OCTG Market Size (2024 – 2030)

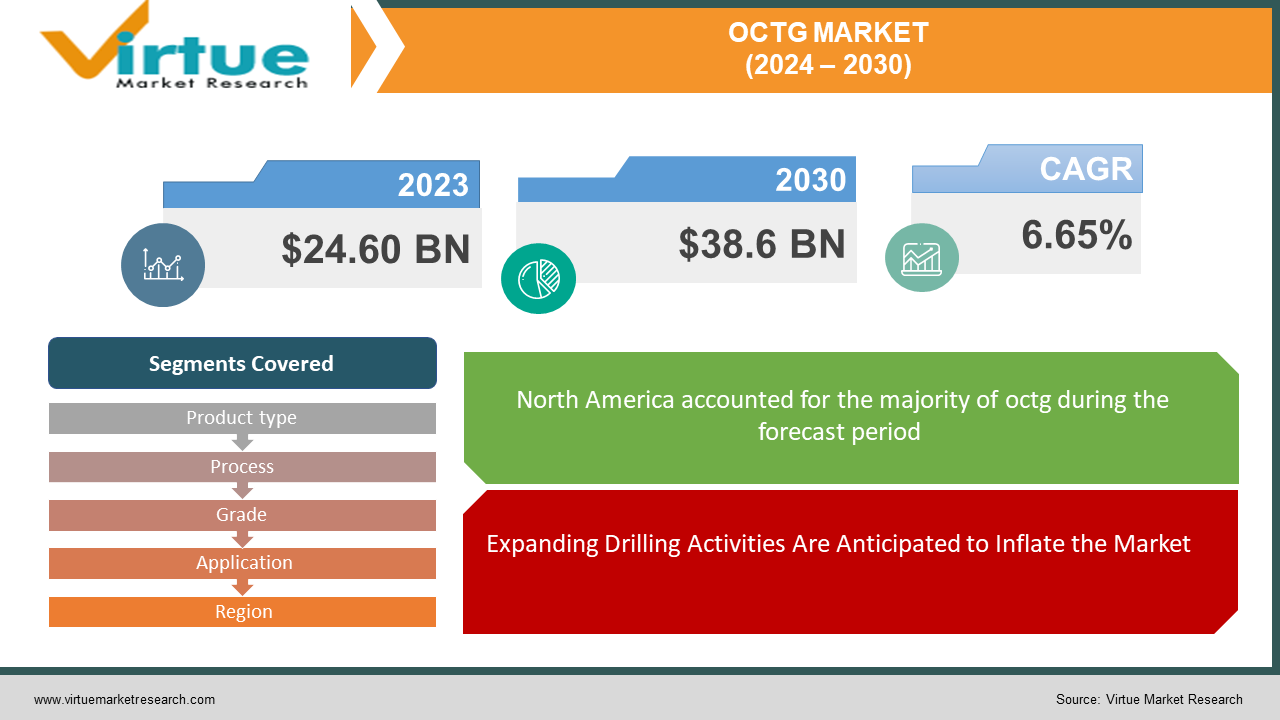

In 2023, the OCTG Market was valued at $24.60 Billion and is projected to reach a market size of $38.6 Billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.65%.

Oil country goods (OCTG) are rolled products extensively used in the oil and gas industry. These products include drill pipes, casings, and tubing that play roles in drilling operations and well equipment, for oil and gas production. Drill pipes are tubes responsible, for rotating the drill bit and circulating drilling fluid. On the hand casings line the borehole enduring tension and internal pressure caused by the pumped oil and gas emulsion. Additionally, tubing serves as a conduit through which gases and oils are transported from the wellbore. OCTG is manufactured using resistance welded (ERW) or seamless processes employing alloy steel or carbon materials to ensure efficient transportation of oil and gas.

Key Market Insights:

Some factors contribute to the growth of the market study. These include the expansion of exploration and production activities the ability to maintain oil breakeven prices through increased oil revenues and advancements, technology cost savings in oil services, and a rise, in directional drilling.

However, the growth of the OCTG market might be hindered during the forecast period due, to factors such as import duties in countries like the United States fluctuations, oil prices, and growing environmental concerns.

Major countries worldwide have adopted a policy of liberalizing the oil and gas sector to attract investments and drive growth in the industry. As a result, the global OCTG market is expected to witness opportunities, in the future.

The natural gas industry is experiencing growth due, to the increased focus on exploring shale reserves. Additionally, the use of drilling techniques has greatly contributed to the production of natural gas from these reserves. This in turn has had an impact, on the premium-grade OCTG market.

OCTG Market Drivers:

Expanding Drilling Activities Are Anticipated to Inflate the Market.

The economy’s recovery has led to an increase, in energy consumption. When it comes to the energy outlook, oil and gas remain the sources. Hydrocarbons play a role in operations such as power generation, transportation, processing, and manufacturing. One notable trend in the OCTG market is the investments made by oilfield service providers and operators in exploration and production activities to meet the soaring demand for oil and gas. The OCTG market outlook is expected to improve due to growth, in drilling operations and the steady expansion of the industry.

Finding Conventional and Unconventional Reserves with Exponential Potential to Drive the Market.

Both government and private entities have shown interest, in finding oil well reserves to meet the growing demand for energy in the future. Major companies are investing heavily in unlocking oil and gas reserves, which is expected to drive the market for oil country goods (OCTG). Additionally, the shale gas revolution in the United States has attracted investors to explore fuel sources. Many countries are also making efforts to reduce their reliance on imported hydrocarbons by discovering both unconventional reserves, within their territories. This is contributing to the growth of the OCTG market.

OCTG Market Restraints and Challenges:

The OCTG industry heavily depends on a workforce to manufacture and install its products. However, there is currently a shortage of labor, in the oil and gas sector, which is causing impacts on the OCTG market;

Decreased production; Due to the scarcity of workers OCTG manufacturers are finding it challenging to meet the growing demand. Consequently, this has resulted in reduced production levels. Longer lead times for OCTG products. Rising costs; The scarcity of labor is also driving up the prices of OCTG products. Manufacturers are compelled to offer wages and benefits to attract and retain workers, which ultimately affects product costs. Project delays; The shortage of labor can lead to delays in oil and gas projects as well. Since OCTG plays a role in these projects any shortage or delay in its availability can hinder completion.

These factors together emphasize the impact caused by the lack of workers, in the OCTG industry and how it affects production levels, costs, and project schedules within the oil and gas sector. The shortage of labor in this industry presents a challenge that requires attention. Manufacturers, in the OCTG sector are taking steps to tackle this challenge by investing in training programs and offering salaries and benefits. However, it will take time to address the shortage and ensure that the OCTG industry has a workforce capable of meeting increasing demand.

OCTG Market Opportunities:

The oil industry was heavily impacted by a decrease, in oil prices in 2019 resulting in companies experiencing reduced revenues and implementing spending cuts. The growing demand for energy and production has played a role in driving the expansion of the oilfield products (OCTG) market. In years the adoption of drilling techniques and hydraulic fracturing technology has significantly increased the demand for oilfield tubular products. Offshore drilling operations and natural gas contribute a portion to the revenue generated by these products and the increasing production from shale resources will further drive the demand for OCTG products in the future. The anticipated rise in platforms worldwide is expected to fuel growth within this sector in the years. Additionally, there is an expansion of existing wells located primarily in deep and ultra-deep waters such as the Gulf of Mexico Persian Gulf, North Sea, and South China Sea which will also drive the demand for OCTG specifically within this segment. Governments and private entities are displaying interest in discovering reserves to meet future energy demands. Leading companies are making investments to unlock reserves of oil and gas which will contribute to further growth in tubular goods markets, across various countries. Furthermore, there is an exploration of fuel sources.

Moreover, numerous nations are facing challenges, in decreasing their reliance, on imported hydrocarbons by uncovering both nontraditional energy sources within their borders. This trend is fueling the growth of the oil country tubular goods (OCTG) market.

OCTG MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.65% |

|

Segments Covered |

By Product type, Process, Grade, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nppon Steel & Sumitomo Metal Co. Vallourec,Tenaris, National Oilwell Varco TMK, Steel Tubular Products Inc, ILJIN STEEL CO, Continental Alloys, Anul Tanda Oil Pipe Company, OCTG Industry Developments |

OCTG Market Segmentation: By Product Type

-

Casing

-

Drill Pipe

-

Tubing

-

Others

In 2022, based on the product type, the Casing segment accounted for the largest revenue share by almost 40% and has led the market. Casing is utilized to line the borehole preventing it from collapsing. It also serves to isolate sections, within the well and shield it from the impact of fluids. Drill pipe stands out as the growing product category in the OCTG market exhibiting a Compound Annual Growth Rate (CAGR) of over 5% throughout the projected timeframe. A drill pipe is employed to rotate the drill bit and facilitate drilling circulation. Additionally it enables tools and equipment to be conveyed into and out of the wellbore. The expansion of the drill pipe market is primarily fueled by increased exploration and production endeavors in oil and gas fields. These fields necessitate drilling at depths, with intricate well designs thereby requiring a larger quantity of drill pipes.

OCTG Market Segmentation: By Process

-

Seamless

-

Electric resistance welding

In 2022, based on the process, the Seamless segment accounted for the largest revenue share by almost 70% and has led the market. Seamless OCTG pipes are created by passing a steel billet through a die resulting in a pipe, with a wall thickness and no welds. This type of OCTG is known for its strength and durability making it suitable for applications like deepwater drilling and unconventional oil and gas production.

On the other hand electric resistance welding (ERW) OCTG is experiencing the fastest growth in the market. With a compound growth rate (CAGR) of over 4% during the projected period this process involves rolling a steel sheet into a cylindrical shape and welding the edges together. Although not as robust as OCTG ERW OCTG offers cost advantages due to its expensive manufacturing process. Typically it finds application in demanding scenarios such, as water drilling and onshore oil and gas production.

OCTG Market Segmentation: By Grade

-

API Grade

-

Premium Grade

In 2022, based on the grade, the API Grade segment accounted for the largest revenue share by almost 80% and has led the market. OCTG manufactured according to the standards set by the American Petroleum Institute (API) is known as API Grade OCTG. This type of OCTG is extensively utilized in applications such, as onshore drilling, offshore drilling, well completions, and well maintenance and repair. It is widely. Commonly used in the industry.

OCTG Market Segmentation: By Application

-

Onshore

-

Offshore

In 2022, based on the application, the Onshore segment accounted for the largest revenue share by almost 60% and has led the market Onshore drilling refers to the practice of extracting oil and gas from land. It is generally considered a costless complicated method compared to offshore drilling. On the other hand offshore drilling, which involves extracting oil and gas from the ocean is experiencing the fastest growth, in the OCTG market with an estimated compound annual growth rate of over 5% during the projected period. Offshore drilling tends to be more expensive and complex compared to onshore drilling. However due to depleting oil and gas reserves offshore drilling is gaining increasing significance, in meeting our energy needs.

OCTG Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, the North American region dominated the global OCTG market with a revenue of 40%. The North American OCTG market is experiencing growth due, to the rise in exploration and production activities in oil and gas fields. In terms of revenue Asia Pacific holds the position of being the OCTG market globally with a share of over 30% expected by 2023. This growth in the Asia Pacific OCTG market is primarily fueled by increased exploration and production activities in countries, like China, India, and Southeast Asia.

COVID-19 Impact Analysis on the Global OCTG Market:

The COVID-19 pandemic has had an impact, on aspects of the global economy including the OCTG market. OCTG plays a role in the oil and gas industry in the production of wells for oil and gas extraction. Due to the pandemic, there has been a decline in the number of active drilling rigs. Consequently, this reduction has led to decreased rates of oil and gas exploration and production activities resulting in a decline in demand for casting products. As a result, the global OCTG market faced challenges throughout 2020. In addition to reduced demand, there have been disruptions in the supply chain for OCTG caused by COVID-19. Furthermore, this health crisis has also resulted in a decrease in oil demand. As a consequence, an enormous surplus of stored oil has accumulated since producers have struggled to sell their products. This scenario led to prices with Brent crude dropping as low as US$15, per barrel in April 2020.

Despite the challenges brought about by the pandemic, there is optimism surrounding the future of the oil country goods (OCTG) market post-COVID. As we gradually recover from the pandemic there is a rise, in demand for OCTG. The oil industry is anticipated to experience a surge in exploration efforts leading to an increased need for OCTG. This is primarily due to its role in extracting oil and gas making it necessary for supporting the intensified exploration activities. Additionally, the long-term demand for OCTG will be driven by the growing need for energy. While renewable energy sources gain prominence globally oil and gas will continue to play a role, as an energy source thereby fuelling demand for OCTG to sustain exploration endeavors.

Latest Trends/ Developments:

The oil country tubular goods market is experiencing growth driven by the increase, in drilling activities. These goods are commonly used in drilling operations in conditions like deep water exploration and remote areas. The demand for energy resources is also contributing to market growth as these goods are widely adopted for exploring oil fields, which help generate various chemical products and fuel. Moreover, the market is being boosted by the use of hydraulic fracturing technology and horizontal drilling to access shale formations that hold deposits. Additionally, the market is benefiting from the increased utilization of pipes, which offer shape and can withstand high pressure without cracking. Furthermore, the industry's progress is expected to be propelled by heightened exploration and production activities along, with government initiatives aimed at boosting oil and gas discovery and extraction.

Key Players:

-

Nppon Steel & Sumitomo Metal Co.

-

Vallourec

-

Tenaris

-

National Oilwell Varco

-

TMK

-

Steel Tubular Products Inc

-

ILJIN STEEL CO

-

Continental Alloys

-

Anul Tanda Oil Pipe Company

-

OCTG Industry Developments

In December 2022 Vallourec received another order as part of the agreement they signed in 2021 with ExxonMobil Guyana. This time the order is, for delivering line pipes, for the ExxonMobil Guyanas Ularu project, which is located in deepwater.

In August 2022 the Abu Dhabi National Oil Organization received a five framework agreement USD 1.83 billion, for drilling and directional drilling services. This comprehensive project encompasses aspects such, as wellheads, downhole completion equipment, liner hangers, cementing services, wireline logging, and directional drilling. The primary objective of this agreement is to facilitate the drilling of wells and enhance the organization's production capabilities.

Chapter 1. OCTG Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. OCTG Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. OCTG Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. OCTG Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. OCTG Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. OCTG Market – By Product Type

6.1 Introduction/Key Findings

6.2 Casing

6.3 Drill Pipe

6.4 Tubing

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2023-2030

Chapter 7. OCTG Market – By Process

7.1 Introduction/Key Findings

7.2 Seamless

7.3 Electric resistance welding

7.4 Y-O-Y Growth trend Analysis By Process

7.5 Absolute $ Opportunity Analysis By Process, 2023-2030

Chapter 8. OCTG Market – By Grade

8.1 Introduction/Key Findings

8.2 API Grade

8.3 Premium Grade

8.4 Y-O-Y Growth trend Analysis By Grade

8.5 Absolute $ Opportunity Analysis By Grade, 2023-2030

Chapter 9. OCTG Market – By Application

9.1 Introduction/Key Findings

9.2 Onshore

9.3 Offshore

9.4 Y-O-Y Growth trend Analysis By Application

9.5 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 10. OCTG Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Application

10.1.3 By Grade

10.2 By Process

10.2.1 Countries & Segments - Market Attractiveness Analysis

10.3 Europe

10.3.1 By Country

10.3.1.1 U.K

10.3.1.2 Germany

10.3.1.3 France

10.3.1.4 Italy

10.3.1.5 Spain

10.3.1.6 Rest of Europe

10.3.2 By Product Type

10.3.3 By Process

10.3.4 By Grade

10.3.5 By Application

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 Asia Pacific

10.4.1 By Country

10.4.1.1 China

10.4.1.2 Japan

10.4.1.3 South Korea

10.4.1.4 India

10.4.1.5 Australia & New Zealand

10.4.1.6 Rest of Asia-Pacific

10.4.2 By Product Type

10.4.3 By Process

10.4.4 By Grade

10.4.5 By Application

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 South America

10.5.1 By Country

10.5.1.1 Brazil

10.5.1.2 Argentina

10.5.1.3 Colombia

10.5.1.4 Chile

10.5.1.5 Rest of South America

10.5.2 By Product Type

10.5.3 By Process

10.5.4 By Grade

10.5.5 By Application

10.5.6 Countries & Segments - Market Attractiveness Analysis

10.6 Middle East & Africa

10.6.1 By Country

10.6.1.1 United Arab Emirates (UAE)

10.6.1.2 Saudi Arabia

10.6.1.3 Qatar

10.6.1.4 Israel

10.6.1.5 South Africa

10.6.1.6 Nigeria

10.6.1.7 Kenya

10.6.1.8 Egypt

10.6.1.9 Rest of MEA

10.6.2 By Product Type

10.6.3 By Process

10.6.4 By Grade

10.6.5 By Application

10.6.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. OCTG Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Nppon Steel & Sumitomo Metal Co.

11.2 Vallourec

11.3 Tenaris

11.4 National Oilwell Varco

11.5 TMK

11.6 Steel Tubular Products Inc

11.7 ILJIN STEEL CO

11.8 Continental Alloys

11.9 Anul Tanda Oil Pipe Company

11.10 OCTG Industry Developments

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global OCTG Market was valued at USD 23.07 billion and is projected to reach a market size of USD 38.6 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.65%.

Expanding Drilling Activities Are Anticipated to Inflate the Market, Finding Conventional and Unconventional Reserves with Exponential Potential to Drive the Market.

Based on Grade, the Global OCTG Market is segmented into API Grade, and Premium Grade.

North America is the most dominant region for the Global OCTG Market.

Nippon Steel & Sumitomo Metal Co., Vallourec, Tenaris, National Oilwell Varco, and TMK are the key players operating in the Global OCTG Market.