Ophthalmic Cancer Diagnostic Market Size (2024 – 2030)

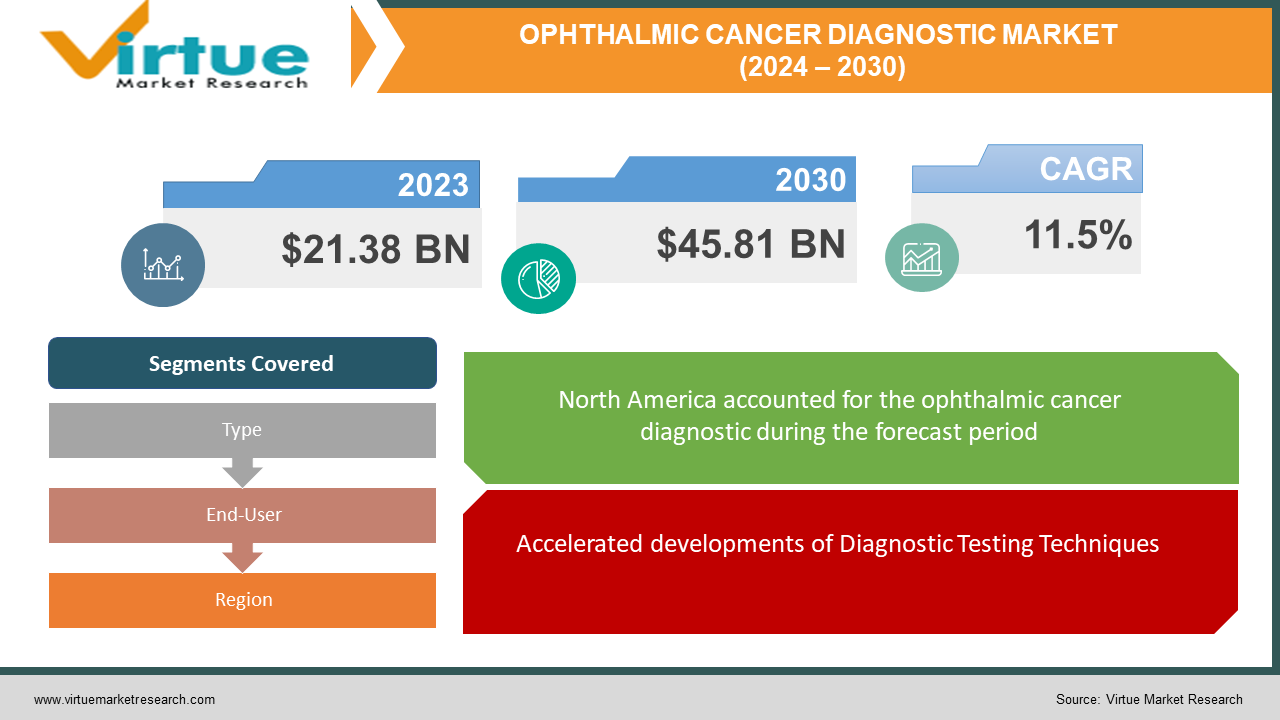

The Cancer Diagnostic Market was valued at USD 21.38 billion in 2023 and is projected to reach a market size of USD 45.81 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 11.5%.

Any cancer that begins in the eye is referred to as Ophthalmic Cancer. When cells begin to grow uncontrollably, cancer develops. Melanoma is the most common type of cancer in the eye, although a variety of cancers affect the other components of the eye. Eye Cancer is a rare type of cancer that affects three elements of the eye: the eyeballs, the orbit, and the adnexa. Cancer diagnostics is the method of identifying numerous proteins, biomarkers, and symptoms that lead to the presence of a cancerous tumor in patients. The detection of particular biomarkers and proteins that are usual in cancer disorders causes the diagnosis process. Detecting cancer involves applying particular techniques and devices used in its diagnosis. Imaging, laboratory tests, tumor biopsy, surgery, endoscopic examination, and genetic testing are all different types of possible cancer diagnostic techniques. Technological advancements in diagnostic tests are expected to accelerate industry growth as healthcare professionals focus on developing effective screening and treatment solutions to check prevalence levels. Different healthcare professionals primarily highlight on developing effective screening and treatment solutions to evaluate the prevalence levels.

Key Market Insights:

-

Over 100 varieties of cancers have been identified. According to Cancer Research UK, worldwide over 14.1 million new cancer cases were registered, which is anticipated to increase in future years. Furthermore, as per the report published in the American Society of Clinical Oncology, over 3500 patients in the US were diagnosed with primary intraocular cancer.

-

Blue Earth Diagnostics received the FDA’s permission for high-affinity radio hybrid (rh) Prostate-Specific Membrane Antigen (PSMA)-targeted PET imaging agent, POSLUMA, for prostate cancer detection and localization. It's based on innovative radio hybrid technology, offering accurate imaging and potential therapeutic applications.

-

Quest Diagnostics bought Haystack Oncology in an all-cash deal to expand MRD testing services, initially targeting colorectal, breast, and lung cancers, targeting to enhance patient outcomes through early MRD detection after treatment.

Ophthalmic Cancer Diagnostic Market Drivers:

Accelerated developments of Diagnostic Testing Techniques

Technological advancements in diagnostic testing are anticipated to boost market growth during the forecast period. For example, Hologic, Inc. announced the commercial access of the Genius Digital Diagnostics System in Europe in 2021. The next-generation ophthalmic cancer screening system includes deep learning-based AI and innovative volumetric imaging technology to help detect Ophthalmic cancer cells and pre-cancerous lesions in women. Thus, this is estimated to boost market growth.

Developing Strategic Collaborations Associated with Cancer Diagnostics

There is a growth in collaborations and acquisitions associated with cancer diagnostics products. For example, the Precision Cancer Consortium (PCC) collaborated with pharmaceutical companies in 2022 by allowing permission for comprehensive testing for all cancer patients worldwide. The PCC runs many initiatives to widen patient access to precision diagnostics via wide-ranging genomic testing, including NGS. Thus, this pushes the market growth

Rise in the number of private diagnostic centers

The number of private diagnostic centers is rising across the globe as there is a growing demand for diagnostic imaging procedures and an increasing burden on public hospitals due to the restricted number of imaging modalities at their disposal. In January 2021, FUJIFILM Corporation launched NURA, a medical screening center focusing on cancer screening in Bangalore, India. This medical screening center is operated by FUJIFILM DKH LLP (FUJIFILM DKH) and Dr. Kutty’s Healthcare (DKH). FUJIFILM DKH LLP (FUJIFILM DKH) is a joint venture of FUJIFILM and Dr. Kutty’s Healthcare (DKH), which operates hospitals and screening centers in India and the Middle East

Ophthalmic Cancer Diagnostic Market Restraints and Challenges:

Diagnostic Imaging is expensive

Many hospitals in underdeveloped and developing countries cannot invest in diagnostic imaging equipment because of high costs and budgetary constraints. However, because of the rising demand for diagnostic imaging processes in these countries, the hospitals that cannot afford to purchase new and advanced imaging systems favor rebuilt ones. Thus, this element restraints the market growth.

Heightened adoption of refurbished diagnostic imaging systems

Many hospitals in developing economies cannot invest in diagnostic imaging equipment due to their higher cost, poor reimbursement rates, and budgetary constraints. However, due to the high necessity for diagnostic imaging procedures in these nations, hospitals that cannot afford to spend on new imaging systems prefer to opt for refurbished ones. Refurbished systems are charged lower than new systems and are approximately in the range of 40% to 60% of the original price of the equipment.

Due to this, many market leaders are now supporting refurbished devices through various programs. For example, Siemens’ Medical Proven Excellence Program, GE Healthcare’s Gold Seal Program, and Philips’ Diamond Select Program are a few noteworthy global refurbishing programs that encourage the utilization of refurbished diagnostic imaging systems.

Ophthalmic Cancer Diagnostic Market Opportunities:

Rising number of awareness programs by major Organizations

An increasing number of programs to spread awareness about malignant tumor screening in numerous organizations is a key factor responsible for the increased demand for diagnostic products globally. Numerous nations have undertaken several measures to increase screening for early screening and aid patients. For example, the Indian government has incorporated the Prime Minister's National Relief Fund and Ayushman Bharat for patients demanding treatment assistance. Thus, this factor pushes market growth.

Growing number of Diagnostic Testing Kit Launches for Cancer

There has been an increasing number of testing kit launches that are assisting in the market growth. For example, Sysmex Corporation launched the ipsogen JAK2 DX reagent in 2020. It is a gene testing kit that measures the JAK2V617F mutation quantitatively, which is widely utilized for screening blood cancers. Moreover, the product gained health insurance coverage, becoming Japan's first diagnostic product to be insured in 2020. Thus, this factor aids in the growth of the market.

OPHTHALMIC CANCER DIAGNOSTIC MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.5% |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AbbVie Inc., Amgen Inc., Astra Zeneca plc., Bayer AG., Bristol-Myers Squibb Company., Carl Zeiss AG., Castle Biosciences, Inc., Eli Lilly & Co. |

Ophthalmic Cancer Diagnostic Market Segmentation: By Type

-

Imaging Testing

-

Biomarkers Testing

-

In Vitro Diagnostic Testing

-

Biopsy

-

Others

The Imaging Segment may dominate the segment during the estimated period. With a 34.2% market share in 2023, the biopsy category led the market and is expected to retain its dominance throughout the forecast period. Modalities used in imaging like computed Tomography (CT) scans and Magnetic Resonance Imaging (MRI) are quick, non-invasive, and painless diagnostic methods. Imaging helps in cancer staging, as do prognostic and therapy system monitoring of metabolic and functional information. Due to these benefits, the use of imaging modalities in cancer screening programs has significantly grown. Worldwide, the use of sophisticated imaging tests, including such as multi-photon microscopy and magnetic resonance imaging, is rising. The various imaging modalities, in conjunction with other genetic and laboratory testing, are employed as evidential tests in detecting a range of cancer forms, aiding in the selection of a suitable treatment strategy. These factors are expected to drive the Imaging segment at an 8.0% CAGR throughout the forecast period.

Ophthalmic Cancer Diagnostic Market Segmentation: End-User

-

Diagnostic Centres

-

Hospitals and Clinics

-

Research Institutes

-

Others

Diagnostic Centres segment dominated every other segment in 2023 with a share of 51.84%. Diagnostic laboratories are expected to represent significant growth over the forecast period owing to enhanced testing and the availability of resources for performing tests. There has been a better reliance of hospitals on diagnostic laboratories for testing & evaluation, which further leads to escalated growth. Increased consciousness about personalized medicine, technological advancements, and development in demand for affordable services are some of the major factors expected to drive the segment growth. Another major element boosting segment growth is a rise in government initiatives to offer various facilities, such as compensation for diagnostic tests. In addition, regulatory authorities are undertaking initiatives to update clinical laboratory diagnostic services and ease the process of diagnosis.

Ophthalmic Cancer Diagnostic Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In terms of market share and revenue, the North American market is anticipated to be the most lucrative market for cancer diagnostics during the forecast period. In 2023, the regional cancer diagnostics market blossomed with a revenue share of 38.9%. One of the primary elements propelling the diagnostics industry in the region is the presence of several biotechnology and medical device firms. North America is likely to maintain its lead over the projection period due to increased spending for Research and Development initiatives and the widespread use of new technology.

During the estimated period, Asia Pacific is expected to record a CAGR of 6.9%. In the future years, the Asia Pacific area is expected to be one of the emerging regions for cancer diagnostics. Due to a big patient pool, the approachability to experienced technicians at a reduced cost, and a clear regulatory environment encouraging quicker product approvals, Asia Pacific is likely to display expanded growth shortly. In addition, the burgeoning medical tourism business in economies like China, India, and Malaysia is likely to grow the demand for cancer diagnosis and treatment screening.

COVID-19 Impact Analysis of the Ophthalmic Cancer Diagnostic Market:

The COVID-19 has been affecting economies and industries in various countries due to lockdowns, travel bans, and business ceases. The closure of various plants and factories has impacted the global supply chains and negatively affected the manufacturing, delivery schedules, and sales of products in the global market. Some companies have already announced possible delays in the delivery of products and slump in future sales of their products. There is a big change in demand for Eye cancer drugs and therapeutics because of the pandemic situation and lockdown scenes so people cannot move out of their homes and cannot receive their treatments which ultimately affects the demand for Eye Cancer therapeutics and medications.

Latest Trends:

Technological advancements in Artificial Intelligence (AI) For Cancer Diagnostics Devices Market

The AI-based cancer detection system is an emerging trend in the Eye cancer diagnostics market. AI aids in upgrading the accuracy of image detection in diagnostic processes such as Eye cancer and lung cancer diagnostics, by detecting cancers in their initial stages. AI also decreases the instances of false positives in lung cancer screening, thus, improving lung cancer detection accuracy. For example, researchers at the Naval Medical Center San Diego and Google's AI research division Google AI developed a trustworthy solution consisting of cancer-detecting algorithms used for autonomous evaluation of lymph node biopsies. This AI solution improved the accuracy of metastatic breast cancer detection to 99%.

Key companies operating in the cancer diagnostic device market are eyeing the development of technology with artificial intelligence (AI), such as Qai Prostate, to earn a competitive edge in the market. Qai Prostate is used as a cancer diagnostic device for prostate cancer diagnosis. For example, In March 2023, Qritive, a Singapore-based company that develops AI-powered diagnostic techniques for pathologists, launched Qai Prostate. QAi Prostate is a modernized artificial intelligence (AI)-powered prostate cancer diagnosis tool. QAi Prostate utilizes machine learning algorithms to precisely identify and classify malignant and benign areas in prostate tissue samples. This tool is designed to a pathologists detect prostate cancer and differentiate between malignant and benign areas in prostate tissue samples.

Key Players:

-

AbbVie Inc.

-

Amgen Inc.,

-

Astra Zeneca plc.

-

Bayer AG.

-

Bristol-Myers Squibb Company.

-

Carl Zeiss AG.

-

Castle Biosciences, Inc.

-

Eli Lilly & Co.

Recent Developments

In 2022, Precipio, Inc. signed a distribution agreement for Heme Screen with a major distribution partner in the U.S. The company continues its Heme Screen distribution expansion strategy of a multi-pronged method by focusing on physician-owned laboratories, national and regional hospital networks, and reference labs.

Chapter 1. Ophthalmic Cancer Diagnostic Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ophthalmic Cancer Diagnostic Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ophthalmic Cancer Diagnostic Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ophthalmic Cancer Diagnostic Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ophthalmic Cancer Diagnostic Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ophthalmic Cancer Diagnostic Market – By Type

6.1 Introduction/Key Findings

6.2 Imaging Testing

6.3 Biomarkers Testing

6.4 In Vitro Diagnostic Testing

6.5 Biopsy

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Ophthalmic Cancer Diagnostic Market – By End User

7.1 Introduction/Key Findings

7.2 Diagnostic Centres

7.3 Hospitals and Clinics

7.4 Research Institutes

7.5 Others

7.6 Y-O-Y Growth trend Analysis By End User

7.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Ophthalmic Cancer Diagnostic Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Type

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Type

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Type

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Type

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Ophthalmic Cancer Diagnostic Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 AbbVie Inc.

9.2 Amgen Inc.,

9.3 Astra Zeneca plc.

9.4 Bayer AG.

9.5 Bristol-Myers Squibb Company.

9.6 Carl Zeiss AG.

9.7 Castle Biosciences, Inc.

9.8 Eli Lilly & Co.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Cancer Diagnostic Market was valued at USD 21.38 billion in 2023 and is projected to reach a market size of USD 45.81 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 11.5%.

The development in testing techniques and collaborations among players is propelling the Ophthalmic Cancer Diagnostic Market.

Ophthalmic Cancer Diagnostic Market is segmented based on Type, End-User, and Region.

North America is the most dominant region for the Ophthalmic Cancer Diagnostic Market.

AbbVie Inc., Amgen Inc., Astra Zeneca plc., Bayer AG., and Bristol-Myers Squibb Company are a few of the key players operating in the Ophthalmic Cancer Diagnostic Market.