OEM GNSS Receiver Market Size (2024 – 2030)

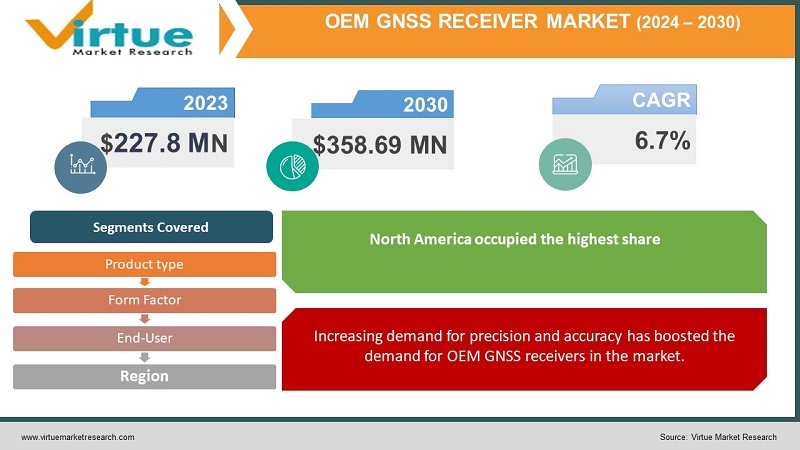

The OEM GNSS Receiver Market was valued at USD 227.8 Million and is projected to reach a market size of USD 358.69 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.7%.

In the past, OEM GNSS were primarily used for positioning and navigation purposes in the military and aviation sector for tracking and management of opponent’s sites, and weapons, and directing own systems towards them. However, with faster developments in technology, particularly GNSS technology, the application of OEM receivers based on GNSS technology increased to various other sectors for surveying, mapping, automotive positioning, asset tracking, and others. Moreover, the increased proliferation of smartphones and smart wearables further increased the usage of OEM chips for positioning and navigation purposes. In addition, structural changes in OEM GNSS receivers such as lightweight, compact size, and energy efficiency increased their usage in sensors, which provided improved accuracy and positioning in harsh environments. Moreover, sensors deployed in autonomous vehicles find increased usage of OEM GNSS receivers due to their ability to detect the surrounding path, obstacles around the vehicle, traffic congestion, and others. The future for OEM GNSS holds positive with increasing trends in 5G integration technologies and rising demand for receivers for space study and research.

Key Market Insights:

As per McKinsey and Company, Avs (autonomous vehicles can reduce road crashes by 90%, potentially leading to a saving of US $190 billion per year.

According to Statistics Canada, the Surveying & mapping Industry witnessed a 14.8% increase in operating revenue and accounted for US $ 2.5 billion in the year 2021.

According to Google Play Store, Google Maps accounts for over 10 billion downloads on Google Play store

OEM GNSS Receiver Market Drivers:

Increasing demand for precision and accuracy has boosted the demand for OEM GNSS receivers in the market.

Industries today require a high level of precision and accuracy, especially in measuring, positioning, and navigation. This is due to rising requirements for studying and analyzing the earth’s surface by geologists and researchers. Moreover, OEM GNSS receivers provide accurate transmission and reception of satellite signals that can help geologists, researchers, and scientists in preparing 3D models that acknowledge the changes in climate, environment, and physiological structures on the earth’s surface. Moreover, OEM GNSS with real-time kinematic positioning is increasingly used in the construction and agriculture industry for positioning of automated tractors, site preparation, grading, and other machinery. In addition, a recent increase in infrastructure projects, especially in developing countries is increasing the demand for OEM GNSS receivers for identifying and assessing issues in construction and repair such as identifying anomalies in underground pipeline systems, networking the machines with one another, reducing the maintenance of road construction by integrating OEM GNSS with construction controlling machines, and others.

Technological advancements drive the demand for OEM GNSS receivers in the market.

Advancements in navigation and positioning technology have increased the market growth of OEM GNSS receivers, as they improve signal processing by detecting obstacles in the path such as in case of construction and automotive industry for detecting noise, obstacles, anomalies in grading, issues at the site, and others. Additionally, trends in real-time analytics have further led to the development of real-time data processing OEM GNSS devices that offer high position accuracy along with constant information to the user, such as in the case of marine and aerial uses, wherein unmanned aerial vehicles are integrated with OEM antennas for sending and receiving information that allows the operator to remotely track and monitor the progress and loss at the site. Moreover, increasing demand for compact structured devices has further led to the development of smaller, lighter, and energy-efficient receivers such as OEM chips that are now increasingly used in wearable devices and smartphones.

OEM GNSS Receiver Market Restraints and Challenges:

Disruptions in signals can affect the market growth of OEM GNSS receivers. Bad environmental conditions, spoofing faulty signal reception, and others can decline the market demand for OEM GNSS receivers.

Furthermore, the expensive cost of advanced and specialized OEM GNSS devices such as modules, chipsets, antennas, devices with advanced integration capabilities, and others can decrease the demand for OEM GNSS receivers in the market.

OEM GNSS Receiver Market Opportunities:

The OEM GNSS Receiver Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing demand for energy-efficient, accurate, and precision technologies is predicted to develop the market for the OEM GNSS Receiver and enhance its future growth opportunities.

OEM GNSS RECEIVER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Product type, Form Factor, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Topcon Positioning Systems, CHCNAV, Navtek India, NovAtel, FURUNO, NavtechGPS, Locosys, Trimble Septentrio, Canal Geomatics, ASB Systems |

OEM GNSS Receiver Market Segmentation: By Product Type

-

Single Frequency

-

Dual Frequency

-

Multi-Frequency

-

Real Time Kinematic (RTK)

-

Dead Reckoning

-

Others

In 2022, based on market segmentation by product type, multi-frequency occupied the highest share of about 26% in the market. Multi-frequency GNSS receivers are designed to receive signals from multiple frequency bands. Moreover, this helps the satellite system in improving accuracy, position, and velocity. Additionally, it helps in receiving satellite signals in harsh environments, where GPS-only positioning is difficult. Furthermore, it is applicable for automotive navigation and telematics systems, intelligent transport systems, augmented reality applications, disaster prevention management systems such as monitoring seismic surges and landslides, and others.

Real-time kinematics (RTK) is the fastest-growing segment during the forecast period. The technique of positioning is increasingly used for providing highly accurate positioning information in satellite-based positioning systems in real time. Moreover, the major advantage of RTK positioning in GNSS is that it provides centimeter-level accuracy that makes it highly applicable in land surveying, agriculture, construction, autonomous vehicle navigation, and others. Additionally, RTK helps in enhancing the positioning of GNSS by using fixed reference stations with known positions. These monitor stations the satellite signals and compute corrections for any errors that occur while transferring satellite signals to the receiver.

OEM GNSS Receiver Market Segmentation: By Form Factor

-

OEM Receiver Chipset

-

OEM Boards

-

OEM Antenna

-

OEM Modules

-

Others

In 2022, based on market segmentation by form factor, the OEM receiver chipset occupied the highest share of about 29% in the market. The growth of this segment is attributed to the increased use of smartphones, tablets, and wearable technology such as smartwatches. Moreover, the OEM receiver chipset is widely used in the electrical and electronics sector due to its compact and lightweight structure. Moreover, they are highly energy-efficient and hence are increasingly used in smartphones and smartwatches. In addition, being highly sensitive in receiving signals they help in location and navigation services in smartphones.

OEM antenna is the fastest-growing segment during the forecast period. OEM antennas are specifically designed for the reception and transmission of GNSS signals and are widely used in aerial, land, marine, and other applications. Moreover, due to its high performance in receiving and transferring signals, and versatility to operate in various frequency bands, it has further increased its applications in fleet management, modems, set-top boxes, routers, asset tracking devices, and others.

OEM GNSS Receiver Market Segmentation: By End-User

-

Aerospace & Defense

-

Automotive

-

Transportation

-

Geology

-

Construction

-

Agriculture

-

Surveying & Mapping

-

Others

In 2022, based on market segmentation by end-users, automotive occupied the highest share of about 35% in the market. The automotive industry finds increased applications of OEM GNSS receivers, which particularly include vehicle navigation systems, tracking systems, real-time direction guidance, and others. Moreover, modern car manufacturers deploy OEM GNSS receivers in their cars to provide in-car GPS navigation that can receive real-time signals and guide the driver regarding location, directions, faster routes to avoid traffic, and others. Additionally, trends in autonomous or self-driving cars have further boosted the usage of OEM GNSS receivers for positioning, navigating, and lane-keeping purposes. Moreover, the devices used for this purpose include AV (autonomous vehicle) sensor stacks (front and end) that help in detecting obstacles and other cars that are moving in the vicinity, thus offering efficient and safe movement of cars on a busy road. Additionally, the OEM GNSS receiver equipped with integration capabilities provides real-time information regarding crashes and blocked lanes through its integration with cameras and sensors in AVs.

Surveying & and mapping is the fastest-growing segment during the forecast period. OEM GNSS receivers are increasingly used for land surveying, urban planning, disaster response and prevention management, environmental monitoring, and others. This growth of OEM GNSS receivers in various aspects is due to their ability to transfer and receive signals accurately and immediately, real-time monitoring accuracy, controlled mapping in case of aerial surveys and remote sensing for analyzing the earth’s surface, and the ability to determine precise coordinates, and others.

OEM GNSS Receiver Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle-East & Africa

In 2022, based on market segmentation by region, North America occupied the highest share of about 43% in the market. Increasing demand for satellite signal receivers in space exploration such as for transmitting and receiving signals for satellite communication, observation of celestial bodies such as Earth for analyzing and studying Earth’s climate, and environment, and for spacecraft tracking, which includes tracking space debris for ensuring safe movement of spacecraft, has contributed to the demand for OEM GNSS receiver in the region.

Asia-Pacific is the fastest-growing region during the forecast period. Rapid technological adoptions in agriculture such as trends in precision agriculture, that is use of crop monitoring sensors, as well as the fast booming electronics industry in countries such as China, India, and Japan, contribute to the demand for OEM GNSS receivers in the region.

COVID-19 Impact Analysis on the OEM GNSS Receiver Market

The pandemic had a significant impact on the OEM GNSS receiver in the market. Disruptions in the supply chain during the pandemic led to a slowdown in production, manufacturing, and distribution of OEM GNSS components, leading to declined demand for OEM GNSS receivers in the market. Moreover, the closure of many industries that were major users of OEM GNSS receivers such as construction, automotive, and others declined the market growth of OEM GNSS receivers in the market. However, increased demand for smartphones, tablets, and other smart devices due to remote working and learning culture led to increased usage of OEM chips based on GNSS technology during the pandemic.

Latest Developments:

The market for OEM GNSS receivers is witnessing an upward trend in the market due to increasing demand for mapping and surveying the earth’s surface by researchers and scientists. Moreover, the growing trends in autonomous vehicle positioning and navigation have further increased the usage of OEM GNSS receivers in the market.

- In January 2023, SBG Systems launched Quanta Plus. The product is a next-gen OEM GNSS-aided INS that is small, light in weight, and provides high performance, accuracy, and reliability, Moreover, it can be easily integrated into the survey systems with third-party sensors or LiDAR. Additionally, the product can provide accurate and reliable navigation data even in harsh environmental conditions.

- In April 2022, Applanix (a Trimble company) launched a next-gen OEM solution relevant to mobile mapping applications. The solution is based on GNSS inertial technology that provides accurate and robust position and orientation for vehicle positioning on land and georeferencing sensors. Additionally, the product enables users to track and monitor fleets, create HD maps, and 3D models, and act as a reference solution for driver-assistance systems testing.

Key Players:

-

Topcon Positioning Systems

-

CHCNAV

-

Navtek India

-

NovAtel

-

FURUNO

-

NavtechGPS

-

Locosys

-

Trimble

-

Septentrio

-

Canal Geomatics

-

ASB Systems

Chapter 1. OEM GNSS Receiver Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. OEM GNSS Receiver Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. OEM GNSS Receiver Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. OEM GNSS Receiver Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. OEM GNSS Receiver Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. OEM GNSS Receiver Market – By Product Type

6.1 Introduction/Key Findings

6.2 Single Frequency

6.3 Dual Frequency

6.4 Multi-Frequency

6.5 Real Time Kinematic (RTK)

6.6 Dead Reckoning

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. OEM GNSS Receiver Market – By Form Factor

7.1 Introduction/Key Findings

7.2 OEM Receiver Chipset

7.3 OEM Boards

7.4 OEM Antenna

7.5 OEM Modules

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Form Factor

7.8 Absolute $ Opportunity Analysis By Form Factor, 2024-2030

Chapter 8. OEM GNSS Receiver Market – By End-User

8.1 Introduction/Key Findings

8.2 Aerospace & Defense

8.3 Automotive

8.4 Transportation

8.5 Geology

8.6 Construction

8.7 Agriculture

8.8 Surveying & Mapping

8.9 Others

8.10 Y-O-Y Growth trend Analysis By End-User

8.11 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. OEM GNSS Receiver Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End-User

9.1.4 By Form Factor

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End-User

9.2.4 By Form Factor

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End-User

9.3.4 By Form Factor

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End-User

9.4.4 By Form Factor

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End-User

9.5.4 By Form Factor

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. OEM GNSS Receiver Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Topcon Positioning Systems

10.2 CHCNAV

10.3 Navtek India

10.4 NovAtel

10.5 FURUNO

10.6 NavtechGPS

10.7 Locosys

10.8 Trimble

10.9 Septentrio

10.10 Canal Geomatics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The OEM GNSS Receiver Market was valued at USD 227.8 Million and is projected to reach a market size of USD 358.69 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.7%.

Increasing demand for precision and accuracy and Technological advancements are the market drivers of the OEM GNSS Receiver market.

Single Band, Dual Band, Tri-band, and Other, are the segments under the OEM GNSS Receiver Market by type.

North America is the most dominant region for the OEM GNSS Receiver Market.

Asia-Pacific is the fastest-growing region in the OEM GNSS Receiver Market.