Global Oncology -Wearable & Remote Monitoring Devices Market Size (2024 – 2030)

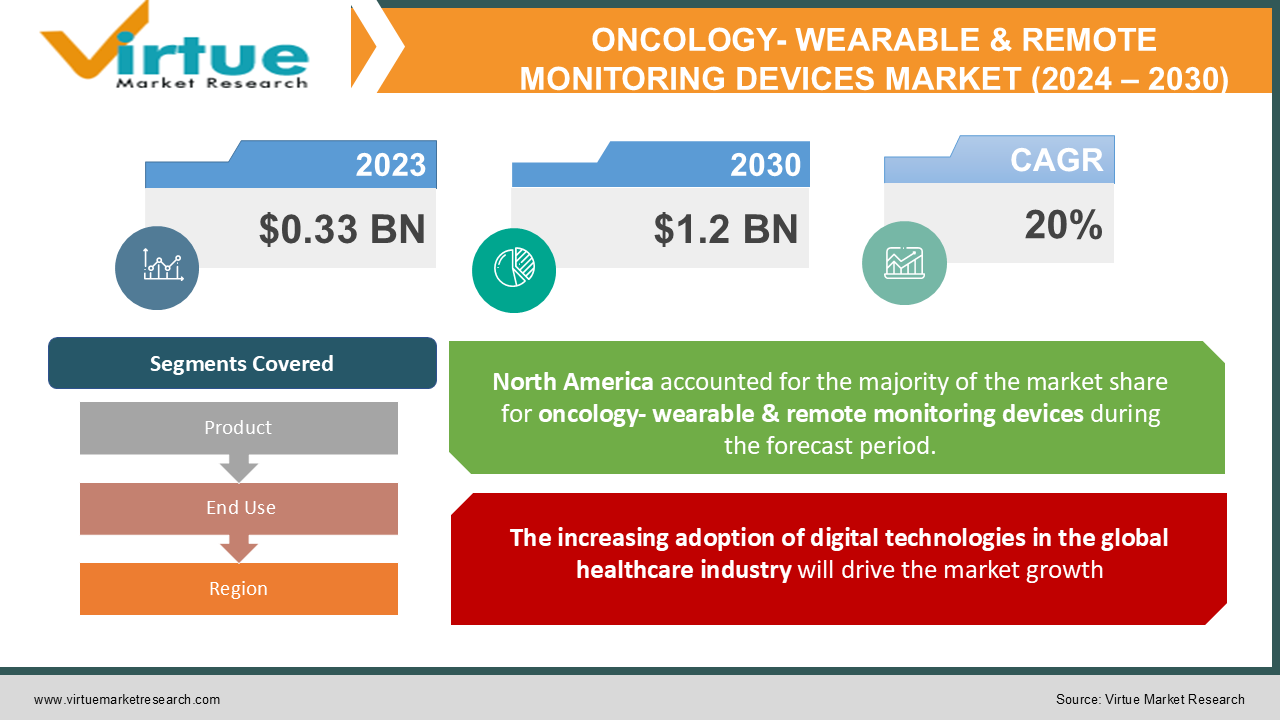

According to our research report, the global oncology-wearables & remote monitoring devices market size in 2023 is USD 0.33 billion and is estimated to reach USD 1.2 billion by 2030. The market is projected to grow with a CAGR of 20% per annum during the period of analysis (2024 - 2030).

Industry Overview

Remote patient monitoring is a method for remotely monitoring patients and collecting physiological and other patient data using digital instruments (RPM). RPM often benefits patients who need chronic, post-discharge, or geriatric care. By linking high-risk patients with remote monitoring, it can warn healthcare organizations about potential health problems or keep track of patient information between visits. RPM can be used by businesses to track workmen's compensation claims and make sure that workers are headed in the right direction for a return to work. Remote patient monitoring technology makes it possible for patients, particularly the elderly, those recovering from surgery, those with chronic illnesses, and those with impairments, to receive medical examinations at home.

Global demand for these systems will rise in the coming years due to the improved chronic illness management provided by remote monitoring systems, early warning indicators, and progress trackers. Diabetes, cancer, and chronic obstructive pulmonary disease have all benefited from timely management because of real-time patient data via remote patient monitoring. The introduction or acceptance of next-generation sensor technology has had an impact on healthcare systems by shortening the distance between the patient and the healthcare provider.

The remote patient monitoring system has been significantly impacted by the COVID-19 epidemic. The enhanced chronic illness management provided by remote monitoring systems, along with early warning indications and progress trackers, will increase demand for these systems globally in the upcoming years. 90% of yearly healthcare costs in the United States are attributable to chronic illnesses. This can be avoided if patients receive prompt assistance through a remote monitoring system.

Impact of Covid-19 on the industry

As telemedicine software aids in digitizing and automating crucial tasks, which minimizes hospital administrative work and expands the use of remote monitoring systems in the coming years, it can delay ER visits and hospitalizations. There is a space crunch in hospitals as a result of the COVID-19 pandemic. In addition, patients are cautioned against physically visiting hospitals due to the risk of contracting an infection, especially those with chronic illnesses. As a result, the market for remote patient monitoring systems grew. Businesses make a significant number of investments by partnering, buying, and cooperating with newly emerging start-ups.

The individualized telemedicine software offers a platform for communication for remote and in-person patient monitoring that serves as a link between the patient and the caregiver. This necessary shift has completely altered the remote patient monitoring system industry in the years following COVID-19. Due to the increased willingness of users to sign up for the app, this modification has sped up recovery rates. The provider's desire to use the app has also improved, and it provides more access and reimbursements. Over 100 million Americans, according to the Centres for Disease Control and Prevention (CDC), suffer from hypertension. The risk of heart disease is considerably elevated by hypertension.

Market Drivers

The increasing adoption of digital technologies in the global healthcare industry will drive the market growth

The market for remote patient monitoring (RPM) systems is primarily driven by the rising usage of digital technologies in the world's healthcare sector. Additionally, the frequency of many dangerous diseases is increasing, the geriatric population is expanding, and the number of traffic accidents is rising, which is fuelling the growth of the global RPM systems market. As the elderly population requires ongoing monitoring of their health problems, the demand for RPM systems is rising quickly. The United Nations estimates that there were 382 million individuals worldwide who were 60 years of age or older in 2017 and expects that figure to increase to 2.1 billion by 2050. Shortly, the RPM systems market is anticipated to be primarily driven by the world's rapidly expanding elderly population. Additionally, increasing disposable income, the need for cutting-edge healthcare facilities, and rising consumer healthcare spending are key factors supporting market expansion globally.

Rising government investment will drive the market growth

The demand for the newest technologies in the healthcare industry is increasing as a result of growing government initiatives and investments to create a robust and sophisticated healthcare infrastructure. The adoption of RPM systems across various markets is also being fuelled by rising investments in the digitalization and automation of healthcare units to improve the operational efficiency of healthcare units. The RPM systems provide enhanced diseases and health management by detecting the deteriorating health conditions early and tracking the progress in the health condition of the patients, which helps the healthcare units to offer improved patient care. The RPM systems can lower the number of expensive chronic conditions and hospitalizations, thereby lowering consumer healthcare costs.

Market Restraints

The lack of Remote Monitoring in developing economies will challenge the market growth

Despite the rising need for solutions, it is projected that the lack of device and software adoption in low- and middle-income nations will restrain market growth throughout the projection period. One aspect of the drop in usage in these nations is the high implementation cost of remote patient monitoring systems. The implementation of these solutions needs appropriate funding, providers, and IT staff to ensure a smooth implementation and the provision of high-quality patient care. For instance, the Journal of Telemedicine and Telecare reported that the annual cost per patient for equipment purchases, servicing, and monitoring ranged from USD 275 to USD 7,963.

Although rich nations like the U.S. have implemented regulatory and reimbursement adjustments to promote patient virtual monitoring, similar improvements are not present in other developing countries or low-income countries. Another barrier preventing the market for remote patient monitoring devices from expanding is a lack of awareness among healthcare professionals and restricted access to high-quality healthcare services in low-to-middle-income countries (LMICS).

GLOBAL ONCOLOGY- WEARABLE & REMOTE MONITORING DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By Product, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, Aerotel Medical Systems, AMD Global Telemedicineine, Baxter International Inc., Boston Scientific Corpation, GE Healthcare, Masimo Corporation, Medtronic PLC, F. Hoffmann-La Roche AG, Omron Corporation |

This research report on the global oncology- wearable & remote monitoring devices market has been segmented and sub-segmented based on, product, end-use and Geography & region.

Global Oncology- Wearable & Remote Monitoring Devices- By Product

-

Specialized Monitors

- Vital Sign Monitors

Based on the product, the specialist monitors market share in 2021 was approximately 81%. Due to their improved effectiveness in monitoring clinical data, specialized monitors are being used more frequently to remotely monitor patients before and after surgery. Remote monitoring is effectively facilitated by the advent of cutting-edge features like smartphone connectivity and wireless communication.

During the forecast period, the vital sign monitors market is anticipated to experience exceptional growth. This is a result of these monitors being used more frequently for everyday tasks. Around the world, the heart rate monitor is widely utilized in the healthcare industry. Additionally, the rising frequency of cardiovascular disorders is anticipated to fuel this market's expansion. The World Health Organization estimates that 17.9 million deaths worldwide in 2019 were directly related to cardiovascular illnesses. This accounted for almost 32% of all deaths worldwide in 2019.

Global Oncology- Wearable & Remote Monitoring Devices- By End Use

-

Hospital Patients

-

Ambulatory Patients

-

Home Healthcare

Hospital patients accounted for more than 80% of the market share in 2021 based on end-use. This is only explained by the hospitals' growing presence in industrialized countries and their expanded penetration into developing markets. The expansion of the hospital patients’ sector over the past few years has been mostly attributed to the increased number of hospital admissions and the accessibility of cutting-edge medical amenities in private hospitals.

During the projected period, the home healthcare category is anticipated to develop at the fastest rate. The primary drivers of the home healthcare market's expansion over the forecast period are an increase in disposable income, a rise in the need for convenience, and a rise in public awareness of hospital-acquired illnesses.

Global Oncology- Wearable & Remote Monitoring Devices- By Geography & Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

According to the region, North America held about 41% of the market in 2021. The main drivers of the RPM market's growth in North America are the rising geriatric population, rising prevalence of various chronic diseases among the populace, increased consumer disposable income, increased adoption rates of cutting-edge technologies in the healthcare sector, presence a developed healthcare infrastructure, and increased awareness of RPM systems.

During the projection period, the market in the Asia Pacific is anticipated to grow at the fastest rate. The region is encouraging the development of RPM systems due to rising consumer disposable income, rising healthcare expenses, rising healthcare spending, and rising chronic disease prevalence. Additionally, it is anticipated that increased government investments in the construction of cutting-edge healthcare infrastructure will accelerate market expansion.

Global Oncology- Wearable & Remote Monitoring Devices- By Companies

-

Abbott Laboratories

-

Aerotel Medical Systems

-

AMD Global Telemedicineine

-

Baxter International Inc.

-

Boston Scientific Corpation

-

GE Healthcare

-

Masimo Corporation

-

Medtronic PLC

-

F. Hoffmann-La Roche AG

-

Omron Corporation

NOTABLE HAPPENINGS IN THE GLOBAL ONCOLOGY- WEARABLE & REMOTE MONITORING MARKET IN THE RECENT PAST:

- Product Launch: - In 2021, Philips announced the introduction of the Philips medical tablet to help clinicians remotely monitor patients through their smart devices.

- Product Launch: - In 2020, 100plus announced the launch of three new RPM devices, namely 100Plus blood pressure cuffs, digital weigh scale, and blood glucose monitor.

Chapter 1. Global Oncology- Wearable & Remote Monitoring Devices Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Oncology- Wearable & Remote Monitoring Devices Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Oncology- Wearable & Remote Monitoring Devices Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Oncology- Wearable & Remote Monitoring Devices Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Oncology- Wearable & Remote Monitoring Devices Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Oncology- Wearable & Remote Monitoring Devices Market – By Product

6.1. Specialized Monitors

6.2. Vital Sign Monitors

Chapter 7. Global Oncology- Wearable & Remote Monitoring Devices Market – By End Use

7.1. Hospital Patients

7.2. Ambulatory Patients

7.3. Home Healthcare

Chapter 8. Global Oncology- Wearable & Remote Monitoring Devices Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Global Oncology- Wearable & Remote Monitoring Devices Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Abbott Laboratories

9.2. Aerotel Medical Systems

9.3. AMD Global Telemedicineine

9.4. Baxter International Inc.

9.5. Boston Scientific Corpation

9.6. GE Healthcare

9.7. Masimo Corporation

9.8. Medtronic PLC

9.9. F. Hoffmann-La Roche AG

9.10. Omron Corporation

Download Sample

Choose License Type

2500

4250

5250

6900