Ocular Implants Market Size (2025 – 2030)

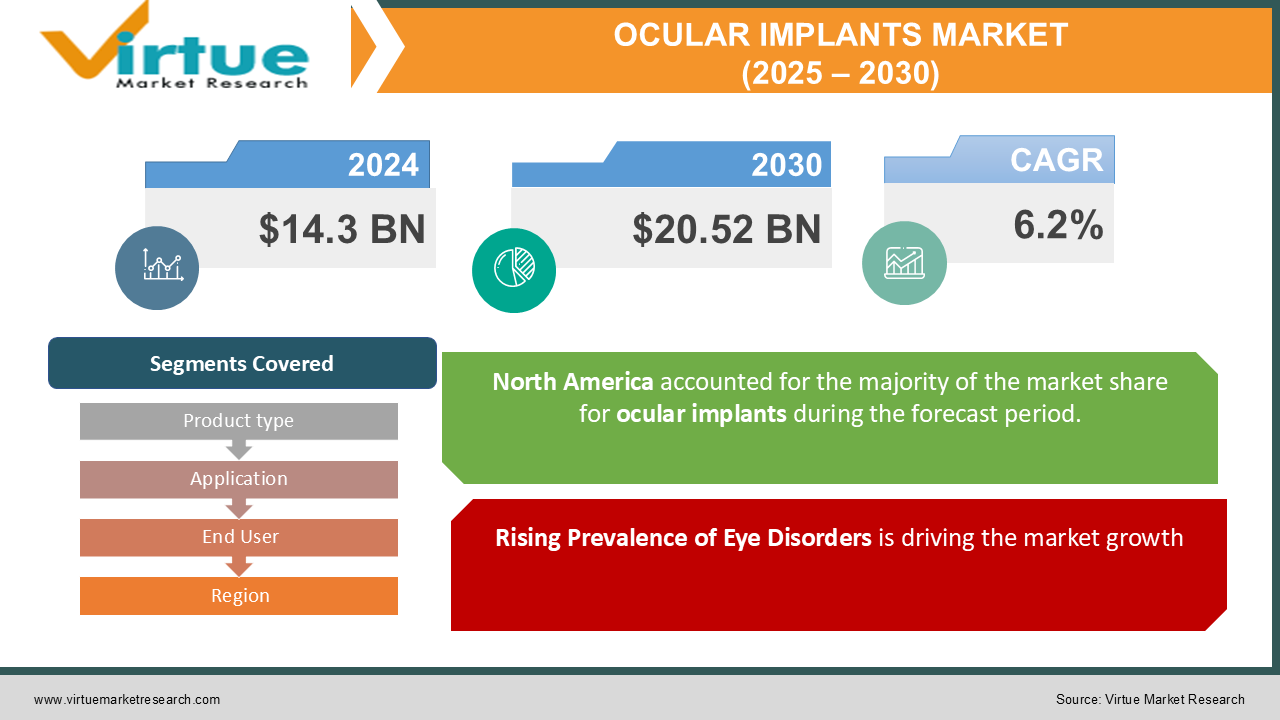

The Global Ocular Implants Market was valued at USD 14.3 billion in 2024 and is projected to reach USD 20.52 billion by 2030, growing at a CAGR of 6.2% during the forecast period (2025–2030).

Ocular implants are medical devices designed to address a range of ocular disorders and injuries, providing functional and cosmetic restoration. The rise in the prevalence of eye-related conditions, technological advancements, and growing awareness of eye care are driving the demand for these implants.

The market is seeing significant traction owing to increased adoption of minimally invasive surgical procedures, the aging global population, and a surge in healthcare expenditure, especially in emerging economies.

Key Market Insights

-

Intraocular lenses (IOLs) dominate the product type segment, accounting for over 50% of the market share, primarily due to their use in cataract surgeries.

-

Cataract surgery leads the application segment, contributing over 60% of the revenue, driven by the global rise in cataract prevalence.

-

Hospitals are the largest end-user segment, representing approximately 55% of the market, as they are the primary centers for advanced ocular treatments.

-

North America holds the largest market share at over 35%, attributed to advanced healthcare systems and high adoption of new technologies.

-

The Asia-Pacific region is expected to register the fastest growth, with a projected CAGR of 7.8%, due to improving healthcare infrastructure and increasing awareness about eye care.

Global Ocular Implants Market Drivers

Rising Prevalence of Eye Disorders is driving the market growth

Globally, the prevalence of eye disorders such as cataracts, glaucoma, and age-related macular degeneration (AMD) is increasing due to an aging population and lifestyle changes. Cataracts remain the leading cause of blindness, with over 50 million surgeries performed annually worldwide, according to the World Health Organization (WHO).

This growing demand for cataract and other corrective surgeries is directly boosting the adoption of ocular implants, particularly intraocular lenses and glaucoma drainage devices. Advancements in diagnostic techniques further enable early detection and treatment of eye disorders, expanding the market.

Technological Advancements in Ocular Implants is driving the market growth

The development of innovative ocular implants, such as multifocal and accommodating intraocular lenses and biodegradable implants, has significantly enhanced the treatment outcomes for patients. These technologies improve vision quality, reduce complications, and extend the lifespan of the implants.

For example, extended depth-of-focus (EDOF) lenses address presbyopia while offering improved visual outcomes. Similarly, biocompatible materials such as hydrophilic acrylic are reducing the risk of post-surgical complications. These advancements are expected to fuel market growth in the coming years.

Increasing Geriatric Population is driving the market growth

The global geriatric population is rising rapidly, with the United Nations estimating that individuals aged 65 years and older will constitute over 16% of the world population by 2050. As older individuals are more prone to conditions like cataracts, glaucoma, and macular degeneration, the demand for ocular implants is increasing significantly.

Governments and healthcare providers are focusing on providing affordable eye care services to address the growing need, particularly in developing regions, further driving the market.

Global Ocular Implants Market Challenges and Restraints

High Cost of Advanced Ocular Implants is restricting the market growth

The high cost associated with advanced ocular implants and related surgical procedures is a major restraint, particularly in low- and middle-income countries. While government healthcare schemes in developed regions cover these expenses to some extent, out-of-pocket costs remain a significant barrier for patients in developing nations.

For example, premium intraocular lenses that address presbyopia and astigmatism are often not covered by insurance policies, limiting their adoption among cost-sensitive populations. This challenge highlights the need for affordable solutions to ensure broader market penetration.

Risk of Post-Surgical Complications is restricting the market growth

Although ocular implants are highly effective, there are risks of complications such as infections, implant dislocation, and increased intraocular pressure. These issues can lead to additional treatments, increasing the overall cost and affecting patient outcomes.

Moreover, the lack of skilled ophthalmologists in certain regions exacerbates the problem, as improper handling and implantation can lead to adverse effects. Addressing these concerns through better training programs and improved implant designs is essential for market growth.

Market Opportunities

The increasing focus on customized ocular implants offers a significant growth opportunity for market players. Tailored implants, designed based on individual patient anatomy and requirements, are gaining traction due to their ability to deliver superior outcomes. Additionally, the integration of artificial intelligence (AI) and 3D printing in the development of ocular implants is expected to revolutionize the market. AI-driven diagnostics can help ophthalmologists plan surgeries more accurately, while 3D printing enables the production of highly customized and cost-effective implants. Emerging markets in Asia-Pacific, Latin America, and the Middle East & Africa also present lucrative opportunities, driven by rising healthcare investments and increasing awareness about eye care. Governments in these regions are actively working to improve access to quality eye care services, creating a favorable environment for market expansion.

OCULAR IMPLANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Product type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Alcon Inc., Johnson & Johnson Vision, Bausch + Lomb, Carl Zeiss Meditec AG, Hoya Corporation, STAAR Surgical Company, Rayner Surgical Group, HumanOptics AG, Ophtec BV, SIFI S.p.A. |

Ocular Implants Market Segmentation - By Product Type

-

Intraocular Lenses (IOLs)

-

Corneal Implants

-

Orbital Implants

-

Others

Intraocular lenses (IOLs) dominate the ocular implants market, primarily due to their widespread use in cataract surgeries. These artificial lenses are implanted in the eye to replace the natural lens, which becomes cloudy in cataract patients. 1 The increasing prevalence of cataracts, especially among aging populations, has significantly driven the demand for IOLs. 2 Advancements in IOL technology, including the development of multifocal, toric, and accommodating IOLs, have further expanded the market. These advanced IOLs offer improved visual outcomes and can correct multiple refractive errors, reducing the need for additional refractive procedures. As a result, IOLs have become an essential component of modern cataract surgery, solidifying their position as the dominant segment in the ocular implants market

Ocular Implants Market Segmentation - By Application

-

Cataract Surgery

-

Glaucoma Surgery

-

Ocular Prosthesis

-

Others

Cataract surgery is the largest application segment for ocular implants, driven by the global rise in cataract prevalence and advancements in surgical techniques. As populations age, the incidence of cataracts, a clouding of the eye's lens, increases significantly. Modern cataract surgery techniques, including phacoemulsification and lens implantation, have revolutionized the treatment of cataracts, providing patients with improved vision and quality of life. The increasing availability of advanced intraocular lenses (IOLs), such as multifocal and toric IOLs, has further expanded the scope of cataract surgery. These innovative lenses can address multiple vision problems, including presbyopia and astigmatism, reducing the need for additional refractive procedures. As a result, the demand for cataract surgery and associated ocular implants continues to grow, making it the dominant application segment in the market.

Ocular Implants Market Segmentation - By End User

-

Hospitals

-

Ambulatory Surgery Centers

-

Clinics

-

Others

Hospitals remain the primary end-user segment for ocular implants, driven by their advanced infrastructure, specialized surgical facilities, and the availability of skilled ophthalmologists. These institutions are equipped to handle complex surgical procedures, particularly those involving advanced implant technologies. The comprehensive range of services offered by hospitals, including preoperative assessments, surgical interventions, and postoperative care, ensures optimal patient outcomes. Additionally, hospitals often have access to cutting-edge research and clinical trials, allowing them to adopt the latest advancements in ocular implant technology. As healthcare systems continue to evolve, hospitals will remain at the forefront of ocular implant surgery, providing high-quality care and driving innovation in the field.

Ocular Implants Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America holds the largest share of the ocular implants market, accounting for over 35% of global revenue. The region benefits from advanced healthcare infrastructure, high adoption rates of new technologies, and the availability of skilled professionals. The U.S. leads the market, driven by a high prevalence of age-related eye disorders and significant healthcare expenditure. Asia-Pacific is anticipated to witness the fastest growth, with a projected CAGR of 7.8% during the forecast period. Factors such as a large geriatric population, rising healthcare investments, and increasing awareness about advanced eye care solutions are driving this growth. Countries like China and India are major contributors, with government initiatives improving access to quality healthcare services.

COVID-19 Impact Analysis

The COVID-19 pandemic had a multifaceted impact on the ocular implants market. Initially, the pandemic led to a significant decline in elective surgeries, including cataract and glaucoma procedures, as healthcare systems prioritized urgent and critical care. However, as the pandemic progressed and healthcare systems adapted to the new normal, the demand for ocular implants began to rebound. The increasing emphasis on outpatient and ambulatory surgical centers, which minimized the risk of exposure to COVID-19, further supported the recovery of the market. Additionally, the pandemic accelerated the adoption of telemedicine and AI-driven diagnostics, enabling ophthalmologists to remotely assess and monitor patients. These technological advancements have improved patient access to care and streamlined the treatment process, positively impacting the ocular implants market. As the world continues to navigate the post-pandemic landscape, the ocular implants market is poised for growth, driven by aging populations, increasing prevalence of eye diseases, and ongoing advancements in implant technology.

Latest Trends/Developments

The field of ophthalmology is undergoing a significant transformation, driven by advancements in technology and a growing focus on patient-centric care. The emergence of smart ocular implants is revolutionizing eye care by enabling continuous monitoring of intraocular pressure and other critical parameters. These innovative devices provide real-time data, empowering healthcare professionals to make informed decisions and optimize treatment plans. Simultaneously, innovations in materials science are leading to the development of biodegradable and biocompatible implants, reducing the risk of complications and enhancing patient comfort. The market is also witnessing a growing demand for pediatric ocular implants, addressing the unique needs of children with congenital and traumatic eye conditions. To ensure equitable access to these life-changing technologies, industry players are collaborating with government and non-government organizations to develop affordable solutions for underserved regions. Additionally, the expansion of specialized training programs for ophthalmologists is improving the availability of skilled professionals, particularly in emerging economies. These collective efforts are shaping the future of ophthalmology, promising to improve the quality of life for millions of people worldwide.

Key Players

-

Alcon Inc.

-

Johnson & Johnson Vision

-

Bausch + Lomb

-

Carl Zeiss Meditec AG

-

Hoya Corporation

-

STAAR Surgical Company

-

Rayner Surgical Group

-

HumanOptics AG

-

Ophtec BV

-

SIFI S.p.A.

Chapter 1. Ocular Implants Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ocular Implants Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ocular Implants Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ocular Implants Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ocular Implants Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ocular Implants Market – By Product Type

6.1 Introduction/Key Findings

6.2 Intraocular Lenses (IOLs)

6.3 Corneal Implants

6.4 Orbital Implants

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Ocular Implants Market – By Application

7.1 Introduction/Key Findings

7.2 Cataract Surgery

7.3 Glaucoma Surgery

7.4 Ocular Prosthesis

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Ocular Implants Market – By End User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Ambulatory Surgery Centers

8.4 Clinics

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End User

8.7 Absolute $ Opportunity Analysis By End User, 2025-2030

Chapter 9. Ocular Implants Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ocular Implants Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Alcon Inc.

10.2 Johnson & Johnson Vision

10.3 Bausch + Lomb

10.4 Carl Zeiss Meditec AG

10.5 Hoya Corporation

10.6 STAAR Surgical Company

10.7 Rayner Surgical Group

10.8 HumanOptics AG

10.9 Ophtec BV

10.10 SIFI S.p.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Ocular Implants Market was valued at USD 14.3 billion in 2024 and is projected to reach USD 20.52 billion by 2030, growing at a CAGR of 6.2% during the forecast period (2025–2030).

Key drivers include the rising prevalence of eye disorders, technological advancements, and an increasing geriatric population.

Segments include Product Type (Intraocular Lenses, Corneal Implants, Orbital Implants), Application (Cataract Surgery, Glaucoma Surgery), and End User (Hospitals, Clinics, Ambulatory Surgery Centers).

North America dominates the market, accounting for over 35% of global revenue, due to advanced healthcare systems and high adoption rates of innovative technologies.

Major players include Alcon Inc., Johnson & Johnson Vision, Bausch + Lomb, and Carl Zeiss Meditec AG.