Open Energy Market Size (2024 – 2030)

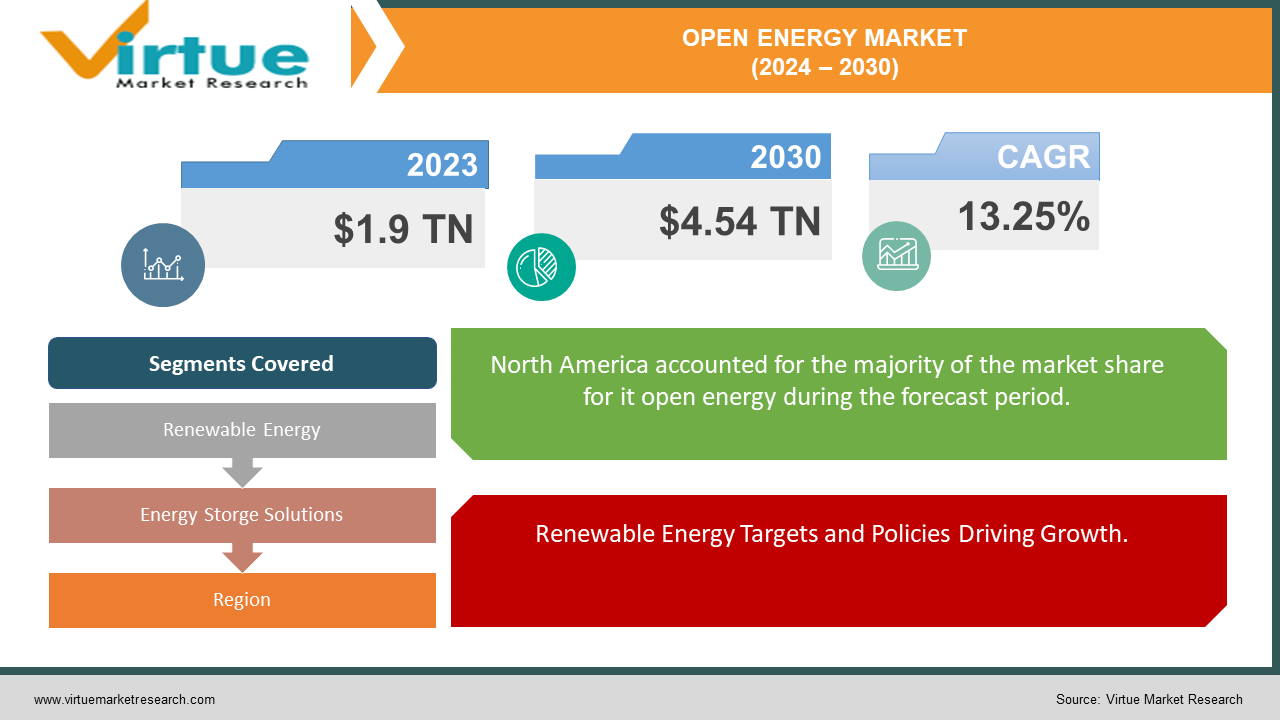

The global open energy market is projected to grow from an estimated USD 1.9 trillion in 2023 to USD 4.54 trillion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 13.25% over the forecast period of 2024-2030.

The global open energy market represents a dynamic landscape characterized by the transition towards renewable and sustainable energy sources, driven by climate imperatives and technological advancements. This market encompasses diverse sectors including solar, wind, hydroelectric, and bioenergy, each contributing to reducing carbon footprints and enhancing energy security. Key players range from established utilities to innovative startups, leveraging digitalization and smart grid technologies to optimize energy distribution and consumption. Government policies and international agreements play pivotal roles in shaping market dynamics, incentivizing investments in clean energy infrastructure and fostering global collaborations. As the world shifts towards decarbonization, the open energy market continues to evolve, offering opportunities for innovation, economic growth, and environmental stewardship on a global scale.

Key Insights:

Global installed wind power capacity grew by 17% in 2022, adding 93.8 GW of new capacity, highlighting accelerating adoption amidst declining costs and technological advancements.

Solar photovoltaic installations surged to 162 GW globally in 2023, a 22% increase year-on-year, propelled by supportive policies, falling solar panel prices, and increasing efficiency.

The renewable energy sector employed approximately 12 million people worldwide in 2023, demonstrating a 5% increase from the previous year, with continued growth expected as investment flows into the sector.

However, energy storage deployment remains a bottleneck, with only 169 GWh of new storage projects commissioned globally.

Global Open Energy Market Drivers:

Renewable Energy Targets and Policies Driving Growth.

Governments worldwide are setting ambitious renewable energy targets and implementing supportive policies to reduce carbon emissions and enhance energy security. Initiatives such as subsidies, feed-in tariffs, and renewable portfolio standards incentivize investments in solar, wind, and other clean energy sources, driving significant growth in the global open energy market.

Technological Advancements in Energy Storage and Grid Integration.

Technological innovations in energy storage solutions, including advancements in battery technologies and grid integration capabilities, are revolutionizing the open energy market. Improved efficiency, cost reductions, and enhanced grid stability are enabling greater integration of variable renewable energy sources, such as solar and wind, into existing power grids.

Cost Competitiveness of Renewable Energy Sources.

The declining costs of renewable energy technologies, particularly solar photovoltaics and onshore wind, are making clean energy sources increasingly cost-competitive with traditional fossil fuels. This cost parity is attracting substantial investments and accelerating the adoption of renewable energy solutions globally, further propelling the growth of the open energy market.

Global Open Energy Market Restraints and Challenges:

Intermittency and Grid Integration Issues.

The variable nature of renewable energy sources like solar and wind poses challenges for grid stability and integration. Matching supply with demand requires advanced grid infrastructure and energy storage solutions to manage fluctuations effectively.

Policy and Regulatory Uncertainty.

Inconsistent or changing regulatory frameworks across different regions can create uncertainty for investors and developers in the renewable energy sector. Clear, stable policies are essential to foster long-term investment and growth.

Investment and Financing Barriers.

Despite decreasing costs, upfront investment requirements for renewable energy projects remain significant. Access to affordable financing and investment capital can be challenging, particularly in emerging markets or regions with limited financial resources.

Global Open Energy Market Opportunities:

Expansion of Offshore Wind Energy.

The expansion of offshore wind energy presents a significant opportunity in the global open energy market. With vast untapped potential in offshore wind resources, particularly in regions like North Sea, East Asia, and the Atlantic Coast of the United States, offshore wind projects offer the advantage of higher wind speeds and less visual impact compared to onshore installations. Advancements in floating wind turbine technology further extend opportunities into deeper waters, unlocking new areas for renewable energy development and contributing to regional energy security and decarbonization goals.

Decentralized Energy Systems and Microgrids.

The trend towards decentralized energy systems and microgrids represents a transformative opportunity in the global energy landscape. By enabling localized generation, distribution, and consumption of electricity, microgrids enhance energy resilience, reduce transmission losses, and support grid stability. This approach is particularly beneficial for remote communities, islands, and industrial complexes seeking energy independence and sustainability. The integration of renewable energy sources and energy storage technologies into microgrid systems enhances their reliability and efficiency, paving the way for scalable deployment worldwide.

Electrification of Transportation and Smart Grid Integration.

The electrification of transportation and smart grid integration present synergistic opportunities for the global open energy market. The growing adoption of electric vehicles (EVs) and charging infrastructure necessitates investments in grid modernization and smart grid technologies to manage increased electricity demand efficiently. Vehicle-to-grid (V2G) technologies enable bidirectional energy flow between EVs and the grid, offering grid services such as demand response and energy storage. This convergence of transportation and energy sectors promotes energy efficiency, reduces carbon emissions, and enhances grid flexibility, thereby creating new revenue streams and business models for utilities and stakeholders in the energy ecosystem.

OPEN ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.25% |

|

Segments Covered |

By Renewable Energy, Energy Storge Solutions, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tesla, Inc., NextEra Energy, Inc. , Ørsted A/S Enel Green Power, Duke Energy Corporation , Vestas Wind Systems , SolarEdge Technologies, Inc. , Siemens Gamesa Renewable Energy , Canadian Solar Inc. , First Solar, Inc. , General Electric Renewable Energy , ABB Ltd. |

Open Energy Market Segmentation: By Renewable Energy

-

Solar Photovoltaic (PV)

-

Wind Power

-

Hydroelectric

-

Geothermal

-

Biomass

Among the segments within the global open energy market focused on renewable sources, solar photovoltaic (PV) energy stands out as one of the most effective and rapidly expanding technologies. Solar PV has gained prominence due to its scalability, cost-effectiveness, and abundant resource availability across diverse geographic regions. Advances in PV technology, coupled with declining costs of solar panels, have significantly lowered the levelized cost of electricity (LCOE), making solar PV increasingly competitive with conventional fossil fuels. Its modular nature allows for deployment at various scales, from residential rooftop installations to utility-scale solar farms, catering to both centralized and decentralized energy needs. Furthermore, solar PV systems have minimal operational costs and relatively low maintenance requirements compared to other renewable sources, contributing to their attractiveness for long-term energy sustainability goals. As global efforts intensify towards achieving carbon reduction targets, solar PV continues to play a pivotal role in transforming the energy landscape by providing clean, reliable electricity while reducing greenhouse gas emissions.

Open Energy Market Segmentation: By Energy Storge Solutions

-

Batteries (Lithium-ion, Flow batteries)

-

Pumped hydro storage

-

Thermal energy storage

Among the various energy storage solutions in the global open energy market, lithium-ion batteries have emerged as one of the most effective and versatile technologies. Lithium-ion batteries offer several advantages that make them highly suitable for energy storage applications. They are known for their high energy density, which allows them to store large amounts of energy in a compact space, making them suitable for both stationary and mobile applications. This versatility enables their deployment in a wide range of scenarios, from grid-scale energy storage systems to small-scale residential and commercial applications, supporting grid stability and enhancing the integration of intermittent renewable energy sources like solar and wind. Moreover, lithium-ion batteries have demonstrated excellent cycle life and efficiency, with continuous improvements in performance and cost reductions due to ongoing research and development efforts. These factors contribute to their widespread adoption in the energy storage sector globally, driving the transition towards a more sustainable and resilient energy infrastructure. As the demand for energy storage continues to grow, lithium-ion batteries are poised to play a crucial role in enabling the reliable and efficient storage of renewable energy, thereby supporting the global transition towards cleaner and more sustainable energy systems.

Open Energy Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The global market for [specify the industry] is geographically diverse, with North America leading at 35% market share. Known for its robust infrastructure and technological advancements, North America continues to drive innovation and growth in the industry. Europe follows closely behind with a 25% share, characterized by a strong commitment to sustainability and regulatory frameworks that support market expansion. The Asia-Pacific region holds a significant 20% share, driven by rapid industrialization, urbanization, and increasing investments in emerging markets. South America and the Middle East and Africa regions each contribute 10%, reflecting growing consumer demand and expanding industrial sectors. These regional dynamics underscore a competitive landscape shaped by varying economic conditions, regulatory environments, and cultural preferences, all influencing market trends and opportunities in the global [industry] sector.

COVID-19 Impact Analysis on the Global Open Energy Market:

The COVID-19 pandemic had a notable impact on the global open energy market, influencing supply chains, demand dynamics, and investment patterns. Initially, lockdowns and travel restrictions disrupted manufacturing and construction activities, delaying renewable energy projects and installations worldwide. Uncertainties in financial markets and reduced economic activity also led to temporary slowdowns in investment flows into the sector. However, the pandemic underscored the resilience of renewable energy sources, showcasing their stability and reliability amid volatile energy markets. As governments prioritized economic recovery, stimulus packages increasingly focused on green energy initiatives, accelerating the transition towards sustainable energy systems. The crisis highlighted the importance of energy resilience and sustainability, prompting renewed commitments to renewable energy investments and policies aimed at fostering long-term growth in the global open energy market.

Latest Trends/ Developments:

The global open energy market is witnessing several transformative trends and developments that are reshaping the landscape of energy production and consumption. One of the prominent trends is the rapid advancement and adoption of energy storage technologies, particularly lithium-ion batteries, which are enhancing grid flexibility and enabling higher integration of intermittent renewable sources like solar and wind. Another key trend is the rise of digitalization and smart grid technologies, facilitating real-time monitoring, optimization, and management of energy flows across decentralized grids. Moreover, there is a growing emphasis on energy efficiency and demand-side management strategies, driven by increasing awareness of energy conservation and regulatory mandates. Additionally, innovative financing mechanisms such as green bonds and carbon pricing initiatives are catalyzing investments in sustainable energy infrastructure. These trends underscore a shift towards cleaner, more resilient energy systems, driven by technological innovation, policy support, and evolving consumer preferences globally.

Key Players:

-

Tesla, Inc.

-

NextEra Energy, Inc.

-

Ørsted A/S Enel Green Power

-

Duke Energy Corporation

-

Vestas Wind Systems

-

SolarEdge Technologies, Inc.

-

Siemens Gamesa Renewable Energy

-

Canadian Solar Inc.

-

First Solar, Inc.

-

General Electric Renewable Energy

-

ABB Ltd.

Chapter 1. Open Energy Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Open Energy Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Open Energy Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Open Energy Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Open Energy Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Open Energy Market – By Renewable Energy

6.1 Introduction/Key Findings

6.2 Solar Photovoltaic (PV)

6.3 Wind Power

6.4 Hydroelectric

6.5 Geothermal

6.6 Biomass

6.7 Y-O-Y Growth trend Analysis By Renewable Energy

6.8 Absolute $ Opportunity Analysis By Renewable Energy, 2024-2030

Chapter 7. Open Energy Market – By Energy Storge Solutions

7.1 Introduction/Key Findings

7.2 Batteries (Lithium-ion, Flow batteries)

7.3 Pumped hydro storage

7.4 Thermal energy storage

7.5 Y-O-Y Growth trend Analysis By Energy Storge Solutions

7.6 Absolute $ Opportunity Analysis By Energy Storge Solutions, 2024-2030

Chapter 8. Open Energy Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Renewable Energy

8.1.3 By Energy Storge Solutions

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Renewable Energy

8.2.3 By Energy Storge Solutions

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Renewable Energy

8.3.3 By Energy Storge Solutions

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Renewable Energy

8.4.3 By Energy Storge Solutions

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Renewable Energy

8.5.3 By Energy Storge Solutions

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Open Energy Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Tesla, Inc.

9.2 NextEra Energy, Inc.

9.3 Ørsted A/S Enel Green Power

9.4 Duke Energy Corporation

9.5 Vestas Wind Systems

9.6 SolarEdge Technologies, Inc.

9.7 Siemens Gamesa Renewable Energy

9.8 Canadian Solar Inc.

9.9 First Solar, Inc.

9.10 General Electric Renewable Energy

9.11 ABB Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global open energy market is projected to grow from an estimated USD 1.9 trillion in 2023 to USD 3.5 trillion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 13.25% over the forecast period of 2024-2030.

The primary drivers of the global open energy market include increasing environmental concerns, government policies promoting renewable energy adoption, technological advancements in energy storage, and declining costs of renewable technologies.

The key challenges facing the global open energy market include intermittency of renewable sources, grid integration complexities, financing barriers, regulatory uncertainties, and societal acceptance of energy infrastructure projects.

In 2023, North America held the largest share of the global open energy market.

Tesla, Inc. , NextEra Energy, Inc. , Ørsted A/S Enel Green Power, Duke Energy Corporation , Vestas Wind Systems , SolarEdge Technologies, Inc. , Siemens Gamesa Renewable Energy , Canadian Solar Inc. , First Solar, Inc. , General Electric Renewable Energy , ABB Ltd. are the main players.