Oilfield Equipment Market Size (2024 – 2030)

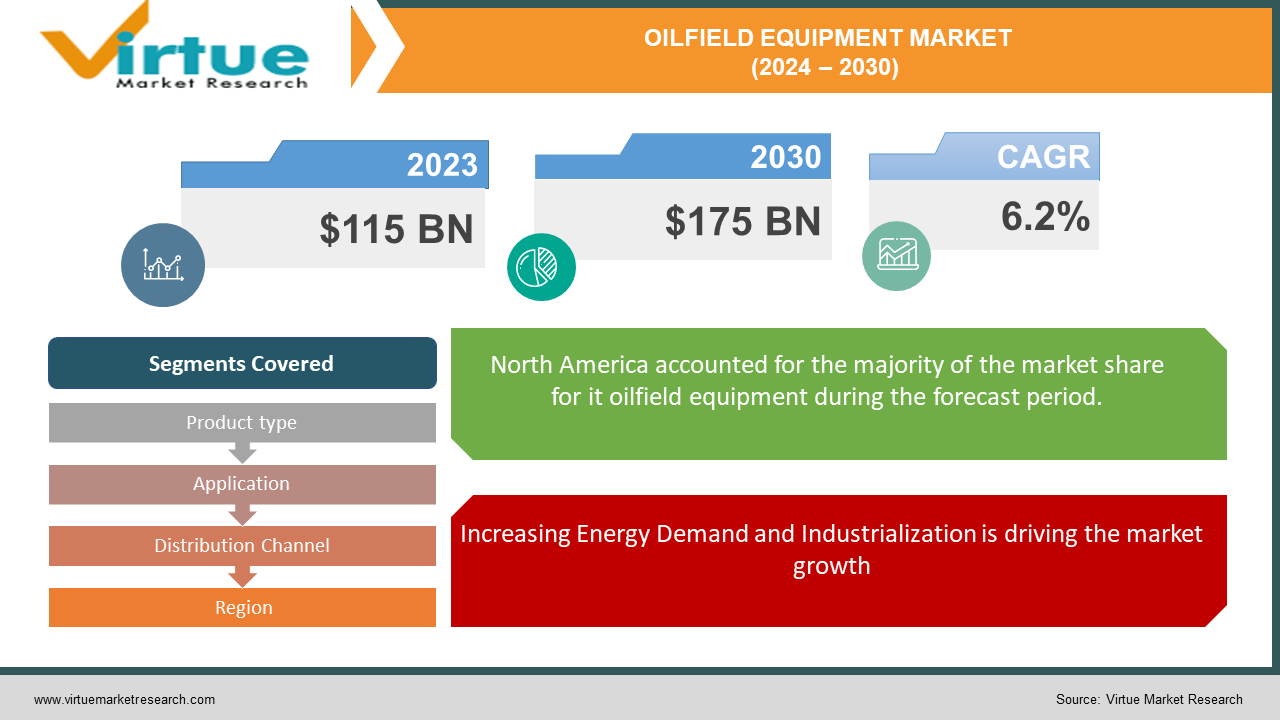

The Global Oilfield Equipment Market was valued at USD 115 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030. The market is expected to reach USD 175 billion by 2030.

The oilfield equipment market encompasses a wide range of machinery and components used in the extraction and production of oil and gas. This includes drilling equipment, pumps and valves, pressure and flow control equipment, and other specialized machinery. The growth in energy demand, advancements in technology, and increasing investments in oil and gas exploration and production activities are some of the major factors driving the market growth.

Key Market Insights:

Technological advancements in oilfield equipment, such as automation and digitalization, are enhancing the efficiency and productivity of oil and gas extraction and production processes.

The rising investments in oil and gas exploration and production activities, particularly in offshore and deepwater drilling, are boosting the demand for specialized oilfield equipment.

The surge in shale gas extraction and hydraulic fracturing activities is creating significant opportunities for the oilfield equipment market.

The oilfield equipment market is witnessing a shift towards sustainable and environmentally friendly practices. Companies are investing in the development of eco-friendly equipment and technologies to minimize the environmental impact of oil and gas operations.

The increasing energy demand globally is significantly driving the need for oilfield equipment.

Global Oilfield Equipment Market Drivers:

Increasing Energy Demand and Industrialization is driving the market growth

The growing global demand for energy is one of the primary drivers of the oilfield equipment market. As the world's population continues to increase and industrialization expands the need for energy sources, including oil and gas, is escalating. According to the International Energy Agency (IEA), global energy demand is expected to grow by nearly 30% by 2040. This surge in energy consumption is driven by developing economies, particularly in Asia-Pacific and Africa, where rapid urbanization and industrial growth are taking place. To meet this rising demand, oil and gas companies are intensifying their exploration and production activities, leading to an increased requirement for oilfield equipment. Drilling rigs, pumps, valves, and pressure control equipment are essential for extracting and producing oil and gas efficiently. The expansion of the oilfield equipment market is thus closely linked to the growing energy needs of the global population and industrial sectors.

Technological Advancements and Automation are driving the market growth

Technological advancements and automation are playing a significant role in driving the growth of the oilfield equipment market. Innovations in drilling technologies, such as horizontal drilling and hydraulic fracturing, have revolutionized the oil and gas industry by enabling the extraction of resources from previously inaccessible reserves. Automation and digitalization of oilfield operations are enhancing efficiency, reducing operational costs, and improving safety. For instance, the use of advanced sensors, real-time data analytics, and remote monitoring systems allows for precise control and optimization of drilling processes. Additionally, the development of robotic drilling systems and automated rigs is minimizing human intervention and increasing productivity. These technological advancements are not only boosting the demand for advanced oilfield equipment but also attracting investments from oil and gas companies seeking to enhance their operational capabilities. The continuous evolution of technology is expected to further propel the growth of the oilfield equipment market in the coming years.

Rising Investments in Oil and Gas Exploration and Production are driving the market growth

The increasing investments in oil and gas exploration and production activities are a major driver of the oilfield equipment market. With the discovery of new oilfields and the development of existing ones, there is a growing need for specialized equipment to support these operations. Offshore and deepwater drilling activities, in particular, require advanced and robust equipment to withstand harsh environmental conditions and ensure efficient extraction processes. According to Rystad Energy, global investments in offshore oil and gas projects are projected to exceed USD 250 billion by 2025. This surge in investments is driven by the rising demand for energy, favorable government policies, and the recovery of oil prices. The development of unconventional oil and gas resources, such as shale gas and oil sands, is also contributing to the increased demand for oilfield equipment. As oil and gas companies continue to explore and develop new reserves, the market for oilfield equipment is expected to experience significant growth.

Global Oilfield Equipment Market Challenges and Restraints:

Volatility in Oil Prices is restricting the market growth

One of the significant challenges faced by the oilfield equipment market is the volatility in oil prices. Fluctuations in oil prices can have a substantial impact on the profitability and investment decisions of oil and gas companies. When oil prices are low, companies tend to reduce their capital expenditure on exploration and production activities, leading to a decline in the demand for oilfield equipment. The oil price crash of 2014, for instance, resulted in a significant reduction in investments in the oil and gas sector, affecting the sales of oilfield equipment. On the other hand, when oil prices are high, there is an increased demand for equipment as companies ramp up their production activities. The cyclical nature of the oil industry and the uncertainty in oil prices make it challenging for equipment manufacturers to maintain a steady demand and supply balance. To mitigate this challenge, companies are focusing on diversifying their product portfolios, expanding into new markets, and investing in research and development to enhance the efficiency and cost-effectiveness of their equipment.

Environmental Concerns and Regulatory Compliance are restricting the market growth

Environmental concerns and stringent regulatory requirements pose significant challenges to the oilfield equipment market. The extraction and production of oil and gas have substantial environmental impacts, including greenhouse gas emissions, water pollution, and habitat destruction. Governments and regulatory bodies worldwide are implementing strict regulations to minimize these environmental impacts and ensure the sustainable development of oil and gas resources. Compliance with these regulations often requires significant investments in advanced technologies and equipment that reduce environmental footprints. For example, the use of low-emission engines, wastewater treatment systems, and blowout preventers is essential to meet regulatory standards. Additionally, public opposition to oil and gas projects, particularly in environmentally sensitive areas, can lead to delays or cancellations of projects, affecting the demand for oilfield equipment. To address these challenges, companies are focusing on developing eco-friendly equipment and adopting best practices in environmental management. Collaborating with regulatory authorities and stakeholders to ensure compliance and promote sustainable operations is also crucial for the growth of the oilfield equipment market.

Market Opportunities:

The Oilfield Equipment Market presents numerous opportunities for growth and innovation. One significant opportunity lies in the increasing adoption of digitalization and automation in oilfield operations. The integration of advanced technologies, such as IoT, AI, and big data analytics, is transforming the way oil and gas companies operate. These technologies enable real-time monitoring, predictive maintenance, and optimized decision-making, leading to enhanced operational efficiency and cost savings. Companies can capitalize on this opportunity by developing and offering smart oilfield equipment that incorporates these technologies. Additionally, the growing focus on renewable energy and the transition towards a low-carbon economy present opportunities for the oilfield equipment market. While oil and gas will continue to play a crucial role in the global energy mix, there is a rising demand for equipment and technologies that support the development of renewable energy sources, such as offshore wind and geothermal energy. Companies can diversify their product portfolios to include equipment for renewable energy projects, leveraging their expertise in the oil and gas sector. Furthermore, expanding into emerging markets with significant untapped oil and gas reserves, such as Africa and Latin America, offers substantial growth potential. By establishing a strong presence in these regions and tailoring their products and services to meet local needs, companies can capitalize on the opportunities and drive the growth of the oilfield equipment market.

OILFIELD EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Product type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Baker Hughes Company, Halliburton Company, Schlumberger Limited, Weatherford International plc, National Oilwell Varco, Inc., TechnipFMC plc, China National Petroleum Corporation, Aker Solutions ASA, Nabors Industries Ltd., Cameron International Corporation |

Oilfield Equipment Market Segmentation - by Product Type

-

Drilling Equipment

-

Pressure and Flow Control Equipment

-

Pumps and Valves

-

Others

Drilling Equipment is the most dominant product type in the Oilfield Equipment Market, driven by the high demand for advanced drilling rigs and technologies used in both onshore and offshore oil and gas extraction.

Oilfield Equipment Market Segmentation - by Application

-

Onshore

-

Offshore

Onshore oilfield equipment holds the dominant market share globally. This is due to several factors. Onshore drilling is generally less expensive and complex compared to offshore operations. It allows for easier transportation of equipment, quicker setup times, and lower maintenance costs. Additionally, onshore resources are often more readily accessible, leading to faster production. However, offshore drilling offers access to vast reserves located in deep waters, and with rising global energy demands, the offshore segment is expected to see significant growth in the future.

Oilfield Equipment Market Segmentation - by Distribution Channel

-

Direct Sales

-

Distributor Sales

-

Online Sales

Direct sales have been strong for complex, high-value equipment where customization and technical expertise are crucial. Sales reps directly engage with oil and gas companies, providing in-depth product knowledge and building long-term relationships. However, distributor sales are gaining traction, especially for standardized equipment. Distributors offer a wider reach and faster turnaround times, making them attractive for smaller purchases. Finally, online sales are a growing force, particularly for readily available replacement parts and consumables. While not yet dominant, online platforms offer convenience and transparency for these specific segments of the market.

Oilfield Equipment Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America currently holds the dominant position in the oilfield equipment market, driven by factors like rising domestic oil production and exploration activities in unconventional reserves. However, the Asia-Pacific region is expected to witness the highest growth in the coming years due to increasing demand for oil and gas and government investments in the sector.

COVID-19 Impact Analysis on the Oilfield Equipment Market:

The COVID-19 pandemic had a profound impact on the Oilfield Equipment Market. The global economic slowdown, coupled with the sharp decline in oil prices, led to a significant reduction in capital expenditure by oil and gas companies. Many exploration and production projects were delayed or canceled, resulting in a decreased demand for oilfield equipment. Additionally, supply chain disruptions and restrictions on the movement of goods and personnel further hampered the market. However, the pandemic also accelerated the adoption of digitalization and remote monitoring technologies in the oil and gas industry. Companies increasingly relied on advanced sensors, IoT, and automation to ensure operational continuity and efficiency while minimizing human intervention. As the world recovers from the pandemic and oil prices stabilize, the Oilfield Equipment Market is expected to rebound. The focus on enhancing operational efficiency, reducing costs, and ensuring sustainability will drive the demand for advanced and smart oilfield equipment in the post-pandemic era.

Latest Trends/Developments:

The Oilfield Equipment Market is witnessing several notable trends and developments that are shaping its growth and evolution. One significant trend is the increasing adoption of digitalization and automation in oilfield operations. The integration of IoT, AI, and big data analytics is enabling real-time monitoring, predictive maintenance, and optimized decision-making, enhancing operational efficiency and reducing costs. Companies are investing in smart oilfield equipment that incorporates these advanced technologies to stay competitive and meet the evolving needs of the industry. Another key trend is the growing focus on sustainability and environmental responsibility. Oil and gas companies are adopting eco-friendly equipment and practices to minimize their environmental impact and comply with stringent regulations. The development of low-emission engines, wastewater treatment systems, and blowout preventers is gaining traction. Additionally, the market is witnessing a surge in investments in offshore and deepwater drilling activities, driven by the discovery of new oilfields and the need to develop existing reserves. Advanced drilling technologies and robust equipment capable of withstanding harsh offshore conditions are in high demand. Furthermore, the increasing interest in renewable energy and the transition towards a low-carbon economy present opportunities for the oilfield equipment market. Companies are diversifying their portfolios to include equipment and technologies that support renewable energy projects, such as offshore wind and geothermal energy. These trends and developments are driving innovation and growth in the Oilfield Equipment Market, providing new opportunities for businesses and enhancing the overall efficiency and sustainability of oil and gas operations.

Key Players:

-

Baker Hughes Company

-

Halliburton Company

-

Schlumberger Limited

-

Weatherford International plc

-

National Oilwell Varco, Inc.

-

TechnipFMC plc

-

China National Petroleum Corporation

-

Aker Solutions ASA

-

Nabors Industries Ltd.

-

Cameron International Corporation

Chapter 1. Oilfield Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Oilfield Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Oilfield Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Oilfield Equipment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Oilfield Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Oilfield Equipment Market – By Product Type

6.1 Introduction/Key Findings

6.2 Drilling Equipment

6.3 Pressure and Flow Control Equipment

6.4 Pumps and Valves

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Oilfield Equipment Market – By Application

7.1 Introduction/Key Findings

7.2 Onshore

7.3 Offshore

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Oilfield Equipment Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributor Sales

8.4 Online Sales

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Oilfield Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Oilfield Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Baker Hughes Company

10.2 Halliburton Company

10.3 Schlumberger Limited

10.4 Weatherford International plc

10.5 National Oilwell Varco, Inc.

10.6 TechnipFMC plc

10.7 China National Petroleum Corporation

10.8 Aker Solutions ASA

10.9 Nabors Industries Ltd.

10.10 Cameron International Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Oilfield Equipment Market was valued at USD 115 billion in 2023 and is projected to reach USD 175 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030.

Key drivers include increasing energy demand and industrialization, technological advancements and automation, and rising investments in oil and gas exploration and production activities.

The market is segmented by product type (drilling equipment, pressure, and flow control equipment, pumps and valves, and others), application (onshore, offshore), and distribution channel (direct sales, distributor sales, online sales).

North America is the most dominant region due to significant oil and gas reserves, high level of exploration and production activities, and the presence of major industry players.

The leading players include Baker Hughes Company, Halliburton Company, Schlumberger Limited, Weatherford International plc, National Oilwell Varco, Inc., TechnipFMC plc, China National Petroleum Corporation, Aker Solutions ASA, Nabors Industries Ltd., and Cameron International Corporation.