Global Nylon Membrane Filters Market Size (2023– 2030)

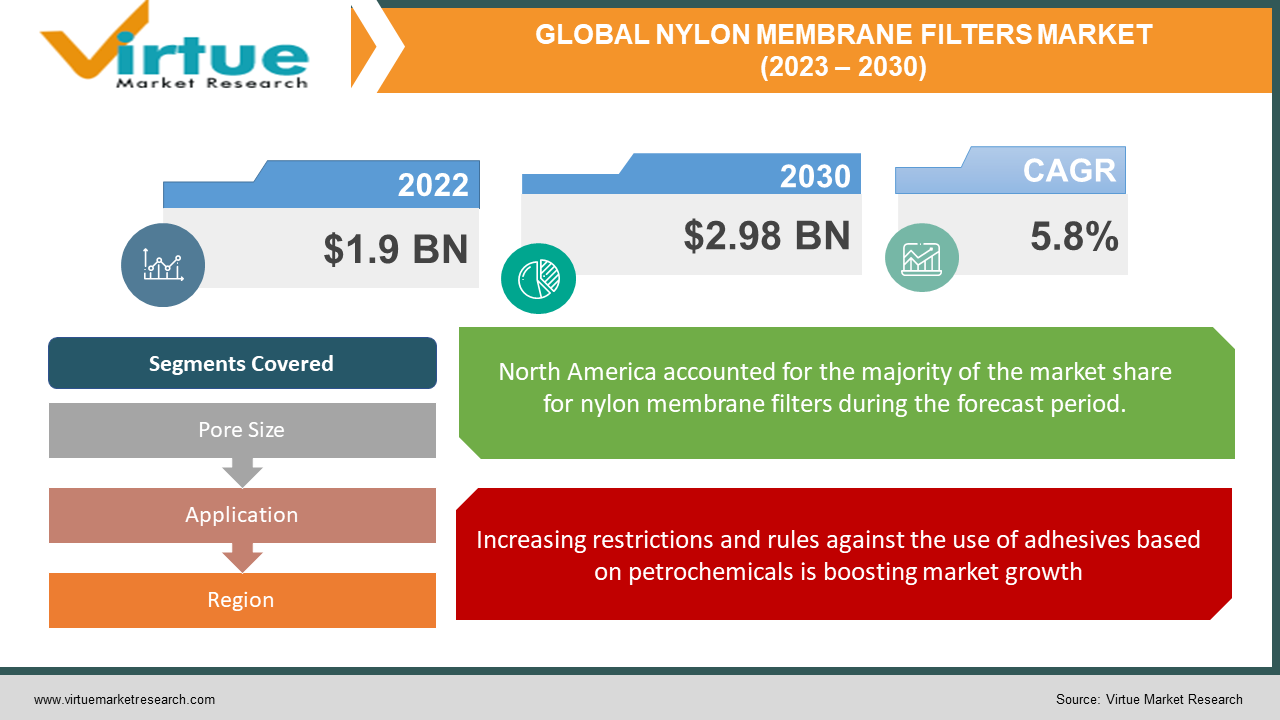

In 2022, the Global Nylon Membrane Filters Market was valued at $1.9 billion, and is projected to reach a market size of $2.98 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 5.8%.

Industry Overview:

A polyester web is infused with the nylon polymer to create Nylon Membrane Filters, which are exceptionally robust, heat-resistant membranes. As nylon membranes are hydrophilic, they do not require wetting agents that might be removed during the filtration of aqueous solutions. The membranes can be autoclaved at 135 oC and are resilient, flexible, and tear-resistant. Additionally, they are compatible with aqueous and alcoholic solvents and solutions. These filters can be used for vacuum degassing, clarifying, and filter sterilizing organic and aqueous solvent solutions, as well as for HPLC sample preparation. Membrane filtration uses membrane technology to separate particles and biomolecules from process fluids to concentrate them. The diameters of membrane filters are their most important characteristic since they make the filtration process easier in the healthcare industry. With such benefits of membrane filters, their use has grown over the past ten years. It is anticipated that the market for nylon membrane filters would expand as a result of developments in membrane filtering technology and increased research efforts in the pharmaceutical and biotechnology sectors. Membrane filtration is currently regarded as one of the most cutting-edge and modern techniques for purifying water and many commercial food and beverage items. Membrane filters provide a high rate of contaminant removal above conventional filters, as well as greater efficiency, simplicity of use, and dependability.

COVID-19 impact on Nylon Membrane Filters Market

The global restrictions imposed by several nations during the Covid-19 outbreak led to a significant decline in the membrane filtration market. The market for membrane filtration was impacted in terms of production, sales, and distribution by the different constraints relating to commercial activities, export, import, and other international activities. The restrictions that were imposed in 2020 had a significant impact on the membrane filtering market's expansion. The demand for the product comes from a variety of businesses, including the filtration, pharmaceutical, and medical sectors. The demand for the product was impacted by restrictions on numerous industries. Operations were also delayed because of a manpower shortage, which had an impact on logistics. On the other hand, online sales and marketing contributed to preserving the product's demand during the pandemic.

MARKET DRIVERS:

Nylon membrane filtration systems are likely to respond favorably to the growth of the bio-based pharmaceuticals sector

Aqueous solutions and the majority of mild organic solutions, particularly alkaline and alcoholic solutions, can be filtered using a membrane disc for solvents. Demand for medications and vaccines has increased as a result of expanding applications in the management of airborne infections. The demand for pharmaceutical membrane filters is expanding as a result of the widespread adoption of nanofiltration technology for the constant growth in the biopharmaceutical industry and quick advancements in generics production. Applications like filtering tissue culture medium, chemical and alcoholic solutions, particle analysis and vacuum degassing, removing microbes and organic solvent, filtering aqueous solution and organic mobile phase, sterilizing biological solutions or buffers, and tissue culture are boosting market demand.

The rise in the number of products launches is boosting the nylon membrane filters market

The membrane filtration market is being driven by low energy costs and an increase in the demand for industrial filtering for improved processing. It is an effective technique for cryopreserving heat-sensitive material and works well with several gases, including air. Instead of eliminating the corrupt microorganisms in the required liquid or gas, it serves as a fence and removes them. There have been more product launches in recent years as a result of the important corporations concentrating on the significant growth in the number of inventions to meet the demand.

MARKET RESTRAINTS:

The market expansion for nylon membrane filters is being hampered by the high operational costs and expenses.

Membrane systems have more expensive operational costs when compared to the traditional systems now being employed in the industry. Investments of a sizeable scale are needed to set up new production facilities for the manufacture of membrane filters. The required technical expertise and equipment are both expensive. Setting up membrane systems also requires expert manpower, which comes at extra expense to the vendors.

Risks of membrane fouling negatively affect the membrane filtration market by reducing filtration effectiveness

There is a possibility that chemicals will gather on the membrane's surface and inside its pores. The water or product that the membrane is being used on can become even more contaminated as a result. The effectiveness of membrane filtration will be impacted by this. Membrane fouling can ultimately cause the water or product to rot. Damage to the system or device in which the membrane filtration is installed can result from a change in the product's quality.

NYLON MEMBRANE FILTERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Pore Size, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sterlitech, Pall, Merck Millipore, Hawach, East Coast Filter, GVS, MDI, Simsii, Inc., Cytiva, and Microlab Scientific |

This research report on the Global Nylon Membrane Filters Market has been segmented based on pore size, application, and region.

Nylon Membrane Filters Market – By Pore Size

-

Below 0.45 µm

-

0.45 to 6 µm

-

Above 6 µm

Based on Pore Size, the Nylon Membrane Filters Market is segmented into Below 0.45 µm, 0.45 to 6 µm, and Above 6 µm. Given its hydrophilicity, nylon 66 membrane filters may filter aqueous solutions without needing to be pre-wetted with extractable solvents. The filter is capable of filtering particles, different solvents, liquid medications, and liquid clarity and sterilization in addition to removing bacteria and contaminants. For filtration of aqueous solutions as well as the majority of organic solutions, 0.22 µm, 0.45 µm nylon membrane filter 47mm is a popular choice over alternative membranes that are either unsuitable or challenging to use. Nylon 66 filter is most frequently used in the chemical sector and is suitable with both aqueous and alcoholic solutions.

Nylon Membrane Filters Market – By Application

-

Biopharmaceutical

-

Electronics

-

Food and Beverage

-

Research Institutes

-

Others

Based on Application, the Nylon Membrane Filters Market is segmented into Biopharmaceutical, Water and Wastewater Treatment, Food and Beverage, and Research Institutes. The majority of organic solvents and aqueous solutions can be filtered using high-quality nylon membranes. The membranes can be utilized in situations where other membranes are impractical or challenging to use since they are appropriate for use with a wide variety of biological preparations. They are designed to filter mobile phase solvents for HPLC analysis as well as water, aqueous solutions, and solvents to remove particles before use in analytical determination. It is employed in pressure filtration devices, particle removal from solvents, filtration of air, gases, or chemicals, and microbiological quality control. It is also used to filter biological, pharmaceutical, and environmental solutions.

The electronics sector can employ nylon filter membrane for the terminal filtering of ink as well as for the filtration of photoresists. The process of cross-flow filtering is mostly utilized in the food business. It is a filtration technique for murky liquids like wine, juice, and other things. Microfiltration is frequently employed in biotechnology applications to separate colloidal hydroxides or oxides or to separate water-oil emulsions. In the pharmaceutical sector, ultrafiltration is typically employed to separate proteins or for cold sterilization.

Nylon Membrane Filters Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

The Middle East, Latin America, and Africa

Geographically, the North American region is anticipated to dominate the global Nylon Membrane Filters Market during the forecast period. This is mainly attributed to technological developments in membrane filters, the presence of key biopharmaceutical manufacturing facilities in the area, new product launches, the rising R&D expenditure by the major players, as well as the well-established distribution channel that is spread across the nation.

Europe is also the dominant region for the nylon membrane filters market due to corporations' preference for sites for R&D, including Germany. As a result, research and development in European nations are accelerating, and manufacturers are increasingly focusing on the introduction of new products in the nylon membrane filtering industry.

The Asia Pacific region has the fastest-growing market for nylon membrane filtration as developing Asian nations are a hub for pharmaceutical research and development. China and India are the most lucrative destinations for manufacturing and R&D in the region owing to their low manufacturing costs. The region's membrane filtration industry is also being stimulated by a rise in governmental laws on wastewater treatment. The market for membrane filtration is expanding due to its application in the separation of emulsified oils in foods and beverages, as well as the expanding dairy and food industries. The market for membrane filtration is also being significantly driven by the rising demand for membrane filtration technologies in water treatment. Wastewater treatment is becoming more and more necessary in the region as a result of the region's population boom, which is happening quickly in nations like China and India. The total operational capacity of wastewater treatment plants in India, as updated in June 2021, is 26,869 megaliters per day, according to statistics from the National Informatics Centre of India. As per CWR (China Water Risk), China has set a goal to enhance the wastewater treatment scenario by installing a 125,900km pipe network and boosting the rate of wastewater treatment to 70% of homes in metropolitan areas.

Major Key Players in the Market

Companies like

-

Sterlitech

-

Pall

-

Merck Millipore

-

Hawach

-

East Coast Filter

-

GVS

-

MDI

-

Simsii Inc.,

-

Cytiva and Microlab Scientific

are playing a pivotal role in the Global Nylon Membrane Filters Market.

Notable happenings in the Global Nylon Membrane Filters Market in the recent past:

Expansion- In May 2022, Merck, a leading scientific and technology business, announced increasing its capacity to produce filters and membranes in Ireland. To boost the capacity for membrane production in Carrigtwohill and to construct a new manufacturing facility in Blarney Business Park, both in Cork, Ireland, the company will invest over €440 million.

Acquisition- In March 2021, Pall Corporation finalized a shareholding acquisition of Pall-Austar Lifesciences Limited, a joint venture founded by Pall and Austar. Through this transaction, manufacturing capacity will be increased, primarily to meet China's COVID-19-driven need for single-use technology supply chains.

Acquisition- In January 2020, GVS Filter Technology de Mexico, a Monterrey, Mexico-based subsidiary of GVS Group has acquired the syringe filter business of Graphic Controls Acquisition Corp. The transaction comprises products that are currently produced in Buffalo, New York, and sold under the DIAFIL brand. Manufacturing will be shifted to GVS Mexico's facility immediately following the agreement.

Chapter 1. Nylon Membrane Filters Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Nylon Membrane Filters Market – Executive Summary

2.1. Market Size & Forecast – (2023– 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Nylon Membrane Filters Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Nylon Membrane Filters Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Nylon Membrane Filters Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Nylon Membrane Filters Market – By Pore Size

6.1. Below 0.45 µm

6.2. 0.45 to 6 µm

6.3. Above 6 µm

Chapter 7. Nylon Membrane Filters Market – By Application

7.1. Biopharmaceutical

7.2. Electronics

7.3. Food and Beverage

7.4. Research Institutes

7.5. Others

Chapter 8. Nylon Membrane Filters Market - By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Nylon Membrane Filters Market – Key companies

9.1 Sterlitech

9.2 Pall

9.3 Merck Millipore

9.4 Hawach

9.5 East Coast Filter

9.6 GVS

9.7 MDI

9.8 Simsii Inc.,

9.9 Cytiva and Microlab Scientific

Download Sample

Choose License Type

2500

4250

5250

6900