Oilseed Processing Market Size (2024 – 2030)

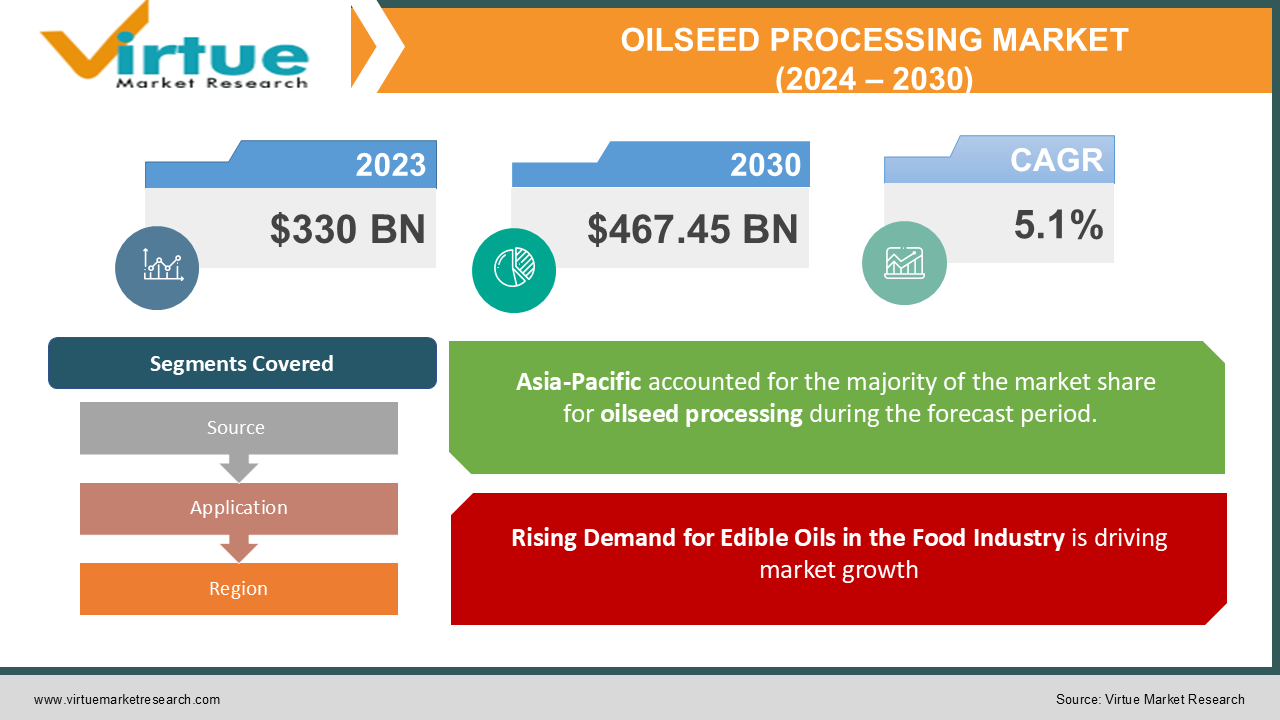

The Global Oilseed Processing Market was valued at USD 330 billion in 2023 and is expected to grow at a CAGR of 5.1% from 2024 to 2030. By the end of 2030, the market is projected to reach USD 467.45 billion.

The oilseed processing market involves the extraction of oils from seeds such as soybeans, sunflower seeds, rapeseeds, cottonseeds, and palm kernels. These oils are widely used in the food, industrial, and biofuel sectors. The industry has been experiencing steady growth, driven by rising demand for edible oils, increasing biodiesel production, and the use of oilseed-derived products in animal feed. Key players in the industry operate advanced crushing and refining facilities to meet the demand for high-quality oils. Sustainability and the growing preference for non-GMO and organic oils are further reshaping the market landscape.

Key Market Insights:

The food sector is the largest consumer of oilseed products. Most of the refined oils used are in cooking, baking, and processed foods. Soybean oil is major, followed by palm oil and sunflower oil.

In many parts of North America and Europe, oilseed processing, especially for rapeseed and soybean oils, increasingly is a significant source of biodiesel production. It is not only increasing; sustainability practices such as non-deforestation supply chains, and organic farming practices are all coming into the fray since consumers and regulators are asking for oil produced responsibly in terms of the environment.

The Asia-Pacific region dominates the world market, while China, India, and Indonesia are both large producers and consumers of oilseeds. This region boasts high volumes of farm output and increasing consumer demand for edible oils.

Global Oilseed Processing Market Drivers:

Rising Demand for Edible Oils in the Food Industry is driving market growth:

The food industry represents the largest consumer segment for oilseed-derived products, particularly refined oils. Edible oils such as soybean oil, palm oil, sunflower oil, and canola oil are essential in household cooking and commercial food preparation. With changing consumer habits and the rising popularity of convenience foods, demand for processed oils continues to grow. In developing countries, increasing and aquaculture. With the rising global demand for meat and dairy products, farmers are increasingly using high-protein feed to improve animal growth and productivity. The aquaculture sector, which requires protein-rich diets for farmed fish, is another significant consumer of oilseed meals. Producers are focusing on improving the quality of oilseed meals by optimizing processing methods, ensuring the meals retain their nutritional properties.

Global Oilseed Processing Market Challenges and Restraints:

Fluctuations in Raw Material Prices are restricting market growth:

The oilseed processing market is highly dependent on the availability and cost of raw materials such as soybeans, rapeseeds, and sunflower seeds. These agricultural commodities are subject to price volatility due to various factors, including weather conditions, geopolitical tensions, and global trade policies. For example, droughts in key soybean-producing regions can lead to supply shortages and price hikes, impacting the profitability of oilseed processors. Additionally, tariffs and trade restrictions can disrupt supply chains, leading to market instability. Managing raw material costs while maintaining competitive pricing remains a significant challenge for companies operating in this market.

Environmental and Sustainability Concerns are restricting market growth:

The oilseed processing industry faces increasing scrutiny over environmental issues, particularly related to deforestation, water usage, and carbon emissions. Palm oil production, in particular, has drawn criticism for contributing to deforestation and biodiversity loss in tropical regions. Governments and consumers are demanding more sustainable practices, including deforestation-free supply chains and certifications for sustainable production. Companies must invest in responsible sourcing and traceability systems to meet these expectations, which can increase operational costs. Balancing sustainability with profitability poses a challenge for many oilseed processors.

Market Opportunities:

The oilseed processing market presents a wide range of opportunities for growth, including changes in consumer preferences, new technologies, and new applications. Perhaps the most significant one is the concept of high-value oils with health benefits, such as flaxseed oil rich in omega-3 and high-oleic sunflower oil. The thrust of these products addresses an increasingly health-conscious consumer, not merely looking for function in and of itself, but going beyond basic nutrition. Additionally, plant-based diets continue to gain popularity, which favors oilseed-derived products like soybean protein isolate and canola protein isolate, both of which continue to make their way into an increasingly large set of meat alternative and dairy-free product categories for vegan and vegetarian consumers. Another benefit that sustainability gives to companies is an avenue of differentiation through environmental responsibility. Oilseed processors can use certification and sustainable agriculture to fill consumer demand for organic and non-GMO oils. Online channels are emerging to offer companies an avenue for direct-to-consumer sales as e-commerce rises. In this regard, the ability of companies to sell specialty oils and meal products to consumers directly using online channels will arise. This also extends their distribution and makes them capable of developing a concentrated marketing campaign. Innovations in processing technology include solvent extraction and cold pressing that enhance efficiency and lead to the production of more quality oils. These advancements are of great help in the development of value-added products, such as flavored oils and functional meal ingredients. The use of blockchain for tracing in supply chains is on the increase and is making it possible for greater transparency of products by the consumer. The time, however, will help in the maturation process for the oilseed processing as such evolution will continue unsalted. Innovation and growth powered by a commitment to meeting the increasing needs of the consumer base will drive dynamism for the oilseed processing market.

OILSEED PROCESSING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company (ADM), Cargill, Incorporated, Bunge Limited, Wilmar International, Louis Dreyfus Company (LDC), CHS Inc., AG Processing Inc., Olam International, Richardson International Limited, Marubeni Corporation |

Oilseed Processing Market Segmentation: By Source

-

Soybean

-

Rapeseed

-

Sunflower

-

Palm Kernel

-

Cottonseed

-

Others

Soybean is the most dominant source in the oilseed processing market, owing to its wide availability and versatility. Soybean oil is extensively used in food preparation and biofuel production, while soybean meal serves as a key ingredient in animal feed.

Oilseed Processing Market Segmentation: By Application

-

Food Industry

-

Biofuels

-

Animal Feed

-

Industrial Use

-

Others

The food industry holds the largest share of the oilseed processing market. Edible oils derived from oilseeds are integral to cooking, baking, and processed foods, making them indispensable in household and commercial kitchens.

Oilseed Processing Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in the global oilseed processing market. The region benefits from favorable agricultural conditions, large-scale production of soybeans and palm oil, and increasing demand for edible oils among the growing population. Countries like China and India are major consumers and producers of oilseeds, driving the regional market's growth.

COVID-19 Impact Analysis on the Oilseed Processing Market:

The pandemic has severely affected supply chains, with lockdowns and restrictions affecting raw materials and transportation networks. Labor shortages and logistical constraints also led to problems in maintaining production levels for oilseed processors. The pandemic, however, brought out the importance of food security. Thus, the government increased support for agricultural initiatives. Demand for edible oils and animal feed remained at an even keel, as consumers stocked for the worse scenario. This stable demand helped navigate the turbulent market environment for oilseed processors. The biofuel sector was not in much demand as transportation activities were at their minimum during the lockdowns. Hence, most oilseed processors diverted towards food and feed applications in order to keep running in operation. This switch has helped them sail through the economic storm. The pandemic also brought to light the need for resilient supply chains and accelerated digital solutions in supply chain management. Companies began investing in technologies that raise visibility and efficiency and better helped them respond to the disruptions triggered by the pandemic. In sum, the pandemic presented some significant challenges; however, it also acted as a catalyst for innovation and adaptability in the oilseed processing industry, which shaped future directions.

Latest Trends/Developments:

The oilseed processing market is in the midst of a significant transformation due to changing consumer preferences and technology advancement. Organic and non-GMO oils are one of the leading trends. The consumer's focus on healthy, sustainable food options forces companies to invest in certification and develop partnerships with farmers to source organically. In general, this trend follows a larger movement toward greater transparency and ethical production. Another factor that is in parallel in a parallel manner is the introduction of advanced extraction technologies including cold pressing. It enables oils to retain nutritional content and is in tune with the interest of the people for health and wellness purposes. Further, companies looking into product quality improvement consider the adoption of cold pressing against the traditional extraction processes used in the industry. Block chain technology is now rising and emerging as an important area which provides transparency in supply chain. Blockchain helps companies provide detailed information about products and manufacturing processes to consumers, which helps ensure accountability in the market. There are new opportunities with plant-based products on account of oilseed-derived ingredients. Oilseed proteins increasingly comprise meat alternatives and dairy-free products for increasing vegan and vegetarian populations. This trend is in the direction of the growing consumption of plant-based diets and surging demand for alternate sources of protein. Further, augmented biodiesel production is fostering demand for oilseed feedstock. Increasing efforts across the world toward carbon-emission reduction, oilseeds are assuming a highly significant role in integrating alternate energy sources. Overall, these trends suggest a dynamic landscape in the oilseed processing market where innovation and sustainability are at the forefront, shaping the future of the industry.

Key Players:

-

Archer Daniels Midland Company (ADM)

-

Cargill, Incorporated

-

Bunge Limited

-

Wilmar International

-

Louis Dreyfus Company (LDC)

-

CHS Inc.

-

AG Processing Inc.

-

Olam International

-

Richardson International Limited

-

Marubeni Corporation

Chapter 1. Oilseed Processing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Oilseed Processing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Oilseed Processing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Oilseed Processing Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Oilseed Processing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Oilseed Processing Market – By Source

6.1 Introduction/Key Findings

6.2 Soybean

6.3 Rapeseed

6.4 Sunflower

6.5 Palm Kernel

6.6 Cottonseed

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Source

6.9 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Oilseed Processing Market – By Application

7.1 Introduction/Key Findings

7.2 Food Industry

7.3 Biofuels

7.4 Animal Feed

7.5 Industrial Use

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Oilseed Processing Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Source

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Source

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Source

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Source

8.4.3 By Source

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Source

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Oilseed Processing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company (ADM)

9.2 Cargill, Incorporated

9.3 Bunge Limited

9.4 Wilmar International

9.5 Louis Dreyfus Company (LDC)

9.6 CHS Inc.

9.7 AG Processing Inc.

9.8 Olam International

9.9 Richardson International Limited

9.10 Marubeni Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Oilseed Processing Market was valued at USD 330 billion in 2023 and is projected to reach USD 467.45 billion by 2030, growing at a CAGR of 5.1% during the forecast period.

Key drivers include rising demand for edible oils, the expansion of biofuel production, and the growing use of oilseed meals in animal feed.

The market is segmented by source (soybean, rapeseed, sunflower, etc.) and application (food industry, biofuels, animal feed, etc.).

Asia-Pacific is the most dominant region, owing to its large-scale production and consumption of oilseeds, particularly in countries like China and India.

Leading players include Archer Daniels Midland Company (ADM), Cargill, Incorporated, Bunge Limited, Wilmar International, and Louis Dreyfus Company (LDC).