Nuts Hulling Equipment Market Size (2024 – 2030)

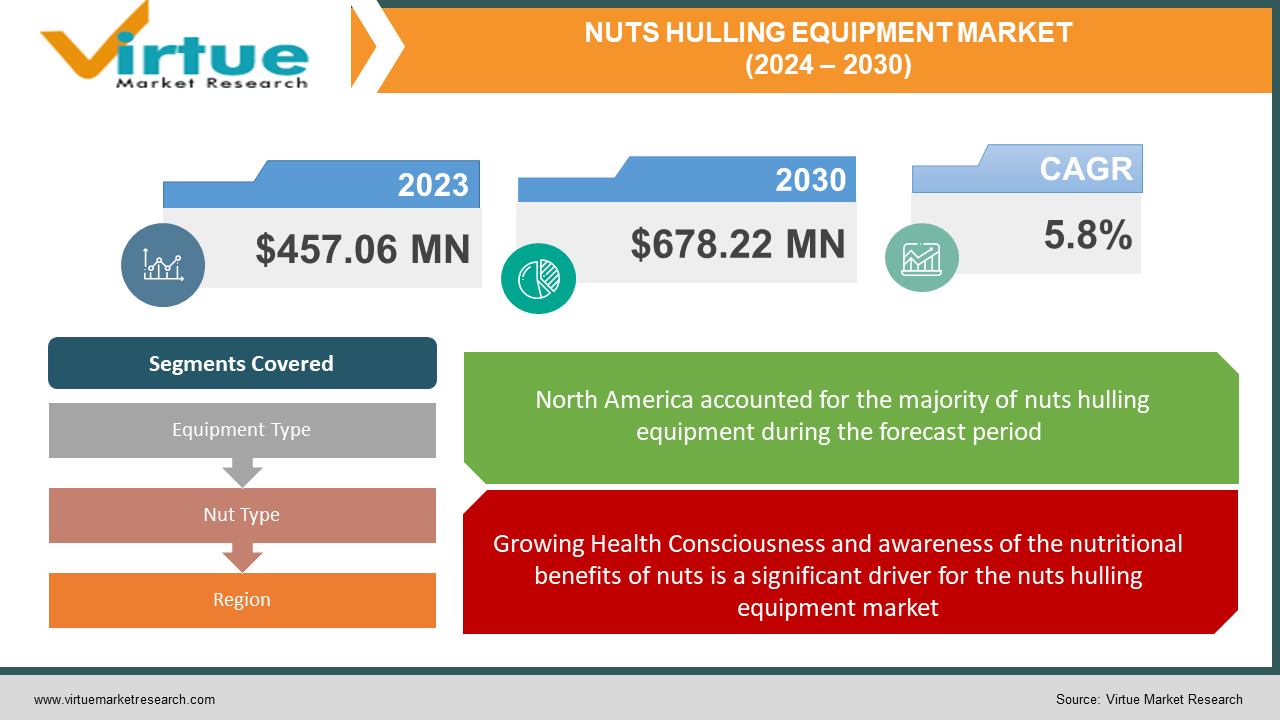

The Global Nuts Hulling Equipment Market valued at USD 457.06 Million and is projected to reach a market size of USD 678.22 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

Nuts hulling equipment has assumed a pivotal role in the nuts processing sector, offering efficient and precise hulling solutions. Over time, this market has evolved significantly, driven by the surging demand for nuts and nut-based products. Today, it stands as a thriving industry, witnessing steady growth and innovation. Key trends such as automation, enhanced precision, and sustainability are reshaping the landscape. Challenges related to scalability and adapting to changing consumer preferences persist. However, opportunities abound as consumers increasingly embrace health-conscious choices and diverse nut varieties. The nuts hulling equipment market is poised for continued expansion, with a promising future characterized by sustained growth and evolving technology.

Key Market Insights:

Regionally, North America and Europe have emerged as prominent players in the nuts hulling market. The United States, in particular, holds a significant share of the market, owing to its extensive nut production and consumption. Moreover, Asia-Pacific is witnessing substantial growth, with countries like China and India becoming major consumers of nuts and related products. This surge in demand has prompted manufacturers to invest in advanced hulling equipment to streamline production processes and meet consumer expectations.

Furthermore, technological advancements are reshaping the nuts hulling industry. Automation and artificial intelligence-driven solutions are enhancing precision and efficiency in hulling operations. Sustainable practices are also gaining prominence, with the industry focusing on reducing waste and energy consumption. As the market continues to evolve, innovative solutions and strategic collaborations are likely to drive further growth, making the nuts hulling market an exciting sector to watch in the coming years.

Market Drivers:

Growing Health Consciousness and awareness of the nutritional benefits of nuts is a significant driver for the nuts hulling equipment market.

The increasing emphasis on health and nutrition is a major driver of the nuts hulling equipment market. Nuts are widely recognized as a nutritious snack, rich in essential nutrients and health-promoting compounds. Consumers are becoming increasingly health-conscious and are incorporating nuts into their diets due to their potential benefits such as heart health, weight management, and reduced risk of chronic diseases. This rising awareness of the nutritional value of nuts creates a growing demand for efficiently hulled nuts, which can be processed into various products, from nut butter to snack bars, aligning perfectly with the nuts hulling equipment market's growth trajectory.

Expansion of Nut-Based Products is necessitating efficient nuts hulling equipment to meet production demands.

The expansion of nut-based product offerings, driven by changing consumer preferences and dietary trends, is propelling the demand for efficient nuts hulling equipment. Nuts are versatile ingredients used in a wide range of food products, including dairy alternatives, confectionery, and bakery items. As the popularity of these products continues to surge, manufacturers are ramping up production to meet consumer demands. To ensure efficient nut processing and high-quality end products, there is a pressing need for advanced hulling equipment capable of handling large volumes effectively. This expansion of nut-based product lines is, therefore, a pivotal driver pushing the nuts hulling equipment market forward.

Technological Advancements in hulling equipment are leading to higher efficiency, lower wastage, and improved product quality is driving market growth.

Ongoing technological advancements in nuts hulling equipment are revolutionizing the industry. Modern hulling machinery incorporates cutting-edge features such as automation, precision control, and artificial intelligence algorithms, which enhance efficiency, reduce wastage, and improve product quality. These innovations are appealing to nut processors seeking to optimize their operations, reduce production costs, and deliver consistent, high-quality nuts to consumers. The allure of higher productivity, lower operational expenses, and improved end-product quality drives the adoption of advanced hulling equipment. As technology continues to evolve, it will likely remain a significant driving force in shaping the nuts hulling equipment market's growth trajectory in the foreseeable future.

Market Restraints and Challenges:

High initial costs and maintenance expenses associated with nuts hulling equipment can pose challenges for small-scale nut processors.

One notable restraint in the nuts hulling equipment market is the substantial initial investment and ongoing maintenance costs associated with this machinery. While larger nut processing facilities can often justify these expenses through economies of scale, small-scale nut processors may find it challenging to bear the upfront costs of acquiring and installing modern hulling equipment. Additionally, ongoing maintenance expenses can strain the budgets of smaller operations. As a result, these financial barriers may hinder the adoption of efficient hulling equipment among smaller players in the industry, potentially limiting their competitiveness and growth.

The disposal of nut shells generated during the hulling process has raised environmental concerns, leading to the need for sustainable disposal solutions.

The disposal of nut shells generated during the hulling process presents an environmental challenge for the industry. Nutshells are often considered waste byproducts, and their improper disposal can lead to environmental pollution and pose disposal challenges. Environmental regulations are increasingly stringent, pushing nut processors to seek sustainable solutions for managing these byproducts. Developing eco-friendly disposal methods, such as recycling nut shells for alternative uses like biofuel or as raw materials for other industries, becomes imperative. Navigating these environmental concerns while maintaining cost-effectiveness is a complex challenge for the nuts hulling equipment market, necessitating innovation and adaptation in waste management practices.

Market Opportunities:

The expansion of nut consumption in emerging markets presents significant growth opportunities for nuts hulling equipment manufacturers.

One of the prominent opportunities in the nuts hulling equipment market is the burgeoning consumption of nuts in emerging markets. As economies in regions like Asia, Latin America, and Africa continue to grow, so does the middle-class population, resulting in increased disposable income and changing dietary preferences. Nuts are being recognized as a healthy and convenient snack choice in these markets. This evolving consumer behavior creates a substantial growth opportunity for nuts hulling equipment manufacturers. By tapping into these emerging markets and adapting their products to local preferences, manufacturers can expand their customer base and significantly increase their market share.

Offering customizable hulling solutions and automation options for nuts processing can attract a broader customer base.

Another key opportunity lies in offering customizable hulling solutions and automation options for nuts processing. Nut processors vary in size and requirements, and providing equipment that can be tailored to meet specific needs can be a game-changer. Additionally, automation in hulling processes streamlines production reduces labor costs, and enhances overall efficiency. Manufacturers that offer a range of automation options, from semi-automated to fully automated systems, can attract a broader customer base. By providing flexibility and scalability in their products, hulling equipment manufacturers can cater to the diverse demands of nut processing businesses, positioning themselves as leaders in the industry and driving growth.

NUTS HULLING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Equipment Type, Nut Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABC Machinery, Almondco Australia Ltd., Crown Iron Works Company, Lewis M. Carter Manufacturing, Modern Process Equipment Corporation, Spectrum Industries, SRS Engineering Corporation, The Andersons, Inc., Westrup A/S |

Nuts Hulling Equipment Market Segmentation: By Equipment Type

-

Rotary Hullers

-

Impact Hullers

-

Abrasive Hullers

-

Others

In 2022, Rotary Hullers had the largest market share of 42.6%, especially for high-capacity operations. Rotary hullers are traditionally a popular choice for large-scale nut processing due to their efficiency and versatility. Rotary hullers are known for their ability to process a wide range of nuts, including almonds and peanuts, with high throughput rates, making them a preferred choice for many nut processors.

Moreover, the Impact Hullers are the fastest growing with a CAGR of 5.8% due to their energy efficiency and reduced damage to nut kernels during the hulling process. Impact hullers use controlled force to remove the hull, minimizing kernel breakage. This efficiency and reduced wastage make them a promising option, leading to a growing market share.

Nuts Hulling Equipment Market Segmentation: By Nut Type

-

Almonds

-

Walnuts

-

Cashews

-

Pistachios

-

Others

In 2022, Almonds had the largest market share of 41.8% and a CAGR of 4.6% primarily due to their global popularity and extensive cultivation. Almonds are renowned for their nutritional value, making them a sought-after snack and ingredient in various culinary applications. The demand for efficient almond hulling equipment is driven by the need to process the large quantities of almonds produced, especially in regions like California, which is a leading almond producer. The equipment used for almond hulling needs to be precise and capable of handling high volumes, making it a vital segment of the nut processing industry.

Moreover, Cashews were the fastest-growing segment with a CAGR of 4.8% in the nut hulling equipment market. Their rise in popularity is attributed to their unique flavor, versatility in recipes, and perceived health benefits. Cashew production is concentrated in regions like Southeast Asia and Africa. As demand for cashews has soared, investment in specialized hulling machinery has increased to streamline the processing of these crescent-shaped nuts. The delicate nature of cashews requires precise hulling equipment that can preserve the nut's integrity, driving innovation in this segment.

Nuts Hulling Equipment Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, North America had the largest market share of 38.2% due to the substantial presence of nut producers, particularly almonds and walnuts in California. Almond production, in particular, drives the demand for advanced hulling machinery. North America's market is characterized by a focus on innovation and automation in nut processing. The stringent quality standards in this region require precise hulling equipment to meet consumer expectations. As sustainability becomes more critical, there's also a growing emphasis on environmentally friendly technologies in nut processing.

Moreover, the Asia-Pacific region had the fastest growth with a CAGR of 5.2% in the nut hulling equipment market, primarily due to the rising popularity of cashews and pistachios. Countries like India and Vietnam are prominent players in the cashew industry, while Iran and Turkey are leading pistachio producers. As nut consumption increases, so does the demand for efficient hulling machinery. Additionally, the region is experiencing technological advancements, with automation and robotics playing an increasingly significant role in nut processing.

COVID-19 Impact Analysis on the Global Nuts Hulling Equipment Market:

The global nuts hulling equipment market experienced a significant impact from the COVID-19 pandemic. The initial disruption in supply chains, labor shortages, and restrictions on movement led to operational challenges for manufacturers. However, as consumer demand for nutritious and convenient snack options remained strong, the market showed resilience. Increased home cooking and baking during lockdowns also boosted the demand for processed nuts. Consequently, the market adapted with a focus on automation and safety measures in manufacturing facilities. Although the pandemic posed challenges, it also accelerated technological advancements and highlighted the importance of ensuring a stable supply of nuts, driving long-term growth prospects in the industry.

Latest Trends/Developments:

One prominent trend is the increased adoption of automation and robotics in nut hulling processes. Manufacturers are investing in smart equipment that can efficiently sort, shell, and process nuts with minimal human intervention. This not only enhances productivity but also ensures consistent quality while reducing labor costs. Advanced sensors and AI-driven technologies are being used to optimize sorting and processing, making the industry more efficient and competitive.

Sustainability has become a key focus in the nuts hulling equipment market. Manufacturers are developing machinery that reduces energy consumption, minimizes waste, and employs eco-friendly materials. The industry is also exploring ways to repurpose nut byproducts, such as shells, for various applications like biofuels or compost. Consumers are increasingly seeking sustainably produced nuts, driving the adoption of green practices in nut processing.

Digitalization is transforming the industry through data-driven insights and remote monitoring capabilities. Nut hulling equipment is equipped with IoT sensors and connectivity, allowing operators to remotely monitor and manage the machinery's performance and maintenance needs. This real-time data analysis enables predictive maintenance, reducing downtime and improving overall efficiency. Additionally, it enhances quality control by providing insights into the processing parameters, ensuring that the final product meets stringent quality standards.

Key Players:

-

ABC Machinery

-

Almondco Australia Ltd.

-

Crown Iron Works Company

-

Lewis M. Carter Manufacturing

-

Modern Process Equipment Corporation

-

Spectrum Industries

-

SRS Engineering Corporation

-

The Andersons, Inc.

-

Westrup A/S

In June 2023, the Department of Industrial Technology at Fresno State's Jordan College opened the WAPA Tree Nut Processing Laboratory. The lab, valued at $800,000, featured cutting-edge nut processing equipment, fostering industry collaboration and student training. Expert-led courses emphasized practical skills and equipment maintenance.

Chapter 1. Nuts Hulling Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nuts Hulling Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nuts Hulling Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nuts Hulling Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nuts Hulling Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nuts Hulling Equipment Market – By Equipment Type

6.1 Introduction/Key Findings

6.2 Rotary Hullers

6.3 Impact Hullers

6.4 Abrasive Hullers

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Equipment Type

6.7 Absolute $ Opportunity Analysis By Equipment Type, 2023-2030

Chapter 7. Nuts Hulling Equipment Market – By Nut Type

7.1 Introduction/Key Findings

7.2 Almonds

7.3 Walnuts

7.4 Cashews

7.5 Pistachios

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Nut Type

7.8 Absolute $ Opportunity Analysis By Nut Type, 2023-2030

Chapter 8. Nuts Hulling Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.1.4 By Equipment Type

8.1.2 By Nut Type

8.1.3 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Equipment Type

8.2.3 By Nut Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Equipment Type

8.3.3 By Nut Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Equipment Type

8.4.3 By Nut Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Equipment Type

8.5.3 By Nut Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Nuts Hulling Equipment Market – Company Profiles – (Overview, Nuts Hulling Equipment Market Portfolio, Financials, Strategies & Developments)

9.1 ABC Machinery

9.2 Almondco Australia Ltd.

9.3 Crown Iron Works Company

9.4 Lewis M. Carter Manufacturing

9.5 Modern Process Equipment Corporation

9.6 Spectrum Industries

9.7 SRS Engineering Corporation

9.8 The Andersons, Inc.

9.9 Westrup A/S

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Nuts Hulling Equipment Market was valued at USD 432 Million and is projected to reach a market size of USD 678.22 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.8%.

Key trends include increased automation and robotics integration, a focus on sustainability, and digitalization and remote monitoring of equipment.

Challenges include high initial costs and maintenance expenses for small-scale processors and environmental concerns related to the disposal of nut shells.

North America and Asia-Pacific are experiencing substantial growth, with North America being driven by almond and walnut production and Asia-Pacific by the rising popularity of cashews and pistachios.

ABC Machinery, Almondco Australia Ltd., Crown Iron Works Company, Lewis M. Carter Manufacturing, and Modern Process Equipment Corporation, are some of the key players in the Global Nuts Hulling Equipment Market.