Open Property Market Size (2024 – 2030)

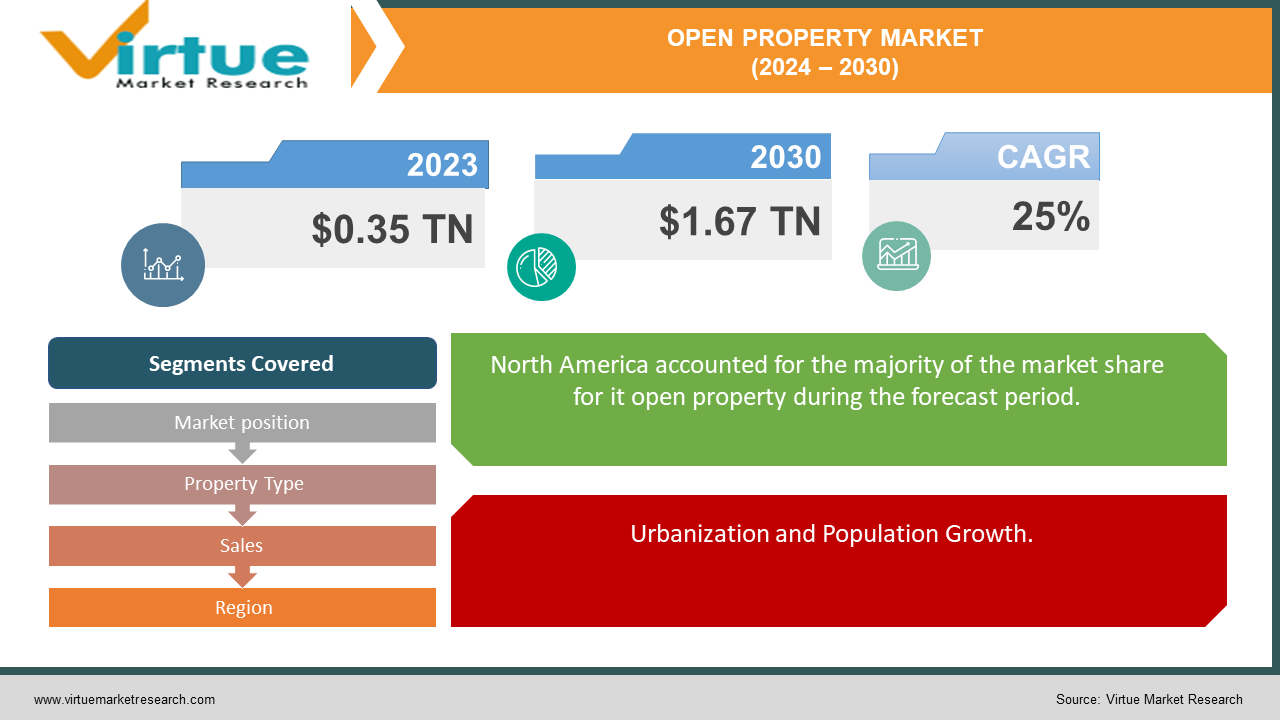

The global open property market is projected to grow from an estimated USD 0.35 trillion in 2023 to USD 1.67 trillion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 25% over the forecast period of 2024-2030.

The global property market is experiencing robust growth, driven by a convergence of economic, demographic, and technological factors. Valued at approximately USD 10.5 trillion in 2023, the market is projected to expand to around USD 14.6 trillion by 2030, reflecting a CAGR of about 5%. This growth is fueled by rapid urbanization, particularly in developing regions, increasing disposable incomes, and a rising demand for both residential and commercial properties. Technological advancements in PropTech are enhancing market efficiencies and transforming property management practices, while sustainability initiatives are driving the development of eco-friendly buildings. Regional dynamics vary, with North America and Europe seeing steady growth, while Asia-Pacific and the Middle East & Africa experience higher growth rates due to urban expansion and economic development. As governments implement policies to encourage affordable housing and commercial development, the property market is set to remain a vital component of the global economy.

Key Insights:

By 2030, it is expected that 60% of the world's population will reside in urban areas, up from 55% in 2023, significantly driving demand for both residential and commercial properties.

The PropTech sector is set to grow at a CAGR of 8%, with innovations in smart home technologies and property management solutions enhancing market efficiencies and customer experiences.

Investments in eco-friendly and sustainable building practices are expected to increase by 7% annually, aligning with global efforts to reduce carbon footprints and enhance energy efficiency in the property sector.

Despite overall market growth, affordability in major urban centers is projected to decline by 3% annually due to rising property prices.

Global Open Property Market Drivers:

Urbanization and Population Growth.

Urbanization and population growth are primary drivers of the global property market. With an increasing number of people moving to urban areas, the demand for residential and commercial properties is rising sharply. By 2030, it is estimated that 60% of the world's population will live in urban regions, up from 55% in 2023. This shift is not only boosting the need for housing but also for associated infrastructure and commercial spaces, driving significant investment and development in the property market.

Technological Advancements in PropTech.

Technological advancements, particularly in PropTech (Property Technology), are transforming the property market landscape. Innovations such as smart home technologies, digital property management tools, and virtual property tours are enhancing operational efficiencies and improving customer experiences. The PropTech sector is projected to grow at a CAGR of 8%, offering new solutions for property transactions, maintenance, and tenant engagement, thereby driving market growth and attracting tech-savvy investors.

Sustainability and Eco-Friendly Practices.

The increasing emphasis on sustainability and eco-friendly practices is a significant driver in the property market. Investors and developers are prioritizing green building techniques and energy-efficient designs to meet rising environmental standards and consumer preferences. Investments in sustainable building practices are expected to increase by 7% annually, contributing to a reduction in carbon footprints and promoting long-term cost savings through improved energy efficiency, making properties more attractive to environmentally conscious buyers and tenants.

Global Open Property Market Restraints and Challenges:

Affordability Crisis.

One of the most pressing challenges in the global property market is the affordability crisis. Rapidly rising property prices, especially in major urban centers, are making it increasingly difficult for average-income individuals and families to purchase homes. This trend is exacerbated by the slow growth of wages compared to property prices, leading to a growing gap between supply and demand for affordable housing. Addressing this issue requires innovative solutions such as government-subsidized housing programs and incentives for developers to build more budget-friendly units.

Regulatory and Policy Uncertainties.

Regulatory and policy uncertainties pose significant challenges to the property market. Frequent changes in property laws, zoning regulations, and tax policies can create an unpredictable environment for developers, investors, and buyers. These uncertainties can delay projects, increase costs, and deter investment. To mitigate these challenges, there is a need for clearer, more stable regulatory frameworks and policies that support sustainable growth and provide confidence to market participants.

Environmental and Climate Risks.

Environmental and climate risks are increasingly impacting the property market. Properties in areas prone to natural disasters such as floods, hurricanes, and wildfires face heightened risks, leading to higher insurance costs and potential losses. Climate change is also driving stricter building codes and sustainability requirements, which can increase development costs. To combat these challenges, the industry must invest in resilient infrastructure, adopt sustainable building practices, and enhance disaster preparedness and response strategies.

Global Open Property Market Opportunities:

Expansion of Smart Cities.

The expansion of smart cities presents a significant opportunity in the global property market. Smart cities integrate advanced technologies such as IoT, AI, and big data to enhance urban living, making cities more efficient, sustainable, and livable. Investment in smart city infrastructure is expected to grow substantially, creating opportunities for property developers to participate in cutting-edge urban projects that attract tech-savvy residents and businesses. This trend promises to drive demand for modern, connected properties equipped with smart technologies.

Growth of Co-Living and Co-Working Spaces.

The growth of co-living and co-working spaces is reshaping the property market, particularly in urban areas. These innovative living and working arrangements cater to the needs of millennials and remote workers, offering flexible, community-oriented spaces. The global co-living market is projected to expand at a CAGR of 10%, while the co-working market is also seeing robust growth. Developers and investors can capitalize on this trend by creating versatile, communal spaces that provide affordable, flexible options for young professionals and freelancers.

Rise of Sustainable and Green Buildings.

The rise of sustainable and green buildings is a major opportunity in the property market. As environmental awareness increases, there is a growing demand for properties that prioritize energy efficiency, reduce carbon footprints, and use eco-friendly materials. Investments in green buildings are expected to increase by 7% annually. Property developers who adopt sustainable practices can attract environmentally conscious buyers and tenants, benefit from potential government incentives, and achieve long-term cost savings through reduced energy consumption.

OPEN PROPERTY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

25% |

|

Segments Covered |

By Market position, Property Type, Sales, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Brookfield Asset Management, Blackstone Group, Simon Property Group, Prologis, Equity Residential, Vonovia, Welltower, Dalian Wanda Group, Gecina, Scentre Group, AvalonBay Communities, Mitsubishi Estate Co., Ltd. |

Open Property Market Segmentation: By Market position

-

Luxury Market

-

Affordable Housing

-

Mid-Range Market

Affordable housing is emerging as one of the most effective and critical segments within the property market. With rapid urbanization and population growth, the demand for affordable housing is surging, especially in developing countries where a significant portion of the population struggles with housing affordability. Governments worldwide are implementing policies and incentives to boost the development of affordable housing to address this growing need. Initiatives such as subsidies, tax breaks for developers, and public-private partnerships are fostering the construction of budget-friendly homes. The affordable housing segment not only addresses the basic need for shelter but also stimulates economic growth by creating jobs and stabilizing communities. Furthermore, as income disparities widen, the importance of affordable housing becomes even more pronounced, ensuring that a larger segment of the population can achieve homeownership and improve their living standards. By focusing on this segment, developers and investors can tap into a vast and underserved market, ensuring both social impact and sustainable business growth.

Open Property Market Segmentation: By Property Type

-

Residential

-

Commercial

-

Speciality

Residential properties represent the most effective and vital segment within the property market. This segment encompasses a broad range of housing options, from single-family homes and apartments to condominiums and townhouses, catering to diverse demographic groups and income levels. The demand for residential properties is consistently high, driven by fundamental human needs for shelter and the increasing global population. Urbanization trends further amplify this demand, as more people move to cities in search of better opportunities and living standards. Additionally, the residential market is bolstered by favorable government policies, such as first-time homebuyer incentives and affordable housing programs, which stimulate development and homeownership. Technological advancements, including smart home technologies and sustainable building practices, are enhancing the appeal and functionality of residential properties, attracting modern buyers. As the backbone of the property market, residential real estate offers stable, long-term investment opportunities with the potential for steady appreciation and rental income, making it a cornerstone for both individual investors and large-scale developers.

Open Property Market Segmentation: By Sales

-

Rentals/Leases

-

Investment

Rentals and leases constitute one of the most effective and dynamic segments within the property market. This segment caters to a wide range of demographics, including young professionals, students, expatriates, and individuals seeking flexible living arrangements. The demand for rental properties is particularly strong in urban areas, where high property prices make homeownership less accessible. The rental market offers significant advantages for both tenants and property owners. For tenants, rentals provide flexibility, less financial commitment, and the ability to live in desirable locations without the burden of a mortgage. For property owners, leasing properties generates steady, predictable income and the potential for property value appreciation over time. Furthermore, the rise of the gig economy and remote work trends has fueled demand for rental properties that offer short-term and flexible lease options. Additionally, institutional investors are increasingly entering the rental market, attracted by its resilience and long-term revenue streams. As housing affordability continues to be a challenge globally, the rentals and leases segment remains a critical and effective component of the property market, meeting the needs of a broad and diverse population.

Open Property Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In the global open property market, North America leads with a commanding 35% market share, driven by robust real estate investment and technological advancements. Europe follows closely behind, securing 25% of the market with its diverse and stable property landscape. The Asia-Pacific region contributes significantly with 20%, reflecting rapid urbanization and burgeoning middle-class demand. South America and the Middle East and Africa each claim a 10% share, showcasing emerging opportunities amidst evolving economic landscapes. This distribution underscores a dynamic global market where regional strengths and growth trajectories shape the future of open property investments worldwide.

COVID-19 Impact Analysis on the Global Open Property Market:

The COVID-19 pandemic has profoundly impacted the global open property market, ushering in a period of unprecedented challenges and adaptations. Initially, the market experienced sharp declines in transaction volumes and property values as lockdowns and economic uncertainty gripped major regions worldwide. However, as the crisis unfolded, there was a notable shift towards digitalization and remote operations within the real estate sector. Virtual tours, digital transactions, and remote work policies became pivotal in sustaining market activity and fostering resilience. Moreover, there emerged a renewed focus on property types such as residential spaces equipped for remote work, and industrial properties supporting e-commerce growth. Looking forward, the market is poised for recovery and transformation, marked by innovative approaches and adaptive strategies that harness technology and accommodate shifting global dynamics.

Latest Trends/ Developments:

In recent years, the global open property market has witnessed a surge of transformative trends and developments. One of the most notable shifts has been the accelerated adoption of digital technologies across all facets of real estate operations. Virtual reality (VR) and augmented reality (AR) have revolutionized property viewings and marketing strategies, offering immersive experiences that bridge geographical distances. Additionally, sustainable building practices and green certifications have gained prominence, reflecting a growing commitment to environmental stewardship and energy efficiency. The rise of co-living and flexible workspace solutions has catered to changing lifestyles and work preferences, while proptech innovations have streamlined property management and tenant experiences. Amidst these advancements, there's also been a renewed focus on wellness-centric design and community-driven spaces, responding to evolving consumer expectations and demographic shifts. As the industry continues to evolve, these trends promise to reshape the future landscape of global real estate, emphasizing sustainability, flexibility, and innovation.

Key Players:

-

Brookfield Asset Management

-

Blackstone Group

-

Simon Property Group

-

Prologis

-

Equity Residential

-

Vonovia

-

Welltower

-

Dalian Wanda Group

-

Gecina

-

Scentre Group

-

AvalonBay Communities

-

Mitsubishi Estate Co., Ltd.

Chapter 1. Open Property Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Open Property Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Open Property Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Open Property Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Open Property Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Open Property Market – By Market position

6.1 Introduction/Key Findings

6.2 Luxury Market

6.3 Affordable Housing

6.4 Mid-Range Market

6.5 Y-O-Y Growth trend Analysis By Market position

6.6 Absolute $ Opportunity Analysis By Market position, 2024-2030

Chapter 7. Open Property Market – By Property Type

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Speciality

7.5 Y-O-Y Growth trend Analysis By Property Type

7.6 Absolute $ Opportunity Analysis By Property Type, 2024-2030

Chapter 8. Open Property Market – By Sales

8.1 Introduction/Key Findings

8.2 Rentals/Leases

8.3 Investment

8.4 Y-O-Y Growth trend Analysis By Sales

8.5 Absolute $ Opportunity Analysis By Sales, 2024-2030

Chapter 9. Open Property Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Market position

9.1.3 By Property Type

9.1.4 By By Sales

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Market position

9.2.3 By Property Type

9.2.4 By Sales

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Market position

9.3.3 By Property Type

9.3.4 By Sales

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Market position

9.4.3 By Property Type

9.4.4 By Sales

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Market position

9.5.3 By Property Type

9.5.4 By Sales

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Open Property Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Brookfield Asset Management

10.2 Blackstone Group

10.3 Simon Property Group

10.4 Prologis

10.5 Equity Residential

10.6 Vonovia

10.7 Welltower

10.8 Dalian Wanda Group

10.9 Gecina

10.10 Scentre Group

10.11 AvalonBay Communities

10.12 Mitsubishi Estate Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global open property market is projected to grow from an estimated USD 0.35 trillion in 2023 to USD 1.67 trillion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 25% over the forecast period of 2024-2030.

The primary drivers of the global open property market include economic growth, urbanization trends, demographic shifts, and technological advancements.

One of the key challenges facing the global open property market is economic volatility and uncertainty, affecting investment confidence and market stability.

In 2023, North America held the largest share of the global open property market.

Brookfield Asset Management, Blackstone Group, Simon Property Group, Prologis, Equity Residential, Vonovia, Welltower, Dalian Wanda Group, Gecin, Scentre Group, AvalonBay Communities, Mitsubishi Estate Co., Ltd. are the main players.