Nylon 66 Fiber Market Size (2023 - 2030)

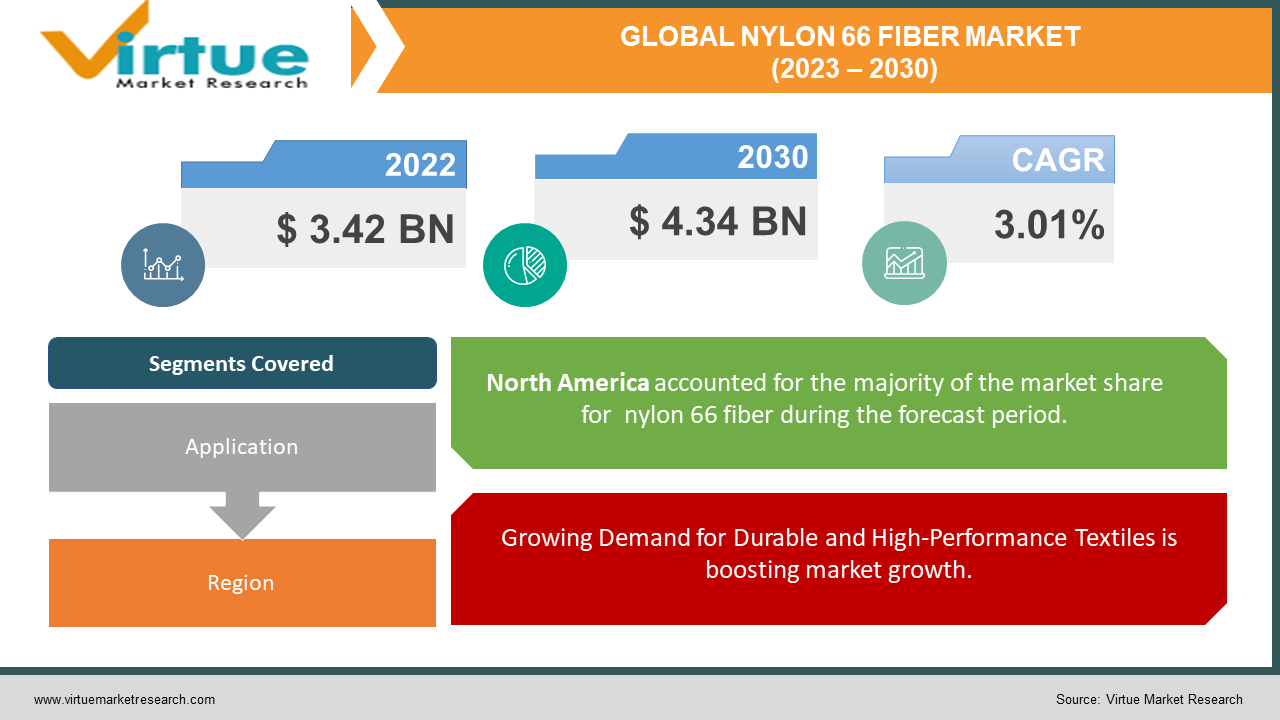

The global Nylon 66 Fiber Market is estimated to be worth USD 3.42 Billion in 2022 and is projected to reach a value of USD 4.34 Billion by 2030, growing at a CAGR of 3.01% during the forecast period 2023-2030.

A type of synthetic fiber in the nylon family, polyamide 66 fiber is often known as nylon 66 fiber. Polyhexamethylene adipamide is a chemical compound made of hexamethylenediamine and adipic acid. The excellent strength, resilience, and abrasion resistance of nylon 66 fiber are well known. Its high melting point and tolerance for high temperatures make it appropriate for a variety of applications. Oils and solvents are just a couple of the myriad things that the fiber is resistant to. Because of its enticing qualities, nylon 66 fiber is commonly used to make textiles, consisting of clothing, sporting goods, and industrial items. It's used to make a variety of products, such as tire cables, ropes, carpets, upholstered furniture, and industrial filters. Due to its strength and hardness, it is particularly suited for applications that require high-performance materials. The textile industry prefers nylon 66 fiber because it is straightforward to dye and effectively keeps color. It is recognized for its extraordinary elasticity and dimensional stability, which enable it to maintain its shape when stretched and crushed. The nylon 66 fiber market is arising quickly as a result of the material's outstanding properties and wide range of industrial applications. The market for nylon 66 fibers is anticipated to escalate further as a result of developing economies, technical improvements, and environmental concerns in the garment, automotive, industrial, and consumer goods sectors. Manufacturers of nylon 66 fibers are aggressively funding research and development to keep up with shifting consumer demands and raise the fiber’s sustainability ratings.

Global Nylon 66 Fiber Market Drivers:

Growing Demand for Durable and High-Performance Textiles is boosting market growth.

One of the main drivers propelling the global nylon 66 fiber market is the growing need for durable, high-performance textiles. Nylon 66 fibers are ideal for a range of applications where durability is important because of their great strength, toughness, and abrasion resistance. The demand for these materials is influenced by a variety of factors. The demand for clothing that is made to perform has increased due to several factors, including the growing popularity of active lifestyles and athleisure wear. Nylon 66 fibers are commonly used to create fitness, sportswear, and outdoor clothing because of their great elasticity, moisture-wicking properties, and durability. The demand for comfy, enduring clothes that can resist demanding physical activity is driving the market for nylon 66 fibers. Second, sectors including automotive, aerospace, and industrial manufacturing are seeing an increase in demand for robust textiles. These industries need materials that can survive intense temperatures, regular use, and hostile environments. These characteristics are satisfied by nylon 66 fibers because of their good dimensional stability, high strength-to-weight ratio, and resistance to abrasion and chemicals. The need for nylon 66 fibers as a dependable and long-lasting textile material is anticipated to rise as these sectors continue to expand.

Technological Advancements in Fiber Production are contributing to the market growth.

Technological advancements in the processes used to make fiber are a significant driver of the worldwide nylon 66 fiber market. As a result of ongoing research and development efforts that have improved manufacturing processes, nylon 66 fibers' quality, performance, and affordability have improved. The development of advanced polymerization processes is a great technological advance. Conventional nylon 66 production processes used batch techniques, which took a long period and resulted in uneven product quality. Continuous polymerization techniques, such as melt-phase and solid-phase polymerization, have been developed to work around these limitations. These processes improve the molecular weight distribution control and manufacturing efficiency of nylon 66 fiber. As a result, there has been an increase in product consistency, a drop in manufacturing costs, and raised production capabilities. Additionally, improvements in spinning and extrusion technology have made it possible to produce nylon 66 fibers that are finer and more homogeneous. The range of uses for nylon 66 fibers has increased as a result, particularly in fields that call for finer yarns or fabrics with improved aesthetic appeal. Unique features, such as antibacterial or flame-retardant properties, have been developed for specialty nylon 66 fibers thanks to cutting-edge spinning techniques including bi-component spinning and microfiber spinning. New opportunities have arisen as a result of these developments in industries like healthcare, technology, and protective gear.

Global Nylon 66 Fiber Market Challenges:

The requirement for sustainable textile production and the escalating environmental concerns they raise are two of the biggest obstacles facing the worldwide nylon 66 fiber market. The majority of nylon 66 fibers are made from non-renewable resources like fossil fuels, and the techniques used to make them are energy-intensive. The sector is under pressure to lessen its impact on the environment, including greenhouse gas emissions, water use, and waste production. Nylon 66 fiber disposal after its useful life also presents issues for recycling and reducing the environmental effect. It will take a lot of research, development, and adoption of eco-friendly production processes and recycling techniques to meet the rising demand for nylon 66 fibers while resolving these sustainability issues.

Global Nylon 66 Fiber Market Opportunities:

Growing consumer demand for eco-friendly and recyclable textiles represents one significant business potential in the worldwide nylon 66 fiber market. There is a rising market for environmentally acceptable replacements for conventional synthetic fibers as sustainability assumes greater importance within the textile industry. By investing in research and development to enhance their sustainability profile, including the use of renewable raw resources and the creation of effective recycling techniques, nylon 66 fibers have the potential to take advantage of this opportunity. For makers of nylon 66 fiber, meeting the need for recyclable and sustainable textiles represents a sizable growth opportunity.

COVID-19 Impact on Global Nylon 66 Fiber Market:

The worldwide nylon 66 fiber market saw some favorable effects related to the COVID-19 epidemic. The requirement for nylon 66 fibers used to make face masks, gowns, and other medical textiles increased along with the need for personal protective equipment (PPE). The market for nylon 66 fiber benefited from the increased emphasis on hygiene and safety precautions, which increased demand for strong, high-performance textiles. The global nylon 66 fiber market was negatively impacted by the epidemic as well. The demand for nylon 66 fibers decreased as a result of disruptions in global supply chains, lockdown measures, and lower consumer expenditure, which had a detrimental impact on the textile and apparel sector. Temporary closures or reduced production at manufacturing facilities affect the expansion of the market as a whole. The market was further impacted by travel and trade restrictions that made it difficult to distribute and export nylon 66 fibers.

Global Nylon 66 Fiber Market Recent Developments:

In May 2022, NYLEO®, the new brand for DOMO Chemical's cutting-edge performance fibers product range, has been revealed. The brand, which has a strong emphasis on innovation, combines three ground-breaking items with DOMO's knowledge of the nylon 66-based fiber market. Improved biodegradability is provided by NYLEO® 4EARTH®, greater flame retardancy is provided by NYLEO® PROTECT, and bacteriostatic characteristics are provided by NYLEO® SAFE. A major step forward in DOMO's mission to offer environmentally friendly solutions across numerous industries has been achieved with this launch.

NYLON 66 FIBER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.01% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

UBE INDUSTRIES Ltd., BASF SE, Ascend Performance Materials, Ensinger, LANXESS, Radici Partecipazioni SpA, Asahi Kasei Corporation, DSM, Dow, DuPont, CELANESE CORPORATION |

Global Nylon 66 Fiber Market Segmentation: By Application

-

Hosiery

-

Weaving and Warp Knitting

-

Tires and Conveyor Belts

-

Coated Fabrics

-

Carpeting

-

Furnishings/Floor Coverings

Hosiery, weaving and warp knitting, tires and conveyor belts, coated fabrics, carpeting, and furnishings/floor coverings can be classified as applications in the worldwide nylon 66 fiber market. Hosiery is a prominent application category in terms of industry insights and market share, driven by the desire for cozy and long-lasting socks, stockings, and tights. Utilizing nylon 66 fibers for the creation of fabrics used in garments, home textiles, and technical textiles, weaving, and warp knitting is common textile industry uses. Nylon 66 fibers are used in tires and conveyor belts for the automotive industry, which benefits from their high strength and abrasion resistance. Nylon 66 fibers are used in coated fabrics like laminates and industrial fabrics because of their ability to resist water and abrasion. Due to their durability and stain resistance, nylon 66 fibers are used in carpeting applications, whereas furnishings/floor coverings include a variety of uses such as upholstery, rugs, and mats. Overall, even though their market shares may differ, these use all help to drive up the demand for nylon 66 fibers on a global scale.

Global Nylon 66 Fiber Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America contributes significantly to worldwide sales due to the presence of significant manufacturers and a robust textile industry. Europe is a key region in the nylon 66 fiber market, with a focus on sustainability and the adoption of eco-friendly textiles. Asia Pacific, which comprises countries like China, India, and Japan, accounts for a sizable chunk of the industry. This is a result of the booming textile industry in the area and arising consumer buying power. The market for nylon 66 fiber is steadily expanding in South America, the Middle East, and Africa, mostly as a result of the development of new infrastructure and the growth of the industrial sector. Despite regional differences in market share, the demand for nylon 66 fibers is still strong globally because of a variety of industries like textile, automotive, and industrial applications.

Global Nylon 66 Fiber Market Key Players:

-

UBE INDUSTRIES Ltd.

-

BASF SE

-

Ascend Performance Materials

-

Ensinger

-

LANXESS

-

Radici Partecipazioni SpA

-

Asahi Kasei Corporation

-

DSM

-

Dow

-

DuPont

-

CELANESE CORPORATION

Chapter 1. Nylon 66 Fiber Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Nylon 66 Fiber Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Nylon 66 Fiber Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Nylon 66 Fiber Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Nylon 66 Fiber Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Nylon 66 Fiber Market - By Application

6.1 Hosiery

6.2 Weaving and Warp Knitting

6.3 Tires and Conveyor Belts

6.4 Coated Fabrics

6.5 Carpeting

6.6 Furnishings/Floor Coverings

Chapter 7. Nylon 66 Fiber Market - By Region

7.1 North America

7.2 Europe

7.3 Asia-Pacific

7.4 Rest of the World

Chapter 8. Nylon 66 Fiber Market - Key Players

8.1 UBE INDUSTRIES Ltd.

8.2 BASF SE

8.3 Ascend Performance Materials

8.4 Ensinger

8.5 LANXESS

8.6 Radici Partecipazioni SpA

8.7 Asahi Kasei Corporation

8.8 DSM

8.9 Dow

8.10 DuPont

8.11 CELANESE CORPORATION

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Nylon 66 Fiber Market was esteemed at USD 3.42 Billion in 2022 and is projected to a value of USD 4.34 Billion by 2030, growing at a fast CAGR of 3.01% during the forecast period 2023-2030.

The Global Nylon 66 Fiber Market is driven by the Increasing Demand for Hosiery Applications.

The Segments under the Global Nylon 66 Fiber Market by the Application are Hosiery, Weaving, Warp Knitting, Tires, and Conveyor Belts.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Nylon 66 Fiber Market.

UBE INDUSTRIES Ltd., BASF SE, and Ascend Performance Materials are the three major leading players in the Global Nylon 66 Fiber Market.