OBD Scanner Market Size (2024 – 2030)

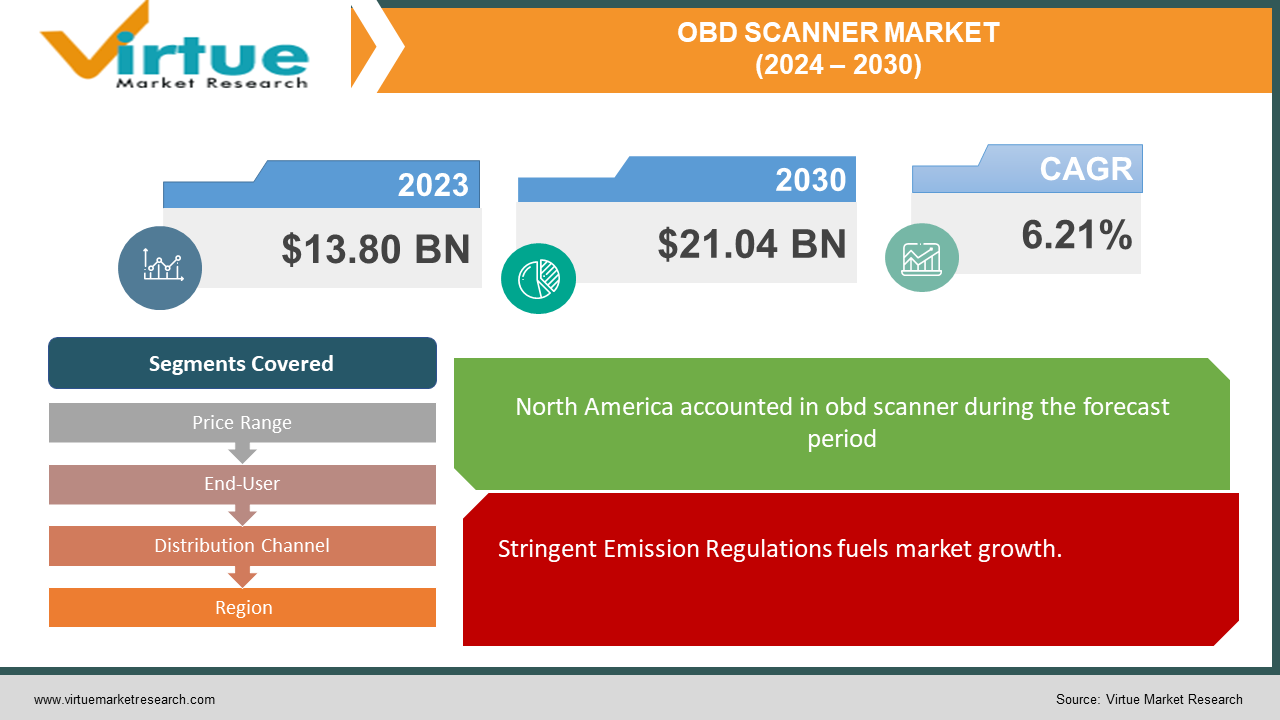

The Global OBD Scanner Market was valued at USD 13.80 billion in 2023 and is projected to reach a market size of USD 21.04 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.21%.

Onboard diagnostics (OBD) scanners are essential tools for vehicle diagnostics, giving users insight into the health and performance of their vehicles. These handheld devices plug into the car's OBD port (usually located under the dash) and communicate with the car's computer. OBD scanners are versatile; It's capable of retrieving fault codes, monitoring real-time data like engine RPM and fuel efficiency, and even advanced features like backup warning lights and test emissions.

Today's OBD scanners are available in many forms, from simple code readers to advanced diagnostic tools with Bluetooth or Wi-Fi connectivity, allowing users to pair them with a wired smartphone or tablet for enhanced functionality and data visualization. Additionally, some OBD scanners are compatible with special software for vehicle diagnosis and maintenance.

Key Market Insights:

North American region has the largest and had almost USD 6.0 billion of total market share in 2023 and is expected to show a CAGR of 9.34%. Technological advancements such as wireless connectivity, cloud-based diagnostics, and predictive maintenance capabilities are shaping the evolution of OBD scanners. Growing vehicle fleet globally, particularly in emerging economies, is driving the demand for maintenance and repair services, consequently boosting the market for OBD scanners. A shift towards online retail channels for OBD scanner distribution is observed, offering consumers convenience, wider product selection, and competitive pricing.

OBD Scanner Market Drivers:

Stringent Emission Regulations fuels market growth.

Increasingly stringent emission regulations worldwide are the key driver of the OBD scanner market. Governments around the world are implementing stricter emissions standards to reduce vehicle pollution and combat climate change. OBD scanners play an important role in ensuring compliance with these regulations by monitoring electronic components and detecting malfunctions that could lead to increased emissions. Due to stricter regulatory requirements, the demand for OBD scanners that can detect transmission-related problems continues, leading to market growth.

Rising Vehicle Complexity accelerates the market growth.

Today's cars are equipped with more electronic systems and equipment. As vehicle technology advances, it becomes more difficult to diagnose and resolve problems without specialized tools such as an OBD scanner. OBD scanners allow technicians to access the vehicle's onboard computer, retrieve diagnostic trouble codes (DTCs), and complete diagnostics quickly and accurately. Increasing competition from vehicles is increasing the demand for OBD scanners with the best features, accelerating the growth of the market.

Growing Vehicle Fleet will drive the OBD Scanner market forward.

The global automotive industry continues to expand, with a growing number of vehicles on the roads worldwide. As the vehicle fleet grows, so does the demand for maintenance and repair services. OBD scanners are an essential tool for mechanics and technicians, allowing them to effectively diagnose and fix problems. The increasing number of vehicles along with the need for timely maintenance and repair has increased the demand for OBD scanners, thus driving the growth of the market.

OBD Scanner Market Restraints and Challenges:

Compatibility Issues and Fragmented Market restrain the market growth.

The OBD scanner market is characterized by a variety of vehicle makes and models, each with its own diagnostic methods and communication standards. Maintaining compatibility with many different vehicles can be difficult for OBD scanner manufacturers, resulting in compatibility issues and interoperability challenges. In addition, the market is fragmented, with many vendors offering OBD scanners with different levels of functionality and compatibility. This fragmentation can confuse consumers and make it difficult for them to choose the right products, hindering business growth.

Data Privacy and Security Concerns prove to be a challenge in the OBD Scanner sector.

With the increasing connectivity of vehicles and OBD scanners, data privacy and security have become important issues. OBD scanners collect and transmit precise vehicle diagnostic data, including information about engine performance, driver behavior, and GPS location. Unauthorized access to this information can compromise user privacy and expose automotives to cybersecurity threats such as hacking and remote access. Addressing these privacy and security concerns is important to gain consumer trust and provide greater support for OBD scanners, but it also creates problems for manufacturers' products and policymakers.

High Initial Investment Costs hinder the market growth.

One of the biggest challenges facing the OBD scanner market is the initial investment cost associated with purchasing advanced diagnostic equipment. Good OBD scanners with features like wireless connectivity, cloud-based diagnostics, and predictive maintenance can be expensive, especially for smaller garages and car enthusiasts. The cost of acquiring and managing this complex equipment will present a barrier to entry for some entrepreneurs and limit business growth, especially in areas where many minor repairs are performed.

OBD Scanner Market Opportunities:

The global OBD scanner market offers various opportunities driven by various factors. First, increasingly stronger international laws require OBD scanners to be certified for vehicle diagnostics, creating a growing market for these solutions. Additionally, the complexity of today's automobiles equipped with advanced electronic systems increases the need for OBD scanners that can diagnose complex problems.

Additionally, the expanding vehicle aftermarket segment driven by increasing global traffic offers great opportunities for OBD scanner manufacturers and service providers. As vehicle ownership increases, the need for maintenance and repair services also increases, increasing the demand for diagnostic tools such as OBD scanners.

Additionally, technological advances such as wireless connectivity, cloud-based diagnostics, and predictive maintenance have the potential to open new avenues for innovation and diversification in the OBD scanner market. With continuous development and changing customer needs, the global OBD scanner market is expected to grow and expand, providing more opportunities for investors to invest.

OBD SCANNER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.21% |

|

Segments Covered |

By Price Range, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Actron, Autel Intelligent Technology , Launch Tech Co., Ltd., Innova Electronics Corporation (Equus Products Inc.), Ancel, FOXWELL, BlueDriver , Snap-on Incorporated, Bosch Automotive Service Solutions Inc., Delphi Technologies (BorgWarner) |

OBD Scanner Market Segmentation by Price Range

-

Budget-Friendly

-

Mid-Range

-

Premium

In 2023, based on the Price Range, the Mid-range holds the largest market share with over 50% of the market. Mid-range OBD scanners are in the middle in terms of price and features. They have more diagnostic capabilities than budget options, including real-time data monitoring, data freezing, and advanced diagnostics for multiple vehicles.

Furthermore, mid-range OBD scanners often provide good value for money, offering a combination of affordability and performance that appeals to a large segment of the market. They are versatile enough to meet the diagnostic requirements of various vehicle types and are widely used across different automotive repair shops, service centers, and garages.

OBD Scanner Market Segmentation by End-User

-

Automotive Repair Shops and Service Centers

-

Independent Mechanics and Technicians

-

Vehicle Owners and Enthusiasts

-

Others

In 2023, based on the End-User, Automotive Repair Shops, and Service Centers hold a significant portion of the market share and are expected to grow at a 7.78% CAGR during the forecast period. Automotive repair shops and service centers need OBD scanners with advanced diagnostic capabilities to diagnose complex problems across a wide range of vehicle makes and models. These scanners often come with features such as real-time data monitoring, data freezing, and advanced diagnostics for many vehicles.

Additionally, there is a consistent demand for OBD scanners in auto repair shops and service centers due to the demand for vehicle maintenance and repair. These establishments prioritize the reliability, accuracy, and efficiency of diagnostic tools, making them willing to invest in high-quality OBD scanners to enhance their operational capabilities and customer satisfaction.

OBD Scanner Market Segmentation by Distribution Channel

-

Online Retail

-

Brick-and-Mortar Stores

-

Automotive Parts Distributors

-

Direct Sales Channels

In 2023, based on the Distribution Channel, Online retail holds the largest market share with over 35% of the market. Online shopping has many advantages for consumers and sellers. Consumers benefit from the convenience of shopping from anywhere with an internet connection, the ability to easily compare products and prices, access to a variety of equipment, and often competitive prices. Additionally, online platforms often provide detailed information about products, customer reviews, and ratings, allowing customers to make informed purchasing decisions.

For sellers, online stores provide global reach, allowing them to target a broader audience than their local store. Additionally, online platforms provide great benefits in terms of marketing products, improving decision-making processes, and providing support to customers. Additionally, the development of e-commerce platforms and digital payments has made it easier to do business online and led to the development of online stores.

OBD Scanner Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023 based on Region, North America has the largest market share, with over 42% market share. North America, especially the United States and Canada, has very strict regulations that require trucks to undergo regular emissions tests and compliance inspections. OBD scanners are important tools in ensuring vehicles comply with these regulations and driving requirements in the region. North America has a large aftermarket auto repair industry, with many auto repair shops, service centers, and independent mechanics. These businesses rely on OBD scanners to diagnose and fix vehicle problems, resulting in high regional demand. In addition to being the center of technology development, North America is also the home region for leading OBD scanner manufacturers and developers. Advanced diagnostic technology and superior features in OBD scanners have made North America a major player in the global market.

The Asia-Pacific region, which includes countries such as China, Japan, India, and South Korea, is the fastest-growing market for OBD scanners. Major factors driving the growth of the market in this region include increasing vehicle production, increasing disposable income, and expanding vehicle aftermarket. Additionally, government initiatives to improve air quality and reduce vehicle emissions are encouraging the use of OBD scanners for monitoring and compliance.

While North America leads the Global OBD Scanner market, other regions such as Asia-Pacific and Europe are experiencing rapid growth and present huge opportunities for OBD Scanner market vendors.

COVID-19 Impact Analysis on the Global OBD Scanner Market:

The COVID-19 pandemic has had a significant impact on the global OBD scanner market, causing disruptions in supply chains, production, and consumer demand. Lockdowns and restrictions in the early stages of the pandemic caused a decline in car sales and after-sales services, resulting in reduced demand for OBD scanners. Auto repair shops and service centers are closing or reducing their operations, limiting their need for diagnostic equipment. However, as restrictions eased and the economy revived, the market gradually recovered, driven by demand for maintenance and repairs. Additionally, the pandemic has accelerated the use of advanced technology and remote solutions, resulting in a focus on OBD scanners with good features such as wireless connectivity and air testing. As the automotive industry continues to change towards new trends, the global OBD scanner market is expected to recover and evolve thanks to continuous technological advancements and customer preferences.

Latest Trends/ Developments:

Several new trends and developments in the global OBD scanner market are shaping the course of the market. A notable trend is the integration of advanced connectivity such as Bluetooth, Wi-Fi, and smartphone compatibility into OBD scanners. These features allow users to remotely access diagnostic information, receive real-time alerts, and perform diagnostic tests using a smartphone or tablet. There is also a focus on the development of OBD scanners that are compatible with and support electric and hybrid vehicles, reflecting the increasing adoption of alternative fuel vehicles worldwide. Additionally, there is a growing need for OBD scanners with predictive maintenance capabilities that use artificial intelligence and machine learning algorithms to predict and prevent emerging vehicle problems. As the automotive industry continues to evolve, these trends are driving innovation and shaping the future of the global OBD scanner market.

Key Players:

-

Actron

-

Autel Intelligent Technology

-

Launch Tech Co., Ltd.

-

Innova Electronics Corporation (Equus Products Inc.)

-

Ancel

-

FOXWELL

-

BlueDriver

-

Snap-on Incorporated

-

Bosch Automotive Service Solutions Inc.

-

Delphi Technologies (BorgWarner)

Chapter 1. OBD Scanner Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. OBD Scanner Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. OBD Scanner Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. OBD Scanner Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. OBD Scanner Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. OBD Scanner Market – By Price Range

6.1 Introduction/Key Findings

6.2 Budget-Friendly

6.3 Mid-Range

6.4 Premium

6.5 Y-O-Y Growth trend Analysis By Price Range

6.6 Absolute $ Opportunity Analysis By Price Range, 2024-2030

Chapter 7. OBD Scanner Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online Retail

7.3 Brick-and-Mortar Stores

7.4 Automotive Parts Distributors

7.5 Direct Sales Channels

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. OBD Scanner Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Automotive Repair Shops and Service Centers

8.3 Independent Mechanics and Technicians

8.4 Vehicle Owners and Enthusiasts

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End-Use Industry

8.7 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. OBD Scanner Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Price Range

9.1.3 By Distribution Channel

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Price Range

9.2.3 By Distribution Channel

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Price Range

9.3.3 By Distribution Channel

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Price Range

9.4.3 By Distribution Channel

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Price Range

9.5.3 By Distribution Channel

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. OBD Scanner Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Actron

10.2 Autel Intelligent Technology

10.3 Launch Tech Co., Ltd.

10.4 Innova Electronics Corporation (Equus Products Inc.)

10.5 Ancel

10.6 FOXWELL

10.7 BlueDriver

10.8 Snap-on Incorporated

10.9 Bosch Automotive Service Solutions Inc.

10.10 Delphi Technologies (BorgWarner)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global OBD Scanner Market was valued at USD 13.80 billion in 2023 and is projected to reach a market size of USD 21.04 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.21%.

The segments under the Global OBD Scanner Market by End-User are Automotive Repair Shops and Service Centers, Independent Mechanics and Technicians, Vehicle Owners and Enthusiasts, and Others.

North America region is the dominant in Global OBD Scanner Market.

Actron, Autel Intelligent Technology, Launch Tech Co., Ltd., Innova Electronics Corporation (Equus Products Inc.), Ancel, etc.

The COVID-19 pandemic has had a significant impact on the global OBD scanner market, causing disruptions in supply chains, production, and consumer demand. Lockdowns and restrictions in the early stages of the pandemic caused a decline in car sales and after-sales services, resulting in reduced demand for OBD scanners.