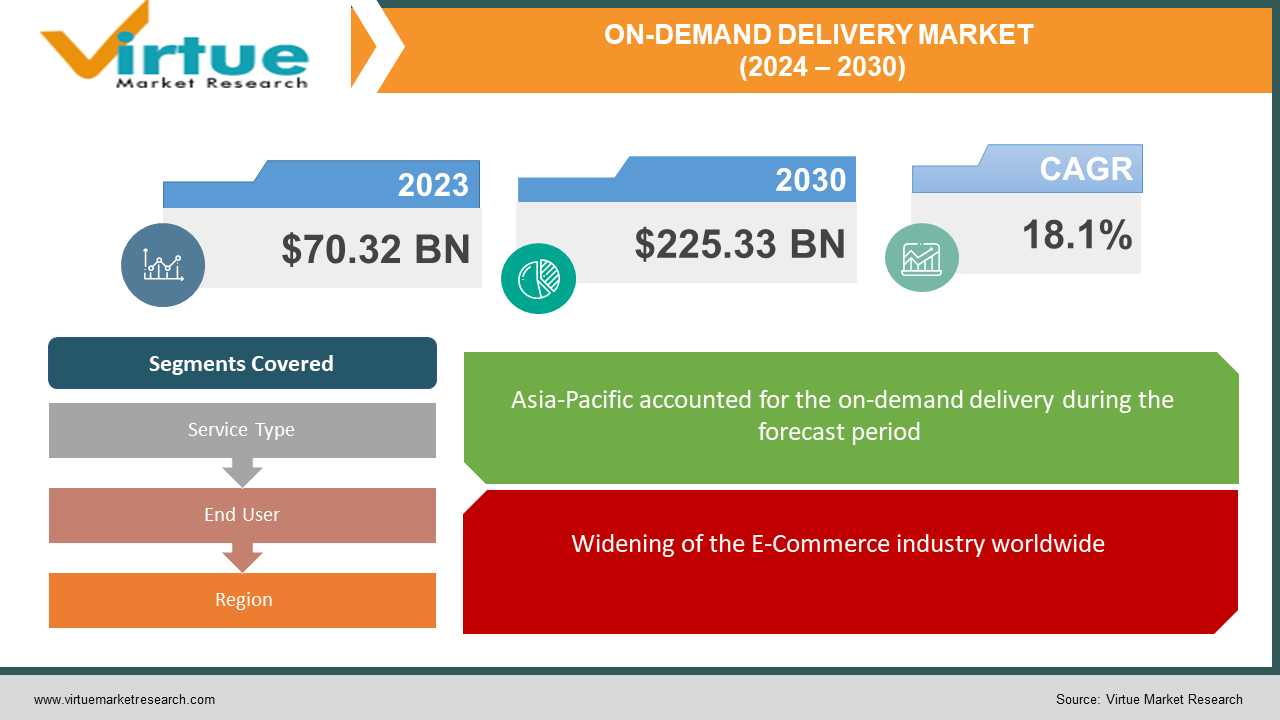

On-Demand Delivery Market Size (2024 – 2030)

The On-Demand Delivery Market was valued at USD 70.32 billion in 2023 and is projected to reach a market size of USD 225.33 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 18.1%.

The growing e-commerce industry is driving the growth of the On-Demand Delivery market. With enhancing customer base, the customer's buying behaviour and expectations are also altering. Customers choose fast shipping with competitive pricing. This demanding delivery schedule hurdles traditional Logistics and encourages businesses to update their business strategies, which is propelling the growth of the Global On-Demand Delivery Market. In 2023, the global e-commerce market for around 14% of all retail sales, an increase of approximately 15% from 2021. The quickest adoption of smartphones and consequent access to the internet has facilitated emerging market customers to be a major global force for online activities including Logistics. As urbanization, industrialization, and household income are set to continue to grow across emerging economies, it is estimated to coincide with an increasing share of online customer spending. It will assist in easing the logistical challenges such as low profitability, lesser number of bookings, and low vehicle usage rate, which is estimated to boost the Global On-Demand Delivery Market.

Key Market Insights:

-

E-commerce and retail sectors are the key contributors to the development of the On-Demand Delivery Market, as they require seamless last-mile delivery services.

-

The availability of modernized technologies such as GPS tracking, real-time data analytics, and route optimization algorithms is propelling the growth of the market.

-

The growing consumer expectations for instant gratification and same-day deliveries are creating enormous opportunities for On-Demand Delivery providers.

-

Strategic partnerships and collaborations between logistics companies and technology providers are becoming increasingly usual to enhance service offerings and widen market reach.

On-Demand Delivery Market Drivers:

Widening of the E-Commerce industry worldwide

E-commerce refers to the buying and selling of goods through the Internet. E-commerce is a virtual store where products & services do not need any physical space and are sold via websites. The e-commerce industry takes the help of logistics services to manage and oversee the supply chain of e-commerce companies, thus, permitting these companies to focus on marketing and other business operations. Easy accessibility, enjoyable shopping experiences, and heavy discounts & offers make e-commerce a famous medium for the purchase of a wide variety of products. These factors have cumulatively contributed to the growth of the market for e-commerce services.

Additionally, COVID-19 also contributed to the development of the e-commerce industry across the globe. Several governments imposed restrictions in their regions to stop the spread of the virus. As there was no access to a physical marketplace, people began to purchase goods or products online, which, in turn, impacted in growth of the e-commerce sector. Furthermore, the development of the e-commerce industry has pushed the On-Demand Delivery industry to adopt digital technologies to address the enhancing demand of customers. They have also begun to use artificial intelligence, the Internet of Things (IoT), and other technologies to facilitate the timely delivery of goods or products to customers. Thus, the expansion of the e-commerce industry globally pushes the growth of the On-Demand Delivery Market.

Increase in demand for fast delivery of packages

With the demand in online shopping along with the customer’s inclination toward buying products via an online platform, the demand for better and more efficient delivery service for the products has increased. With the advent of the COVID-19 pandemic, customer’s preference for online shipping of daily necessities has increased, which has supplemented the growth of the On-Demand Delivery market. For instance, there has been an escalation in e-grocery orders in China due to consumer’s inclination toward e-commerce companies such as JD.com, Alibaba Group, and MTDP to shop virtually for their household needs. This is followed to avoid face-to-face contact among individuals during the pandemic. Also, to prevent the need to avoid direct contact among individuals, JD.com in China has invested in its autonomous robot delivery technology in Wuhan to handle grocery and medical package deliveries. Furthermore, various ways to deliver a package such as by drones or by autonomous vehicles have risen, due to the demand for on-time delivery of packages, which further extends the growth of the On-Demand Delivery market across the globe.

On-Demand Delivery Market Restraints and Challenges:

Poor infrastructure and higher logistics expenses

Logistics demands amazing infrastructure, supply chain, and trade facilitation. Without these, firms have to gather more stock reserves and working capital, which can strongly result in national and regional competitiveness due to high financial costs. Additionally, lack of infrastructure hinders the On-Demand Delivery market as it raises costs and reduces supply chain dependency.

These include major inefficiencies in transport, tough tax structure, low rate of technology adoption, and poor skills of logistics professionals. For example, as per a report by the Economist, an international newspaper, Latin America lacks proper infrastructure. Higher than 60% of the region’s roads are unpaved. Further, inconsistency in the address and postal system is the other hurdle for parcel delivery in Latin American nations. As many countries lack postal codes and depend on local landmarks for addresses, shipping companies often have problems delivering parcels successfully. In addition, logistics costs are heavily determined by the approachability and quality of infrastructure. Infrastructure directly increases transport costs and indirectly shakes the level of inventories, and consequently financial expenses.

Thus, due to poor transport infrastructure, firms need to hold high levels of inventories to account for contingencies, which can result in higher overall logistics costs. Therefore, poor infrastructure coupled with high inventory costs and inadequate warehousing space are assumed to hamper the On-Demand Delivery Market growth.

On-Demand Delivery Market Opportunities:

Growing economies to hold the lucrative opportunity for Service Providers

Increasing demand in emerging economies offers lucrative opportunities for competitors in the On-Demand Delivery market. The quicker adoption of smartphones and continuous access to the internet has facilitated emerging market customers to be a key global force for online activities including On-Demand Delivery. As urbanization, industrialization, and household income are set to continue to grow across emerging nations, these are assumed to coincide with a growing share of online customer spending. It will aid in easing the logistical challenges, such as low profitability, fewer bookings, and a low vehicle usage rate.

The demand for instant gratification continues to grow, logistics providers can widen their service offerings to involve specialized delivery options, such as medical supplies or high-value products. Moreover, expanding into underserved markets, both locally and internationally, offers major growth potential. Sustainable logistics solutions, including electric vehicles and sustainable packaging, are gaining attention, providing an avenue for differentiation and attracting environmentally aware consumers. The market's adaptability and capacity to cater to evolving consumer preferences make it congenial for continued expansion and creativity.

ON-DEMAND DELIVERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.1% |

|

Segments Covered |

By Service Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lalamove EasyVan (Thailand) Co. Ltd., Uber Freight LLC, Deliv Inc., MENA 360 DWC-LLC (Fetchr), Shadowfax Technologies Pvt. Ltd., Deliveree (Thailand) Co. Ltd. , Bringg Delivery Technologies Ltd., Shippify Inc. , Stuart Delivery Ltd. (STUART), GoGo Tech Ltd. (GoGoVan) |

On-Demand Delivery Market Segmentation: By Service Type

-

Transportation

-

Warehousing

-

Value Added Services

Based on service type, the transportation segment was the biggest market in 2023, contributing to over three-fourths of the global On-Demand Delivery market share, and is expected to maintain its leadership status during the estimated period. This is due to growing trade-related contracts and technological modernizations in the transportation sector over the future years.

On the other side, the Value-Added Services segment is expected to witness the fastest CAGR of 24.7% from 2024 to 2030, as these services offer advantages for both customers and service providers. Customers have the chance to receive something above and beyond their basic needs whereas providers benefit from an enhanced rapport with clients, which could convert into more revenue.

On-Demand Delivery Market Segmentation:By End User

-

B2B

-

B2C

-

C2C

Based on End users, the B2C segment held the biggest market share of nearly 50% of the global On-Demand Delivery market in 2023 and is estimated to maintain its leadership during the forecast period. Additionally, the same segment is expected to witness the largest CAGR of 21.8% from 2024 to 2030. This is because the exchange of services or products in B2C becomes easier, which eventually impacts the growth of the segment. Furthermore, the enhanced online purchasing activities across the world have also facilitated companies to develop faster product delivery models, which catalyze the growth of the segment.

On-Demand Delivery Market - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, the market in Asia-Pacific was the largest in 2023, capturing nearly one-third of the global On-Demand Delivery market share, and is estimated to lead the trail during the forecast period. The growth in online shopping activities and the necessity for product delivery within a shorter period have made companies provide same-day on-demand delivery services to local customers, which has pushed the growth of the market in the region.

However, the market in North America is certain to manifest the fastest CAGR of 22.1% during the estimated period. The growing demand for foreign goods in different parts of the region acts as one of the key forces that supplement the growth of the market across the region. Furthermore, the rise in adoption of e-commerce among the higher spending power population, emerging investments by companies on same-day delivery of consumer goods, and integrated use of technology in express delivery operations are major factors propelling the growth of the market in the region.

COVID-19 Impact Analysis on the On-Demand Delivery Market:

-

The COVID-19 pandemic added to the growth of the e-commerce industry globally. Due to lockdowns and social distancing, there was no access to a physical marketplace, leading people to purchase goods or products online. This led to the development of the e-commerce sector and the On-Demand Delivery market.

-

While the business-to-business (B2B) logistics industry came to a pause, business-to-customer (B2C) surged during the pandemic, due to the development of the online retail and e-commerce industry.

-

The growth of the e-commerce sector is predicted to continue in the post-pandemic period. Additionally, with the revival in trade, the On-Demand Delivery market is estimated to grow at a quick pace during the forecast period.

Latest Trends:

On-demand B2C Delivery Volume to grow faster than B2B Deliveries

The On-Demand Delivery market is estimated to witness exponential growth in the business-to-customer (B2C) category during the predicted period. This can be attributed to the fact that the services can be accessed through mobile apps, which are highly easy to use. These apps ensure greater safety of the products transferred, as the users can track their items to be delivered in real-time. Furthermore, individuals majorly shop for especially stuff, the deliveries can be easily made through the On-Demand Delivery model.

Demand for Hyperlocal Delivery

The demand for hyperlocal deliveries, targeting specific neighborhoods or local areas, is on growth, directed by consumers’ desire for faster and more customized services.

Joining hands with AI

AI-powered algorithms are being utilized for demand prediction, route optimization, and smart dispatching, enhancing operational efficiency and lowering costs.

Key Players:

-

Lalamove EasyVan (Thailand) Co. Ltd.

-

Uber Freight LLC

-

Deliv Inc.

-

MENA 360 DWC-LLC (Fetchr)

-

Shadowfax Technologies Pvt. Ltd.

-

Deliveree (Thailand) Co. Ltd.

-

Bringg Delivery Technologies Ltd.

-

Shippify Inc.

-

Stuart Delivery Ltd. (STUART)

-

GoGo Tech Ltd. (GoGoVan)

Chapter 1. On-Demand Delivery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. On-Demand Delivery Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. On-Demand Delivery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. On-Demand Delivery Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. On-Demand Delivery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. On-Demand Delivery Market – By Service Type

6.1 Introduction/Key Findings

6.2 Transportation

6.3 Warehousing

6.4 Value Added Services

6.5 Y-O-Y Growth trend Analysis By Service Type

6.6 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. On-Demand Delivery Market – By End User

7.1 Introduction/Key Findings

7.2 B2B

7.3 B2C

7.4 C2C

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. On-Demand Delivery Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Service Type-

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Service Type-

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Service Type

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Service Type

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Service Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. On-Demand Delivery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Lalamove EasyVan (Thailand) Co. Ltd.

9.2 Uber Freight LLC

9.3 Deliv Inc.

9.4 MENA 360 DWC-LLC (Fetchr)

9.5 Shadowfax Technologies Pvt. Ltd.

9.6 Deliveree (Thailand) Co. Ltd.

9.7 Bringg Delivery Technologies Ltd.

9.8 Shippify Inc.

9.9 Stuart Delivery Ltd. (STUART)

9.10 GoGo Tech Ltd. (GoGoVan)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The On-Demand Delivery Market was valued at USD 70.32 billion in 2023 and is projected to reach a market size of USD 225.33 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 18.1%.

The widening E-Commerce industry and demand for fast delivery of packages are propelling the On-Demand Delivery Market.

The on-Demand Delivery Market is segmented based on Service Type, End-User, and Region.

Asia-Pacific is the most dominant region for the On-Demand Delivery Market.

MENA 360 DWC-LLC (Fetchr), Shadowfax Technologies Pvt. Ltd., Deliveree (Thailand) Co. Ltd., Bringg Delivery Technologies Ltd., Shippify Inc., Stuart Delivery Ltd. (STUART), GoGo Tech Ltd. (GoGoVan) are the few of the key players operating in the On-Demand Delivery Market.