On-Premises Molecular Imaging Market Industry Market size (2024 - 2030)

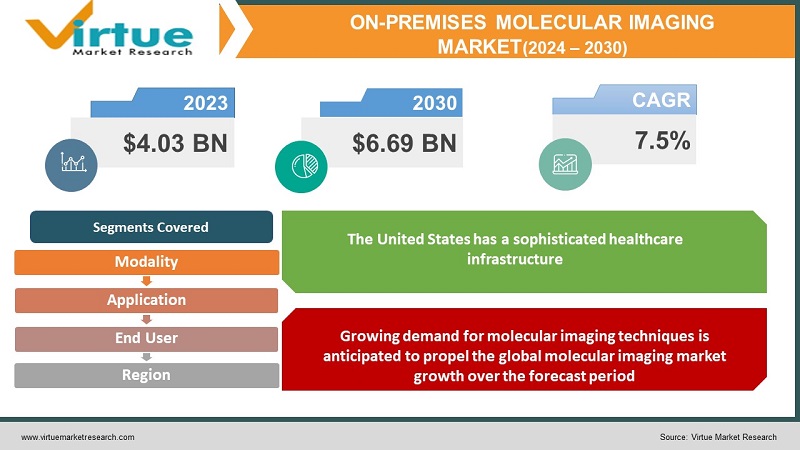

In 2023, the Global On-Premises Molecular Imaging Market was valued at $4.03 Billion and is projected to reach a market size of $6.69 Billion by 2030. The market is projected to grow with a CAGR of 7.5% per annum during the period of analysis (2024 - 2030).

Industry Overview

Medical imaging that focuses on imaging molecules of medical interest in patients while they are still alive is called molecular imaging. It combines molecular and cellular biology with cutting-edge imaging technology. It is a painless, non-invasive, safe method used to diagnose and treat a variety of illnesses, including respiratory, gastrointestinal, cardiovascular, neurologic, and oncological conditions. Nuclear medicine includes the subject of molecular imaging. To diagnose and cure illness, it contains a small number of radioactive substances (radiopharmaceuticals). Additionally, molecular imaging supports improved personalization of patient care and illness management for doctors.

A new area called molecular imaging combines molecular biology, chemistry, computer science, engineering, and medicine. Several contemporary imaging techniques, such as optical imaging (either by bioluminescence or fluorescence), computed tomography (CT), magnetic resonance imaging (MRI), positron emission tomography (PET), single-photon emission computed tomography (SPECT), and ultrasound, have been extensively used to track structural, functional, and molecular changes in cancer tissues (US).

The demand for early disease diagnosis is increasing due to the rising prevalence of numerous chronic diseases like cancer and other genetic disorders, which is anticipated to fuel the expansion of the worldwide molecular imaging market. The Centers for Disease Control and Prevention (CDC) reports that approximately 22,000 men and 9,000 women are diagnosed with liver cancer each year in the United States, and approximately 16,000 men and 8,000 women pass away from the disease.

Impact of Covid-19 on the Industry

The global coronavirus or COVID-19 outbreak, which originated in Wuhan, China, has spread across continents and has impacted several businesses. Due to forced quarantine, a scarcity of raw materials and labor, and serious disruption in the delivery of essential materials. Transporting raw materials between areas is impossible because regional warehouse operations are not efficient. The global market for molecular imaging equipment has been impacted by the paucity of raw materials and components. However, during the pandemic, the use of molecular imaging methods like positron emission tomography/computed tomography (PET/CT) for the detection and management of the COVID-19 virus boosted the growth of the worldwide molecular imaging industry.

In July 2021, a review article on nuclear medicine called Seminars in Nuclear Medicine reported that MRI and chest CT have an excellent agreement in identifying the hallmarks of COVID-19 pneumonia.

Market Drivers

Growing demand for molecular imaging techniques is anticipated to propel the global molecular imaging market growth over the forecast period

Due to their widespread application in the diagnosis and prognosis of cancer, molecular imaging techniques including positron emission tomography (PET), computed tomography (CT), magnetic resonance imaging (MR imaging), and others are in higher demand. Throughout the forecast period, this is anticipated to boost the growth of the worldwide molecular imaging market. To diagnose structural problems in the human body without the use of ionizing radiation, around 60 million magnetic resonance imaging (MRI) scans are carried out year worldwide, according to a July 2021 article published in the Journal of Clinical Medicine of Kazakhstan.

Government Initiative will drive the market growth

Demand is anticipated to be pushed by government initiatives for stronger regulatory controls and investments in healthcare and research and development (R&D). These investments are meant to support the creation of more effective, non-invasive methods for the early identification of diseases with a focus on oncology or cardiology. Machine learning-based approaches for image categorization are anticipated to have a significant impact on the procedure in the coming years and result in automation. Minimal fluid biopsy attacks demonstrate a reliable method for determining the genomic characteristics of a DNA tumor, particularly in pediatric oncology.

Increasing advances in technology will drive the market growth

Higher usage of molecular imaging will result from increasing technological improvements, product introductions, mergers and acquisitions, and strategic partnerships by top industry players, which will also provide prospects for product development. A benchtop magnetic resonance spectrometer featuring a high-field 9.4 Tesla small animal MRI device and integrated in-line PET, for instance, was introduced by Bruker Corporation in 2019.

Market Restraints

The high cost of MRI machines challenges the market growth

The high cost of imaging devices like MRI machines and CT scanners is a significant factor that is anticipated to restrain the growth of the global market for molecular imaging equipment. A high-end magnetic resonance imaging (MRI) device, for instance, costs over US$ 1 million, with prices starting at US$ 150,000.

ON-PREMISES MOLECULAR IMAGING MARKET INDUSTRY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Modality, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hermes Medical Solutions, Bruker Corporation, GE Company,. Fujifilm Holdings Corp., Koninklijke Philips N.V., Siemens AG., Toshiba Medical System Corp., Mirada Medical Limited, Carestream Health, Inc., Esaote SpA, Positron Corporation., Medisco Ltd., Hitachi Medical Corp., MIM Software Inc. |

Global On-Premises Molecular Imaging Market- By Modality

-

Positron Emission Tomography (PET)

-

Positron Emission Tomography- Computed Tomography (PET-CT)

-

Positron Emission Tomography- Magnetic Resonance (PET-MR)

-

Single Photon Emission Computed Tomography (SPECT)

-

Software

-

On-Premises Solutions

-

Cloud-Based Solutions

-

-

Magnetic Resonance

-

Molecular Ultrasound Imaging

In developing regions, there has been a major investment in healthcare infrastructure development and improvement. Approximately 90% of Positron Emission Tomography-Computed Tomography (PET-CT) operations are used for cancer monitoring and diagnosis, but the upcoming commercial release of innovative radiotracers is meant to aid in the identification of prevalent neurodegenerative diseases like Alzheimer's disease. This has boosted PET-adoption CTs in neurology.

PET-CT is being used more frequently in cardiology to image myocardial perfusion. The PET-CT subset of molecular imaging technology is growing rapidly due to the rising cancer prevalence in the world. Manufacturers are reacting to the rising demand for PET in radiation oncology by releasing larger PET / CT scanners that are suited to the unique requirements of radiation treatment users. As an illustration, Philips unveiled the "Big Bore" Gemini TF PET/CT, which has an 85cm-diameter bore and can incorporate radiotherapy placement devices. The development of genetic diagnostic labs for molecular imaging with precise and non-invasive methods of diagnostic assays will be accelerated by clinical improvements, financial incentives, and enhanced healthcare infrastructure.

Through the forecast period, PET-CT is anticipated to have about 34.3 percent of the global market across modality types. Due to its excellent sensitivity, infinite depth of penetration, and quantitative capabilities, PET-CT has developed into a potent tool for fundamental research in a variety of fields, including oncology, neurology, and cardiology. In the clinic, PET is essential for cancer identification, staging, and assessing treatment response. According to reports, whole-body PET/CT increases the precision of cancer staging and diagnosis.

Global On-Premises Molecular Imaging Market- By Application

-

Cardiology

-

Oncology

-

Gastrointestinal Disorders

-

Neurology Disorders

-

Others

In every nation on earth, cancer is the top cause of mortality and a major impediment to raising life expectancy. According to predictions from the World Health Organization for 2019, cancer ranks third or fourth in another 23 nations and is one of the top causes of death before the age of 70 in 112 of 183. Over the anticipated period, oncology revenue is anticipated to grow at a CAGR of more than 11%. During the projected period, the rising incidence of cancer will fuel the demand for molecular imaging for effective diagnosis and treatment.

Global On-Premises Molecular Imaging Market- By End-User

-

Hospitals

-

500+ Beds

-

200-499 Beds

-

Less than 200 Beds

-

-

Ambulatory Surgical Centres

-

Diagnostic Centres

The highest market share is held by hospitals, which are anticipated to grow at a CAGR of more than 12% over the anticipated period. The use of molecular imaging in hospital settings will expand due to the aging population and cancer mortality. As hospitals take steps to handle an increase in patient traffic, this will in turn boost demand for diagnostic imaging equipment.

Global On-Premises Molecular Imaging Market- By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

Throughout the forecast period, the U.S. market will continue to be the most profitable. The United States has a sophisticated healthcare infrastructure, which makes it a valuable market for molecular imaging and one of the main reasons for promoting market expansion. Prostate, lung and bronchus, and colorectal cancers account for 42% of all instances of cancer in males, according to the American Cancer Society. While 30% of all malignancies in women are breast, lung, and colorectal. The incidence of cancer is 442.4 per 100,000 men and women per year, and the fatality rate is 158.3 per 100,000, according to the National Cancer Institute. The U.S.'s high cancer mortality rate is increasing in demand, and the market is anticipated to grow at a noteworthy CAGR of more than 9% over the forecast period.

One of the biggest nations in Europe, Germany, has a cancer incidence rate of 313.1 per 100,000 inhabitants. Breast, prostate, colorectal, lung, and bladder cancers are the most prevalent types in Germany. About 57 percent of all new cancer cases in Germany in 2012 belonged to these five categories. According to estimates, 43 percent of women and 51 percent of men in Germany will have cancer at some point in their lives. In 2008, the German National Cancer Plan, or Nationaler Krebsplan, was introduced by the federal health ministry in collaboration with the German Cancer Society, the German Cancer Aid, and the Association of German Inflammatory Centers. Assessment, enhancing oncological care facilities and quality assurance, ensuring that cancer treatment is successful, and developing a more patient-centered approach are the four main focuses of the program. The Krebsfrüherkennungs- und -registergesetz (KFRG), which went into effect in April 2013, marked a turning point in the execution of this program by establishing the law of cancer early detection.

The difficulties a person faces after a term of rigorous therapy greatly depend on the stage at which they are diagnosed. Therefore, molecular imaging complements the organization's objective to provide early and accurate cancer detection to treat it quickly and raise the survival rate of cancer patients. By 2030, cancer will overtake heart disease as the biggest cause of death in Europe, according to the International Agency for Research on Cancer. These elements encourage growth in Germany.

Cancer cases have been increasing dramatically in France. More than 47% of cases of cancer are prostate, breast, lung, and colorectal. In addition, the World Health Organization (WHO) reports that France has a prevalence rate of 1445 strokes per 100,000 people. The prevalence of neurological illnesses was 2349 per 100,000 people, according to DALY's 2016 study. In France, public health regulations actively support initiatives for cancer identification and prevention. A health and scientific organization devoted to cancer is the French National Cancer Institute. The Institute addresses all aspects of the fight against cancer, including strategies for early cancer detection and better, more enduring patient care.

Over the past few years, China has seen a tremendous increase in the number of domestic manufacturers and distributors. A report on cancer statistics in China and GLOBAL indicates that 2.9 million people died from cancer in China in 2018 and that there were 4.3 million new cases. In comparison to nations like the United States and the United Kingdom, China has a higher cancer-related mortality rate. The demand for cutting-edge technology for illness diagnosis is predicted to increase in China due to the country's growing elderly population and chronic diseases, opening up the market potential for the production of molecular imaging equipment.

Global On-Premises Molecular Imaging Market- By Companies

-

Hermes Medical Solutions

-

Bruker Corporation

-

GE Company

-

Fujifilm Holdings Corp.

-

Koninklijke Philips N.V.

-

Siemens AG

-

Toshiba Medical System Corp.

-

Mirada Medical Limited

-

Carestream Health, Inc.

-

Esaote SpA

-

Positron Corporation

-

Medisco Ltd.

-

Hitachi Medical Corp.

-

MIM Software Inc.

NOTABLE HAPPENINGS IN THE GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET IN THE RECENT PAST:

-

Business Collaboration: - In 2021, To increase awareness of and jointly promote the benefits of dosimetry, radiopharmaceutical treatment (RPT), and customized medicine, Hermes Medical Solutions (HMS), a pioneer in the global market for molecular imaging and dosimetry software solutions, teams up with Isotopic.

-

Merger & Acquisition: - In 2019, a pioneer in health technology said today that it had successfully acquired Carestream Health Inc.'s Healthcare Information Systems (HCIS) division in 26 of the company's 38 operating nations. Philips' existing enterprise diagnostic informatics solutions, which already include productivity improvement, imaging data management, and advanced visualization and analysis, will be enhanced by Carestream HCIS' cloud-enabled enterprise imaging platform.

-

Merger & Acquisition: - In 2021, Under the name FUJIFILM Healthcare Americas Corporation, FUJIFILM Medical Systems, and FUJIFILM Healthcare Americas Corporation (formerly Hitachi Healthcare Americas) have combined.

Chapter 1.GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET – By Modality

6.1. Positron Emission Tomography (PET)

6.2. Positron Emission Tomography- Computed Tomography (PET-CT)

6.3. Positron Emission Tomography- Magnetic Resonance (PET-MR)

6.4. Single Photon Emission Computed Tomography (SPECT)

6.5. Software

6.5.1. On-Premises Solutions

6.5.2. Cloud-Based Solutions

6.7. Magnetic Resonance

6.9. Molecular Ultrasound Imaging

Chapter 7.GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET– By Application

7.1. Cardiology

7.2. Oncology

7.3. Gastrointestinal Disorders

7.4. Neurology Disorders

7.5. Others

Chapter 8.GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET – By End-User

8.1. Hospitals

8.1.1. 500+ Beds

8.1.2. 200-499 Beds

8.1.3. Less than 200 Beds

8.2. Ambulatory Surgical Centres

8.3. Diagnostic Centres

Chapter 9.GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.GLOBAL ON-PREMISES MOLECULAR IMAGING MARKET – Key Players

10.1. Hermes Medical Solutions

10.2. Bruker Corporation

10.3. GE Company

10.4. Fujifilm Holdings Corp.

10.5. Koninklijke Philips N.V.

10.6. Siemens AG

10.7. Toshiba Medical System Corp.

10.8. Mirada Medical Limited

10.9. Carestream Health, Inc.

10.10. Esaote SpA

10.11. Positron Corporation

10.12. Medisco Ltd.

10.13. Hitachi Medical Corp.

10.14. MIM Software Inc.

Download Sample

Choose License Type

2500

4250

5250

6900