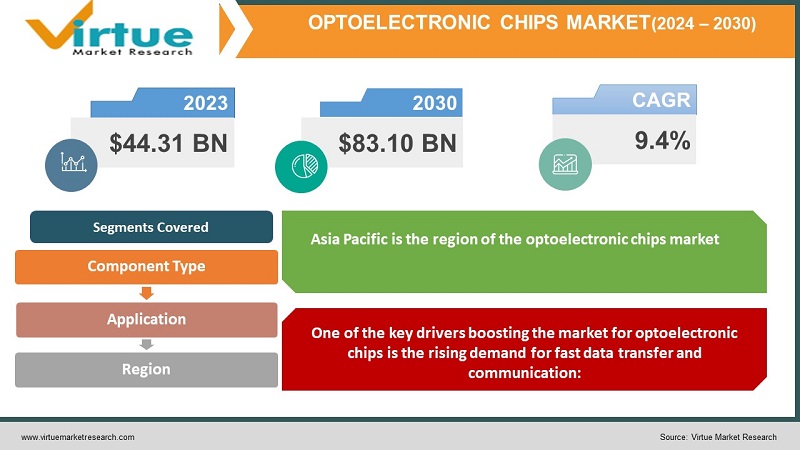

Optoelectronic Chips Market Size (2024-2030)

The Global Optoelectronic Chips Market was estimated to be worth USD 44.31 Billion in 2023 and is projected to reach a value of USD 83.10 Billion by 2030, growing at a fast CAGR of 9.4% during the outlook period 2024-2030.

Optoelectronic chips are semiconductor devices that can emit or detect light, including LEDs, lasers, photodiodes, and image sensors. They are utilized in many different applications, including data storage, sensing, illumination, display, and communication. Optoelectronic components include things like photovoltaic cells, optocouplers, image sensors, light-emitting diodes, laser diodes, and infrared components. Optoelectronic chips are superior to traditional electronic chips in several ways, including speed, size, power consumption, and dependability. Additionally, they make novel features like optical computing, optical interconnects, and quantum information processing possible. Optoelectronic chips are made of a variety of materials, such as silicon, gallium arsenide, indium phosphide, and organic compounds. They can be integrated with other electronic components using a variety of methods, including wire bonding, flip-chip bonding, and hybrid integration, either on the same chip or on distinct chips.

Global Optoelectronic Chips Market Drivers:

One of the key drivers boosting the market for optoelectronic chips is the rising demand for fast data transfer and communication:

High-speed data transport and communication are becoming more and more necessary as the internet and linked gadgets become more and more common. Optoelectronic chips are superior to conventional electronic devices in terms of data transmission rates and bandwidth, making them perfect for usage in data centers, telecommunications, and consumer electronics. High-speed data transfer and communication are required for numerous applications, including data centers, telecommunications, consumer electronics, cloud computing, and 5G networks. Large volumes of data must be transmitted quickly and reliably between several devices or over great distances for these applications to function.

The market for optoelectronic chips is anticipated to grow in the next years as healthcare adopts more of these devices:

Optoelectronic chips are being employed more frequently in medical imaging, diagnosis, and monitoring applications. These chips are perfect for use in medical equipment since they have great sensitivity and precision. Optoelectronic chips are being employed more frequently in medical imaging, diagnosis, and monitoring applications. These chips are perfect for use in medical equipment since they have great sensitivity and precision. Optical sensors can monitor a wide range of physiological parameters, including blood pressure, heart rate, oxygen saturation, blood glucose level, and body temperature. High-resolution images of tissues and organs can be obtained using optical imaging tools such as endoscopes, microscopes, cameras, and scanners.

Global Optoelectronic Chips Market Challenges:

Due to the high cost of production for optoelectronic devices, the market growth for optoelectronic chips may be hampered:

The high production costs of optoelectronic devices, which require intricate fabrication procedures, significant capital expenditures, and cutting-edge materials, are tied to the high purchase costs. the poor yield rate of optoelectronic devices which indicates that a significant portion of the produced devices are defective or fall short of quality standards also has an impact on the high acquisition cost. The optoelectronics market must overcome the high acquisition cost of optoelectronic devices by lowering production costs, boosting yield rates, and raising consumer awareness of and preference for optoelectronic products.

COVID-19 Impact on Global Optoelectronic Chips Market:

The COVID-19 epidemic has had both favorable and unfavorable effects on the world market for optoelectronic chips. Optoelectronic chip manufacture and distribution were impacted by the pandemic's effects on the worldwide supply chain. Optoelectronic device production was impacted by trade restrictions, plant closures, and logistical issues that caused delays and shortages in the supply of parts. During the pandemic, the demand for medical supplies and equipment increased significantly in the healthcare industry. Optoelectronic chips are essential in medical imaging, diagnostics, and sensing applications, particularly image sensors and infrared components. The demand for optoelectronic chips in various industries was driven by the rising attention on healthcare and medical solutions.

Global Optoelectronic Chips Market Recent developments:

- In August 2021 - Ayar Labs announced that it will start shipping its first commercial product based on its patented monolithic electronic-photonic technology (MEPT) in early 2022.

OPTOELECTRONICS CHIPS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.4% |

|

Segments Covered |

By Component Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Samsung Electronics, Sony Corporation, Broadcom Inc., Osram GmbH, TT Electronics plc, Cree, Inc., ON Semiconductor Corporation, Vishay Intertechnology, Inc., Hamamatsu Photonics K.K., Lumentum Holdings Inc. |

Global Optoelectronic Chips Market Segmentation: By Component Type

-

Photovoltaic (PV) cells

-

Optocouplers

-

Image sensors

-

Light emitting diodes (LED)

-

Laser diode (LD)

-

Infrared components (IR)

The market for optoelectronic chips' image sensor category is expanding at the fastest rate. Numerous gadgets, including smartphones, digital cameras, security systems, car cameras, and medical imaging equipment, use image sensors. The growing need for high-resolution photography, advancements in camera technology, and the use of image sensors in cutting-edge technologies like AI, AR/VR, and autonomous vehicles are driving the growth of this industry.

The category of light-emitting diodes (LEDs) dominates the market for optoelectronic chips. LEDs are widely used in lighting applications in the home, commercial, and industrial sectors due to their energy efficiency, extended lifespan, and environmental benefits. Government policies promoting energy-efficient lighting, the widespread use of LED lighting solutions, and the move towards smart lighting systems all contribute to this market's domination.

Global Optoelectronic Chips Market Segmentation: By Application

-

Aerospace & Defense

-

Automotive

-

Consumer electronics

-

Information technology

-

Healthcare

-

Residential and commercial

-

Industrial

Consumer electronics is now the market category for optoelectronic chips that is growing the fastest. The rising demand for optoelectronic chip-based consumer electronics like smartphones, tablets, smart TVs, wearable technology, and other consumer electronics is what is fueling this expansion. Due to technical advancements including the use of optoelectronic sensors for augmented reality, gesture control, and facial recognition, this industry is growing.

The information technology industry dominates the market for optoelectronic chips. Optoelectronic chips are widely used in data centers, telecommunications networks, and networking hardware for optical sensing, signal processing, and high-speed data transmission. The rapid development of cloud computing, 5G networks, and Internet of Things (IoT) applications is fueling the demand for optoelectronic chips in this sector. The dominance of this market is also attributed to the growing use of optoelectronic data storage and optical connection solutions.

Global Optoelectronic Chips Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East, and Africa

Asia Pacific is the region of the optoelectronic chips market with the quickest growth. This region is expanding dramatically as a result of several factors, including the rapidly expanding consumer electronics market, increased demand for cutting-edge displays and lighting alternatives, and the existence of sizable optoelectronic chip makers in countries like China, South Korea, and Japan. North America is the region with the most market share for optoelectronic chips. Leading makers of optoelectronic chips are well represented in this area, which is also the site of numerous technological developments and advances. The widespread use of optoelectronic chips in sectors such as telecommunications, automotive, healthcare, and defense also plays a role in this market segment's supremacy.

Key Players:

- Samsung Electronics

- Sony Corporation

- Broadcom Inc.

- Osram GmbH

- TT Electronics plc

- Cree, Inc.

- ON Semiconductor Corporation

- Vishay Intertechnology, Inc.

- Hamamatsu Photonics K.K.

- Lumentum Holdings Inc.

Chapter 1. OPTOELECTRONIC CHIPS MARKET– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. OPTOELECTRONIC CHIPS MARKET– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. OPTOELECTRONIC CHIPS MARKET– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. OPTOELECTRONIC CHIPS MARKET- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. OPTOELECTRONIC CHIPS MARKET– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. OPTOELECTRONIC CHIPS MARKET– By Application

6.1 Introduction/Key Findings

6.2 Aerospace & Defense

6.3 Automotive

6.4 Consumer electronics

6.5 Information technology

6.6 Healthcare

6.7 Residential and commercial

6.8 Industrial

6.9 Y-O-Y Growth trend Analysis By Application

6.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. OPTOELECTRONIC CHIPS MARKET– By Component Type

7.1 Introduction/Key Findings

7.2 Photovoltaic (PV) cells

7.3 Optocouplers

7.4 Image sensors

7.5 Light emitting diodes (LED)

7.6 Laser diode (LD)

7.7 Infrared components (IR)

7.8 Y-O-Y Growth trend Analysis By Component Type

7.9 Absolute $ Opportunity Analysis By Component Type, 2024-2030

Chapter 8. OPTOELECTRONIC CHIPS MARKET, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Component Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Component Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Component Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Component Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Component Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. OPTOELECTRONIC CHIPS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Samsung Electronics

9.2 Sony Corporation

9.3 Broadcom Inc.

9.4 Osram GmbH

9.5 TT Electronics plc

9.6 Cree, Inc.

9.7 ON Semiconductor Corporation

9.8 Vishay Intertechnology, Inc.

9.9 Hamamatsu Photonics K.K.

9.10 Lumentum Holdings Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Semiconductors called optoelectronic chips transform electrical signals into light or the other way around. They are in numerous applications, including illumination, display, communication, and sensing.

Some examples of the various types of optoelectronic chips include photovoltaic (PV) cells, optocouplers, image sensors, light-emitting diodes (LED), laser diodes (LD), and infrared components (IR).

The market for optoelectronic chips is expanding as a result of factors like the rising need for fast data transmission and communication, the expanding use of these chips in the consumer electronics, automotive, and healthcare industries, and the development of new technologies like 5G, wireless communication, and organs on chips.

The high production costs of optoelectronic devices, the lack of semiconductor supplies as a result of the COVID-19 pandemic, and the compatibility and integration problems of optoelectronic chips with other electronic components are some of the challenges facing the market for optoelectronic chips.

The development of novel materials and devices, such as ultra-wide bandgap semiconductors, quantum chips, silicon photonics chips, and optoelectronic hybrid integrated chips, as well as the expansion of applications in developing industries like aerospace & defense, industry, and information technology, are opportunities for the market for optoelectronic chips.