Open Insurance Market Size (2024 – 2030)

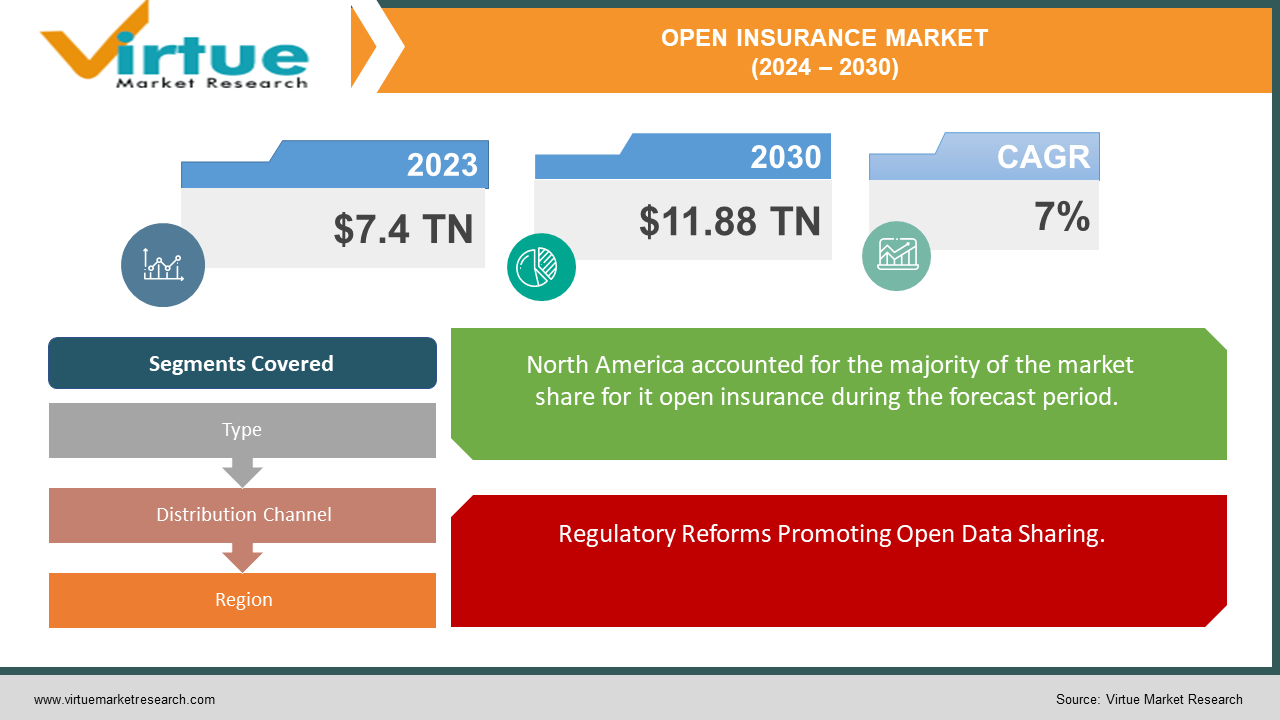

The global open insurance market is projected to grow from an estimated USD 7.4 trillion in 2023 to USD 11.88 trillion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 7% over the forecast period of 2024-2030.

The open insurance market growth is fueled by the increasing adoption of digital solutions, such as AI-driven underwriting and blockchain for secure transactions, which enhance operational efficiency and customer experience. Insurtech startups are playing a pivotal role in disrupting traditional insurance models, offering innovative products tailored to individual needs and leveraging open APIs to facilitate seamless integration with other financial services. Regulatory initiatives promoting open data sharing and interoperability further bolster market dynamics, fostering competition and expanding market access. As insurers embrace digital transformation and collaborate with tech-driven partners, the open insurance market continues to evolve, catering to a more diverse and dynamic landscape of insurance consumers worldwide.

Key Insights:

Insurtech startups are expected to capture a significant portion of the market, with their market share anticipated to increase by 12% annually over the next five years.

The adoption of AI in underwriting processes is forecasted to reduce operational costs for insurers by 15% by 2025.

Regulatory reforms promoting open data sharing are projected to increase market transparency and efficiency, leading to a 20% decrease in fraud rates within the next three years.

Despite technological advancements, cybersecurity incidents in the open insurance sector are on the rise, with reported breaches increasing by 25% annually. Implementing robust cybersecurity protocols and investing in advanced encryption technologies are crucial steps to mitigate these risks.

Global Open Insurance Market Drivers:

Technological Advancements Fueling Innovation in Open Insurance Market.

The rapid advancement of technologies such as artificial intelligence (AI), machine learning, and blockchain is revolutionizing the open insurance market. AI-powered algorithms are enhancing underwriting processes, enabling more accurate risk assessments and personalized insurance offerings. Blockchain technology ensures secure, transparent transactions and reduces administrative costs. These innovations not only streamline operations but also improve customer experiences by offering faster claims processing and more tailored insurance solutions.

Regulatory Reforms Promoting Open Data Sharing.

Regulatory initiatives aimed at fostering open data sharing are playing a pivotal role in expanding the open insurance market. Policies mandating insurers to share anonymized data with third-party providers through open APIs are fostering competition and innovation. This accessibility to data allows insurtech startups and traditional insurers alike to develop new products, improve pricing models, and enhance customer engagement strategies. Such regulatory frameworks are driving industry-wide collaboration and paving the way for a more interconnected insurance ecosystem.

Shifting Consumer Preferences Towards Digital Solutions.

Increasing consumer demand for seamless digital experiences is driving insurers to adopt open insurance models. Customers now expect convenient access to insurance services through mobile apps, websites, and digital platforms. Open APIs enable insurers to integrate with fintech solutions, offering customers personalized insurance products, real-time policy management, and simplified claims processes. This shift towards digital-first solutions not only meets customer expectations but also improves operational efficiencies for insurers, leading to higher customer satisfaction and retention rates.

Global Open Insurance Market Restraints and Challenges:

Data Privacy and Security Concerns Threaten Open Insurance Market Growth.

The open insurance market is grappling with significant data privacy and security challenges as insurers increasingly share sensitive customer information through open APIs. Concerns over data breaches, unauthorized access, and regulatory compliance loom large. Insurers must prioritize robust cybersecurity measures, including encryption technologies, regular audits, and staff training, to mitigate risks and build consumer trust in the safety of their data.

Integration Complexities Impede Seamless Operations in Open Insurance.

Integrating diverse systems and platforms across insurers and third-party providers presents formidable challenges in the open insurance landscape. Compatibility issues, interoperability gaps, and varying technological standards hinder seamless data exchange and operational efficiency. Insurers need to invest in scalable API architectures, standardized protocols, and collaborative partnerships to streamline integration processes and accelerate time-to-market for new digital products and services.

Regulatory Compliance Burden Puts Pressure on Open Insurance Innovations.

Navigating complex and evolving regulatory frameworks poses a significant hurdle for insurers embracing open insurance models. Compliance with data protection laws, consumer rights directives, and industry-specific regulations requires dedicated resources and expertise. Insurers must stay abreast of regulatory changes, engage proactively with policymakers, and adopt flexible compliance strategies to ensure regulatory adherence while fostering innovation and market competitiveness in the dynamic open insurance market.

Global Open Insurance Market Opportunities:

Innovation in Customer Experience.

Open insurance models allow insurers to leverage data-driven insights and digital platforms to offer personalized, customer-centric insurance products and services. By embracing AI, machine learning, and predictive analytics, insurers can enhance customer engagement, streamline claims processes, and deliver tailored solutions that meet evolving consumer preferences.

Partnerships with Insurtech Startups.

Collaborating with innovative insurtech startups enables traditional insurers to tap into new technologies and business models. These partnerships facilitate rapid experimentation and adoption of cutting-edge solutions such as IoT-enabled devices for risk monitoring, blockchain for secure transactions, and automated underwriting algorithms. Such collaborations drive innovation, accelerate time-to-market, and expand market reach.

Expansion into Emerging Markets.

The adoption of open insurance models presents opportunities for insurers to penetrate emerging markets where there is a growing demand for accessible and affordable insurance solutions. By leveraging digital channels and mobile platforms, insurers can reach underserved populations, expand their customer base, and diversify revenue streams.

OPEN INSURANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Type of Insurance, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lemonade, Oscar Health, ZhongAn Online P&C Insurance, Ping An Insurance, Metromile, Hippo Insurance, Policybazaar, Cover Genius, Trov, BIMA, Bought By Many, Root Insurance Company |

Open Insurance Market Segmentation: By Type of Insurance

-

Life Insurance

-

Health Insurance

-

Property Insurance

-

Others

Among the types of insurance segmented within the global open insurance market, health insurance stands out as particularly effective in leveraging open insurance models. The integration of open APIs and digital platforms has revolutionized how health insurers interact with customers, healthcare providers, and data sources. Open insurance facilitates real-time data sharing for personalized health monitoring, remote consultations, and proactive wellness programs. This approach not only enhances customer engagement and satisfaction but also improves operational efficiencies through automated claims processing and fraud detection. Moreover, open health insurance fosters innovation by enabling insurers to collaborate with health tech startups and integrate advanced technologies like wearables and telemedicine solutions. As regulatory frameworks evolve to support data privacy and security, health insurers embracing open insurance are well-positioned to drive industry-wide transformation and deliver value-driven healthcare solutions in a rapidly digitizing world.

Open Insurance Market Segmentation: By Distribution Channel

-

Consumers

-

Facilitating comparison

-

Purchase

-

Management of policies

Among the distribution channels segmented within the global open insurance market, facilitating comparison platforms stands out as highly effective. These platforms provide consumers with transparent and accessible information, enabling them to compare various insurance products and services easily. By offering comprehensive insights into coverage options, premiums, and benefits from multiple insurers, comparison platforms empower consumers to make informed decisions tailored to their specific needs and preferences. This transparency fosters competition among insurers, driving innovation in product offerings and pricing strategies. Moreover, facilitating comparison platforms streamlines the insurance shopping experience, reducing friction in the purchase journey and enhancing customer satisfaction. Insurers leveraging these channels benefit from increased market visibility, expanded customer acquisition opportunities, and improved brand reputation for accessibility and consumer-centricity. As digital adoption continues to rise, comparison platforms play a crucial role in shaping the future of the open insurance market by promoting market efficiency, customer empowerment, and sustainable growth.

Open Insurance Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The global open insurance market exhibits diverse regional distributions, with North America leading at 30%, followed closely by Europe at 25%, and the Asia-Pacific region at 24%. South America contributes 11%, while the Middle East and Africa combined account for 10% of the market share. North America's prominent position can be attributed to its robust technological infrastructure and early adoption of digital innovations in insurance services. Europe follows suit with strong regulatory frameworks supporting open insurance initiatives and fostering competitive market dynamics. The Asia-Pacific region showcases rapid growth driven by expanding middle-class populations and increasing digital penetration. South America the Middle East and Africa regions are steadily progressing, focusing on enhancing insurance accessibility and modernizing regulatory environments to stimulate further market expansion. As global connectivity and digital transformation continue to evolve, these regional disparities in market share are expected to narrow, presenting opportunities for insurers to innovate and cater to diverse consumer demands on a more global scale.

COVID-19 Impact Analysis on the Global Open Insurance Market:

The COVID-19 pandemic has had a profound impact on the global open insurance market, reshaping industry dynamics and consumer behavior. Initially, the pandemic prompted a surge in demand for health and life insurance products as individuals sought coverage against health risks and uncertainties. Insurers quickly adapted by leveraging digital platforms and open insurance models to facilitate remote consultations, claims processing, and customer service, ensuring continuity amid lockdowns and social distancing measures. The crisis also accelerated digital transformation within the insurance sector, prompting increased investments in AI-driven underwriting, telemedicine solutions, and customer engagement technologies. However, the economic downturn and job losses during the pandemic have posed challenges, affecting premium collections and insurance affordability for some segments. Moving forward, insurers are expected to prioritize resilience, agility, and customer-centric strategies, harnessing the lessons learned from COVID-19 to innovate and address evolving consumer needs in a post-pandemic world.

Latest Trends/ Developments:

The global open insurance market is witnessing transformative trends and developments that are reshaping the industry landscape. Key among these is the increasing adoption of digital technologies, such as artificial intelligence (AI), machine learning, and blockchain, to enhance operational efficiency and customer engagement. Insurers are leveraging AI for advanced data analytics and personalized underwriting, improving risk assessment accuracy and tailoring insurance offerings to individual needs. Blockchain technology is being utilized to streamline claims processing, ensuring transparency and security in transactions. Moreover, there is a growing emphasis on ecosystem partnerships and collaboration with insurtech startups to drive innovation and expand service offerings. Customer expectations are also evolving, with a demand for seamless digital experiences, mobile-first solutions, and on-demand insurance products. Regulatory developments promoting open data sharing and interoperability further catalyze market evolution, fostering a more interconnected and competitive landscape. As insurers navigate these trends, the focus remains on agility, customer-centricity, and leveraging technology to stay ahead in an increasingly digital and interconnected insurance market.

Key Players:

-

Lemonade

-

Oscar Health

-

ZhongAn Online P&C Insurance

-

Ping An Insurance

-

Metromile

-

Hippo Insurance

-

Policybazaar

-

Cover Genius

-

Trov

-

BIMA

-

Bought By Many

-

Root Insurance Company

Chapter 1. Open Insurance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Open Insurance Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Open Insurance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Open Insurance Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Open Insurance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Open Insurance Market – By Types

6.1 Introduction/Key Findings

6.2 Life Insurance

6.3 Health Insurance

6.4 Property Insurance

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Types

6.7 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Open Insurance Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Consumers

7.3 Facilitating comparison

7.4 Purchase

7.5 Management of policies

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Open Insurance Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Open Insurance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Lemonade

9.2 Oscar Health

9.3 ZhongAn Online P&C Insurance

9.4 Ping An Insurance

9.5 Metromile

9.6 Hippo Insurance

9.7 Policybazaar

9.8 Cover Genius

9.9 Trov

9.10 BIMA

9.11 Bought By Many

9.12 Root Insurance Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global open insurance market is projected to grow from an estimated USD 7.4 trillion in 2023 to USD 11.88 trillion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 7% over the forecast period of 2024-2030.

The primary drivers of the global insurance market include increasing awareness of risk management, regulatory reforms, technological advancements, and expanding middle-class populations.

The key challenges facing the global open transport market include regulatory complexities, infrastructure limitations, integration barriers, and ensuring equitable access to mobility solutions.

In 2023, North America held the largest share of the global open insurance market.

Lemonade, Oscar Health, ZhongAn Online P&C Insurance, Ping An Insurance, Metromile, Hippo Insurance, Policybazaar, Cover Genius, Trov, BIMA, Bought By Many, and Root Insurance Company are the main players.