronics

-

Automotive, Industrial

-

Telecommunication

-

Healthcare

-

Aerospace & Defense

-

Energy & Utilities

Among the diverse end-user industries driving demand for optoelectronic components, the telecommunications sector emerges as one of the most impactful and dynamic segments. Rapid advancements in telecommunications technologies, coupled with the exponential growth in data consumption and connectivity requirements, propel the demand for high-performance optoelectronic devices. Fiber optic networks, in particular, form the backbone of modern telecommunications infrastructure, enabling high-speed data transmission over vast distances with minimal latency and signal degradation. Optical transceivers, lasers, and photodetectors play pivotal roles in ensuring the efficiency and reliability of these networks. Moreover, the ongoing transition to 5G networks and the emergence of technologies like the Internet of Things (IoT) and cloud computing further amplify the importance of optoelectronic components in enabling faster, more reliable, and higher-capacity communication networks. As telecommunications continue to evolve and expand, the demand for innovative optoelectronic solutions is expected to remain robust, driving growth and innovation in the global optoelectronic components market.

Optoelectronic Components Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Among the regional markets for optoelectronic components, North America stands out as the most influential and dynamic. With a commanding market share of 37%, North America leads the global optoelectronic components market, driven by robust technological innovation, substantial investments in research and development, and a strong presence of key industry players. The region is home to major technology hubs, including Silicon Valley in the United States and technology clusters in Canada, fostering a conducive environment for the development and adoption of cutting-edge optoelectronic technologies. Moreover, North America boasts a highly developed telecommunications infrastructure, which drives significant demand for optoelectronic components in applications such as fiber optic networks, data centers, and high-speed communication systems. Additionally, the region's automotive, aerospace, and healthcare sectors contribute to the demand for optoelectronic components, fueling further growth. With a combination of technological prowess, robust infrastructure, and a thriving market ecosystem, North America is poised to maintain its leading position in the global optoelectronic components market.

COVID-19 Impact Analysis on the Global Optoelectronic Components Market:

The COVID-19 pandemic has had a profound impact on the global optoelectronic components market, disrupting supply chains, dampening demand, and altering consumer behavior. During the initial phases of the pandemic, widespread lockdowns and restrictions on manufacturing and trade resulted in supply chain disruptions, leading to delays in production and delivery of optoelectronic components. Moreover, the economic downturn caused by the pandemic led to decreased consumer spending, particularly in sectors such as automotive, consumer electronics, and industrial manufacturing, which are significant consumers of optoelectronic components. However, as the pandemic accelerated digital transformation efforts across various industries, there was an increased demand for optoelectronic components supporting remote work, online education, telemedicine, and e-commerce. Additionally, the rollout of 5G networks and the continued expansion of data centers to support remote operations and digital services provided a growth opportunity for optoelectronic component manufacturers. Looking ahead, while the immediate impact of the pandemic has been challenging, the long-term prospects for the optoelectronic components market remain promising, driven by the increasing adoption of advanced technologies and the growing demand for high-speed data transmission and connectivity solutions.

Latest Trends/ Developments:

The global optoelectronic components market is witnessing several significant trends and developments that are shaping its trajectory in the coming years. One notable trend is the increasing integration of optoelectronic components in emerging technologies such as the Internet of Things (IoT), artificial intelligence (AI), and autonomous vehicles. This integration is driven by the demand for enhanced sensing, imaging, and communication capabilities in various applications. Additionally, advancements in materials science and manufacturing techniques are enabling the development of smaller, more efficient, and cost-effective optoelectronic devices, expanding their potential applications across industries. Furthermore, the rising demand for high-speed data transmission and bandwidth-intensive applications is driving innovation in optical communication technologies, including the development of silicon photonics and photonic integrated circuits. Moreover, there is a growing emphasis on sustainability and energy efficiency, leading to the adoption of optoelectronic components in renewable energy systems, smart lighting, and energy-efficient displays. Overall, these trends signify the increasing importance of optoelectronic components in enabling technological advancements and addressing the evolving needs of industries and consumers.

Key Players:

-

Broadcom Inc.

-

Sony Corporation

-

Samsung Electronics Co., Ltd.

-

Nichia Corporation

-

OSRAM Licht AG

-

Cree, Inc.

-

Hamamatsu Photonics K.K.

-

Philips Photonics

-

Finisar Corporation

-

II-VI Incorporated

-

Texas Instruments Incorporated

-

Panasonic Corporation

Chapter 1. Optoelectronic Components Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Optoelectronic Components Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Optoelectronic Components Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Optoelectronic Components Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Optoelectronic Components Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Optoelectronic Components Market – By Material Type

6.1 Introduction/Key Findings

6.2 Silicon

6.3 Gallium Arsenide (GaAs)

6.4 Indium Phosphide (InP)

6.5 Gallium Nitride (GaN)

6.6 Silicon Carbide (SiC)

6.7 Y-O-Y Growth trend Analysis By Material Type

6.8 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 7. Optoelectronic Components Market – By Functionality

7.1 Introduction/Key Findings

7.2 Illumination

7.3 Sensing

7.4 Data Communication

7.5 Energy Generation

7.6 Y-O-Y Growth trend Analysis By Functionality

7.7 Absolute $ Opportunity Analysis By Functionality, 2024-2030

Chapter 8. Optoelectronic Components Market – By End-User Industry

8.1 Introduction/Key Findings

8.2 Consumer Electronics

8.3 Automotive, Industrial

8.4 Telecommunication

8.5 Healthcare

8.6 Aerospace & Defense

8.7 Energy & Utilities

8.8 Y-O-Y Growth trend Analysis By End-User Industry

8.9 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 9. Optoelectronic Components Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material Type

9.1.3 By Functionality

9.1.4 By By End-User Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material Type

9.2.3 By Functionality

9.2.4 By End-User Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material Type

9.3.3 By Functionality

9.3.4 By End-User Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material Type

9.4.3 By Functionality

9.4.4 By End-User Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material Type

9.5.3 By Functionality

9.5.4 By End-User Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Optoelectronic Components Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Broadcom Inc.

10.2 Sony Corporation

10.3 Samsung Electronics Co., Ltd.

10.4 Nichia Corporation

10.5 OSRAM Licht AG

10.6 Cree, Inc.

10.7 Hamamatsu Photonics K.K.

10.8 Philips Photonics

10.9 Finisar Corporation

10.10 II-VI Incorporated

10.11 Texas Instruments Incorporated

10.12 Panasonic Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for optoelectronic components was estimated to be worth USD 55 billion in 2023 and is expected to increase to USD 107.18 billion by 2030, with a projected compound annual growth rate (CAGR) of 10% from 2024 to 2030.

The primary drivers of the global optoelectronic components market include increasing demand for high-speed data transmission, growing adoption of smartphones and consumer electronics, advancements in healthcare technology, and rising investments in automotive safety and automation.

The key challenges facing the global optoelectronic components market include pricing pressure, supply chain disruptions, and technological complexities.

In 2023, North America held the largest share of the global optoelectronic components market.

Broadcom Inc., Sony Corporation, Samsung Electronics Co., Ltd., Nichia Corporation, OSRAM Licht AG, Cree, Inc., Hamamatsu Photonics K.K., Philips Photonics, Finisar Corporation, II-VI Incorporated, Texas Instruments Incorporated, Panasonic Corporation are the main players