Oilseed Market Size (2024–2030)

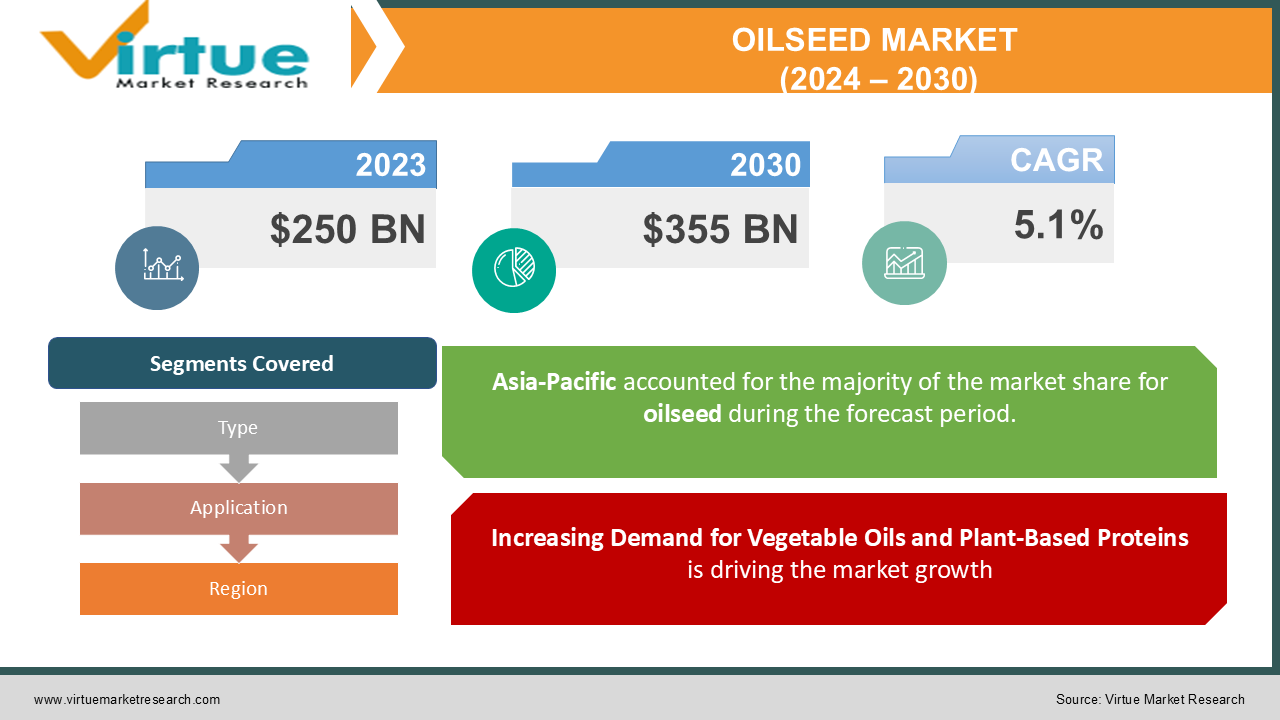

The Global Oilseed Market was valued at USD 250 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030, reaching an estimated USD 355 billion by 2030.

Oilseeds are essential raw materials for producing oils, meals, and other byproducts used across multiple industries, including food, animal feed, biofuel, and various industrial applications. Demand is driven by population growth, increasing global consumption of vegetable oils, and the biofuel industry's expansion. The market benefits from advancements in agricultural practices and biotechnological improvements aimed at enhancing oilseed yield, disease resistance, and nutrient profile.

The oilseed market encompasses a diverse range of crops, including soybeans, rapeseed, sunflower seeds, and palm oil, cultivated for their oil content. These oils find applications in various sectors, such as food, feed, biofuels, and industrial products. Factors driving the oilseed market include the increasing global population, rising demand for healthy and sustainable food products, and the growing biofuel industry. However, challenges like climate change, fluctuating commodity prices, and geopolitical tensions can impact the market's stability. As consumer preferences evolve and technological advancements continue, the oilseed market is expected to witness significant growth and transformation.

Key Market Insights

-

Soybean dominates the oilseed market, accounting for over 60% of global production, due to its versatility and widespread application in food and feed industries.

-

Biofuel demand is a significant growth driver, with oilseeds such as soybean, rapeseed, and palm kernel being essential for biodiesel production.

-

Food industry applications are expanding, especially for sunflower and groundnut oils, due to rising health-conscious consumer trends.

-

Genetically modified (GM) seeds are widely used in soybean and cottonseed production, providing higher yields and improved resistance to pests and environmental conditions.

-

Asia-Pacific is the largest and fastest-growing region due to high consumption of oilseed-derived products in China and India, driven by dietary and industrial demand.

-

Rising adoption of sustainable practices is influencing the industry, with producers focusing on reducing deforestation, improving traceability, and enhancing environmental performance.

-

Technological advancements in extraction and processing methods are increasing yield efficiency and enhancing the quality of oils derived from oilseeds.

Global Oilseed Market Drivers

Increasing Demand for Vegetable Oils and Plant-Based Proteins is driving the market growth

The demand for vegetable oils is expanding globally due to their versatile applications in cooking, processed foods, cosmetics, and industrial sectors. Growing awareness of plant-based diets and protein sources has further driven demand for oilseed byproducts. Health-conscious consumers are turning towards healthier alternatives such as sunflower, rapeseed, and soybean oils, which are perceived to be lower in saturated fats. Furthermore, as meat alternatives gain popularity, oilseed meals and proteins serve as valuable ingredients in developing plant-based food products, thereby driving the oilseed market forward.

Growth of the Biofuel Sector is driving the market growth

With biofuel production on the rise due to environmental concerns and policies promoting renewable energy, oilseeds play a critical role as a sustainable raw material. Biodiesel, primarily produced from soybean, rapeseed, and palm oil, represents a key application of oilseeds in reducing fossil fuel dependency. Governments worldwide are implementing policies to increase the use of biodiesel in fuel mixes, especially in regions like North America, Europe, and parts of Asia. This trend has led to significant investments in oilseed production and processing, positioning the sector as an essential contributor to the renewable energy landscape.

Technological Advancements in Crop Biotechnology and Processing is driving the market growth

Innovations in genetic engineering and biotechnology have resulted in high-yield, disease-resistant, and pest-tolerant oilseed varieties, particularly for soybean and rapeseed. These advancements enable farmers to produce more resilient and higher-quality oilseeds, enhancing production efficiency and reducing costs. Furthermore, processing technologies, including solvent extraction, cold pressing, and hexane extraction, are continually improving, allowing for higher yields and enhanced oil quality. These technological advancements make oilseed production more profitable and sustainable, helping the industry meet the growing demand across multiple sectors.

Global Oilseed Market Challenges and Restraints

Environmental and Sustainability Concerns is restricting the market growth

Oilseed production, particularly palm oil, has significant environmental implications, including deforestation, loss of biodiversity, and greenhouse gas emissions. The cultivation of oilseeds in areas prone to deforestation, such as tropical rainforests, has led to increased scrutiny from environmental organizations and consumer advocates. As consumers and regulatory bodies push for sustainable sourcing practices, producers are under pressure to adopt environmentally responsible practices, which may increase costs and affect profit margins. Additionally, the need for land preservation may limit the expansion of oilseed farming, posing a restraint on the industry's growth.

Price Volatility and Dependency on Weather Conditions is restricting the market growth

Oilseed production is heavily dependent on climatic conditions, making it vulnerable to seasonal variations and extreme weather events. Unfavorable weather conditions, such as droughts, floods, and temperature extremes, can lead to fluctuations in oilseed supply, impacting market prices. Furthermore, geopolitical events, trade policies, and currency fluctuations can affect global oilseed prices, creating volatility in the market. Price instability affects both producers and consumers, as it leads to uncertainties in income for farmers and cost management challenges for processors and end-users.

Market Opportunities

The growing demand for organic and non-GMO oilseeds presents a lucrative opportunity in the oilseed market. Consumers are increasingly prioritizing organic and non-GMO products, driving demand for oilseeds produced using natural and sustainable farming practices. This shift has led to increased investments in organic farming and the development of certification programs to cater to the premium segment of the market. Additionally, Asia-Pacific’s expanding middle class and their preference for healthier and more diverse food options represent a promising opportunity for growth in oilseed-based products, particularly in food and biofuel applications. The increasing global demand for healthy and sustainable food products is driving the demand for oilseeds, particularly those rich in omega-3 fatty acids and antioxidants. The growing awareness of the health benefits associated with plant-based diets is further boosting the market for oilseeds. Additionally, the rising demand for biofuels and renewable energy sources is creating new opportunities for oilseeds as feedstock for biodiesel production. Furthermore, technological advancements in oilseed processing and extraction are enabling the production of high-quality oils and value-added by-products. As the world population continues to grow and consumer preferences evolve, the oilseed market is poised for significant expansion in the coming years.

OILSEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Bunge Limited, Cargill, Inc., Wilmar International Limited, Louis Dreyfus Company, AGT Food and Ingredients, CHS Inc., Richardson International, Glencore Agriculture Limited, Ag Processing Inc. |

Oilseed Market Segmentation - By Type

-

Soybean

-

Sunflower

-

Rapeseed

-

Cottonseed

-

Palm Kernel

-

Groundnut

Soybean remains the dominant type within the market, largely due to its extensive applications in both the food and feed sectors. With the highest global production among oilseeds, soybeans are essential in manufacturing vegetable oils, soy protein, and animal feed. Additionally, soybean-derived products, including biodiesel, are gaining traction, further contributing to this segment's dominance in the oilseed market.

Oilseed Market Segmentation - By Application

-

Food

-

Animal Feed

-

Industrial

-

Biofuel

The food application segment holds the largest market share, driven by the demand for vegetable oils derived from oilseeds like sunflower, rapeseed, and soybean. As consumers shift towards plant-based and health-oriented diets, the use of oilseed products in cooking oils, margarine, and processed foods continues to expand, positioning the food sector as a key contributor to the oilseed market’s growth.

Oilseed Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific dominates the global oilseed market due to high demand in food and feed applications, particularly in China and India. The region's expanding middle-class population, rising disposable incomes, and changing dietary preferences contribute to increased consumption of oilseed-based products. Furthermore, advancements in agricultural practices and supportive government policies in Asia-Pacific countries are fostering growth in this region.

COVID-19 Impact Analysis on the Global Oilseed Market

The COVID-19 pandemic had a mixed impact on the oilseed market. Initial disruptions in the supply chain, labor shortages, and logistical challenges affected production and distribution. However, as global economies adapted to the new normal, the demand for edible oils and plant-based proteins surged as consumers focused on health and wellness. The biofuel sector experienced temporary setbacks due to reduced transportation demand during lockdowns, but it has since rebounded, with governments continuing to support biofuel policies. As a result, the oilseed market is expected to regain momentum and continue its growth trajectory post-pandemic. Initially, supply chain disruptions and lockdowns led to decreased demand and production. However, as the pandemic progressed, increased focus on health and immunity boosted demand for healthy oils, benefiting oilseed producers. Additionally, the shift towards home cooking and baking during lockdowns spurred demand for cooking oils. While the initial impact was negative, the long-term effects of the pandemic have been mixed. Increased food security concerns and a shift towards local production have created new opportunities for oilseed producers, particularly in regions with strong domestic demand

Latest Trends/Developments

The oilseed market is witnessing a shift towards sustainable and certified production practices. Companies are investing in environmentally responsible farming methods, including crop rotation, reduced pesticide use, and water management, to improve the sustainability of oilseed production. Furthermore, non-GMO and organic oilseed products are gaining popularity among health-conscious consumers, prompting companies to diversify their product portfolios. Advances in digital agriculture—such as precision farming, drone technology, and IoT—are also being adopted to increase yield, improve resource efficiency, and reduce environmental impact, reflecting a strong commitment to sustainability in the oilseed sector. The increasing global demand for healthy and sustainable food products is driving the demand for oilseeds rich in omega-3 fatty acids, antioxidants, and other beneficial nutrients. The growing awareness of the health benefits associated with plant-based diets is further boosting the market for oilseeds. Additionally, the rising demand for biofuels and renewable energy sources is creating new opportunities for oilseeds as feedstock for biodiesel production. Furthermore, technological advancements in oilseed processing and extraction are enabling the production of high-quality oils and value-added by-products. As the world population continues to grow and consumer preferences evolve, the oilseed market is poised for significant expansion in the coming years.

Key Players

-

Archer Daniels Midland Company

-

Bunge Limited

-

Cargill, Inc.

-

Wilmar International Limited

-

Louis Dreyfus Company

-

AGT Food and Ingredients

-

CHS Inc.

-

Richardson International

-

Glencore Agriculture Limited

-

Ag Processing Inc.

Chapter 1. Oilseed Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Oilseed Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Oilseed Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Oilseed Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Oilseed Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Oilseed Market – By Type

6.1 Introduction/Key Findings

6.2 Soybean

6.3 Sunflower

6.4 Rapeseed

6.5 Cottonseed

6.6 Palm Kernel

6.7 Groundnut

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Oilseed Market – By Application

7.1 Introduction/Key Findings

7.2 Food

7.3 Animal Feed

7.4 Industrial

7.5 Biofuel

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Oilseed Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Oilseed Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company

9.2 Bunge Limited

9.3 Cargill, Inc.

9.4 Wilmar International Limited

9.5 Louis Dreyfus Company

9.6 AGT Food and Ingredients

9.7 CHS Inc.

9.8 Richardson International

9.9 Glencore Agriculture Limited

9.10 Ag Processing Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 250 billion in 2023 and is projected to reach USD 355 billion by 2030, growing at a CAGR of 5.1%.

Key drivers include increasing demand for vegetable oils, growth of the biofuel sector, and advancements in crop biotechnology and processing technologies.

The market is segmented by type (soybean, sunflower, rapeseed, cottonseed, palm kernel, groundnut) and by application (food, animal feed, industrial, biofuel).

Asia-Pacific leads with the largest market share, driven by high demand for food and feed applications and supportive government policies.

Major players include Archer Daniels Midland Company, Bunge Limited, Cargill, Inc., Wilmar International Limited, and Louis Dreyfus Company.