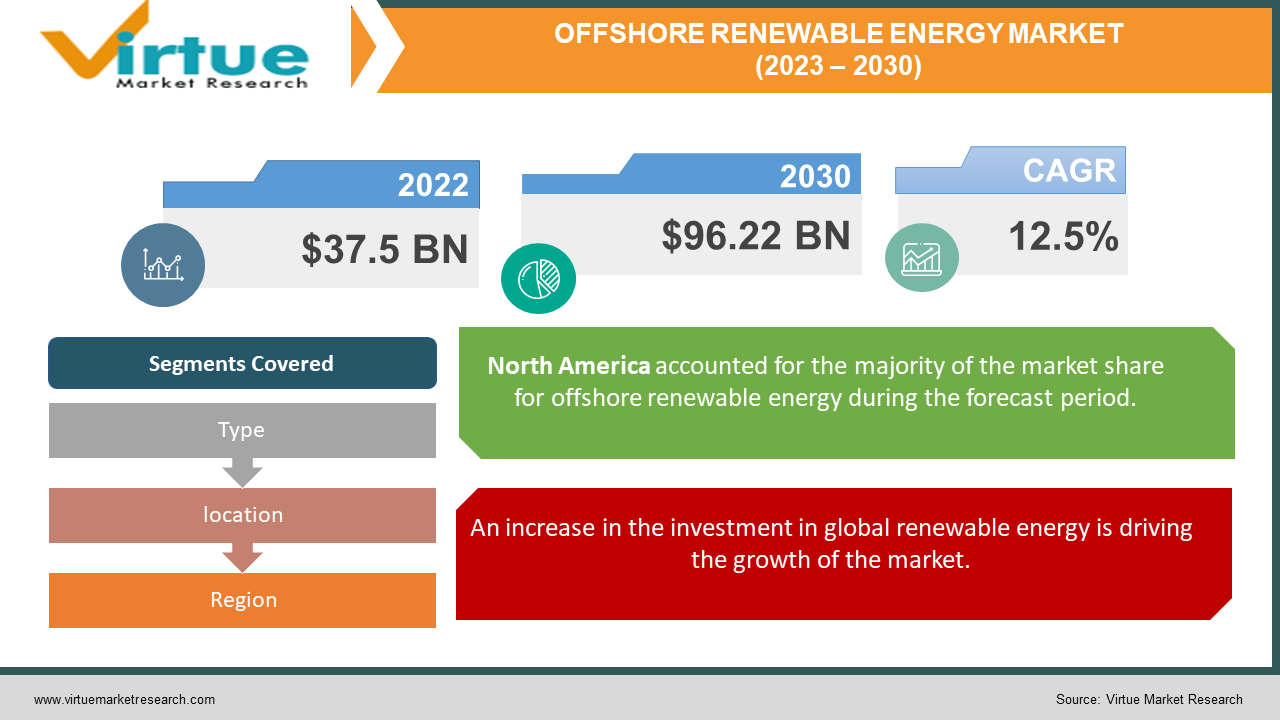

Offshore Renewable Energy Market Size (2023 – 2030)

In 2022, the Global Offshore Renewable Energy Market was valued at USD 37.5 billion and is projected to reach a market size of USD 96.22 billion by 2030. This market is witnessing a healthy CAGR of 12.5% from 2023 - 2030. The increase in investment in the global renewable energy market and new government policies are majorly driving the growth of the industry.

Industry Overview:

Offshore renewable strength – consisting of offshore wind and photo voltaic power, as nicely as rising ocean strength applied sciences – should aid sustainable long-term development and pressure a shiny blue economy. For international locations and communities around the world, offshore renewables can grant reliable, steady electricity, as properly as help water desalination and aquaculture.

The improvement of renewable sources and applied sciences at sea guarantees to spur new industries and create jobs in line with the international power transition. Offshore wind towers, with both constant or floating foundations, and floating photo voltaic photovoltaic (PV) arrays provide clear technological and logistical synergies with the current offshore oil and gasoline industry.

The ongoing shift from the traditional electricity sources to renewable electricity applied sciences owing to the implementation of strict environmental insurance policies will positively motivate the market growth. Accelerating offshore possibilities coupled with the improvement of a sturdy industrial & industrial area base will affect the product penetration. The principal factors, such as the introduction of quite a number of offshore renewable projects, coupled with the imposition of quite a number of regulatory frameworks and policies, are accelerating the international demand. In addition, increasing funding for the improvement of smooth power, rising demand for energy, and surging emission tiers related to the common energy plant are the similarly impelling elements that might also positively affect the enterprise boom over the forecasting years.

COVID-19 impact on the Offshore Renewable Energy Market

COVID-19 has slowed the boom of the offshore wind market, as international locations have been compelled to enforce lockdowns for the duration of the first 1/2 of 2020. Strict pointers have been issued by means of governments and neighborhood authorities, and all non-essential operations have been halted. This adversely affected the offshore wind market owing to much less center of attention on improvement of the offshore wind market.

The COVID- 19 pandemic has slowed down the typical market expansion. However, perfect vaccination packages by way of respective authorities throughout a range of international locations have resulted in a decline in the range of patients. The developing requirement to supply power to several sectors inclusive of residential, healthcare, services, and meals & drinks has positively motivated the enterprise landscape. Furthermore, the upliftment of stringent rules for international motion will in addition improve the offshore wind venture pipelines thereby stimulating the enterprise dynamics.

Renewable energy is that energy requires a large area and a lot of care from time to time to maintain the flow which makes this tough for people during the time of pandemics and also restricted the growth of the market. In addition, manufacturing and furnish chain delays had been additionally witnessed at some point of the 2nd quarter which poised a task to the offshore wind market.

MARKET DRIVERS:

An increase in the investment in global renewable energy is driving the growth of the market

There has been a sizeable shift in the strength area towards renewable and inexperienced power due to elements such as the want to decrease carbon emissions, depletion of fossil fuels, climatic change, etc. Various authority's insurance policies are in the area to aid the initiative towards greener energy. Many multinational groups are taking initiatives to reduce their carbon footprint to make a contribution to a greener planet and sustainability. Surging investments towards the improvement of sustainable power structures such as constant and floating offshore wind tasks will gas the technological know-how adoption. Low maintenance, decreased manpower requirement, and minimal land footprint is some of the distinguished elements impelling the market share. Moreover, the sturdy R&D initiatives targeted at improving the potential utilization element for electricity technology in a low-cost & environment-friendly manner will positively motivate the market dynamics.

Initiatives by governments and companies to reduce carbon emissions will also drive the market

Renewable electricity demand will proceed to rise, owing to the falling technological know-how costs, developing want to limit CO2 emissions and growing power consumption in growing and undeveloped countries. According to the International Renewable Energy Agency (IRENA), the share of renewables in each year's international strength era needs to upward thrust from the modern-day 25% to 86% with the aid of 2050 to fulfill the Paris Agreement's targets

MARKET RESTRAINTS:

High costs related to the set-up and maintenance are restraining the growth of the market

Offshore wind is one of the most promising and eco-friendly energy-producing technologies. Though it has a high-capacity aspect in contrast with associated technologies, such as photo voltaic and onshore wind, its massive capital fee is deterring its implementation. Offshore wind generators are prone to erosion, as they function for many years in harsh marine environments. Sometimes, even the most tremendous features, such as excessive wind speeds, come to be a poor thing for offshore wind turbines.

For instance, the generators have a tendency to shut down when the wind velocity exceeds 25 m/s. As the measurement of offshore wind farms has accelerated over time, challenges associated with construction, transportation, installation, and operation have additionally increased. Challenges related to logistics, in general, are a higher undertaking in offshore wind farms. Wind farms are generally positioned very a long way from the shore and are challenging to access, especially in awful climate conditions.

OFFSHORE RENEWABLE ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

12.5% |

|

Segments Covered |

By Type, location, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Prysmian Group, Siemens Gamesa, Sumitomo Electric, Nexans, Southwire LLC, IMPSA, Enessere, LS Cable & System, Vestas, Goldwind, General Electric, Nordex, WEG, Suzlon Energy, Global Energy (Group), Senvion, RTS Wind, ENVISION Group, NSW Cable, Bergey Windpower, Clipper Windpower, Enercon, JDR Cable, Northland Power, NKT A/S, Vattenfall, Ørsted, and Zhejiang Windey |

Offshore Renewable Energy Market - Type:

-

-

Tidal Power.

-

Offshore Wind Energy.

-

Electric Lines.

-

Turbines.

-

Renewable Energy Source.

-

Waves Energy.

-

others

-

Based on the type, wind energy is leading the market with 60% of the share in the total market. Wind energy near the fore is the more used energy which is used to create electricity and other things. There are various components that are associated with renewable energy. This wind energy is thus very good as it is renewable and it doesn't release toxic things. at a particular time, there is a high amount of wind that blows in the daytime which creates more opportunities to create wind energy. So wind energy can’t be created the whole year but during a particular time when the wind is strong enough to rotate the windmills and produce electricity which sometimes comes out as restraint.

After that, tidal energy covers the other main part of the renewable energy sector. Tides are formed due to the gravitational force exerted by the Moon on the Earth only. Tides are formed due to the alternating winds blowing over the ocean surface. Tides are formed due to the gravitational force exerted by the Sun and the Moon on the Earth. It is still in development because this technique can only be used in those areas where tide forms continuously and there are certain times during night especially when the time is formed and that kinetic energy is used to drive the turbine and rotate the shafts.

Offshore Renewable Energy Market - By location:

-

Shallow water

-

Transitional water

-

Deepwater

By location, the shallow water section accounted for the biggest share of the offshore wind market, by using location, in 2021. The majority of tasks are undertaken in this segment. The presence of a comparatively much less difficult climate and ease of upkeep make this section the proffered preference for improvement of offshore wine farms. Also, whilst putting up a wind turbine, the institution of electrical infrastructure is comparatively less complicated in shallow water. Due to comparatively much less wind pace reachable in shallow water, the generators with much less MW potential are set up in this region.

Offshore Renewable Energy Market- By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, The UK offshore wind electricity market is estimated to witness over a 4% increase in fees by using 2030. Favorable authority's insurance policies and a number of subsidies & incentive schemes alongside sturdy regulatory & coverage frameworks will help the acceptance of wind strength in the economy.

Rapid infrastructural enlargement and the improvement of offshore wind electricity initiatives throughout Europe have augmented the market progression. The area has a massive plausible for offshore renewable power presented by way of countless water bodies which include the Baltic and the North Sea to the Mediterranean, from the Atlantic to the Black Sea, masking the outermost regions. Moreover, stringent authorities’ policies to curb emissions and favorable insurance policies for the deployment of offshore windfarms will beautify the enterprise demand.

European place has been a pioneer in offshore wind technological know-how and offshore wind farm development. This improvement of offshore wind strength is supported through the European Wind Initiative (EWI), a wind strength R&D program, developed to take the wind enterprise to the next degree in Europe. The international locations in the EU are specifically focusing on upgrading they're getting older electrical infrastructure, and governments of these international locations are merchandising strength era thru renewable electricity sources and are constructing networks, from era to end-users, to permit for environment-friendly electricity and power trading.

Offshore Renewable Energy Market Share by Company

-

Chapter 1. Offshore Renewable Energy Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Offshore Renewable Energy Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Offshore Renewable Energy Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Offshore Renewable Energy Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Offshore Renewable Energy Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Offshore Renewable Energy Market– By Type

6.1 Introduction/Key Findings

6.2 Tidal Power.

6.3 Offshore Wind Energy.

6.4 Electric Lines.

6.5 Turbines.

6.6 Renewable Energy Source.

6.7 Waves Energy.

6.8 others

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Offshore Renewable Energy Market– By location

7.1 Introduction/Key Findings

7.2 Shallow water

7.3 Transitional water

7.4 Deepwater

7.5 Y-O-Y Growth trend Analysis By location

7.6 Absolute $ Opportunity Analysis By location, 2023-2030

Chapter 8. Offshore Renewable Energy Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By location

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By location

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By location

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By location

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By location

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Offshore Renewable Energy Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Prysmian Group

9.2 Siemens Gamesa

9.3 Sumitomo Electric

9.4 Nexans

9.5 Southwire LLC

9.6 IMPSA

9.7 Enessere

9.8 LS Cable & System

9.9 Vestas

9.10 Goldwind

9.11 General Electric

9.12 Nordex

9.13 WEG

9.14 Suzlon Energy

9.15 Global Energy (Group)

9.16 Senvion

9.17 RTS Wind

9.18 ENVISION Group

9.19 NSW Cable

9.20 Bergey Windpower

9.21 Clipper Windpower

9.22 Enercon

9.23 JDR Cable

9.24 Northland Power

9.25 NKT A/S

9.26 Vattenfall

9.27 Ørsted

9.28 Zhejiang Windey

For example, GE Renewable Energy announced that it has finalized the Turbine Supply and Service and Warranty contracts for the third and final phases of the Dogger Bank offshore wind farm.

Siemens Gamesa has been confirmed as a preferred supplier for the full 1,044 MW Hai Long offshore (in Taiwan) wind projects.

Eminent manufacturers are focusing on strategic partnerships & collaborations to gain a competitive edge over their opponents. These strategies have been developed to significantly reorganize the industry trends by accelerating the manufacturing efficiency and reducing the overall cable expenditure to gain a significant revenue share.

NOTABLE HAPPENINGS IN THE GLOBAL OFFSHORE RENEWABLE ENERGY MARKET IN THE RECENT PAST:

-

Product Launch - In June 2021, Siemens Gamesa launched SG 14-222 DD offshore wind turbine with a nameplate capacity of 14 MW which can reach 15 MW with Power Boost. Its 222-meter rotor diameter uses massive 108-meter long B108 blades.

-

Product Launch- Goldwind launched the GW1S turbine which is highly efficient compared to previous models.

Chapter 1. Offshore Renewable Energy Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Offshore Renewable Energy Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Offshore Renewable Energy Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Offshore Renewable Energy Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Offshore Renewable Energy Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Offshore Renewable Energy Market– By Type

6.1 Introduction/Key Findings

6.2 Tidal Power.

6.3 Offshore Wind Energy.

6.4 Electric Lines.

6.5 Turbines.

6.6 Renewable Energy Source.

6.7 Waves Energy.

6.8 others

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Offshore Renewable Energy Market– By location

7.1 Introduction/Key Findings

7.2 Shallow water

7.3 Transitional water

7.4 Deepwater

7.5 Y-O-Y Growth trend Analysis By location

7.6 Absolute $ Opportunity Analysis By location, 2023-2030

Chapter 8. Offshore Renewable Energy Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By location

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By location

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By location

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By location

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By location

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Offshore Renewable Energy Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Prysmian Group

9.2 Siemens Gamesa

9.3 Sumitomo Electric

9.4 Nexans

9.5 Southwire LLC

9.6 IMPSA

9.7 Enessere

9.8 LS Cable & System

9.9 Vestas

9.10 Goldwind

9.11 General Electric

9.12 Nordex

9.13 WEG

9.14 Suzlon Energy

9.15 Global Energy (Group)

9.16 Senvion

9.17 RTS Wind

9.18 ENVISION Group

9.19 NSW Cable

9.20 Bergey Windpower

9.21 Clipper Windpower

9.22 Enercon

9.23 JDR Cable

9.24 Northland Power

9.25 NKT A/S

9.26 Vattenfall

9.27 Ørsted

9.28 Zhejiang Windey

Download Sample

Choose License Type

2500

4250

5250

6900