Global Online Used Car Market Size (2023 - 2030)

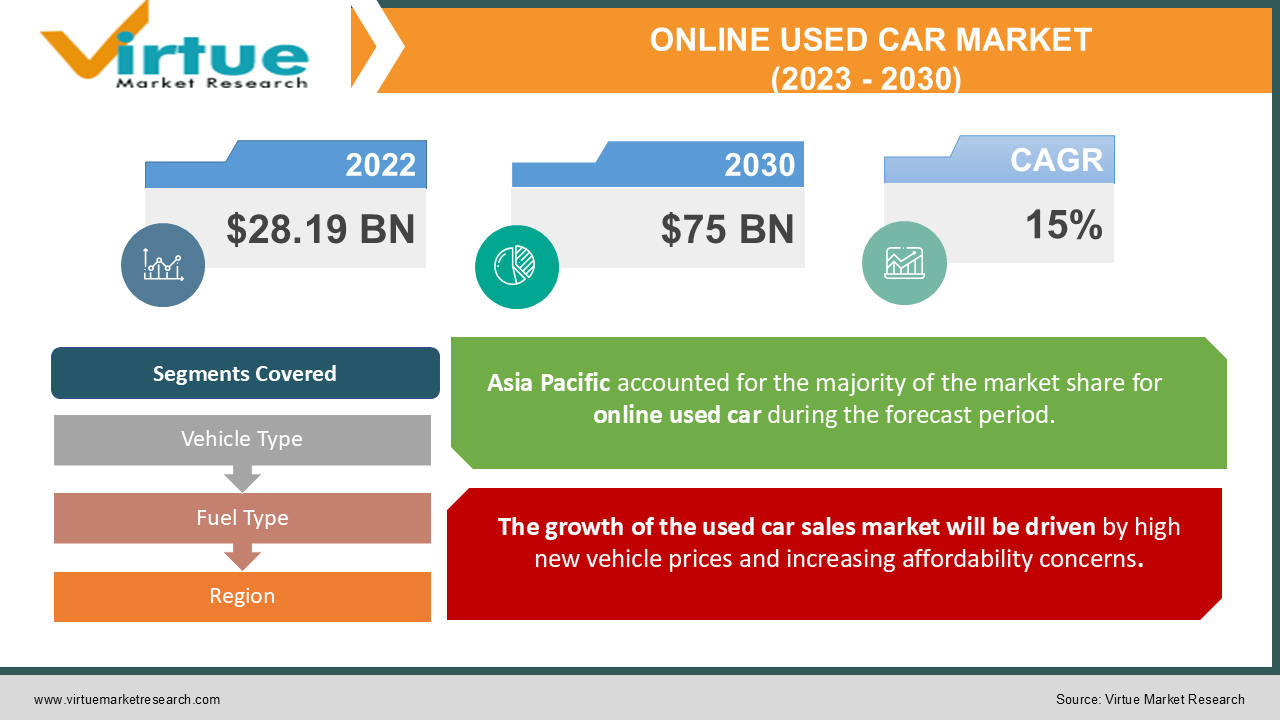

The Global online used car market was valued at USD 28.19 billion in 2022 and is projected to reach a market size of USD 75 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 15%.

Industry Overview

The second-hand car that is up for sale is referred to as a used car. Used cars are sold through a variety of channels, including franchise and independent car dealers, rental car agencies, auctions, private party sales, and leasing offices. Due to the high cost of cars and the associated maintenance costs, millennials buy fewer cars overall. Additionally, because millennials tend to be cost-conscious, they frequently choose second-hand automobiles for vacation. Additionally, the high cost of new automobiles prevents many people from purchasing them, which increases demand for older cars. This opens the door for various investments by sector players to set up their dealership network in the market.

The market for used automobiles is estimated to develop as a result of factors including the high price of new cars, worries about affordability, and increased demand from franchises, leasing offices, and car dealers for off-lease cars and subscription services. The expansion of the international market is, however, hampered by the unstructured used automobile transactions and the absence of regularisation. In addition, the emergence of e-commerce and online technologies, a steady rise in organized/semi-organized sales in developing nations, an increase in the global market for electric vehicles, and the demand for car-sharing services are all predicted to present lucrative opportunities for the expansion of the used-car market.

Additionally, the importance of internet sales has grown to be a crucial industry development component. Online car markets have been crucial in enabling consumers to access products with a single touch. The market for second-hand automobiles has increased as a result of a number of these changes. The market has expanded as a consequence of several causes like affordability, the availability of used automobiles, the rise in demand for personal mobility, and the appearance of numerous internet players to organise the market. For instance, Ebay Inc. introduced a new eBay Motors application in 2019 to improve the online procedure for selling and buying old cars.

Market Drivers

The growth of the used car sales market will be driven by high new vehicle prices and increasing affordability concerns.

The demand for cutting-edge technologies in cars, such power steering, temperature control, anti-lock braking, and others, has surged over the last few years, according to the automotive industry. This has caused the cost of new automobiles to increase as a result. Furthermore, the price increases in 2019 that were driven by popular passenger vehicle classes are a hint of problems with affordability in the emerging market. Additionally, rising auto costs are returning to the second-hand market. As a result, the automotive sector has seen more used car sales than new vehicle sales, which is estimated to enhance demand for used automobiles in the near future.

Rise in demand for off-lease cars & subscription service by the franchise, leasing offices, and car dealers

The danger of new entrants into the market and increased competition are the main drivers of the used vehicle dealership industry's expansion. Consumer perceptions of the used car industry have evolved as a result of the reliability and added services/quality. Franchised dealers are also well-positioned to gain from the expansion of the used vehicle market thanks to support from OEM engagement in certification and marketing programmes, online inventory pooling, and access to high-quality contracts. In addition, demand for vehicle subscription services, which let customers use cars on a monthly basis in exchange for payments that cover maintenance, insurance, and roadside assistance, has increased recently.

Market Restraints

Number of unorganized players in the used cars market challenge the market growth

The growth of the used car market is hampered by the unorganised players. The unorganised businesses dominate the used automobile industry in nations like India, China, Thailand, Brazil, and Mexico. Furthermore, the unorganised players do not provide any kind of guarantee for used autos. Additionally, some vendors engage in dishonest tactics like repainting and dent removal on accident-damaged automobiles in order to conceal their damage and get an artificially inflated value, which makes potential buyers wary of purchasing second hand cars. Therefore, the increased rate of fraud and the bigger market share held by unorganised dealers pose a danger to the expansion of the used automobile industry.

Lack of regularization will challenge the market growth

The seller is crucial to the used car dealer because without the owner's consent, the dealer cannot acquire vehicles to serve their clientele. After a while, the market will run out of new automobiles if new car sales decline. Additionally, the pandemic has significantly disrupted the car business. After the epidemic, customers are predicted to choose private transportation. As a result, the used car market is totally dependent on replacement buyers, auto owners selling their vehicles, and used car imports, which raise a lot of questions about how much supply will be available to meet demand. These elements are thus anticipated to limit the expansion of the used automobile industry in the near future.

ONLINE USED CAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Vehicle Type, Fuel Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Alibaba.com, AsburyAutomotive Group, AutoNation Inc., CarMax Business Services, LLC, Cox Automotive, eBay Inc., Group 1 Automotive Inc., Hendrick Automotive Group, LITHIA Motor Inc., Scout24 AG, TrueCar, Inc., Car24, OLX Cars, Ouickr Cars |

Segmentation Analysis

Global Online Used Car Market- By Vehicle Type:

- Hybrid

- Conventional

- Electric

In terms of shipments, the conventional car sector held a proportion of more than 40.0% in 2021. In addition to the hybrid vehicle, the electric vehicle category is anticipated to see a high CAGR throughout the projection period. Used electric car pricing have remained affordable for customers over the past several years, which has been a major contributor in the growth of the electric vehicle market. Used electric car costs have historically been less expensive than used hybrid vehicle pricing, according on price analyses from the previous several years. Used EV sales have increased significantly as a result of electric vehicle characteristics including technology-driven performance, which, in the luxury car market, serve as a status symbol and promote sustainability.

Large inventories of conventional gasoline automobiles provide a variety of options at a reasonable cost. The greatest percentage of all vehicle sizes, including small, mid-size, and SUV automobiles, belonged to this group of vehicles. Furthermore, there is a high demand for alternatives to traditional gasoline-powered vehicles because to growing worries over climate change and rising pollution. Consequently, the market for second-hand electric vehicles has seen notable expansion.

Global Online Used Car Market- By Fuel Type:

- Compact

- Mid-size

- SUVs

In 2021, the fuel category had the highest volume share (almost 40.0%). As the government forbids the acquisition of second-hand diesel automobiles, this is credited to the decline in the use of diesel vehicles. Over the projection period, the others category is anticipated to have considerable expansion. Used car volume sales for CNG-powered vehicles have also increased over time in emerging nations.

One of the factors contributing to the decline in diesel vehicle sales is the emission regulations for compression ignition (diesel) and positive ignition (gasoline, NG, LPG, and ethanol) vehicles. Additionally, the reduction in sales of vehicles with diesel engines and the growth of the alternative market might be linked to the high NOx emissions from diesel engines. Compared to passenger automobiles powered by diesel, the pollution regulation for gasoline-powered vehicles is less strict. Furthermore, a sizable customer base has been drawn to petrol automobiles in recent years, and it is anticipated that this trend will continue in the years to come. These cars have a refined engine, respectable fuel efficiency, and powerful top-end performance. A further element propelling the petrol market is the rising supply of SUVs powered by gasoline.

Global Online Used Car Market- By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In terms of shipments, Asia Pacific held the greatest market share of over 35.0% in 2021, mostly as a result of the rapidly increasing demand for used cars in China. Over the projection period, Asia Pacific is anticipated to see the greatest CAGR growth. This is explained by the rise in used automobile sales in China, India, and other Asian nations. Due to the declining growth in recent years, the North American area maintained a sizeable market share in 2021 and is anticipated to see consistent growth going forward.

China has increased its market share in the Asian market due to the growth of organised businesses offering used automobile trading services in the Asia Pacific area. Some Indian auto dealers provide a wide range of cutting-edge technology-enabled solutions, such as mobile applications, an online showroom that functions as a virtual showroom, cloud services for lead management systems, the ability to track sales success, and assistance with digital marketing. Additionally, the level of development in the Indian used automobile market offers the customer base fantastic potential. Indonesia, Malaysia, Indonesia, South Korea, and other emerging nations in the area have demonstrated tremendous market potential.

Global Online Used Car Market- By Companies:

-

Alibaba.com

-

Asbury Automotive Group

-

AutoNation Inc.

-

CarMax Business Services, LLC

-

Cox Automotive

-

eBay Inc.

-

Group 1 Automotive Inc.

-

Hendrick Automotive Group

-

LITHIA Motor Inc.

-

Scout24 AG

-

TrueCar, Inc.

-

Car24

-

OLX Cars

-

Ouickr Cars

Impact of Covid-19 on the industry

Due of the global COVID-19 epidemic, countries had to temporarily reduce their desire for both new and used automobiles. Additionally, the global economic recession has a negative impact on consumers, which lowers automobile sales, but individuals all over the world have started avoiding public transportation due to the danger of infection and to preserve social distance. Additionally, the majority of people worldwide want to purchase automobiles following the lockout. There is a trend in preference away from taxis and public transit toward private automobiles, for instance, as per the cars24 research, which found that customers prefer to use private cars and less public transportation.

The used car market has experienced a huge increase in sales in some countries due to factors like a decline in income, a lack of money, and a rise in preference for private cars to maintain social distance, which is estimated to positively impact the used car industry during the COVID-19 outbreak even though some automotive companies are struggling as a result of the pandemic.

NOTABLE HAPPENINGS IN THE GLOBAL ONLINE USED CAR MARKET IN THE RECENT PAST:

-

Service Launch: - In 2020, To provide a fantastic used vehicle online purchasing experience, Asbury Automotive Group announced the debut of its end-to-end digital retailing system dubbed Clicklane.

-

Business Collaboration: - In 2020, Volkswagen announced a significant investment in the used automobile market through a partnership between its own used car chain, Das WeltAuto, and several used car platforms.

-

Product Launch: - In 2019, Ebay Inc. introduced a new eBay Motors application to improve the online procedure for selling and buying old cars.

Chapter 1. Global Online Used Car Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Online Used Car Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Online Used Car Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Online Used Car Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Online Used Car Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Online Used Car Market – By Vehicle Type

6.1. Hybrid

6.2. Conventional

6.3. Electric

Chapter 7. Global Online Used Car Market – By Fuel Type

7.1. Compact

7.2. Mid Size

7.3. SUVs

Chapter 8. Global Online Used Car Market – By Geography and Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East And Africa

Chapter 9. Global Online Used Car Market – By Companies

9.1. ALIBABA.COM

9.2. ASBURY AUTOMOTIVE GROUP

9.3. AUTONATION INC.

9.4. CARMAX BUSINESS SERVICES, LLC

9.5. COX AUTOMOTIVE

9.6. EBAY INC.

9.7. GROUP 1 AUTOMOTIVE INC.

9.8. HENDRICK AUTOMOTIVE GROUP

9.9. LITHIA MOTOR INC.

9.10. SCOUT24 AG

9.11. TRUECAR, INC.

9.12. CAR24

9.13. OLX CARS

9.14. OUICKR CARS

Download Sample

Choose License Type

2500

4250

5250

6900