Global Operations as a Service (OaaS) Market Size (2024-2030)

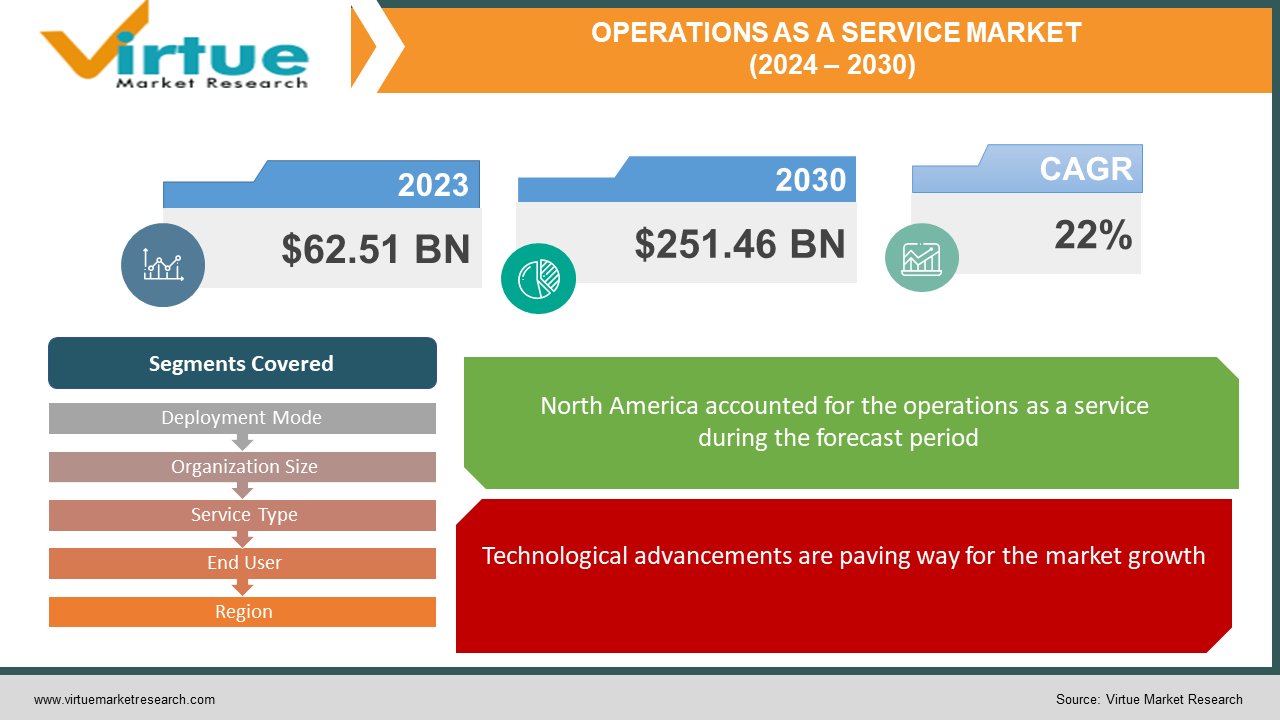

In 2023, The Operations as a Service (OaaS) Market was valued at $ 62.51 Billion, and is projected to reach a market size of $ 251.46 Billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 22%.

Operations as a Service (OaaS) has seen substantial growth over the years. It had a popular presence in the past from employing tasks like data center management, call operations, and other helpdesk services. However, with global expansion and developing economies, more firms as well as companies started the employment of these services. It holds improved features by integration with AI and other Robotic Process Transformation (RPT) processes. In the future, with technological advancements coupled with eco-friendly solutions, this market is expected to grow tremendously. During the forecast period, this market is predicted to grow significantly.

Key Market Insights:

Artificial intelligence (AI) is heavily used for service operations strategy and corporate finance, with nearly all industries reporting around 20 percent usage of AI in these functions.

IT Outsourcing dominated the market with a projected market volume of US$460.10bn in 2023.

The average cost of data breaching in Operations as a service was more than 300 million in 2020. To tackle this, regular audits, employee training, protocols, and other data encryption methods were being implemented.

Operations as a Service (OaaS) Market Drivers:

Technological advancements are paving way for the market growth.

There have been major milestones over the years in the computer science field, especially in branches involving artificial intelligence, machine learning, and automation. This has been a major factor in helping the market to grow. Operations as a service is associated with a lot of advantages making it an attractive choice. They are cost-effective, flexible, scalable, and effective. Additionally, they improve decision-making, reduce errors, and help in improving the process. Moreover, they can provide innovative solutions along with optimization of the process involved. Many companies and other organizations are employing these services to ease human life. With ongoing research activities and continuous improvements, this market is expected to see lucrative growth opportunities.

Cost-effectiveness has been helping with the market expansion.

Companies are on a constant lookout to reduce their budget on miscellaneous expenses. OaaS helps to assign specific tasks to providers who manage these activities at a lower cost. Moreover, the suppliers are extremely skilled and have very less chances of any mistakes. This is a very big advantage to smaller firms and startups at an early stage. This helps the organization to divert the funds towards other causes and departments where it is crucial.

Globalization is aiding the boost of the market.

Over the years, the economies of many regions have strengthened facilitating them to improve trade activities across borders and provide services. The expansion of these companies comes along with the challenges of managing the data, customers, supply chain, and other planning operations. Operations at a service is a huge benefit to managing these diverse and complex operations across different regions. Accurate and efficient results are obtained due to this.

Operations as a Service (OaaS) Market Restraints and Challenges:

Data security, loss of control, and integration complexity are the main issues that are currently being faced by the market.

Data privacy is one of the biggest barriers. Data breaches, cyber-attacks, and hacking are some of how the data can be acquired. This can be often misused causing huge losses to the company and the region. Secondly, lack of control over data is another concern. By handling the operations of the business to an external firm, ownership and authenticity can be threatened. Thirdly, few organizations have very old and outdated systems, difficult architecture, and other legal systems. Ensuring a smooth integration of these services can be extremely challenging in such cases.

Operations as a Service (OaaS) Market Opportunities:

Research institutes, universities, and companies are focusing on developing environmentally friendly solutions. The current service has been causing a lot of carbon footprint contributing to climate change, pollution, and an imbalance in the ecosystem. Secondly, tailoring to the customized needs of clients has been helping the market to expand. By offering industry-specific solutions, the market is presented with an ample number of opportunities. Moreover, cutting-edge technologies which include cloud computing technology, AI, and ML are being looked upon to improve the existing features and find better as well as innovative solutions.

OPERATION AS A SERVICE (OaaS) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

22% |

|

Segments Covered |

By Deployment Mode, Organization Size, Service Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM, Accenture, Hewlett Packard Enterprise (HPE), Cognizant, Tata Consultancy Services (TCS), Infosys, Wipro, Capgemini, DXC Technology, Genpact |

Operations as a Service (OaaS) Market Segmentation:

Operations as a Service (OaaS) Market Segmentation: By Deployment Mode:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on deployment mode, the public cloud is the largest segment holding a share of around 60%. This is because of their cost effectiveness, accessibility, flexibility, accessibility, security measures, rapid deployment, reduced maintenance, and higher availability. Companies like Amazon Web Services, Microsoft, and Google are known for their domination in this category. However, the hybrid segment is the fastest growing. This is due to cost optimization, global reach, security, services offered, and agility.

Operations as a Service (OaaS) Market Segmentation: By Organization Size:

- Small and Medium Scale Enterprise

- Large Scale Enterprise

Based on organization size, large-scale enterprises are the largest in the market with a share exceeding 60%. This is due to a larger workforce, investments, complex tasks, global operations, and specialized services. However, small-scale enterprises are the fastest growing in this market holding a share of around 40%. This is due to increasing investments, Governmental involvement, emerging startups, a better economy, and an increase in the availability of resources.

Operations as a Service (OaaS) Market Segmentation: By Service Type:

- IT Operations

- Customer Support

- Finance and Accounting

- Human Resources

- Supply Chain Management

Based on service type, IT operations are the dominant segment in the market. With the growing need to adapt to technology and digitalization, IT operations have become crucial for the working of a company. They involve protection against hacks, data security and privacy, networking support, data management, cloud services, cybersecurity, and other essential operations. Therefore, OaaS is vital for managing such complex tasks, easing human life, and helping with time management. Customer support is the fastest growing. With, access to facilities remotely, customer experience is an important factor. Ensuring customer satisfaction becomes the top priority. Chatbots, virtual assistants, and other AI-driven tools are playing a huge role in boosting the segment.

Operations as a Service (OaaS) Market Segmentation: By End User:

- Healthcare

- BFSI

- Retail

- IT and Telecom

- Education

- Others

Based on end users, the BFSI segment is the largest in the market. The BFSI industry requires the need to process vast amounts of data, transactions, and other daily as well as end-to-end operations. Additionally, customer support is very crucial for this market to grow. To analyze and carry out a smooth process, OaaS becomes a vital part, moreover, risk mitigation is an important part of this industry fueling the success of this segment. Education is considered to be one of the fastest-growing segments. This is due to an increase in distance learning methods. OaaS is beneficial in managing student data, helping in the delivery of remote classes, and ensuring the successful carrying out of other operations.

Operations as a Service (OaaS) Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Based on region, North America is the largest in the market holding an approximate share of 30%. The expansion is being fueled by investments, research activities, economic strength, the existence of significant corporations, and the strong presence of the banking, healthcare, and IT sectors. Leading nations include the United States and Canada. However, Asia Pacific is the region with the fastest growth, led by nations like China, Japan, and India. Greater access, expanding outreach, and better IT facilities are the main reasons. Additionally, government initiatives in the areas of AI and ML, a growing economy, a surge in investments, newly emerging creative businesses, a focus on sustainability, rising R&D activities, and a shift in lifestyle are helping the market growth. This region is estimated to have a share of around 22%.

COVID-19 Impact Analysis on the Global Operations as a Service (OaaS) Market:

Lockdowns, social isolation, and movement restrictions became the new norm. This caused a shift towards working from home. With this adjustment, it was necessary to ensure data safety, managing operations, and customer support. Cloud adoption became important due to this. The pandemic also people to lean towards freelance work and startups. This caused an upsurge in the market. Moreover, the healthcare sector saw an increase in the adoption of telemedicine. As per Statista, in a survey of 398 healthcare professionals, it was predicted that after the pandemic almost 20 percent of patient appointments will still be conducted via telemedicine. This further enlarged the market. Furthermore, online and virtual classes in the education sector aid market growth.

Latest Trends/ Developments:

Companies in this industry are driven to increase their market share using a variety of tactics, including alliances, investments, and acquisitions. Along with maintaining competitive pricing, businesses are paying much to advance the existing technology as well as finding choices. This has also led to greater enlargement.

Developments are being carried out in terms of risk mitigation which ensures the protection of data, compliance, reduced data breaches, smoother operations, and disaster recovery & and management. Robust security measures are expected to continue and help the market to generate more profits.

Key Players:

- IBM

- Accenture

- Hewlett Packard Enterprise (HPE)

- Cognizant

- Tata Consultancy Services (TCS)

- Infosys

- Wipro

- Capgemini

- DXC Technology

- Genpact

In June 2023, Genpact teamed with Google Cloud to accelerate Artificial Intelligence adoption for the enterprise. This partnership leveraged Google Cloud's advanced GenAI capabilities to cater to enterprises in key industries, including consumer goods, retail, life sciences, healthcare, hi-tech, and financial services.

In June 2023, IBM expanded a partnership with Adobe to deliver content supply chain solutions using generative AI. Leveraging Adobe's AI-accelerated Content Supply Chain solution and IBM Consulting services, the partners could help clients build an integrated content supply chain ecosystem that drives collaboration, optimizes creativity, and increases speed and creative projects.

In October 2020, Accenture and ServiceNow launched a dedicated business group to help organizations transform work. They formed a new business group to help private and public sector clients accelerate their digital transformation and better address the dynamic operational challenges.

Chapter 1. Global Operations as a Service (OaaS) Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Operations as a Service (OaaS) Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Operations as a Service (OaaS) Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Operations as a Service (OaaS) Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Operations as a Service (OaaS) Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Operations as a Service (OaaS) Market– By Service Type

6.1. Introduction/Key Findings

6.2. IT Operations

6.3. Customer Support

6.4. Finance and Accounting

6.5. Human Resources

6.6. Supply Chain Management

6.7. Y-O-Y Growth trend Analysis By Service Type

6.8. Absolute $ Opportunity Analysis By Service Type , 2023-2030

Chapter 7. Global Operations as a Service (OaaS) Market– By Deployment Mode

7.1. Introduction/Key Findings

7.2. Public Cloud

7.3. Private Cloud

7.4. Hybrid Cloud

7.5. Y-O-Y Growth trend Analysis By Deployment Mode

7.6. Absolute $ Opportunity Analysis By Deployment Mode , 2023-2030

Chapter 8. Global Operations as a Service (OaaS) Market– By Organization Size

8.1. Introduction/Key Findings

8.2. Large Enterprises

8.3. Small and Medium-sized Enterprises (SMEs)

8.4. Y-O-Y Growth trend Analysis Organization Size

8.5. Absolute $ Opportunity Analysis Organization Size , 2023-2030

Chapter 9. Global Operations as a Service (OaaS) Market– By End User

9.1. Introduction/Key Findings

9.2. Banking, Financial Services, and Insurance (BFSI),

9.3. IT and Telecom

9.4. Healthcare

9.5. Retail

9.6. Education

9.7. Others

9.8. Y-O-Y Growth trend Analysis End User

9.9. Absolute $ Opportunity Analysis End User, 2023-2030

Chapter 10. Global Operations as a Service (OaaS) Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Service Type

10.1.3. By Deployment Mode

10.1.4. By End User

10.1.5. Organization Size

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Service Type

10.2.3. By Deployment Mode

10.2.4. By End User

10.2.5. Organization Size

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Service Type

10.3.3. By Deployment Mode

10.3.4. By End User

10.3.5. Organization Size

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Service Type

10.4.3. By Deployment Mode

10.4.4. By End User

10.4.5. Organization Size

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Service Type

10.5.3. By Deployment Mode

10.5.4. By End User

10.5.5. Organization Size

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Operations as a Service (OaaS) Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 IBM

11.2. Accenture

11.3. Hewlett Packard Enterprise (HPE)

11.4. Cognizant

11.5. Tata Consultancy Services (TCS)

11.6. Infosys

11.7. Wipro

11.8. Capgemini

11.9. DXC Technology

11.10. Genpact

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Operations as a Service (OaaS) Market was valued at USD 42 billion and is projected to reach a market size of USD 206.12 billion by the end of 2030. Over the outlook period of 2023-2030, the market is anticipated to grow at a CAGR of 22%.

Technological advancements, cost-effectiveness, and globalization are the main drivers that have been driving the Global Operations as a Service (OaaS) Market

Based on Deployment Mode, the Global Operations as a Service (OaaS) Market is segmented into Public Cloud, Private Cloud, AND Hybrid Cloud

North America is the most dominant region for the Global Operations as a Service (OaaS) Market.

IBM, Accenture, and Hewlett Packard Enterprise (HPE) are the key players operating in the Global Operations as a Service (OaaS) Market.