Open Telecoms Market Size (2024 – 2030)

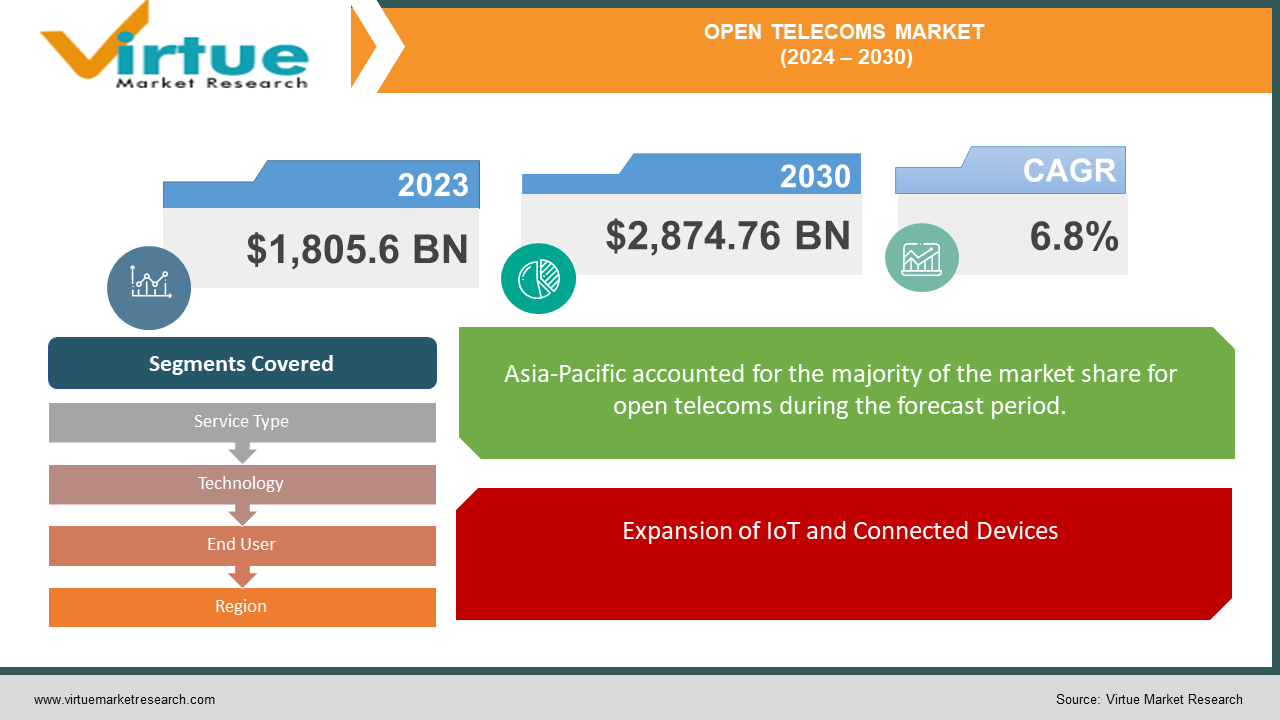

The Global Open Telecoms Market was valued at USD 1,805.6 billion in 2023 and is projected to reach a market size of USD 2,874.76 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.8% between 2024 and 2030.

The global open telecoms market is at the forefront of a digital revolution, reshaping the way communication networks are built, managed, and utilized. Driven by the need for greater flexibility, cost-efficiency, and interoperability, open telecoms leverage open standards and interfaces to foster innovation and reduce dependency on proprietary solutions. This market is experiencing rapid growth, propelled by technological advancements such as 5G, software-defined networking (SDN), network function virtualization (NFV), and edge computing. These technologies are not only enhancing network performance but also enabling new applications in various sectors, including smart cities, IoT, and autonomous vehicles. The adoption of 5G is particularly transformative, offering ultra-fast speeds, low latency, and higher capacity, which are essential for next-generation digital services. Additionally, SDN and NFV are revolutionizing network management by allowing operators to virtualize network functions and manage them via software, significantly lowering operational costs. Edge computing further enhances real-time data processing capabilities by bringing computation closer to data sources. Despite challenges such as security concerns and regulatory compliance, the open telecoms market is poised for significant expansion, driven by the increasing demand for advanced communication infrastructure and the continuous evolution of digital technologies.

Key Market Insights:

As of 2023, over 150 telecom operators in more than 60 countries have launched commercial 5G services. This number is expected to exceed 300 operators by 2025.

Global investment in 5G infrastructure is estimated to surpass USD 200 billion annually by 2025, with significant contributions from major telecom operators and technology companies.

The adoption rate of software-defined networking (SDN) and network function virtualization (NFV) is growing rapidly, with over 70% of telecom operators globally expected to have implemented these technologies by 2025.

The edge computing market is projected to grow from USD 3.6 billion in 2022 to USD 15.7 billion by 2027, at a compound annual growth rate (CAGR) of 34%.

The number of IoT connections worldwide is expected to reach 25 billion by 2025, up from 12 billion in 2020, driving demand for robust and scalable open telecom networks.

Global Open Telecoms Market Drivers:

Growing Demand for High-Speed Internet and 5G Networks.

The surge in demand for high-speed internet and the deployment of 5G networks are significant drivers of the global open telecoms market. As the world becomes increasingly digital, consumers and businesses require faster, more reliable internet connections to support a wide range of activities, from streaming high-definition content to powering complex industrial IoT systems. The transition to 5G technology offers unparalleled speed, lower latency, and higher capacity, enabling new applications and services that were previously unattainable with older networks. This advancement is not only enhancing user experience but also driving innovation in various sectors such as healthcare, transportation, and smart cities. As telecom operators and technology companies invest heavily in 5G infrastructure, the open telecoms market is poised for substantial growth, meeting the evolving connectivity needs of a digital-first world.

Expansion of IoT and Connected Devices.

The proliferation of Internet of Things (IoT) devices is another major driver propelling the global open telecoms market forward. IoT technology connects everyday objects to the internet, allowing for seamless communication and data exchange between devices. This interconnected ecosystem is revolutionizing industries by enabling real-time monitoring, automation, and data-driven decision-making. From smart homes and wearable technology to industrial automation and smart agriculture, the applications of IoT are vast and varied. Telecom operators play a crucial role in providing the network infrastructure necessary to support the massive data generated by IoT devices. As more devices become connected, there is an increasing demand for robust, scalable, and secure telecom networks. This demand is fueling investments in open telecom solutions that offer flexibility, interoperability, and cost-effectiveness, ensuring the market continues to expand in response to the growing IoT landscape.

Global Open Telecoms Market Restraints and Challenges:

One of the primary restraints in the global open telecoms market is the growing concern over security and regulatory compliance. As telecom networks become more open and interconnected, they also become more vulnerable to cyber-attacks and data breaches. The proliferation of connected devices and the increasing reliance on digital communication channels create numerous entry points for malicious activities, posing significant risks to data integrity and privacy. Telecom operators must invest heavily in advanced security measures to safeguard their networks and comply with stringent regulatory standards set by governments and industry bodies. These regulations often vary across regions, adding complexity to the implementation of uniform security protocols. Additionally, the need for continuous monitoring, threat detection, and response strategies can lead to increased operational costs and resource allocation challenges. Balancing the need for openness and innovation with the imperative for robust security measures and regulatory adherence remains a significant challenge for the industry. This delicate balance impacts the speed at which open telecom solutions can be deployed and adopted, potentially slowing down market growth despite the rising demand for advanced telecom infrastructure.

Global Open Telecoms Market Opportunities:

The global open telecoms market is ripe with opportunities driven by the accelerating adoption of cloud-based telecom solutions. Cloud technology offers telecom operators unprecedented flexibility, scalability, and cost-efficiency, transforming how services are delivered and managed. By leveraging cloud infrastructure, telecom companies can quickly deploy new services, reduce operational costs, and enhance their ability to scale in response to changing market demands. Cloud-based solutions also facilitate better data management and analytics, enabling operators to gain deeper insights into network performance and customer behavior, which can inform strategic decisions and personalized service offerings. Furthermore, the integration of cloud technology with telecom networks supports the deployment of innovative applications such as edge computing, which brings data processing closer to the source of data generation, reducing latency and improving user experience. This capability is particularly crucial for emerging technologies like autonomous vehicles, smart cities, and augmented reality, which require real-time data processing. As enterprises and consumers increasingly demand agile and efficient telecom services, the shift towards cloud-based solutions presents a significant growth opportunity for the open telecoms market, driving innovation and enhancing competitiveness in a rapidly evolving digital landscape.

OPEN TELECOMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Service Type, Technology, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nokia Corporation, Huawei Technologies Co., Ltd., Ericsson AB, Cisco Systems, Inc., Samsung Electronics Co., Ltd., ZTE Corporation, NEC Corporation, Fujitsu Limited, AT&T Inc., Verizon Communications Inc. |

Global Open Telecoms Market Segmentation: By Service Type

-

Mobile Data

-

Mobile Voice

-

Fixed Data

-

Fixed Voice

The Global Open Telecoms Market by Service Type, Mobile Data market share last year and is poised to maintain its dominance throughout the forecast period. The global open telecoms market is significantly influenced by several key drivers, including the rising use of smartphones, the demand for high-speed internet, and the proliferation of data-driven applications. The increasing penetration of smartphones worldwide has dramatically elevated mobile data usage, as people rely on their devices for a range of activities such as browsing the web, streaming videos, engaging in social media, and online gaming. This trend is creating a substantial demand for more robust data networks. Concurrently, both consumers and businesses are seeking faster and more reliable internet connections, prompting continuous advancements in mobile data technologies. The evolution from 4G to 5G networks is a testament to this demand, as these technologies offer significant enhancements in speed and capacity, meeting the growing need for high-speed connectivity. Additionally, the rise of data-driven applications like ride-sharing apps, food delivery services, and social media platforms is further driving the need for mobile data. As these applications become increasingly embedded in everyday life, they contribute to the continuous growth of mobile data demand, compelling telecom operators to innovate and expand their network capabilities to keep pace with these evolving requirements.

Global Open Telecoms Market Segmentation: By Technology

-

Wireline

-

Wireless

The Global Open Telecoms Market by Technology, Wireless market share last year and is poised to maintain its dominance throughout the forecast period. The global shift towards wireless dominance is largely driven by the explosive growth in mobile data usage, which has heightened the need for robust and expansive wireless networks. As mobile data consumption soars, the demand for high-performing wireless infrastructure becomes critical to accommodate the increased traffic and provide reliable connectivity. While fixed-line technologies such as fiber optics offer superior speed and reliability, their deployment is often constrained by geographical limitations, particularly in rural and developing regions. In contrast, wireless networks offer broader coverage and can be deployed more quickly, making them an attractive solution for areas where fiber optic infrastructure is impractical. The expansion of 5G technology further amplifies this trend by delivering significantly faster speeds, lower latency, and the capability to connect a larger number of devices simultaneously. This leap in technology not only enhances user experience but also drives further investment in wireless infrastructure. Additionally, the inherent convenience and flexibility of wireless connectivity enable users to access data and voice services while on the move, overcoming the geographical constraints associated with fixed-line connections. Together, these factors underscore the growing dominance and importance of wireless networks in meeting modern connectivity needs.

Global Open Telecoms Market Segmentation: By End User

-

Consumers

-

Businesses

The Global Open Telecoms Market by End-Use, Consumers market share last year and is poised to maintain its dominance throughout the forecast period. Multiple market research reports highlight that the consumer or residential segment has consistently held the largest market share in the Global Open Telecoms Market by end-use. This dominance is driven by several key factors. The widespread adoption of smartphones has been a major catalyst, as consumers use their devices for communication, entertainment, and various other activities, all of which require robust telecom services. Additionally, households increasingly rely on internet access for activities such as browsing, streaming, and online gaming, which fuels demand for data plans and internet subscriptions. The large number of individual consumers compared to businesses also contributes to this significant market force. Looking ahead, the residential segment is expected to maintain its leading position throughout the forecast period. This is supported by the growth of Internet of Things (IoT) devices in homes, which creates further demand for consumer telecom services. Moreover, as internet penetration continues to rise in developing regions, the consumer base for telecom services is set to expand, reinforcing the residential segment's dominance in the market.

Global Open Telecoms Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Open Telecoms Market by Region, Asia-Pacific market share last year and is poised to maintain its dominance throughout the forecast period. Several market research reports indicate that the Asia-Pacific region captured the largest market share in the Global Open Telecoms Market by region in 2023 and is expected to maintain this lead. This dominance is driven by several factors. The region's massive population, particularly in countries like China and India, results in a vast consumer base for telecom services. Rapid development in telecom infrastructure is also a significant contributor, with substantial investments being made in fiber optic networks to enhance internet speed and reliability, as well as in mobile technology, including the widespread adoption of 4G and the rollout of 5G networks. Additionally, government initiatives across the region are actively promoting digitalization and increasing internet access, further fueling market growth. Looking ahead, the Asia-Pacific region is poised to maintain its dominance throughout the forecast period due to rising smartphone penetration, driven by increased affordability, and the booming e-commerce sector, which heavily relies on robust telecom infrastructure. These factors collectively ensure that the region continues to lead in the global open telecoms market.

COVID-19 Impact Analysis on the Global Open Telecoms Market.

The COVID-19 pandemic has profoundly impacted the global open telecoms market, accelerating digital transformation and highlighting the critical role of robust telecom infrastructure. As lockdowns and social distancing measures were implemented worldwide, there was an unprecedented surge in demand for reliable internet connectivity to support remote work, online education, telemedicine, and digital entertainment. Telecom operators faced immense pressure to ensure network resilience and capacity to handle the increased traffic. This period saw rapid deployment and upgrades of network infrastructure, including accelerated rollouts of 5G technology and expansion of broadband services to underserved areas. Additionally, the pandemic underscored the importance of cloud-based telecom solutions, as organizations shifted to virtual operations and required scalable, flexible, and secure communication tools. Despite the challenges posed by supply chain disruptions and economic uncertainties, the telecom sector demonstrated resilience and adaptability. However, the pandemic also exposed disparities in digital access, prompting a renewed focus on bridging the digital divide. In summary, COVID-19 acted as a catalyst for growth and innovation in the open telecoms market, driving investment in advanced technologies and highlighting the necessity of equitable access to digital services.

Latest trends / Developments:

The global open telecoms market is witnessing several transformative trends and developments, driven by technological advancements and evolving consumer demands. One prominent trend is the rapid adoption of 5G technology, which is reshaping the telecom landscape with its promise of ultra-fast speeds, low latency, and high capacity. This is enabling new applications in areas such as augmented reality, autonomous vehicles, and smart cities. Another significant development is the increasing shift towards software-defined networking (SDN) and network function virtualization (NFV), which are revolutionizing network management by allowing greater flexibility, efficiency, and scalability. These technologies enable telecom operators to virtualize network functions and manage them through software, reducing dependence on proprietary hardware and lowering operational costs. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) in telecom networks is enhancing predictive maintenance, network optimization, and customer service through advanced analytics and automation. The rise of edge computing is also notable, as it brings data processing closer to the source of data generation, reducing latency and improving real-time data handling capabilities. These trends, coupled with a growing focus on cybersecurity and data privacy, are driving the evolution of the global open telecoms market, fostering innovation, and enhancing service delivery.

Key Players:

-

Nokia Corporation

-

Huawei Technologies Co., Ltd.

-

Ericsson AB

-

Cisco Systems, Inc.

-

Samsung Electronics Co., Ltd.

-

ZTE Corporation

-

NEC Corporation

-

Fujitsu Limited

-

AT&T Inc.

-

Verizon Communications Inc.

Chapter 1. Open Telecoms Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Open Telecoms Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Open Telecoms Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Open Telecoms Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Open Telecoms Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Open Telecoms Market – By Service Type

6.1 Introduction/Key Findings

6.2 Mobile Data

6.3 Mobile Voice

6.4 Fixed Data

6.5 Fixed Voice

6.6 Y-O-Y Growth trend Analysis By Service Type

6.7 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. Open Telecoms Market – By Technology

7.1 Introduction/Key Findings

7.2 Wireline

7.3 Wireless

7.4 Y-O-Y Growth trend Analysis By Technology

7.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Open Telecoms Market – By End User

8.1 Introduction/Key Findings

8.2 Consumers

8.3 Businesses

8.4 Y-O-Y Growth trend Analysis By End User

8.5 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Open Telecoms Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Service Type

9.1.3 By Technology

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Service Type

9.2.3 By Technology

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Service Type

9.3.3 By Technology

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Service Type

9.4.3 By Technology

9.4.4 By Technology

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Service Type

9.5.3 By Technology

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Open Telecoms Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nokia Corporation

10.2 Huawei Technologies Co., Ltd.

10.3 Ericsson AB

10.4 Cisco Systems, Inc.

10.5 Samsung Electronics Co., Ltd.

10.6 ZTE Corporation

10.7 NEC Corporation

10.8 Fujitsu Limited

10.9 AT&T Inc.

10.10 Verizon Communications Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Open Telecoms market is expected to be valued at US$ 1,805.6 billion.

Through 2030, the Global Open Telecoms market is expected to grow at a CAGR of 6.8%.

By 2030, the Global Open Telecoms Market is expected to grow to a value of US$ 2,874.76 billion.

Asia-Pacific is predicted to lead the Global Open Telecoms market.

The Global Open Telecoms Market has segments By Service Type, Technology, End-user, and Region.