Optical Coatings Market Size (2024 – 2030)

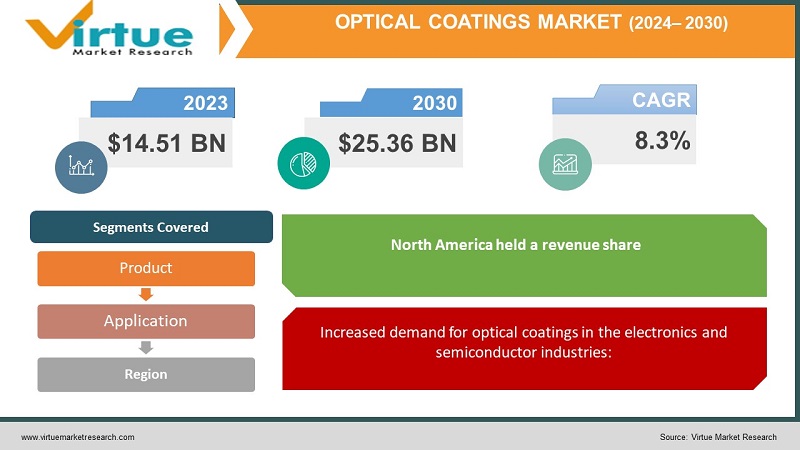

The Global Optical Coatings Market was valued at USD 14.51 billion and is projected to reach a market size of USD 25.36 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.3%.

The rising usage of thin-film optical coating in semiconductor technologies, scientific apparatus, solar energy, and military hardware has stimulated the market. Additionally, several industrial businesses are investing in R&D to enhance their coating techniques and raw ingredients to create high-performance optical coatings. As the population rises, there is a rising need for eyewear, including sunglasses and prescription glasses. Both sectors employ these coatings. The market is expected to expand as a result of recent innovations in optical manufacturing and deposition techniques, as well as rising consumer demand for potent optical goods in end-use applications.

Key Market Insights:

The unique MAGNAVI glass fibre, made by Nippon Sheet Glass Co., Ltd., has a high modulus and excellent strength. The greatest mechanical quality of all glass fibres, MAGNAVI TM is a reinforcing option for fibre-reinforced plastics (FRP) and fibre-reinforced thermoplastics (FRTP). Additionally, it keeps the radio-permeability and heat resistance that are intrinsic to glass fibres.

The cooperation between Schott AG and Edmund Optics was expanded to give designers quick access to thin-coated optical filter glass with shorter lead times.

To provide multi-functional, lightweight, high-index smart lenses for eyeglasses, PPG Industries Inc. and Meta Materials announced their partnership, making a significant contribution to the optical coating industry.

With the next-generation SIRRUS plasma physical vapour deposition (PVD) technology for optical filters, Alluxa Inc. unveiled a ground-breaking capability in increasing the optical range performance.

To provide electrocoating (e-coat) services for original equipment manufacturer (OEM) aviation components, PPG Industries Ohio, Inc. and Stays, a French industrial organisation with expertise in sealing painting, and surface treatment for aircraft, have partnered.

To produce paint films, which include multi-layered coatings with at least one layer of paint, PPG and Entrotech Inc. have formed a joint venture.

Global Optical Coatings Market Drivers:

Increased demand for optical coatings in the electronics and semiconductor industries:

Numerous sectors, including semiconductors, high-temperature lamp tubing, telephony, optics, and microelectronics, use optical coatings. They are essential for wafer modification, ICs, and PCB coating in the electronics and semiconductor industry, allowing components to resist extreme temperature gradients and quick thermal processing. New-generation wafers are now being used in this industry, which has increased demand for high-purity optical coatings that improve product performance. Smartphone screens, camera lenses, and semiconductor chips are all being added with optical coatings to improve touch sensing and display capabilities. Market expansion is fueled by the increasing use of optical coatings in smart devices.

The Telecommunications Sector's Rapid Development Will Drive the Market:

The exchange of voice and data is the foundation for the interconnectedness of the global economy. The expansion of optical fibre networks has increased the activity of connections across continents. The exponential rise of the optical business is also being fueled by the usage of the internet. These coatings can be used on lenses as a value-added component or as an optical feature on a range of devices. The mass production and coating of numerous optical components might reduce costs and boost income for the coating industry. Utilising sophisticated filters, optical fibre network signal transmission is tracked. Multi-layer thin film stacks expand the bandwidth of optical fibre distribution in the communications industry. The telecommunications sector will have the coating applications market with the greatest growth. Multiple layers and tiny particles make up thin-film filters. Despite their small production volume, they yield significant benefits at market rates. If manufacturers could use coating technology in high-end sectors, they would be among the leaders in this industry. The efficiency requirements for thin-film optical filters have increased significantly in response to the needs of the optical communications sector.

Global Optical Coatings Market Challenges:

Evaporation Deposition Process Errors that Prevent Market Growth:

A low-cost method that may be used on a variety of materials, including metals and dielectrics, is evaporation deposition. The construction of the chamber also provides a large separation between the substrate source and the optical bits. As a result, even for intricately formed and steeply curved optical components, high coating uniformity is obtained. Nevertheless, it is frequently a labour-intensive manufacturing technique that is more prone to random and planned failures than other systems and depends significantly on operator feedback. The main cause is changes in process factors including deposition rate, vapour distribution, temperature, vacuum pressure, and others. These modifications lead to increased layer-to-layer faults and inconsistent spectral efficiency. A full coating run also takes longer and uses less material in an evaporation chamber. Depending on the requirements, it might take up to twice as long as alternative advanced plasma reactive sputtering (APRS) methods. Given that power, yield, and production cycle time are all significant cost factors, the final cost of an evaporation-produced component is typically lower than necessary.

Global Optical Coatings Market Opportunities:

Rising use of cutting-edge automobile electronics fuels the market growth:

The desire for safer driving experiences, smarter transportation systems, and environmental concerns are all contributing to an increase in the demand for automotive electronics in the transportation sector. In today's cutting-edge vehicle electronics systems, optical coatings are essential. Opportunities for the optical coatings market are presented by the advancement of driver assistance systems, communication technology, and entertainment features in automobiles. Automotive parts including switches, light guides, headlight lenses, and taillights all require optical coatings. They provide exhibit windows on public transit vehicles with protection, as well. Anti-reflection (AR), highly reflective, and filter coatings are the most used optical coating types in transportation.

OPTICAL COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.3% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DuPont, PPG Industries Ohio, Nippon Sheet, Glass Co., ZEISS Group, Newport Corporation, Inrad Optics, Artemis Optical, Limited, Abrisa Technologies |

Global Optical Coatings Market Segmentation: By Product

-

Anti-Reflective Coatings

-

Reflective Coatings

-

Filter Coatings

-

Conductive Coatings

-

Electrochromic Coatings

-

Others

In 2022, the market was headed by the anti-reflective product category, which had a revenue share of over 29.0%. Thin-film optical coatings known as antireflective coatings are made up of many layers with varying refractive indices between each layer. The thickness of each layer is selected to interfere with light beams reflected by the surface in a self-extinguishing manner. This makes it appropriate for glass and plastic substrates used in the manufacture of eyeglasses, camera lenses, display screens, and magnifying lenses.

Over the course of the forecast period, the market is anticipated to develop as a result of rising demand for anti-reflective coatings used in the manufacture of photovoltaic solar panels, vehicle displays, windows, and GPS navigation systems. Due to the widespread use of solar panels, the conductive coatings product category is anticipated to increase significantly over the course of the projection period. The development of alternative energy sources is expected to receive more attention in the future, and nations like China, India, and the U.S. will likely make substantial expenditures in solar energy production. Over the course of the projection period, it is also projected that rising usage in instrument display windows, solar panels, heaters, LCD manufacturing, heads-up displays, shielding for radio frequency interference, and LED displays would boost market expansion.

Global Optical Coatings Market Segmentation: By Application

-

Consumer Electronics

-

Solar

-

Medical

-

Architecture

-

Aerospace & Defense

-

Automotive

-

Telecommunication

-

Others

In 2022, the consumer electronics application category dominated the market and held a revenue share of over 31.0%. Rising consumer discretionary income and the quickly expanding smartphone market are two factors predicted to fuel the segment's growth throughout the projected period. Additionally, it is projected that technical developments in the area of smart televisions and smart consumer electronics, such as smartphones and smartwatches, would have a favourable impact on the market throughout the projection period. Additionally, throughout the course of the forecast period, the demand for optical coatings is anticipated to be driven by a rise in the need for multifunctional devices and the expansion of major players.

The electronics sector makes extensive use of infrared and anti-reflective coatings because of the increased need for improved optical display and impact-resistant capabilities. Over the projection period, it is anticipated that the expanding semiconductor sector and technological improvements will increase demand for these optical coatings. The market for consumer electronics items is being impacted by the global reduction in discretionary expenditure for COVID-19. It is additionally projected that this will reduce consumer electronics products' need for optical coatings.

Due to its great impact and abrasion resistance, it is utilised in speedometer displays in the automobile sector. Over the course of the projected period, it is predicted that increasing usage of optical coatings in a variety of automotive components, including headlight lenses, vehicle windows, windscreens, and gear knob tops, would propel market expansion. In the automotive sector, components are also coated with I-IV and abrasion-resistant materials.

Global Optical Coatings Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, North America held a revenue share of more than 37.0% and led the optical coatings market. The demand in this area is being driven by the expanding solar sector in the United States and the emphasis on building domestic businesses. The aerospace and defence industries are seeing great growth potential for reflective coating materials as a result of an increase in the U.S. defence budget. Since many mid and small-scale medical equipment manufacturers are based in North America, this region is anticipated to drive up demand for optical coatings throughout the projected period. Additionally, during the course of the projection period, there will be a surge in demand for optical coatings due to the growth of sectors including instrumentation, microelectronics, biotechnology, software development, and medical devices.

Additionally, the steadily growing patient population brought on by the COVID-19 epidemic at the community level is anticipated to drive the demand for medical components and therefore increase the demand for optical coatings in the United States. Over the course of the projected period, the market in Asia Pacific is anticipated to expand significantly. Over the course of the projection period, the region's market is anticipated to be driven by the expanding youth population and the rising demand for consumer electronics items such as cameras, LED displays, video gaming consoles, personal computers, cellphones, and tablets.

COVID-19 Impact on Global Optical Coatings Market:

Lockdowns and economic uncertainty caused a halt in several end-use industries that largely rely on optical coatings, including consumer electronics, automotive, aerospace, and defence. The market for optical coatings was directly impacted by the decline in demand from these industries. The delays brought on by the pandemic hampered the schedules for releasing new items with optical coatings. Therefore, it is projected that business development in the approaching years will be driven by the decreased number of COVID-19 instances and the implementation of subsequent measures by government and non-government organisations.

Global Optical Coatings Market Recent developments:

Several sectors, notably consumer electronics and optics, are seeing an increase in demand for anti-reflective coatings. AR coatings are used to improve optical clarity and boost the functionality of displays, lenses, and camera systems by lowering reflections and glare. High-performance optical coatings with certain qualities, such as high durability, scratch resistance, and resistance to environmental conditions, are in greater demand. Critical industries including aerospace, defence, and medical equipment need these coatings. Advanced optical coatings are being created using an increasing amount of nanotechnology.

Key Players:

-

DuPont

-

PPG Industries Ohio

-

Nippon Sheet

-

Glass Co.

-

ZEISS Group

-

Newport Corporation

-

Inrad Optics

-

Artemis Optical

-

Limited

-

Abrisa Technologies

- In June 2023: Recently, a partnership between DuPont and JetCool Technologies Inc., also known as JetCool, was established to encourage the wider application of cutting-edge liquid cooling technology. This partnership's main goal is to improve thermal control methods for diverse high-power electronic applications, such as semiconductors, data centres, and high-performance computing units. DuPont and JetCool hope to promote innovation and make it easier for these demanding industries to adopt more effective cooling methods by working together

- In March 2023: The ZEISS Group started the building process to expand its Wetzlar facility for its Semiconductor Manufacturing Technology (SMT) business. The anticipated expansion entails allocating more than 12,000 square metres to the creation and fabrication of lithography optics for the global production of microchips. The growing need for microchips in the semiconductor sector on a global scale is what motivated ZEISS to make this strategic step.

Chapter 1. Optical Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Optical Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Optical Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysi

Chapter 4. Optical Coatings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Optical Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Optical Coatings Market – By Product

6.1 Introduction/Key Findings

6.2 Anti-Reflective Coatings

6.3 Reflective Coatings

6.4 Filter Coatings

6.5 Conductive Coatings

6.6 Electrochromic Coatings

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Optical Coatings Market – By Application

7.1 Introduction/Key Findings

7.2 Consumer Electronics

7.3 Solar

7.4 Medical

7.5 Architecture

7.6 Aerospace & Defense

7.7 Automotive

7.8 Telecommunication

7.9 Others

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Optical Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Optical Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DuPont

9.2 PPG Industries Ohio

9.3 Nippon Sheet

9.4 Glass Co.

9.5 ZEISS Group

9.6 Newport Corporation

9.7 Inrad Optics

9.8 Artemis Optical

9.9 Limited

9.10 Abrisa Technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Optical Coatings Market was valued at USD 14.51 billion and is projected to reach a market size of USD 25.36 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.3%.

Increased demand for optical coatings in the electronics and semiconductor industries and The Telecommunications Sector's Rapid Development Will Drive the Market are the factors driving the Global Optical Coatings Market.

The process of evaporation deposition is preventing major market growth.

Electrochromic Coatings product type is the fastest growing in the Global Optical Coatings Market.

Asia-Pacific region is the fastest growing in the Global Optical Coatings Market.