Nylon-based Fire-Resistant Fabrics Market Size (2024 – 2030)

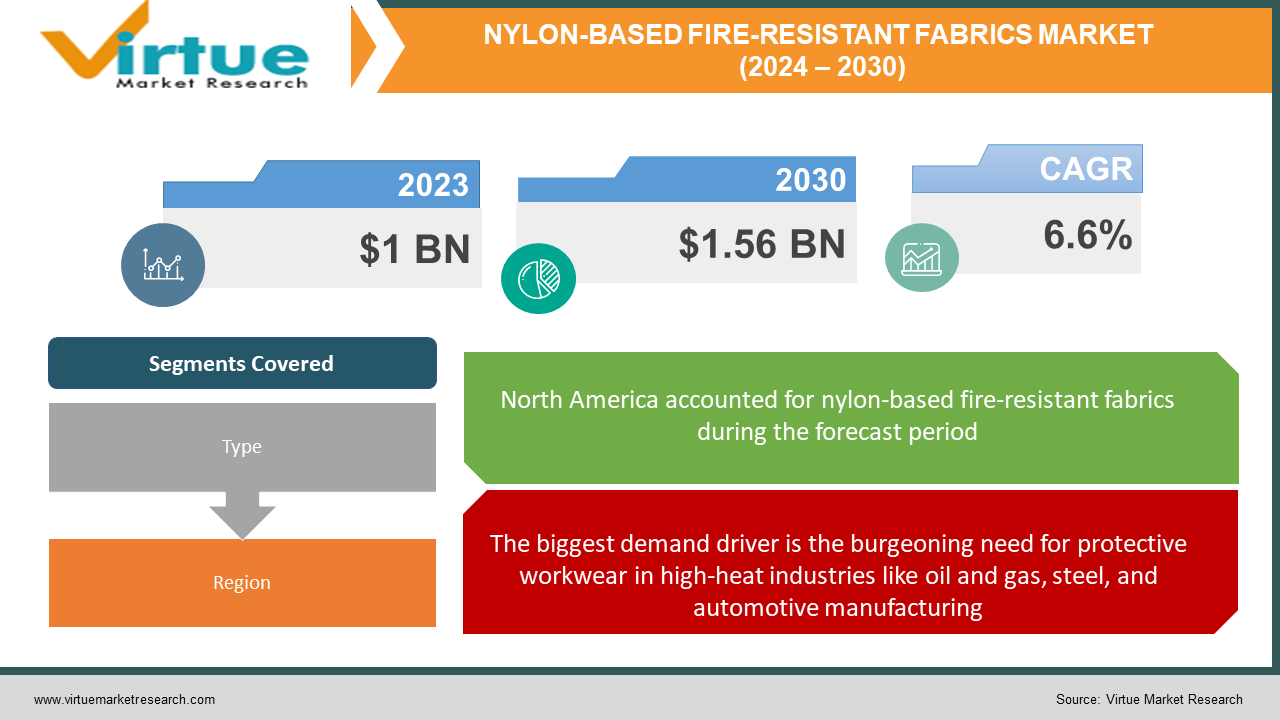

The nylon-based fire-resistant fabric market was valued at USD 1 billion in 2023 and is projected to reach a market size of USD 1.56 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.6%.

The realm of fire-resistant fabrics has been transformed by the advent of nylon. With its innate flame-retardant properties, nylon has become the fiber of choice for manufacturing specialized textiles designed to withstand high temperatures. The key to nylon's thermal resistance lies in its molecular structure. Strong hydrogen bonds between polymer chains in nylon fibers allow them to charge instead of melting when exposed to heat. This prevents the fabric from adhering to the skin and causing burns. Buoyed by increasing regulation and safety consciousness, demand for nylon-based fire-resistant fabrics has ignited in recent years. Myriad industries are fueling this growth, ranging from oil and gas to utilities to the military and beyond. Even home furnishings and bedding have become key application segments as fire safety takes priority. North America and Europe currently lead the market, but the Asia-Pacific region is catching up quickly. Countries like China and India are implementing more stringent safety standards, compelling industries to invest in fire-resistant gear. This is expanding the horizons for nylon fabric manufacturers. Innovations in nanotechnology and smart fabrics are also driving growth. Companies are developing moisture-wicking nylon fabrics blended with fibers like Kevlar. Integrating sensors and electronics creates intelligent fabrics that can detect heat or ignition.

Key Market Insights:

The foremost driver propelling the nylon-based fire-resistant fabric market is the paramount importance of safety across industries. With stringent government regulations mandating the use of flame-retardant apparel and gear in high-risk work environments, demand for specialty nylon fabrics continues to surge. The oil and gas industry is a prime consumer of fire-resistant fabrics made from nylon. Employees in drilling, refining, and petrochemical operations are exposed to flash fires and intense heat, necessitating reliable protective clothing. This creates a steady revenue stream for manufacturers. Rapid industrialization and massive infrastructure investments in the Asia-Pacific are creating lucrative growth opportunities. Countries like India, China, and Indonesia are investing heavily in safety upgrades across sectors. This is expected to boost the regional adoption of fire-resistant nylon fabrics. Manufacturers are innovating with fabric finishes and smart textiles to enhance comfort and eco-sustainability. Moisture-wicking nylon, sensor-integrated fabrics, and recyclable nylon are key R&D focus areas in the market. The reliance on petrochemical feedstocks makes nylon production vulnerable to oil price fluctuations. This creates margin pressure for manufacturers if input costs rise unexpectedly. Securing an economical and steady feedstock supply is a key imperative.

Nylon-based Fire-Resistant Fabrics Market Drivers:

The biggest demand driver is the burgeoning need for protective workwear in high-heat industries like oil and gas, steel, and automotive manufacturing.

Protecting industrial workers from burn injuries and heat exposure has become a top priority for employers globally. This is creating massive demand for protective workwear made using nylon-based fire-resistant fabrics. Industries like oil and gas, petrochemicals, electricity, mining, and automotive manufacturing involve flammable materials and intense heat exposure. A single errant spark or electrical flash can cause devastating fires and explosions. Ensuring worker safety in such potentially hazardous environments requires specialized flame-retardant apparel. That's where nylon plays a crucial role. With their high tensile strength and innate resistance to ignition, nylon fibers are tailored into fabrics that can withstand sparks, electric arcs, and flash fires. When exposed to extreme heat, nylon chars instead of melting or sticking to the skin. By using nylon workwear like coveralls, jackets, pants, and gloves, industrial workers get a reliable shield against burn injuries. The fabric self-extinguishes once the heat source is removed. This prevents the fire from spreading and minimizes damage. Standards set by OSHA, NFPA, and other bodies mandate the use of protective workwear in high-risk industries. As a result, oil and gas, mining, steel foundries, and similar sectors are investing heavily in procuring nylon-based fire-resistant gear for employees. The trend is fuelled further by workers demanding more comfortable protective wear. This has led to product innovations like breathable nylon blends integrated with meta-aramids like Nomex.

From aircraft and trains to buses, nylon fire-resistant fabrics are being extensively used in transportation upholstery and interior fabrics.

With passenger safety paramount, the transportation industry is emerging as a major growth avenue for nylon-based fire-resistant fabrics. Their low flammability makes them ideal for aircraft, trains, and automotive interiors to prevent fire risks. Specifically in aviation, factors like jet fuel volatility and the presence of electrical systems necessitate the use of specialized fire-resistant textiles. Commercial airlines use nylon fabrics extensively in seat upholstery, curtains, flooring, and wall liners. The FAA and other regulators mandate meeting flammability standards, driving adoption. The same holds for railways and mass transit systems. Subway trains, high-speed rail, and commuter buses rely on nylon fabrics to cover seats, interior walls, and floors. Poor flame retardancy can have catastrophic consequences in confined spaces. Hence, transportation agencies stipulate the use of fire-resistant nylon. In autos, nylon fabrics reduce risks from electrical shorts and fuel leakage. Seat covers and cabin liners made from high-tenacity nylon fibers prevent fire spread. As electric vehicles become ubiquitous, having flame-resistant interiors will become even more crucial. Nylon fabrics also make their way into transportation infrastructure. Airplane hangars, metro stations, and bus stands all utilize these fabrics in furnishings and interior design. Durability, easy maintainability, and cost-effectiveness further bolster nylon's appeal. With increasing air and rail travel globally, OEMs are innovating with eco-friendly nylon blends and smart fabrics for transportation applications. This presents sustained growth opportunities for manufacturers catering to this safety-centric sector.

Nylon-based Fire-Resistant Fabrics Market Restraints and Challenges:

As nylon is synthesized from petrochemical precursors, its production costs are vulnerable to crude oil price fluctuations. Spikes in the costs of raw materials like adipic acid create margin pressures for manufacturers.

The manufacturing of nylon fabrics is heavily dependent on petrochemical feedstocks like benzene and adipic acid. This exposes producers to significant cost volatility driven by fluctuations in crude oil prices. Nylon polymerization requires benzene, which is derived from petroleum refining. Adipic acid, made from cyclohexane, is also needed to synthesize nylon 6. As these feedstocks are linked to oil prices, any spikes or supply constraints directly impact production costs. For instance, when crude prices shot up due to geopolitical factors in 2022, adipic acid and benzene prices also escalated. This created a challenging situation for nylon manufacturers as their key raw material costs increased steeply. Such volatility squeezes profit margins and affects the supply stability of nylon-based fire-resistant fabrics. Manufacturers then have to weigh options like passing on the higher costs to customers or absorbing a part of them to stay competitive. The issue is more pronounced for smaller producers who lack the financial heft or purchasing power of large petrochemical companies. They cannot hedge against feedstock price risks as effectively. Alliances with feedstock suppliers to secure economical, long-term contracts are crucial. Companies are also exploring alternate precursors from bio-based sources instead of oil refining byproducts.

With sustainability becoming imperative, the non-biodegradable nature of nylon poses environmental issues. New technologies are needed to improve recycling and ensure responsible disposal.

While nylon is prized for its durability and protective traits, its resistance to decomposition poses sustainability challenges for disposal and recycling. Being a synthetic polymer, nylon does not biodegrade easily when discarded after use. It remains in landfills for decades without breaking down naturally. This contributes to plastic pollution and ecological damage. Recyclability is also an issue. Compared to materials like PET, nylon is more difficult to repeatedly recycle into either fibers or other products. Complex separation is needed when nylon is blended with other fibers like polyester or wool. These factors are at odds with the growing global imperative of reducing plastic waste, curbing emissions, and promoting circular economies. Governments are also enacting stricter regulations regarding safe material disposal. Nylon producers are responding through initiatives like using more recycled content in manufacturing and developing innovative recycling technologies. For instance, Aquafil utilizes Econyl's patented technology to recycle nylon from fishing nets and carpets into fabrics. More R&D is focused on increasing the biodegradability of nylon via composites and polymer modifications. Biomimicry models that mimic natural material decomposition are also being explored.

Nylon-based Fire-Resistant Fabrics Market Opportunities:

Developing nations in Asia, Latin America, and the Middle East are investing heavily in industrial safety upgrades and infrastructure. This presents immense potential to provide fire-resistant nylon fabrics for construction, oil and gas, transportation, and manufacturing sectors. Advancements in wearable technology and smart fabrics provide opportunities to develop nylon-based fabrics integrated with sensors, electronics, and temperature-regulating coatings. These would offer enhanced safety, performance tracking, and comfort. Increasing awareness and stringent safety norms are driving the adoption of fire-resistant nylon fabrics for residential and commercial furnishings and mattresses. Manufacturers can cater to this demand through consumer-friendly designs. Blending nylon with fibers like Kevlar, PBI, and wool creates fabrics that combine strength, heat resistance, comfort, and improved sustainability. This offers new product development and differentiation potential. Sustainability-focused innovations in manufacturing like using recycled nylon, bio-based coatings, and greener chemistry processes allow tapping into the growing demand for eco-friendly fire-resistant fabrics. Unlike other elements, such as aramid fibers, nylon boasts an exceptional strength-to-weight ratio. This translates to fire-resistant garments that are not only protective but also lightweight and comfortable for extended wear. This is particularly valuable for firefighters, industrial workers, and military personnel who require mobility and dexterity in high-risk environments. Compared to high-performance alternatives like PBI, nylon offers a more cost-effective solution. This affordability opens doors for wider adoption across various industries, making fire safety more accessible and democratizing protection. This affordability, coupled with its inherent properties, makes nylon a strong contender for budget-conscious applications like welding blankets and industrial curtains. The fire-resistant fabric market is increasingly focusing on eco-friendly solutions. Nylon offers potential here due to its recyclability and lower water footprint compared to certain alternatives. Manufacturers are exploring the use of recycled nylon to create sustainable fire-resistant garments, aligning with the growing demand for environmentally conscious products. Fire-resistant fabrics are no longer limited to utilitarian applications. Fashion brands are starting to incorporate them into clothing lines, catering to a growing demand for stylish and protective apparel for activities like motorcycle riding or outdoor adventures. This opens a vast new market segment for nylon-based fire-resistant fabrics, blending safety with aesthetics.

NYLON-BASED FIRE-RESISTANT FABRICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.6% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DuPont de Nemours & Co., Teijin Limited Honeywell International, Inc., Royal TenCate N.V., PBI Performance Products, Inc, Kaneka Corporation, Hyosung Corporation, Fibertex Nonwovens |

Nylon-based Fire-Resistant Fabrics Market Segmentation: By Type

-

Nylon 66

-

Meta-Aramid

-

Para-Aramid

Nylon 66 currently holds the largest share of the market, estimated at around 60–65%. Nylon 66 is inherently cheaper than other fire-resistant fibers like meta-aramid and para-aramid, making it suitable for budget-conscious applications. It readily accepts various flame-retardant treatments, offering diverse levels of fire resistance for various applications. With a well-established production infrastructure, Nylon 66 readily meets the high demand for affordable fire-resistant fabrics. Meta-aramid holds a share of around 20–25% and is the fastest-growing type. Meta-aramid offers superior fire resistance and strength compared to Nylon 66 but comes at a higher cost. Its application is primarily in high-performance, safety-critical scenarios like firefighter apparel and industrial settings. Para-aramid, representing the smallest share of 10–15%, boasts the highest heat resistance and strength among nylon-based options. However, its significantly higher cost limits its usage to specialized applications like racing suits and aerospace interiors.

Nylon-based Fire-Resistant Fabrics Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America currently holds the largest share of the nylon-based fire-resistant fabric market. North America has extensive and well-enforced safety regulations across various industries, mandating fire-resistant clothing and materials in specific settings. The region boasts a mature and diverse industrial sector, requiring fire-resistant fabrics for worker safety and equipment protection. Consumers in North America are generally willing to invest in safety-related products, creating a robust market for fire-resistant textiles. Europe holds a share of around 30%, and Europe follows closely behind North America. Similar factors contribute to its strong presence, including stringent regulations, a developed industrial base, and safety-conscious consumers. The Asia-Pacific region represents the fastest-growing segment, with an estimated share of 20% and projected growth significantly outpacing other regions. Rising industrialization and infrastructure development in countries like China and India lead to increased demand for fire-resistant fabrics. Heightened awareness of workplace safety and fire hazards fuels the demand for protective apparel and fire-resistant materials. With rising living standards, consumers in Asia and the Pacific are becoming more receptive to safety-related products. South America, the Middle East, and Africa hold a smaller share of around 10% but offer growth potential.

COVID-19 Impact Analysis on the Nylon-based Fire-Resistant Fabrics Market.

The COVID-19 pandemic caused major disruptions for nylon fire-resistant fabric manufacturers due to lockdowns, logistical issues, and weakened demand. However, the long-term outlook remains positive. Supply chain disruptions stemming from restrictions on manufacturing and transportation capacity affected production activity. This was compounded by labor shortages and raw material delays. Many facilities had to operate at reduced capacity. Demand contracted significantly in key end-user segments like oil and gas, automotive, infrastructure, and construction, which saw activity slump during pandemic lockdowns. The decline in discretionary spending also impacted the furnishing and apparel segments. However, sectors like medical, military, and emergency services sustained demand for specialized protective gear made from fire-resistant nylon. The increased production of masks and medical supplies during the pandemic utilized these fabrics. The severity of the impact differed across regions. China and Asia witnessed a V-shaped recovery. Europe and North American demand took longer to recover to pre-pandemic levels. The travel restrictions also affected export revenues and profitability. In response, most manufacturers focused on logistics agility, safety protocols for workers, securing supplies of key raw materials, and aligning inventories to demand. Many accelerated investments in digitalization. Post-pandemic, as economic activity recovered globally, demand patterns also normalized. Investments in infrastructure projects, energy transitions, and ESG initiatives are expected to revive demand growth in fire-resistant nylon fabrics across all major regions.

Latest Trends/ Developments:

Due to environmental concerns, manufacturers are increasingly adopting recyclable, biodegradable, and eco-friendly variants of nylon. The use of recycled ocean plastics, bio-derived coatings, and green chemistry principles for production is rising. New moisture-wicking finishes and hydrophobic coatings are being applied to nylon fire-resistant fabrics. These draw sweat away from the skin, providing more comfort to workers wearing protective gear in hot environments. Integration of sensors, data analytics, and wearable technology into nylon fabrics enables real-time monitoring and transmission of data like gas leaks, equipment issues, or worker health. This enhances workplace safety and efficiency. Fabrics derived from high-performance polymers like Vectran, PBI, Basofil, and Zylon are gaining traction over chemically treated nylon. Though more expensive, these provide durable and consistent flame resistance. Reinforcing engineering plastics, building panels, and structural composites with fire-resistant nylon fabrics is increasing. This imparts strength while meeting strict fire safety codes for infrastructure and transportation. Manufacturers are using soft Nordic nylon blends and modacrylic fleece backs to improve comfort in protective workwear. Vibrant colors and prints are being introduced to expand into casual apparel.

Key Players:

-

DuPont de Nemours & Co.

-

Teijin Limited

-

Honeywell International, Inc.

-

Royal TenCate N.V.

-

PBI Performance Products, Inc.

-

Kaneka Corporation

-

Hyosung Corporation

-

Fibertex Nonwovens

Chapter 1. NYLON-BASED FIRE-RESISTANT FABRICS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. NYLON-BASED FIRE-RESISTANT FABRICS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. NYLON-BASED FIRE-RESISTANT FABRICS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. NYLON-BASED FIRE-RESISTANT FABRICS MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. NYLON-BASED FIRE-RESISTANT FABRICS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. NYLON-BASED FIRE-RESISTANT FABRICS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Nylon 66

6.3 Meta-Aramid

6.4 Para-Aramid

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. NYLON-BASED FIRE-RESISTANT FABRICS MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Type

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Type

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Type

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Type

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Type

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. NYLON-BASED FIRE-RESISTANT FABRICS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 DuPont de Nemours & Co.

8.2 Teijin Limited

8.3 Honeywell International, Inc.

8.4 Royal TenCate N.V.

8.5 PBI Performance Products, Inc.

8.6 Kaneka Corporation

8.7 Hyosung Corporation

8.8 Fibertex Nonwovens

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Demand for protective workwear in high-heat industries like oil & gas, steel, and automotive manufacturing and extensive use in transportation upholstery and interior fabrics are the main key factors in this market.

Associated costs and environmental issues are the main concerns that are currently being experienced by the market.

DuPont, TenCate, Milliken & Company, Lenzing AG, PBI Performance Products Inc., Kaneka Corporation, and Hyosung Corporation are the major players.

North America currently holds the largest market share.

Asia-Pacific exhibits the fastest growth, driven by its increasing population and expanding economy.